Home

HomeSurvey

Surveys

Portfolios ▾

Options

Board/Coins ▾

Invest and Relax

Explore the advantages of a passive index investing strategy

An IFA wealth advisor provides invaluable guidance in helping you accomplish your financial goals

IFA Wealth Advisor Today!

Get Started

Services

Awards

Top 100 Independent RIAs 2024

#51

Top Financial Advisors in California 2024

Mark Hebner

CNBC Top 100 Financial Advisors

2023

Top Financial Advisors in California 2023

Mark Hebner

IFA Index Portfolios

Index Portfolio 100

Most Aggressive

Index Portfolio 95

Highly Aggressive

Index Portfolio 90

Highly Aggressive

Index Portfolio 85

Aggressive

Index Portfolio 80

Aggressive

Index Portfolio 75

Moderately Aggressive

Index Portfolio 70

Moderately Aggressive

Index Portfolio 65

Moderately Aggressive

Index Portfolio 60

Moderately Aggressive

Index Portfolio 55

Moderately Aggressive

Index Portfolio 50

Moderate

Index Portfolio 45

Moderately Conservative

Index Portfolio 40

Moderately Conservative

Index Portfolio 35

Moderately Conservative

Index Portfolio 30

Moderately Conservative

Index Portfolio 25

Conservative

Index Portfolio 20

Conservative

Index Portfolio 15

Conservative

Index Portfolio 10

Highly Conservative

Index Portfolio 5

Most Conservative

Videos

The Papers that Changed Investing: The Adjustment of Stock Prices to New Information

Tune Out the Noise - Documentary Film

The Papers that Changed Investing: Proof Prices Fluctuate Randomly

Index Funds: The Movie - 2024 Version

Market Declines and Volatility

Why It's Not Different This Time

Determining a Safe Withdrawal Rate

An Interview with Mark Hebner

What Makes IFA Different?

The IFA Story

Index Funds: The 12 Steps Video Summary

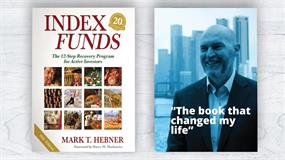

The Book that Changed My Life

25 Years of IFA with David Booth

Dimensional Fund Advisors Turns 40

Efficient Market Hypothesis Explanation

Charts

Articles

Investor Education

Introduction

Step 1: Active Investors

Step 2: Nobel Laureates

Step 3: Stock Pickers

Step 4: Time Pickers

Step 5: Manager Pickers

Step 6: Style Drifters

Step 7: Silent Partners

Step 8: Riskese

Step 9: History

Step 10: Risk Capacity

Step 11: Risk Exposure

Step 12: Invest and Relax

Appendix

Store

Learn About an Evidence-Based Approach to Investing

Investing in U.S. Financial History: Understanding the Past to Forecast the Future by IFA Wealth Advisor Mark J. Higgins

Participation in a book contest typically requires an entrance fee. This fee is intended to cover administrative expenses and is not material in amount. Referenced 'Praise' for previous editions of the book “Index Funds: The 12-Step Recovery Program for Active Investors” is on file. It is not intended to be an endorsement or testimonial for Mark Hebner, Index Fund Advisors, Inc. (IFA), or it advisory services. 2023 New England Book Festival Winner: Business Book category. Awarded 12/20/2023. 2024 Southern California Book Festival Winner: Business/Technology. Awarded 12/21/2023. 2024 Nonfiction Authors Association Nonfiction Book Award Winner. Awarded 02/07/2024. 2024 Book Excellence Award Winner in Finance Category Awarded on 03/05/2024. 2024 Los Angeles Book Festival Winner: Best Business Book Awarded 4/18/2024. 2024 Goody Business Book Award Winner: Money/Personal Finance Book category. Awarded 11/15/2024.

Referral Services

What are Index Funds?

IFA defines index funds as mutual or exchange-traded funds that follow a set of rules of ownership which, under normal circumstances, are held constant.

The SEC categorizes index funds as NIF or TIF: