I wanted confirmation that a flip of the new IFA MarketCoin would illustrate the randomness and unpredictability of the future direction of returns compared to the median return of an index. The analysis looked at the chance of future returns of the S&P 500 index being above or below the average (median) return over multiple time horizons, such as daily, monthly, 1-year, 5-years, or 20-years.

I conversed with an AI agent on many related topics and came up with this summary of a long discussion with the agent and my own input. The research incorporates Nobel Laureate Eugene Fama's Efficient Market Hypothesis (EMH), statistical properties, and market dynamics. Below is a summary of the core concept, applications, limitations, key findings, and conclusions.

Core Concept: Average (Median) Returns and a Coin Flip

- Median Definition: Median is one of the three types of averages, along with the mean and the mode. The median return for any time horizon (daily, monthly, 1-year, 5-years, 20-years) is the middle value when returns are ordered, splitting historical data 50/50 (50% above, 50% below). This holds for both the S&P 500 Total Return Index and a single stock, regardless of distribution shape.

- Coin Flip Model: A coin flip, with a 50% probability of heads or tails, aligns with the median's 50/50 split, serving as a conceptual framework to illustrate future return randomness relative to the median. The MarketCoin has UP and DOWN instead of heads and tails.

- EMH Framework: EMH posits that prices reflect all available information, rendering prices fair and returns unpredictable. This supports the fair coin flip's ~50% probability, as no timing strategy reliably forecasts returns above or below the median.

Application to the S&P 500 Total Return Index over the last 20 Years

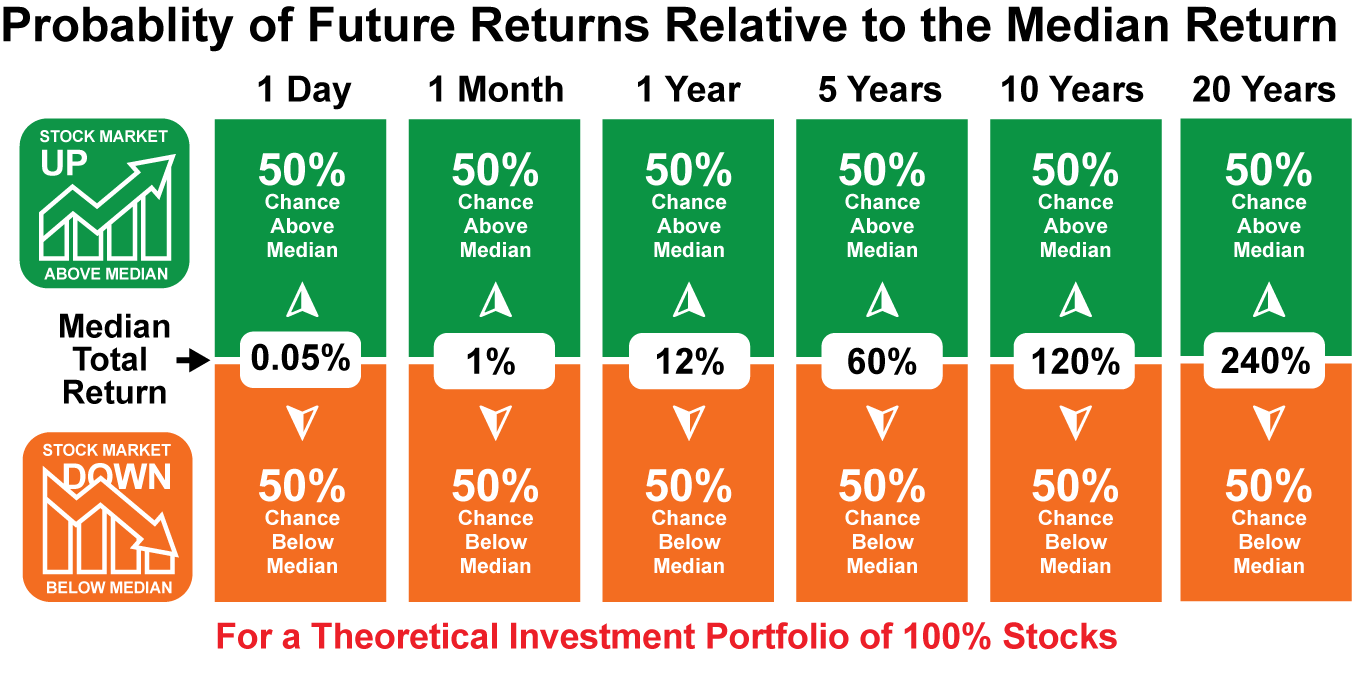

- Daily Returns:

- Median Split: ~5,040 trading days (2005–2025) yield a median daily return of about 0.05% at the 2,540th midway point, with 50% of returns above and below that.

- EMH Support: EMH indicates daily returns are random, aligning with a coin flip's 50% probability.

- Characteristics: Returns are left-skewed (-0.62), highly leptokurtic (kurtosis ~20.68), with ~53% positive days, but the median daily return ensures a 50/50 split above and below it.

- Monthly Returns:

- Median Split: ~240 monthly returns yield a median between 0.7% to 1.0%, splitting data 50/50.

- EMH Support: EMH suggest unpredictability supporting a coin flip.

- Characteristics: Less skewed and kurtotic than daily returns, with ~60–65% positive months, but the median return ensures a 50/50 split.

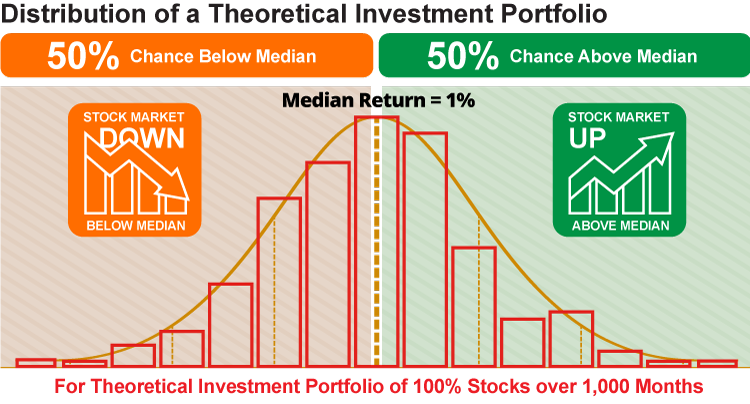

- The distribution of 1,000 monthly returns of a theoretical portfolio shown below goes beyond Up and Down, by illustrating the a range of relative probabilities of returns throughout the distribution. It also highlights the center as the median return of 1% with 50% above and 50% below that return.

- 1-Year Returns:

- Median Split: 20 1-year returns yield a median (~8–10%), splitting data 50/50.

- EMH Support: Unpredictability due to priced-in information leading to fair prices, aligning with a fair coin flip.

- Characteristics: Standard deviation of ~15%, ~75–80% positive years, less skewed than shorter horizons.

- 5-Year Returns:

- Median Split: ~4 non-overlapping periods yield a median (~8–10% annualized), splitting ~50/50.

- EMH Support: Randomness exists while median return is unreliable due to small sample, but still supporting a ~50% probability.

- Characteristics: Smoother, nearly normal distribution, ~70–80% positive periods.

- Caveats: Small sample size and mean-reversion introduce variability, but the coin flip remains fair.

- 20-Year Returns:

- Median Split: Only one 20 year return (~10% annualized for the S&P 500TR, which is close to the 97-year 9.7% annulaized return) defines the median, limiting this analysis, but future 20-year returns have a theoretical 50% chance of exceeding it or the long term return.

- EMH Support: Unpredictability aligns with a coin flip, as structural factors and all available information are priced in.

- Caveats: Single observation reduces relevance. Further study should look at S&P 500 data going back too 1926.

The illustration below summarizes the multiple periods discussed above, but for a theoretical investment portfolio over 1,000 months.

EMH and Coin Flip Across Horizons

- EMH Rationale: EMH assumes that past returns don't predict future returns and that all available information and forecasts are priced into securities. This suggests that neither technical nor fundamental analysis reliably predicts returns, including above or below the median for any index, including the S&P 500, or even an individual stock. The coin flip's 50% probability mirrors this unpredictability.

- S&P 500 Efficiency: The S&P 500's high efficiency (rapid information incorporation) makes the coin flip robust, especially for daily and monthly returns.

