Home

HomeSurvey

Surveys

Portfolios ▾

Options

Board/Coins ▾

IFA MarketCoins

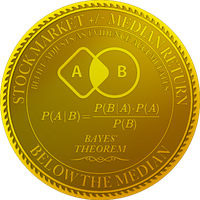

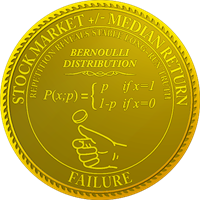

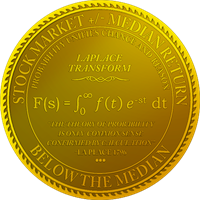

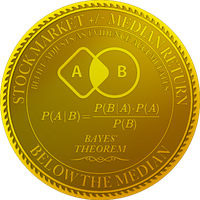

MarketCoins function as an educational tool for investors, illustrating the inherent randomness and unpredictability of market return direction relative to the historical median. One side of the coin is labeled “Above the Median Return,” while the other reads “Below the Median Return.” Given the assumption of fair pricing in efficient markets, the future direction of returns is effectively unpredictable—akin to the outcome of a fair coin toss.

IFA Series

Statistician Series

Francis Galton was born in Birmingham, England, into a wealthy and intellectually prominent family. A cousin of Charles Darwin, Galton was a polymath whose interests ranged from geography and meteorology to anthropology and psychology. His life journey was marked by extensive travel, scientific curiosity, and a lifelong effort to measure and classify human variation. Though brilliant and influential, his legacy is complex, as some of his social ideas later became ethically controversial.

Galton’s contributions to statistics were foundational. He introduced the concepts of regression toward the mean and correlation, laying groundwork for modern statistical analysis. His work on the normal distribution and variability transformed statistics into a tool for studying natural and social phenomena. Galton’s ideas directly influenced the development of biostatistics, psychometrics, and quantitative social science.

Blaise Pascal was born in Clermont-Ferrand, France, and displayed extraordinary intellectual talent from an early age. Educated by his father, he made significant contributions to mathematics and physics while still a teenager. Pascal’s life took a dramatic turn in his thirties when he experienced a profound religious conversion, after which he devoted much of his remaining life to philosophy and theology. He died young at age 39.

In probability theory, Pascal is best known for his correspondence with Pierre de Fermat, which established the mathematical foundations of probability. Their work addressed problems of fair division in games of chance, introducing expected value and systematic probabilistic reasoning. Pascal’s Triangle, though known earlier, became central to combinatorics and probability calculations.

Born in Brunswick, Germany, Carl Friedrich Gauss was a child prodigy who astonished teachers with his mathematical abilities. Supported by patrons, he pursued advanced studies and spent most of his professional life at the University of Göttingen. Gauss lived a relatively quiet life but produced work of extraordinary depth and breadth, earning him the title “Prince of Mathematicians.”

Gauss made enduring contributions to statistics through the normal distribution, often called the Gaussian distribution. He formalized the method of least squares, providing a rigorous framework for estimation and error analysis. These ideas became essential to statistics, physics, astronomy, and econometrics, shaping how uncertainty and measurement error are handled.

Jacob Bernoulli was born in Basel, Switzerland, into a prominent family of mathematicians. Initially trained in theology, he later turned to mathematics against his family’s wishes. His intellectual journey was marked by persistence and originality, though rivalry with his brother Johann Bernoulli strained family relations. He worked as a professor at the University of Basel until his death.

Jacob Bernoulli’s most significant contribution is the Law of Large Numbers, which formally connected probability theory with real-world frequencies. His book Ars Conjectandi, published posthumously, laid the foundations of mathematical probability. This work demonstrated how random events, when observed in large numbers, produce stable and predictable patterns.

Adolphe Quetelet was born in Ghent (modern-day Belgium) and trained in mathematics and astronomy. His career spanned science, administration, and social reform, and he played a key role in establishing statistical institutions across Europe. Quetelet believed strongly in applying quantitative methods to understand society, an idea that was revolutionary at the time.

