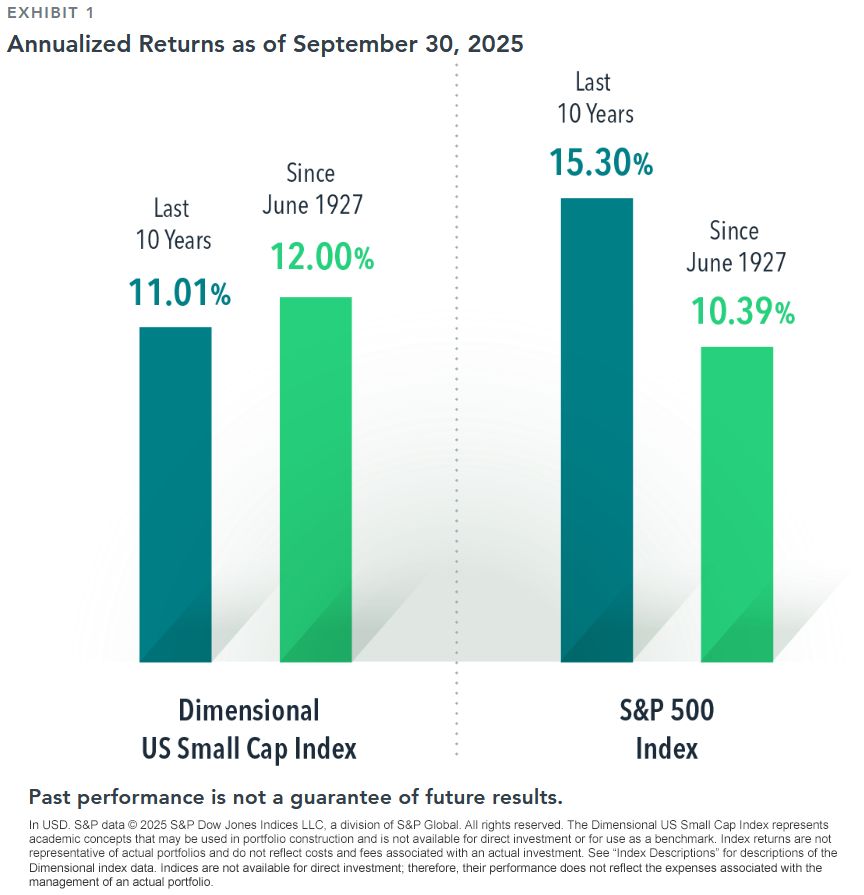

One of the most common questions I hear is, "What's wrong with small caps?" This concern usually stems from relative returns over the past 10 years, during which US small caps underperformed the S&P 500 Index by a little over 4 percentage points. But which one of these asset classes has been behaving abnormally?

US small cap's return over the last decade was within 1 percentage point of its average since 1927, at 11.01% versus 12.00%. The large cap S&P 500, on the other hand, was far from its long-run average. The index returned more than 15% over the last 10 years, nearly 50% more than its average since 1927 of 10.39%.

The S&P 500 has substantial weight in companies like the Magnificent 7, which have exceeded investor expectations with their earnings growth in recent years.1 When investors are surprised in a good way, outsize returns may follow. That's a windfall for investors with diversified portfolios. But expecting a continuation of large cap returns well in excess of the historical norm is betting on further unexpected success stories for these firms.

Many people have been searching for stories to explain US small cap underperformance. We've written previously about looking at the bigger picture with small cap returns and how some of the concerns over the current opportunity set may be overblown. But the stark contrast between short-term and long-term large cap returns suggests maybe investors are questioning the wrong segment of the market.

Footnotes

1. The Magnificent 7 stocks are represented by Alphabet, Apple, Amazon, Meta, Microsoft, NVIDIA, and Tesla. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. Named securities may be held in accounts managed by Dimensional.

Index Descriptions

The Dimensional indices have been retrospectively calculated by Dimensional Fund Advisors LP and did not exist prior to their index inception dates. Accordingly, results shown during the periods prior to each index's inception date do not represent actual returns of the index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains.

