SEC enforcement actions have hit a 20-year high, with 200 cases filed in just three months. The latest casualty? Vanguard — paying $19.5 million for secretly incentivising advisors while marketing them as "salaried employees." When even the poster child for investor-first principles hides conflicts from wealthy clients, your advisor's true loyalties become the million-dollar question.

Picture this. Your "trusted" financial advisor just recommended moving your $2 million portfolio into a managed account service. They assured you it's in your best interest. What they didn't mention? They'll earn bonuses, salary increases, and promotions for steering you there — while their marketing materials claim they're "salaried employees who receive no commissions."

This isn't happening at some dodgy brokerage. It's Vanguard — the company built on investor-first principles. Vanguard recently paid $19.5 million to settle SEC charges for hiding these conflicts from clients in their Personal Advisor Services program.

The Vanguard case exposes troubling industry reality. If even Vanguard secretly incentivised advisors whilst publicly claiming otherwise, what's happening elsewhere?

Enforcement Explosion

SEC enforcement actions surged to 200 cases in fiscal 2025's first quarter — the highest since 2000. These weren't minor compliance lapses but serious breaches including "failures to disclose conflicts of interest" and "misleading disclosures to brokerage customers."

Recent enforcement highlights reveal systematic problems. Private Advisor Group paid £5.8 million for investing wrap-program clients in higher-cost mutual fund share classes whilst failing to disclose conflicts. Empower Advisory Group and Empower Financial Services paid combined penalties of £1.5 million for incentivising retirement plan advisors to enrol participants in managed accounts whilst telling clients they were "salaried" or "non-commissioned." The SEC also took action against executives at Momentum Advisors who allegedly misappropriated £223,000 in client funds through more than 100 transactions for personal expenses.

For high-net-worth investors, these enforcement actions expose uncomfortable truths about an industry that markets itself as advisory but operates as sales-driven. The distinction between genuine fiduciary advice and commission-motivated recommendations has real consequences for wealth preservation.

Regulatory Priority Shift

The SEC has made fiduciary duties and conflicts of interest a top enforcement priority for 2025. Senior leaders explicitly stated that enforcement would refocus on "traditional core enforcement areas" — including breaches of fiduciary duties by investment advisors.

The Department of Labor launched parallel efforts through its proposed Retirement Security Rule, attempting to expand fiduciary coverage for retirement advice.

According to the SEC's own analysis, "conflicted recommendations can result in harm to high net-worth individuals" regardless of financial sophistication. Wealth alone doesn't protect investors from conflicted advice's adverse effects.

The Recommendation Game

The enforcement cases reveal a consistent pattern: advisors steering clients toward products that generate higher fees rather than better outcomes. When Empower told retirement plan participants their advisors were "salaried," those same advisors received financial incentives to push managed accounts. When Private Advisor Group placed clients in expensive mutual fund share classes, cheaper alternatives existed in the same programs.

This isn't accidental. Fund companies and insurance providers systematically use commission structures, retention bonuses, and sales contests to influence advisor behavior. The result? Recommendations driven by advisor compensation rather than client suitability.

The financial impact compounds over time. Higher-cost actively managed funds consistently underperform their benchmarks after fees. SPIVA data shows that over 15-year periods, active funds across all major categories fail to beat their benchmarks. Yet these are precisely the products that generate the highest advisor compensation.

The Critical Difference: Demanding Fiduciary Standards

So, what can consumers do about it? Insist that advisors work to the fiduciary standard. This single decision transforms the entire advisor-client relationship.