Quetelet pioneered social statistics, introducing the concept of the “average man.” He applied probability distributions to human characteristics such as height, weight, and crime rates, helping to extend statistics beyond physical sciences. His work influenced sociology, demography, and public policy, and he popularized the normal distribution in social measurement.

Born in Normandy, France, Pierre-Simon Laplace rose from modest beginnings to become one of Europe’s most influential scientists. He lived through the French Revolution and Napoleonic era, navigating political upheaval while maintaining scientific productivity. Laplace held prominent academic and governmental positions throughout his life.

Laplace made profound contributions to probability theory, including Bayesian inference, generating functions, and the central limit theorem. His Théorie analytique des probabilités unified probability into a coherent mathematical discipline. Laplace’s work shaped statistical reasoning and remains foundational to modern probability and inference.

Leonardo of Pisa, known as Fibonacci, was born in Italy and educated partly in North Africa, where he learned Arabic mathematics. His travels exposed him to advanced numerical methods that were unknown in much of Europe. Fibonacci spent his life promoting practical mathematics for commerce and calculation.

Fibonacci introduced the Hindu-Arabic numeral system to Europe through his book Liber Abaci. He is also known for the Fibonacci sequence, which appears in probability, growth models, and stochastic processes. His work laid the numerical groundwork necessary for later developments in mathematics and statistics.

Pierre de Fermat was born in France and worked primarily as a lawyer while pursuing mathematics as a private passion. He rarely published his work, preferring to communicate ideas through letters. Fermat’s life was outwardly conventional, yet intellectually transformative.

In probability theory, Fermat’s collaboration with Pascal marked the birth of formal probability mathematics. His insights into combinatorics and expected value formed the basis for analyzing games of chance. Fermat’s methods influenced later statisticians and established probability as a legitimate mathematical discipline.

Abraham de Moivre was born in France but spent much of his life in England after fleeing religious persecution. Despite limited financial success, he became a respected mathematician and advisor to gamblers and insurers. His career exemplifies intellectual achievement under difficult circumstances.

De Moivre made major contributions to probability theory, including the normal approximation to the binomial distribution. His book The Doctrine of Chances was one of the first comprehensive probability texts. De Moivre’s work directly influenced the development of the normal distribution and actuarial science.

Andrey Markov was born in Ryazan, Russia, and spent most of his academic career in St. Petersburg. He was known for his rigorous style, strong opinions, and occasional conflicts with colleagues. Markov lived during a period of intense mathematical development in Russia and contributed significantly to its growing reputation in probability theory. Markov introduced Markov chains, mathematical models describing systems that transition from one state to another based solely on the current state. This concept revolutionized probability theory and has since been applied in economics, finance, physics, genetics, and computer science. Markov processes are now central to modeling random behavior over time.

Girolamo Cardano was born in Pavia, Italy, and lived a turbulent life marked by professional success and personal tragedy. He was a physician, astrologer, and mathematician, often controversial and outspoken. Despite setbacks, Cardano remained intellectually productive throughout his life.

Cardano authored one of the earliest works on probability, analyzing games of chance and random outcomes. His informal treatment of probability anticipated later formal methods and introduced key ideas about randomness and fairness. Cardano’s work represents the earliest bridge between gambling problems and mathematical probability.

Thomas Bayes was born in England and worked primarily as a Presbyterian minister. Little is known about his personal life, as he lived quietly and published very little during his lifetime. His most famous work was discovered and published posthumously by his friend Richard Price.

Bayes introduced what is now known as Bayes’ Theorem, which describes how probabilities should be updated when new information becomes available. This principle became the foundation of Bayesian statistics, influencing fields from economics and finance to machine learning and artificial intelligence. Bayesian reasoning provides a formal framework for learning from data.

Christiaan Huygens was born in The Hague, Netherlands, into a prominent intellectual family. He was educated privately and became one of Europe’s leading scientists, contributing to astronomy, physics, and mathematics. Huygens traveled widely and maintained correspondence with leading thinkers of his era.

