When seeking financial advice and assistance, there is a good chance that you might run into several different credentials that indicate a professional's background as well as area of expertise. When it comes to financial planning the CFP® designation is widely recognized for its rigorous education, examination, experience, and ethical requirements.

In 2023 the CFP Board announced it would conduct a 10-year-long research initiative named "The Financial Planning Longitudinal Study". This study would be designed to track, follow, and measure the overall financial wellbeing outcomes of a diverse group of American households. This is the first time this area has been researched by the CFP Board.

This study has the potential to provide insights into how financial planning is delivered and correlations between financial well-being and working with a CFP® professional. It's an exciting step forward in the profession's evolution—and a reminder that when clients choose a CFP®, they're aligning themselves with a higher standard of care, backed by data, ethics, and long-term accountability.

The inaugural study launched in July of 2024 surveying over 4,000 applicants from across different socio-economic groups. The study was split into three different groups:

1) CFP® Professional Advised (denoted in blue)

2) Advised by a non-CFP® Professional (denoted in gray)

3) Not Advised (denoted in white)

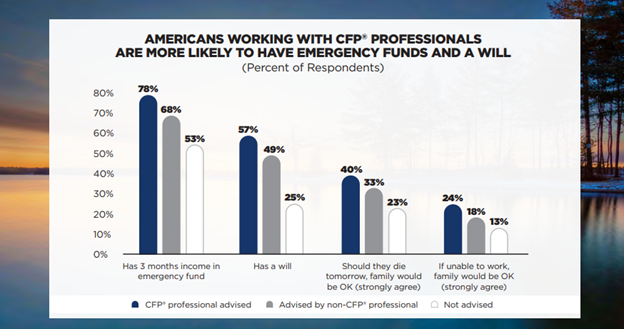

According to the study, Americans working with CFP professionals reported being 10% more likely to have 3 months of emergency funds on hand than those who were advised by non-CFP professionals and 25% more likely than those not advised at all.

When it comes to having a will those working with CFP professionals were 8% more likely to have a will than those advised by a non-CFP professional, and 32% more likely to have a will than those not being advised.

When it comes to emergencies such as the loss of a job or the death of a family member those who were working with a CFP professional came out ahead of those who didn't by decent margins.

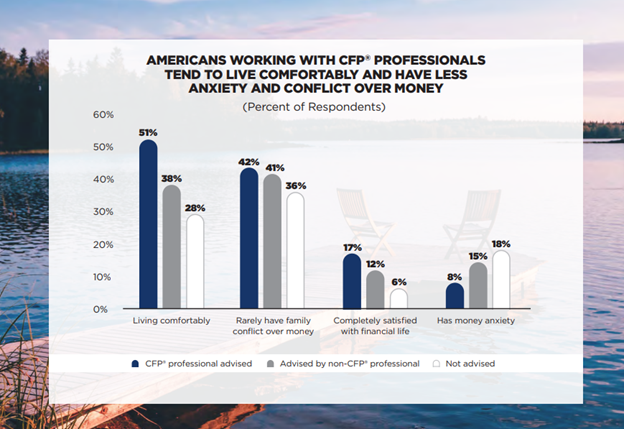

The study findings suggest a correlation between working with CFP professionals and a more comfortable lifestyle. Those advised by CFP professionals were 13% more likely to reprot living comfortably than those advised by a non-CFP professional and 23% more likely than Americans without any advisement. Correlation is not causation. Results reflect the study's surveyed respondents and assumptions.

Similarly, respondents working with CFP professionals were significantly more likely to be satisfied with their financial life and rarely have family conflict over money. On the other hand, with no advisement were 10% more likely than those with a CFP professional to have money anxiety.

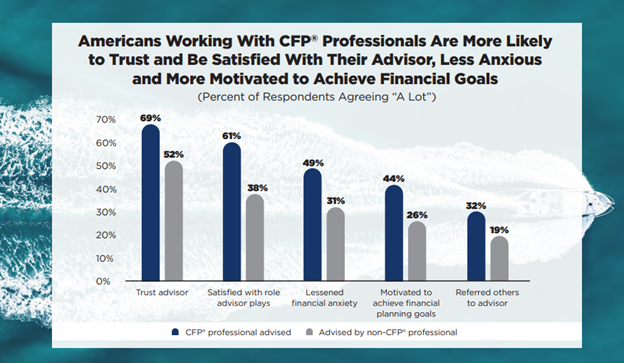

Shown below is the emotional correlation between working with CFP professionals and the respondents' trust and satisfaction. with CFP professionals were 17% more likely to trust their advisor than someone working with a non-CFP professional.

