In a previous installment of Above the Fray, we highlighted how investors looking to mitigate the impact of a falling equity market could use fixed income as a "buffer." Today, we look at how this form of downside protection compares to buffered equity strategies.

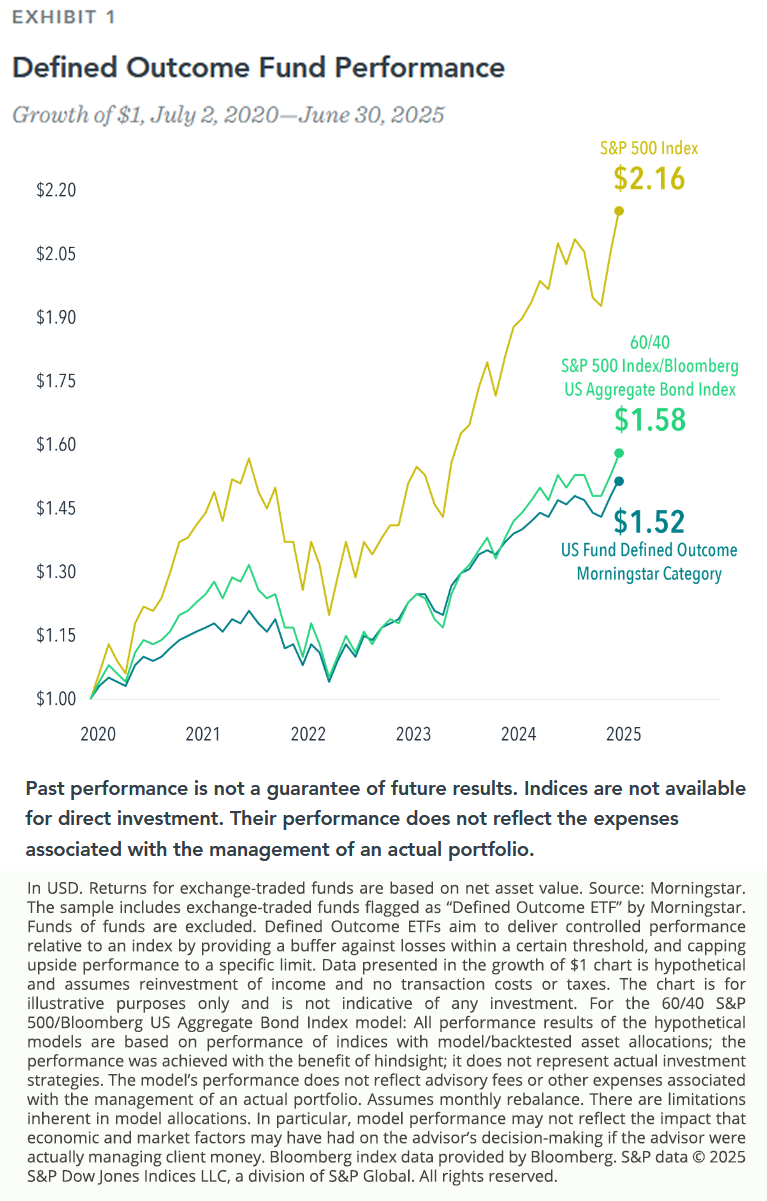

Buffer strategies and traditional equity/fixed income allocations both aim to provide downside protection at the cost of upside participation. For example, compare the S&P 500 Index to either the Defined Outcome Morningstar Category or a 60/40 S&P 500 Index/Bloomberg US Aggregate Bond Index asset allocation. Both have tended to perform better than the S&P 500 when the equity market was down and lagged the S&P 500 when it was up. The tradeoff between upside participation and downside exposure is comparable whether using defined outcome strategies or a simple mix of stocks and bonds.

What's not similar between these two approaches is the overall performance. Over the five-year period ending June 30, 2025, the 60/40 S&P 500 Index/Bloomberg US Aggregate Bond Index asset allocation returned 9.62% annualized, outperforming the Defined Outcome Morningstar Category's 8.75% annualized return. High fees for these strategies can be a potential performance drag. True product innovation should lead to novel solutions, not just costly repackaging. Please see the end of this document for important disclosures.

This article originally appeared July 17, 2025, in the DFA's "Above the Fray" series. Writen by Kevin Green, PhD, Head of Investment Solutions Analytics and Vice President and Jackie Pincus, CFA, Investment Strategist A. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Disclosures

The information in this material is intended for the recipient's background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

"Dimensional" refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.