Huygens wrote the first formal textbook on probability, De Ratiociniis in Ludo Aleae. He clarified concepts of expected value and applied probability systematically to games of chance. His work helped standardize probability theory and influenced later developments by Bernoulli, de Moivre, and Laplace.

Gene Fama, “a poor kid from Malden,” a working-class town in eastern Massachusetts, at first majored in French when he enrolled at Tufts, his local university, in the 1950s. But he soon discovered economics and fell in love with it. Fama, a 2013 Nobel laureate, is regarded as the father of the efficient market hypothesis.

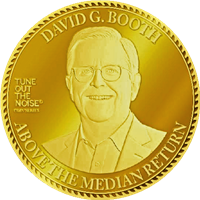

When he sold shoes on commission as a teenager in Lawrence, Kansas, David Booth refused to shade the truth just to make a sale. Booth eventually built a global investment firm based on the reality of market pricing instead of the mirage of stock picking. “It’s not about being big,” says the Founder and Chairman of Dimensional Fund Advisors. “It’s about doing things the right way.

While studying finance as a PhD student at the University of Rochester in the early 1980s, Ken French realized that the names of most mutual funds told investors almost nothing about their underlying investments. A decade later, trailblazing research by Eugene Fama and French on factors that explain stock and bond returns forever changed the mutual fund landscape and the fundamentals of portfolio management.

A ruptured aorta took his dad’s life in 1950, when Rex Sinquefield was 5 years old. He grew up in a St. Louis orphanage and was drafted into the military before landing in the legendary Merton Miller’s class at the University of Chicago, where he first learned about efficient markets. Sinquefield and fellow UChicago PhD student David Booth would go on to found Dimensional in 1981.

A farm boy from Sandwich, Illinois, John “Mac” McQuown grew up understanding that agriculture was a numbers game. His dedication to data analysis eventually led to a position created just for him at Wells Fargo Bank in 1964. A decade later, McQuown and Booth created one of the first S&P 500 index funds. When Booth launched Dimensional, McQuown became a founding board member.

Paul Samuelson was an American economist who was awarded the Nobel Prize in Economic Sciences in 1970 for his fundamental contributions to nearly all branches of economic theory. Samuelson was educated at the University of Chicago (B.A., 1935) and at Harvard University (Ph.D., 1941). He became a professor of economics at the Massachusetts Institute of Technology (MIT) in 1940. He also served as an economic adviser to the United States government.

At 10 years old, Robert Merton bought his first stock (General Motors). In the next two decades, painstaking work by researchers who studied stock price data revolutionized finance into a science—and Merton’s own scientific work in dynamic portfolio theory and the pricing of derivatives paved the way for industry-leading advances in risk management.

Not “mechanically inclined,” Roger Ibbotson knew he wasn’t cut out for his family’s HVAC business. So he went to the University of Chicago to study economics. Ibbotson and another UChicago alum, Rex Sinquefield, transformed voluminous data generated by the Center for Research in Security Prices (CRSP) into Stocks, Bonds, Bills, and Inflation, their influential 1977 study of major US asset class returns.

After big success in the pharmaceutical industry, Mark Hebner retired at age 32. Then a cold-calling broker persuaded him to buy a bunch of individual municipal bonds and stocks. Compared to investing in a portfolio of passively managed funds, that sales pitch led to his missing out on millions in potential gains. To help other investors avoid his error, Hebner created one of the first web-based advisory firms, Index Fund Advisors.

Born in Bulgaria, a communist country at the time, Savina Rizova came to Dartmouth College to study finance and became a research assistant for Professor Ken French. Now Co-CIO and Global Head of Research at Dimensional, Rizova was named one of Barron’s “100 Most Influential Women in US Finance” in 2022, 2023, and 2024.

A co-founder of Forum Financial Management, Norm Mindel is a renowned financial advisor, attorney, CPA, CFP, author, and public speaker. Working with Dimensional changed his professional career and helped his clients and family achieve their financial goals through a long-term, disciplined investment approach.