Challenges and Limitations

- Non-Stationarity: The median return is constantly updating with new data points.

- Sample Size: Small samples (twenty 1-year, four 5-years, one 20-year) increase median variability.

- Single-Stock Risks: Volatility and firm-specific events introduce patterns (e.g., momentum) that challenge EMH more than for the S&P 500

- Data Access: Lack of daily 2005–2025 return data for the S&P 500 TR requires reliance on historical patterns and EMH theory.

Key Findings

- S&P 500: The coin flip is a strong approximation for daily, monthly, and annual returns due to high market efficiency and the median's 50/50 split.

- EMH Support: The index aligns with EMH's unpredictability, making the coin flip a theoretically sound baseline. The S&P 500's greater efficiency makes it even a better fit than a single stock, but still better than stock selection or market timing methods.

- Practical Implication: EMH advocates long-term passive investing over short-term predictions. For one stock, diversification mitigates the much higher single-stock risk.

When flipping two standard coins, there are four possible outcomes: Heads on both coins (HH), Tails on both coins (TT), Heads on the first coin and Tails on the second (HT), or Tails on the first coin and Heads on the second (TH). Each of these outcomes is equally likely. Since there are four possible outcomes, the probability of each outcome is 25%.

If the market resembles a coin flip and you have a MarketCoin with UP on one side and DOWN on the other, you now have a situation that is like flipping two coins, the market and the coin flip. When observing the market and the flip of the MarketCoin, the table below summarizes the four possible outcomes and 25% probability of each outcome.

Conclusion

A coin flip serves as a good theoretical framework to demonstrate the principles of randomness in future returns of an index. The coin flip is comparable to the above or below median returns and EMH suggests unpredictability.

The S&P 500's high efficiency makes the coin flip robust across all horizons. Non-stationarities, small samples, and other factors add uncertainty, but EMH supports the coin flip's simplicity, emphasizing long-term strategies over short-term forecasts.

When modeling the MarketCoin to market return directions, the scenario resembles flipping two independent coins with four possible outcomes, each having a 25% probability. This is consistent with EMH's view of unpredictable returns and the median's 50/50 split of returns. The model applies similarly to a single stock, though with slightly more uncertainty.

The coin flip's simplicity underscores the Efficient Market Hypothesis and Eugene Fama's advice to avoid short-term predictions and trading in favor of a long-term buy, hold and rebalance strategy, just like IFA has been espousing for over 26 years.

Until actual MarketCoins are available in a few months, you can simulate randomness with this coin. Flip away!

Citations

- Artificial Intelligent Agent Grok 3.0, accessed on June 24, 2025

- Fama, E. F. (1970). "Efficient Capital Markets: A Review of Theory and Empirical Work." Journal of Finance.

- Fama, E. F., & French, K. R. (1988). "Permanent and Temporary Components of Stock Prices." Journal of Political Economy.

- Jegadeesh, N., & Titman, S. (1993). "Returns to Buying Winners and Selling Losers." Journal of Finance.

- Daily S&P 500 returns have a highly leptokurtic distribution.

- The distribution of daily S&P 500 index returns from 1963-2016.

- AAPL historical data.

Disclosures:

This article is intended for informational purposes only and should not be construed as investment, financial, or predictive advice. The analysis presented herein is based on historical data, theoretical models, and assumptions, many of which are subject to change or variability. References to Eugene Fama's Efficient Market Hypothesis (EMH) and other academic concepts are included for educational discussion and may not represent practical suitability for investment strategies.

Any mention of securities or reference to the S&P 500 Total Return Index is for illustrative purposes only and does not constitute an endorsement or recommendation to buy, sell, or hold any securities. Predictions and models discussed, including the concept of the "MarketCoin" or coin flip analogy, are conceptual applications and do not guarantee future market behavior or outcomes.

Investing involves risks, including market volatility, potential loss of principal, and variations in return performance that cannot be forecasted with certainty. Readers are encouraged to consult with an experienced financial advisor or tax professional before engaging in investment activities.

Index Fund Advisors, Inc. (IFA) and its affiliates do not provide guarantees regarding the accuracy, reliability, or completeness of the information presented or the suitability of any strategies discussed herein. Academic citations used in this article are included for context and are not exhaustive or verified for all possible applications.