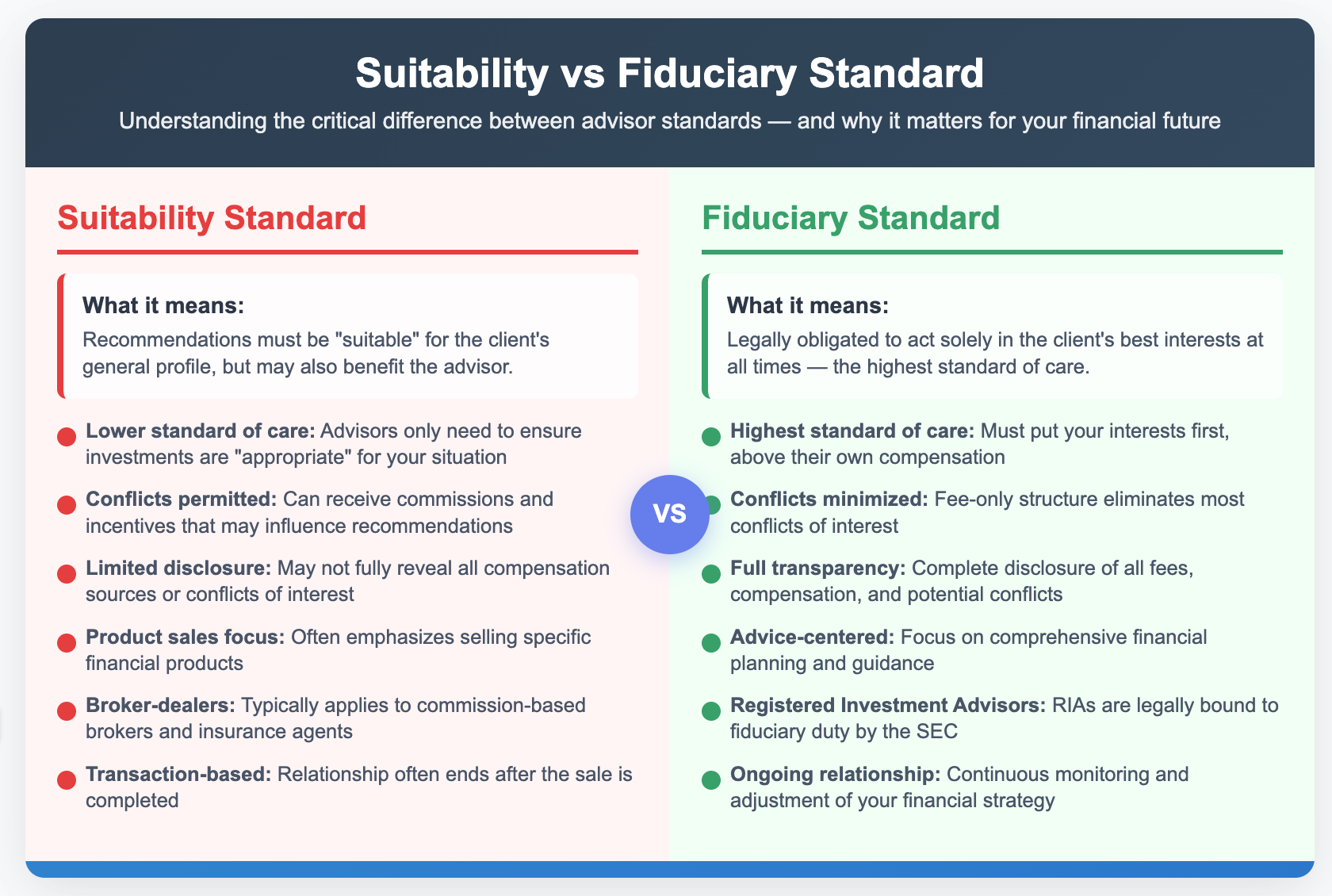

Under suitability standards governing most commission-based brokers, recommendations need only be "appropriate" for your general situation. This permits conflicts of interest, limited disclosure, and product-sales focus emphasising highest commissions rather than client benefit.

"Fiduciary" derives from Latin fiduciarius, meaning "holding in trust." Investment fiduciaries are legally bound to act solely in the clients best interests — always, not just when convenient.

Registered Investment Advisors face SEC fiduciary standards, creating legal obligations that eliminate commission conflicts. When advisors are compensated for advice rather than product sales, recommendations focus entirely on client outcomes rather than revenue generation.

Red Flags: Spotting Advisory Conflicts

Ask directly: "Are you always acting as a fiduciary, without exception?" Registration status provides crucial insight. Independent RIAs face fiduciary standards legally requiring client interests above their own. Dual registrants — firms acting as both broker-dealers and investment advisors — face inherent conflicts.

Demand compensation transparency. Ask specifically about third-party payments, retention bonuses, and product sales incentives. Hebner suggests asking: "How do you get paid from this decision I'm making?" and "What financial products do you yourselves buy?"

Complex disclosures often signal problems rather than transparency. If conflict disclosures are difficult to understand or span multiple pages, that complexity may be intentional.

Your Next Steps

With enforcement escalating and conflicts documented, wealthy investors face a clear choice. Audit your current advisor's compensation structure and registration status. Demand written confirmation of fiduciary duty applying to all recommendations. Conduct comprehensive fee analysis comparing total costs to low-cost index fund alternatives.

When the SEC imposes multimillion-dollar penalties for hiding advisor conflicts, settling for anything less than true fiduciary guidance becomes an expensive mistake. Evidence-based portfolio construction, genuine fiduciary commitment, and behavioral coaching aligned with client interests aren't luxury features — they're essential protections against an industry where conflicts remain widespread despite increased regulatory scrutiny.

ROBIN POWELL is the Creative Director at Index Fund Advisors (IFA). He is also a financial journalist and the Editor of The Evidence-Based Investor. This article reflects IFA's investment philosophy and is intended for informational purposes only.

Disclosure: This article is intended for informational purposes only and does not constitute investment advice or a recommendation for any particular service, individual, or entity. This article provides commentary on recent enforcement actions and industry practices based on publicly available information as of the date of publication. References to specific firms, penalties, and regulatory priorities are factual observations and should not be construed as generalizations about the broader financial industry. Assumptions regarding advisor practices, incentives, or conflicts reflect situations discussed in enforcement reports and do not imply universal applicability. This commentary does not constitute investment advice, legal guidance, or endorsement of any specific advisor or firm. Readers are encouraged to consult their financial advisors and review all disclosures regarding fiduciary duties, compensation, and conflicts of interest before making decisions.