Dimensional needed to hire somebody to manage trading when the firm began. At the time, Rex Sinquefield’s wife, Jeanne, who had a PhD and an MBA from the University of Chicago, was designing options for the Chicago Board of Trade. A self-described “data freak,” Jeanne took the job at Dimensional, where she ended up wearing numerous hats, including training all traders and portfolio managers. She served as Executive Vice President and Head of Trading until retiring in 2005.

Dan Wheeler founded Dimensional Fund Advisors Financial Advisor Services group, and has been instrumental in bringing modern portfolio theory to the community of fee-only financial advisors. Throughout his career, Dan has helped build the advisor community and change investment advice in retail markets. Prior to Dimensional, Dan worked at Arthur Anderson & Co., was the controller of Triad International Marketing and owned a fee-only investment advisory firm.

Robert Novy-Marx is the Lori and Alan S. Zekelman Distinguished Professor of Finance at the Simon Business School in the University of Rochester. His research focuses on asset pricing, both theoretical and empirical, as well as industrial organization, public finance, and real estate. His seminal work on the government pensions crisis established him as a leading national voice on the issue, while his work on profitability is foundational for asset managers.

A financial advisor once told former US Senator Bill Bradley, “Not many people have access to something so intimate as people’s dreams. That’s what I have.” The lesson, Bradley says, is that achieving any dream—a vacation home, a beautiful painting, sending children to college—depends on how people invest. Bradley, a two-time NBA champion with the New York Knicks, is a consultant to Dimensional.

At age 16, when most teens are just thinking about college, Ireland native Gerard O’Reilly was studying for a BA in theoretical physics at Trinity College Dublin. An MS in high-performance computing followed, then a PhD in aeronautics from Caltech in 2004. The next milestone for this rocket scientist: researcher at Dimensional, where he would later rise to Chief Investment Officer. In 2017, O’Reilly became the firm’s Co-CEO and is also Co-CIO.

Following a decorated college basketball career at the University of California, Berkeley, and a few years as a pro, Dave Butler joined a big Wall Street firm. He would soon lose a significant amount of his net worth on a stock (Boston Chicken) recommended by his broker. It was one of several “aha” moments that led Butler, now Co-CEO of Dimensional, to become a champion of “holistic wealth management.”

Errol Morris is the Director of Tune Out the Noise. His films have won many awards, including an Oscar for The Fog of War, the Grand Jury Prize at the Sundance Film Festival for A Brief History of Time, the Silver Bear at the Berlin International Film Festival for Standard Operating Procedure, and the Edgar from the Mystery Writers of America for The Thin Blue Line. His films have been honored by the National Society of Film Critics and the National Board of Review.

Tune Out the Noise Series

Francis Galton was born in Birmingham, England, into a wealthy and intellectually prominent family. A cousin of Charles Darwin, Galton was a polymath whose interests ranged from geography and meteorology to anthropology and psychology. His life journey was marked by extensive travel, scientific curiosity, and a lifelong effort to measure and classify human variation. Though brilliant and influential, his legacy is complex, as some of his social ideas later became ethically controversial.

Galton’s contributions to statistics were foundational. He introduced the concepts of regression toward the mean and correlation, laying groundwork for modern statistical analysis. His work on the normal distribution and variability transformed statistics into a tool for studying natural and social phenomena. Galton’s ideas directly influenced the development of biostatistics, psychometrics, and quantitative social science.

Blaise Pascal was born in Clermont-Ferrand, France, and displayed extraordinary intellectual talent from an early age. Educated by his father, he made significant contributions to mathematics and physics while still a teenager. Pascal’s life took a dramatic turn in his thirties when he experienced a profound religious conversion, after which he devoted much of his remaining life to philosophy and theology. He died young at age 39.

In probability theory, Pascal is best known for his correspondence with Pierre de Fermat, which established the mathematical foundations of probability. Their work addressed problems of fair division in games of chance, introducing expected value and systematic probabilistic reasoning. Pascal’s Triangle, though known earlier, became central to combinatorics and probability calculations.