Dimensional US Small Cap Index was created by Dimensional in March 2007 and is compiled by Dimensional. It represents a market-capitalization-weighted index of securities of the smallest US companies whose market capitalization falls in the lowest 8% of the total market capitalization of the eligible market. The eligible market is composed of securities of US companies traded on the NYSE, NYSE MKT (formerly AMEX), and Nasdaq Global Market. Exclusions: non-US companies, REITs, UITs, and investment companies. From January 1975 to the present, the index excludes companies with the lowest profitability and highest relative price within the small cap universe. The index also excludes those companies with the highest asset growth within the small cap universe. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Asset growth is defined as a change in total assets from the prior fiscal year to current fiscal year. Source: CRSP and Compustat. The index monthly returns are computed as the simple average of the monthly returns of 12 subindices, each one reconstituted once a year at the end of a different month of the year. The calculation methodology was amended in January 2014 to include profitability as a factor in selecting securities for inclusion in the index. The calculation methodology was amended in December 2019 to include asset growth as a factor in selecting securities for inclusion in the index.

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

This article originally appeared November 24, 2025, in the DFA's "Perspectives Article" series. Writen by Wes Crill, PhD, Senior Client Solutions Director and Vice President of DFA. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

This article is reprinted with permission from Dimensional Fund Advisors LP (DFA) and reflects the views of its original author, Wes Crill. The content and opinions expressed are those of the author and not necessarily those of Index Fund Advisors, Inc. (IFA). This article is provided for educational purposes only and does not constitute investment advice, a recommendation of securities, or an endorsement of any specific strategy by IFA. Investors are encouraged to consult with a qualified financial professional to address their individual circumstances before making any investment decision.

Disclosures

The information in this material is intended for the recipient's background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

"Dimensional" refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

UNITED STATES

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.

CANADA

These materials have been prepared by Dimensional Fund Advisors Canada ULC. The other Dimensional entities referenced herein are not registered resident investment fund managers or portfolio managers in Canada.

This material is not intended for Quebec residents.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise noted, any indicated total rates of return reflect the historical annual compounded total returns, including changes in share or unit value and reinvestment of all dividends or other distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

WHERE ISSUED BY DIMENSIONAL IRELAND LIMITED

Issued by Dimensional Ireland Limited (Dimensional Ireland), with registered office 25 North Wall Quay, Dublin 1, D01 H104, Ireland. Dimensional Ireland is regulated by the Central Bank of Ireland (Registration No. C185067).

WHERE ISSUED BY DIMENSIONAL FUND ADVISORS LTD.

Issued by Dimensional Fund Advisors Ltd. (Dimensional UK), 20 Triton Street, Regent's Place, London, NW1 3BF. Dimensional UK is authorised and regulated by the Financial Conduct Authority (FCA) - Firm Reference No. 150100.

Dimensional UK and Dimensional Ireland do not give financial advice. You are responsible for deciding whether an investment is suitable for your personal circumstances, and we recommend that a financial adviser helps you with that decision.

Dimensional UK and Dimensional Ireland issue information and materials in English and may also issue information and materials in certain other languages. The recipient's continued acceptance of information and materials from Dimensional UK and Dimensional Ireland will constitute the recipient's consent to be provided with such information and materials, where relevant, in more than one language.

NOTICE TO INVESTORS: This is advertising material.

JAPAN

For Institutional Investors and Registered Financial Instruments Intermediary Service Providers.

This material is deemed to be issued by Dimensional Japan Ltd., which is regulated by the Financial Services Agency of Japan and is registered as a Financial Instruments Firm conducting Investment Management Business and Investment Advisory and Agency Business.

Dimensional Japan Ltd.

Director of Kanto Local Finance Bureau (FIBO) No. 2683

Membership: Japan Investment Advisers Association

SINGAPORE

This material is deemed to be issued by Dimensional Fund Advisors Pte. Ltd. (UEN:201210847M), which is regulated by the Monetary Authority of Singapore and holds a capital markets services license for fund management.

This advertisement has not been reviewed by the Monetary Authority of Singapore or the Central Provident Fund (CPF) Board.

FOR PROFESSIONAL INVESTORS IN HONG KONG

This material is deemed to be issued by Dimensional Hong Kong Limited (CE No. BJE760) ("Dimensional Hong Kong"), which is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

This material should only be provided to "professional investors" (as defined in the Securities and Futures Ordinance [Chapter 571 of the Laws of Hong Kong] and its subsidiary legislation) and is not for use with the public. This material is not intended to constitute and does not constitute marketing of the services of Dimensional Hong Kong or its affiliates to the public of Hong Kong. When provided to prospective investors, this material forms part of, and must be provided together with, applicable fund offering materials. This material must not be provided to prospective investors on a standalone basis. Before acting on any information in this material, you should consider whether it is suitable for your particular circumstances and, if appropriate, seek professional advice.

Neither Dimensional Hong Kong nor its affiliates shall be responsible or held responsible for any content prepared by financial advisors. Financial advisors in Hong Kong shall not actively market the services of Dimensional Hong Kong or its affiliates to the Hong Kong public.