Each year, money managers and financial pundits release their latest predictions about what's most likely to happen in the next 12 months. Likewise, we like to look back and see just how their forecasts panned out.

Will the market continue to deliver back-to-back years of over 20% gains? Will these prognosticators prove to have a more accurate crystal ball than anyone else? Here is a sampling of what we discovered in terms of market forecasts by large brokerages and fund managers.

Wells Fargo

In its 2025 Outlook report ("Charting the Economy's Next Chapter"), the Wells Fargo Investment Institute wrote: "The U.S. economy's continued expansion will lead the world economy. As well, the U.S. stock market rally will broaden, with earnings being the primary driver of prices across equity asset classes." 1

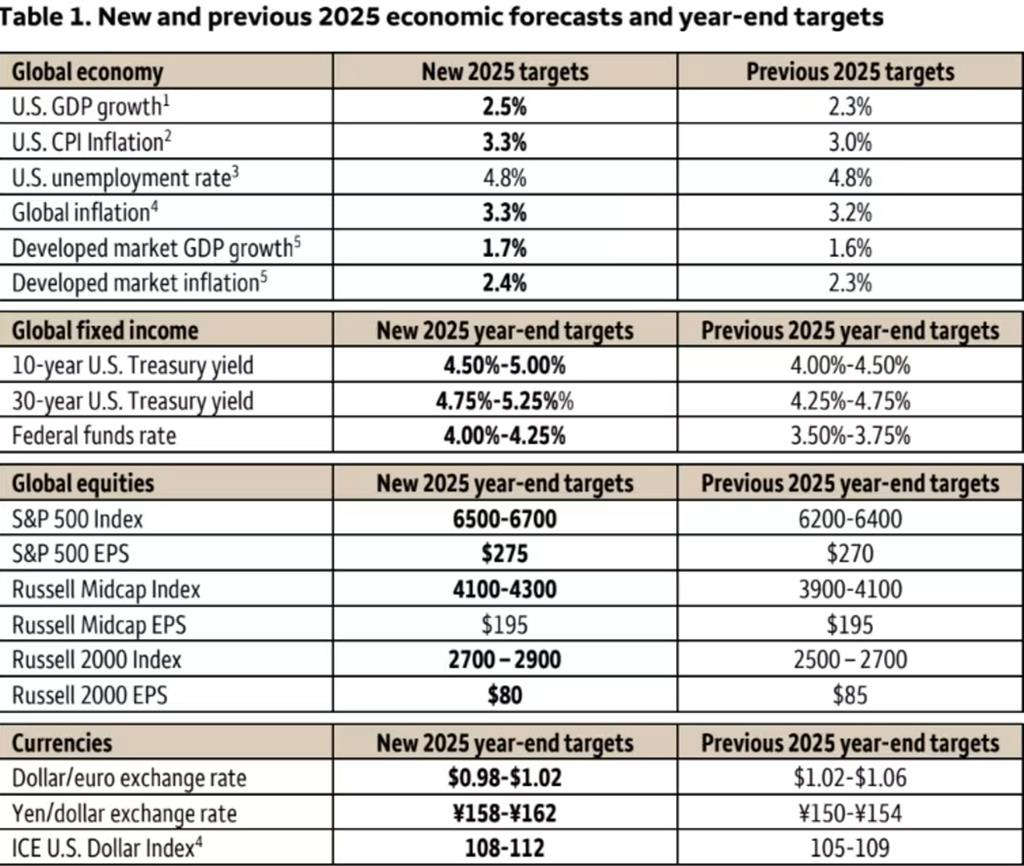

Strategists at the Wells Fargo Investment Institute expected the S&P 500 to finish 2025 around the 6,600 level, up nearly 12%, with gains expected to be driven by a strong U.S. economy and earnings growth under President-elect Donald Trump's second term. "Our forecast for stronger economic growth, along with policies aimed at reducing regulatory costs, should help boost the S&P 500's earnings-per-share to $275 [by the end of 2025], above our prior forecast of $270," the global investment strategy team at Wells Fargo Investment Institute said in a Wednesday client note.2

Table 1 shows Wells Fargo Investment Institutes original 2025 target and updated mid-year target forecasts. In the beginning of the year they forecast a moderate increase in the market with the S&P 500 ending the year between 6200-6400. Their mid-year target adjusted their forecast up to 6500-6700. This goes to show while although forecasts may be positive even professional institutions can't reliably predict where markets will end up.