Born in Brunswick, Germany, Carl Friedrich Gauss was a child prodigy who astonished teachers with his mathematical abilities. Supported by patrons, he pursued advanced studies and spent most of his professional life at the University of Göttingen. Gauss lived a relatively quiet life but produced work of extraordinary depth and breadth, earning him the title “Prince of Mathematicians.”

Gauss made enduring contributions to statistics through the normal distribution, often called the Gaussian distribution. He formalized the method of least squares, providing a rigorous framework for estimation and error analysis. These ideas became essential to statistics, physics, astronomy, and econometrics, shaping how uncertainty and measurement error are handled.

Jacob Bernoulli was born in Basel, Switzerland, into a prominent family of mathematicians. Initially trained in theology, he later turned to mathematics against his family’s wishes. His intellectual journey was marked by persistence and originality, though rivalry with his brother Johann Bernoulli strained family relations. He worked as a professor at the University of Basel until his death.

Jacob Bernoulli’s most significant contribution is the Law of Large Numbers, which formally connected probability theory with real-world frequencies. His book Ars Conjectandi, published posthumously, laid the foundations of mathematical probability. This work demonstrated how random events, when observed in large numbers, produce stable and predictable patterns.

Adolphe Quetelet was born in Ghent (modern-day Belgium) and trained in mathematics and astronomy. His career spanned science, administration, and social reform, and he played a key role in establishing statistical institutions across Europe. Quetelet believed strongly in applying quantitative methods to understand society, an idea that was revolutionary at the time.

Quetelet pioneered social statistics, introducing the concept of the “average man.” He applied probability distributions to human characteristics such as height, weight, and crime rates, helping to extend statistics beyond physical sciences. His work influenced sociology, demography, and public policy, and he popularized the normal distribution in social measurement.

Born in Normandy, France, Pierre-Simon Laplace rose from modest beginnings to become one of Europe’s most influential scientists. He lived through the French Revolution and Napoleonic era, navigating political upheaval while maintaining scientific productivity. Laplace held prominent academic and governmental positions throughout his life.

Laplace made profound contributions to probability theory, including Bayesian inference, generating functions, and the central limit theorem. His Théorie analytique des probabilités unified probability into a coherent mathematical discipline. Laplace’s work shaped statistical reasoning and remains foundational to modern probability and inference.

Leonardo of Pisa, known as Fibonacci, was born in Italy and educated partly in North Africa, where he learned Arabic mathematics. His travels exposed him to advanced numerical methods that were unknown in much of Europe. Fibonacci spent his life promoting practical mathematics for commerce and calculation.

Fibonacci introduced the Hindu-Arabic numeral system to Europe through his book Liber Abaci. He is also known for the Fibonacci sequence, which appears in probability, growth models, and stochastic processes. His work laid the numerical groundwork necessary for later developments in mathematics and statistics.

Pierre de Fermat was born in France and worked primarily as a lawyer while pursuing mathematics as a private passion. He rarely published his work, preferring to communicate ideas through letters. Fermat’s life was outwardly conventional, yet intellectually transformative.

In probability theory, Fermat’s collaboration with Pascal marked the birth of formal probability mathematics. His insights into combinatorics and expected value formed the basis for analyzing games of chance. Fermat’s methods influenced later statisticians and established probability as a legitimate mathematical discipline.

Abraham de Moivre was born in France but spent much of his life in England after fleeing religious persecution. Despite limited financial success, he became a respected mathematician and advisor to gamblers and insurers. His career exemplifies intellectual achievement under difficult circumstances.

De Moivre made major contributions to probability theory, including the normal approximation to the binomial distribution. His book The Doctrine of Chances was one of the first comprehensive probability texts. De Moivre’s work directly influenced the development of the normal distribution and actuarial science.