They are also seen to be 23% more likely to be satisfied with their advisor, 18% more likely to have lessened financial anxiety, and 18% more likely to be motivated to achieve their financial goals. Those working with CFP professionals were also significantly more likely to refer their advisor to others compared to those working with non-CFP professionals.

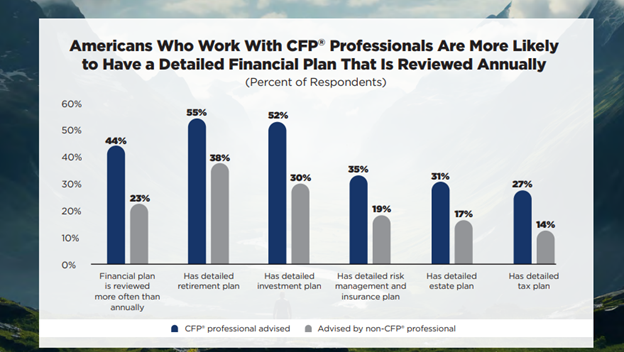

Similarly, Americans who work with CFP professionals are seen to overall be more likely to have a detailed financial plan than those who work with non-CFP professionals. For example, those working with a CFP professional are 21% more likely to have a financial plan that is reviewed more than once a year, 17% more likely to have a detailed retirement plan, and 22% more likely to have a detailed investment plan.

Similar significant trends appear for having a detailed risk management and insurance plan, estate plan, and tax plan.

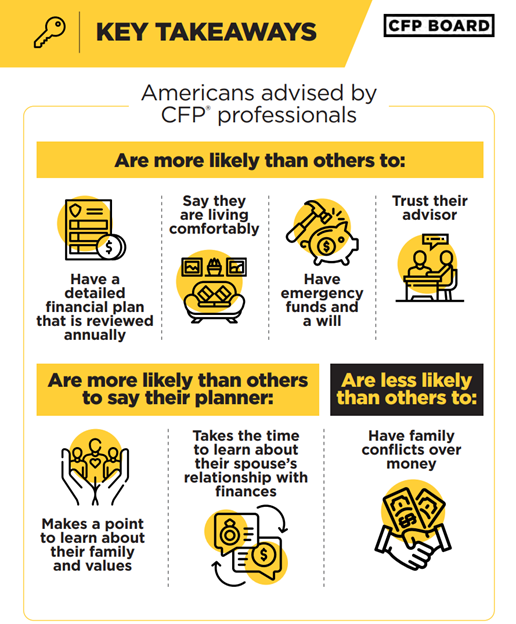

Putting it all together, there are a few major takeaways regarding Americans advised by CFP professionals. First, those that are advised by a CFP professional are more likely to live a comfortable lifestyle, trust their advisor, and have a detailed financial plan that even accounts for emergencies and a will.

They also are more likely to say their planner takes the time to learn about their family, their values, and their spouse's relationship with finances. At the same time, those with a CFP professional are much less likely to have family conflicts over money.

IFA offers all clients complimentary financial planning services through their Financial Planning Team. The outcomes and results of any plan depend on each client's unique circumstances, and no guarantees are made regarding financial success. Please consult with a qualified Certified Financial Planner™ professional or other accredited expert to determine the right approach based on your unique goals, values, and financial situation. IFA uses the Right Capital software to help generate financial plans as well as prompt important conversations around your financial goals, tax strategies, and estate planning. Please contact your advisor or [email protected] if you have any questions or would like to set up your own personalized financial plan.

*The first-year survey and its data are just the beginning. Subsequent years' surveys will enable the researchers to explore more closely the relationship between working with a financial planner (specifically a CFP® professional) and better outcomes.

Study: With CFP® Professionals Enjoy Greater Financial Well-Being | CFP Board

Souce for the Charts: Financial Planning Longitudinal Study 2024 Key Results, CFP Board

The referenced study and data are valid as of 2024 and are subject to updating as part of the ongoing Financial Planning Longitudinal Study.

Disclosure:

This article is for informational purposes only and reflects the perspectives of Index Fund Advisors (IFA). It is not an offer, solicitation, recommendation, or endorsement of any specific financial planning service, credential, or individual professional. The referenced data and studies, including the Financial Planning Longitudinal Study, were conducted by third parties and are cited to illustrate general trends and findings. These findings may not represent the experiences of every individual and are contingent on the study's methodology, which could involve assumptions or selective criteria not outlined here. Past performance or outcomes mentioned in this context are not indicative of future success, and all financial planning approaches involve uncertainty and risk.