You can hardly open your inbox these days without receiving an email about buffer ETFs. Also known as "defined outcome strategies," buffer ETFs offer a way to hedge downside equity risk in exchange for lower participation during market upswings. There is typically a downside protection amount (the "buffer") ranging from 10% to 100%, and a capped potential upside over a set period, typically one year.

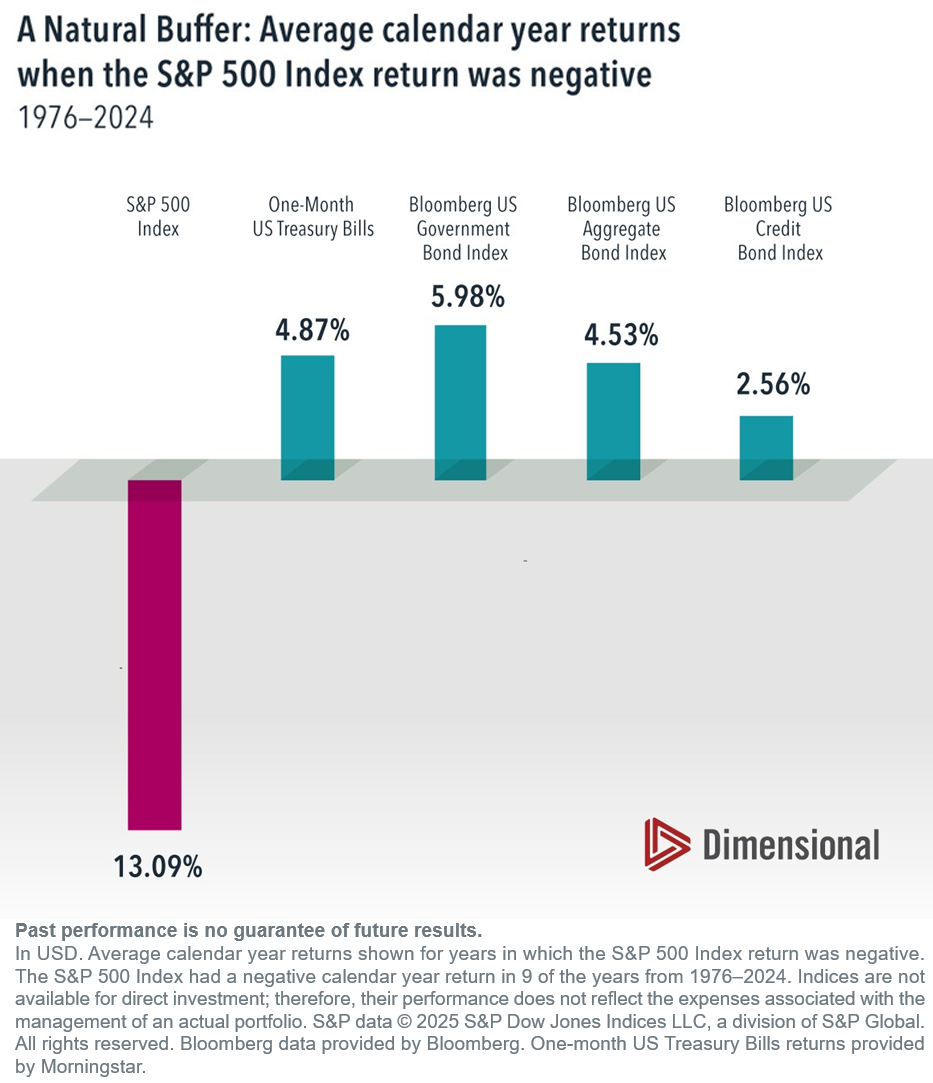

Softening the blow during equity market downturns is appealing for most investors. However, we already have a well-established asset category to help achieve this: fixed income. Historically, fixed income investments across a wide range of sectors have had a positive average return when equities have had a negative return. Since 1976, for example, the Bloomberg US Aggregate Bond Index had an average return of 4.53% in years when the S&P 500 Index had a negative return.

Some have questioned the diversifying benefit of fixed income based on recent episodes of rising correlations between stocks and bonds. It's important to remember that short-term past correlations do not predict future correlations, and historical data shows that the volatility reduction benefit has been insensitive to the correlation between stocks and bonds.

Investors who are worried about equity volatility can benefit from a fixed income allocation—and redirect unwanted buffer ETF emails to the junk mail folder.

This article originally appeared July 17, 2025, in the DFA's "Above the Fray" series. Writen by Kevin Green, PhD, Head of Investment Solutions Analytics and Vice President and Jackie Pincus, CFA, Investment Strategist A. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.