Andrey Markov was born in Ryazan, Russia, and spent most of his academic career in St. Petersburg. He was known for his rigorous style, strong opinions, and occasional conflicts with colleagues. Markov lived during a period of intense mathematical development in Russia and contributed significantly to its growing reputation in probability theory. Markov introduced Markov chains, mathematical models describing systems that transition from one state to another based solely on the current state. This concept revolutionized probability theory and has since been applied in economics, finance, physics, genetics, and computer science. Markov processes are now central to modeling random behavior over time.

Girolamo Cardano was born in Pavia, Italy, and lived a turbulent life marked by professional success and personal tragedy. He was a physician, astrologer, and mathematician, often controversial and outspoken. Despite setbacks, Cardano remained intellectually productive throughout his life.

Cardano authored one of the earliest works on probability, analyzing games of chance and random outcomes. His informal treatment of probability anticipated later formal methods and introduced key ideas about randomness and fairness. Cardano’s work represents the earliest bridge between gambling problems and mathematical probability.

Thomas Bayes was born in England and worked primarily as a Presbyterian minister. Little is known about his personal life, as he lived quietly and published very little during his lifetime. His most famous work was discovered and published posthumously by his friend Richard Price.

Bayes introduced what is now known as Bayes’ Theorem, which describes how probabilities should be updated when new information becomes available. This principle became the foundation of Bayesian statistics, influencing fields from economics and finance to machine learning and artificial intelligence. Bayesian reasoning provides a formal framework for learning from data.

Christiaan Huygens was born in The Hague, Netherlands, into a prominent intellectual family. He was educated privately and became one of Europe’s leading scientists, contributing to astronomy, physics, and mathematics. Huygens traveled widely and maintained correspondence with leading thinkers of his era.

Huygens wrote the first formal textbook on probability, De Ratiociniis in Ludo Aleae. He clarified concepts of expected value and applied probability systematically to games of chance. His work helped standardize probability theory and influenced later developments by Bernoulli, de Moivre, and Laplace.

Gene Fama, “a poor kid from Malden,” a working-class town in eastern Massachusetts, at first majored in French when he enrolled at Tufts, his local university, in the 1950s. But he soon discovered economics and fell in love with it. Fama, a 2013 Nobel laureate, is regarded as the father of the efficient market hypothesis.

When he sold shoes on commission as a teenager in Lawrence, Kansas, David Booth refused to shade the truth just to make a sale. Booth eventually built a global investment firm based on the reality of market pricing instead of the mirage of stock picking. “It’s not about being big,” says the Founder and Chairman of Dimensional Fund Advisors. “It’s about doing things the right way.

While studying finance as a PhD student at the University of Rochester in the early 1980s, Ken French realized that the names of most mutual funds told investors almost nothing about their underlying investments. A decade later, trailblazing research by Eugene Fama and French on factors that explain stock and bond returns forever changed the mutual fund landscape and the fundamentals of portfolio management.

A ruptured aorta took his dad’s life in 1950, when Rex Sinquefield was 5 years old. He grew up in a St. Louis orphanage and was drafted into the military before landing in the legendary Merton Miller’s class at the University of Chicago, where he first learned about efficient markets. Sinquefield and fellow UChicago PhD student David Booth would go on to found Dimensional in 1981.

A farm boy from Sandwich, Illinois, John “Mac” McQuown grew up understanding that agriculture was a numbers game. His dedication to data analysis eventually led to a position created just for him at Wells Fargo Bank in 1964. A decade later, McQuown and Booth created one of the first S&P 500 index funds. When Booth launched Dimensional, McQuown became a founding board member.

Paul Samuelson was an American economist who was awarded the Nobel Prize in Economic Sciences in 1970 for his fundamental contributions to nearly all branches of economic theory. Samuelson was educated at the University of Chicago (B.A., 1935) and at Harvard University (Ph.D., 1941). He became a professor of economics at the Massachusetts Institute of Technology (MIT) in 1940. He also served as an economic adviser to the United States government.

At 10 years old, Robert Merton bought his first stock (General Motors). In the next two decades, painstaking work by researchers who studied stock price data revolutionized finance into a science—and Merton’s own scientific work in dynamic portfolio theory and the pricing of derivatives paved the way for industry-leading advances in risk management.