Source: WELLS FARGO INVESTMENT INSTITUTE

Fidelity

Fidelity's Director of Global Macro, Jurrien Timmer, noted in his forward-looking piece that 2025 looked like another — yet perhaps slower — growth year for stocks. Referencing 2024's strong run, he observed: "I remain bullish on stocks for 2025. The earnings picture looks robust going into 2025, based on S&P 500 consensus expected earnings. Earnings expectations for the mega-cap growers, such as the "Magnificent 7" group of stocks, look even better, and have continued to show impressive acceleration." 3

Timmer noted that the risks for 2025 could be that the opposite happens in that Mag 7 momentum reverses and takes the market down with it. The other potential risk comes from inflation, the Fed, and bond yields.

So how did the Mag 7 do overall? Two of the seven beat the broader market S&P 500 Index which returned 16.4%. Alphabet led the way with an almost 65% return. Nvidia finished the year up almost 39%. The top two accounted for 29% of the return of the S&P 500. The rest lagged, but did finish the year positive.

J.P. Morgan Chase & Co.

The bank's global research team in their 2025 Outlook Report attempted to look ahead to forecast a new year. "Our 2025 Outlook, developed by our Global Investment Strategy Group, highlights how advancements in artificial intelligence and innovation, as well as easing monetary policy globally and increasing capital investment, can continue to drive economies and markets forward. By adding diversification and income, we believe clients can fortify portfolios to respond to an evolving economic environment." 4

It predicted that the S&P 500 will reach 6,500 by the end of 2025, representing an estimated 9% upside from current levels. The S&P 500 finished the year at 6,845.

Morgan Stanley

In its outlook for stocks in the coming year, Morgan Stanley's applied equity advisors group forecast the possibility for "more muted equity returns" although positive in 2025. The team also saw "opportunities in growth and value stocks" in the coming 12 months. They also noted a continued adoption of artificial intelligence could lead to a productivity boom such as we had in the late 90s.5

Another area to note is to watch investors behavior as the famed investor Sir John Templeton captured the idea that investor psychology plays a large role in market cycles in this 1966 quote: "Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria."

Alternative Currencies

2025 saw increased adoptment of cryptocurrency in the institutional space and the mainstream. Along with increased regulatory rules crypto ownership has nearly tripled since the end of 2021 with over 65 million American adults or roughly 28% owning the alternative currencies. That comes with increased market volatility for digital alternative currency traders in Bitcoin and the like. Bitcoin saw a market high of $126,000 in October only for it to lose 30%, and fall to $84,000 in November. The decline was attributed to significant volatility, culminating in a major November crash due to leveraged positions. Though public enthusiasm for crypto has grown in recent years, 40% of people who own cryptocurrency still aren't confident that the technology is safe and secure. Nearly one in five cryptocurrency owners have had difficulty accessing or withdrawing their funds from custodial platforms.6

As reviewed in our latest survey of 12-month forecasts by large brokerage houses and active fund managers, the prevailing message is clear for long-time fund investors: No matter what they're prognosticating — whether it's stocks, bonds or alternative markets — active managers haven't been able to produce successful track records of timing markets, either in the shorter- or longer-term. (See also our reports on the most current SPIVA studies and Dalbar research.)

In 2025, most of the predictions made by some of Wall Street's most venerable names were calling for a positive but muted return in equities. While bullish, the market outperformed even their predictions with the S&P 500 returning over 17.9% total return for a third year in a row and reaching 6,845.

To help you stick to an objective and scientific-driven investment discipline, we've continued development of IFA's online educational tools. For example, our Risk Capacity Survey is designed to measure how much portfolio risk is appropriate in an IFA Index Portfolio. This and a range of other free resources are built for use on a desktop, laptop and through the IFA App, which is available to download from both the Apple App Store and the Google Play Store for Android. We also invite you to take advantage of a complimentary financial plan to help in setting up and tracking your progress in building wealth over a lifetime.

Footnotes:

1.) Wells Fargo Investment Institute, "2025 Outlook: Charting the Economy's Next Chapter." December 2024.

2.) Market Watch, "Another bullish call for stocks in 2025. Wells Fargo raises S&P 500 target on strong economy, Trump's policy changes.", November 20, 2024.

3.) Fidelity, "What's ahead for stocks in 2025," Jurrien Timmer, Jan 9, 2025.

4.) J.P. Morgan Global Research, "2025 Market Outlook."

5.) Morgan Stanley, "Stock Market Outlook 2025: Can the Bull Run Persist?," Feb. 19, 2025.

6.) Security.org, "2025 Cryptocurrency Adoption and Consumer Sentiment Report," Nov. 21, 2025.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Hypothetical data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such past or future performance.