Not “mechanically inclined,” Roger Ibbotson knew he wasn’t cut out for his family’s HVAC business. So he went to the University of Chicago to study economics. Ibbotson and another UChicago alum, Rex Sinquefield, transformed voluminous data generated by the Center for Research in Security Prices (CRSP) into Stocks, Bonds, Bills, and Inflation, their influential 1977 study of major US asset class returns.

After big success in the pharmaceutical industry, Mark Hebner retired at age 32. Then a cold-calling broker persuaded him to buy a bunch of individual municipal bonds and stocks. Compared to investing in a portfolio of passively managed funds, that sales pitch led to his missing out on millions in potential gains. To help other investors avoid his error, Hebner created one of the first web-based advisory firms, Index Fund Advisors.

Born in Bulgaria, a communist country at the time, Savina Rizova came to Dartmouth College to study finance and became a research assistant for Professor Ken French. Now Co-CIO and Global Head of Research at Dimensional, Rizova was named one of Barron’s “100 Most Influential Women in US Finance” in 2022, 2023, and 2024.

A co-founder of Forum Financial Management, Norm Mindel is a renowned financial advisor, attorney, CPA, CFP, author, and public speaker. Working with Dimensional changed his professional career and helped his clients and family achieve their financial goals through a long-term, disciplined investment approach.

Dimensional needed to hire somebody to manage trading when the firm began. At the time, Rex Sinquefield’s wife, Jeanne, who had a PhD and an MBA from the University of Chicago, was designing options for the Chicago Board of Trade. A self-described “data freak,” Jeanne took the job at Dimensional, where she ended up wearing numerous hats, including training all traders and portfolio managers. She served as Executive Vice President and Head of Trading until retiring in 2005.

Dan Wheeler founded Dimensional Fund Advisors Financial Advisor Services group, and has been instrumental in bringing modern portfolio theory to the community of fee-only financial advisors. Throughout his career, Dan has helped build the advisor community and change investment advice in retail markets. Prior to Dimensional, Dan worked at Arthur Anderson & Co., was the controller of Triad International Marketing and owned a fee-only investment advisory firm.

Robert Novy-Marx is the Lori and Alan S. Zekelman Distinguished Professor of Finance at the Simon Business School in the University of Rochester. His research focuses on asset pricing, both theoretical and empirical, as well as industrial organization, public finance, and real estate. His seminal work on the government pensions crisis established him as a leading national voice on the issue, while his work on profitability is foundational for asset managers.

A financial advisor once told former US Senator Bill Bradley, “Not many people have access to something so intimate as people’s dreams. That’s what I have.” The lesson, Bradley says, is that achieving any dream—a vacation home, a beautiful painting, sending children to college—depends on how people invest. Bradley, a two-time NBA champion with the New York Knicks, is a consultant to Dimensional.

At age 16, when most teens are just thinking about college, Ireland native Gerard O’Reilly was studying for a BA in theoretical physics at Trinity College Dublin. An MS in high-performance computing followed, then a PhD in aeronautics from Caltech in 2004. The next milestone for this rocket scientist: researcher at Dimensional, where he would later rise to Chief Investment Officer. In 2017, O’Reilly became the firm’s Co-CEO and is also Co-CIO.

Following a decorated college basketball career at the University of California, Berkeley, and a few years as a pro, Dave Butler joined a big Wall Street firm. He would soon lose a significant amount of his net worth on a stock (Boston Chicken) recommended by his broker. It was one of several “aha” moments that led Butler, now Co-CEO of Dimensional, to become a champion of “holistic wealth management.”

Errol Morris is the Director of Tune Out the Noise. His films have won many awards, including an Oscar for The Fog of War, the Grand Jury Prize at the Sundance Film Festival for A Brief History of Time, the Silver Bear at the Berlin International Film Festival for Standard Operating Procedure, and the Edgar from the Mystery Writers of America for The Thin Blue Line. His films have been honored by the National Society of Film Critics and the National Board of Review.