In the first half of 2025, developed markets outside the US returned 19.0%, outperforming the US and emerging markets.1 But that outcome masks the wide range of returns across individual countries, from Spain's 43.0% to Denmark at -5.5%. This kind of dispersion isn't unusual—it's a defining characteristic of global investing.

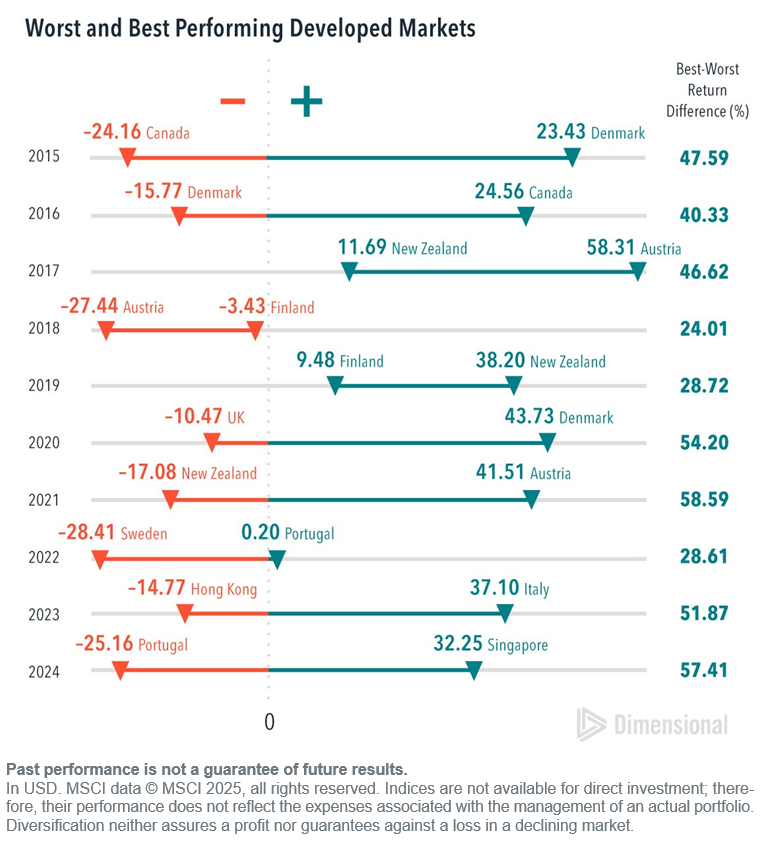

On average, the difference in return between the best- and worst-performing country exceeded 43% over the past ten calendar years. It's no wonder investors may be tempted to chase recent winners or avoid losers. However, there's little evidence that timing strategies consistently pay off. Country returns can turn quickly. For example, Canada posted the worst returns in 2015, down over 24%, but was the top performer in 2016, up over 24%. An investor who lost patience at the end of 2015 potentially missed out on the subsequent market recovery.

Country volatility is a normal part of global investing. Fortunately, as 2025 illustrates, investors in a globally diversified portfolio can benefit from international diversification without risking getting on the wrong side of country swings.

----

1. Measured by the MSCI World ex USA Index (net div.), MSCI USA Index (net div.), and MSCI Emerging Markets Index (net div.).

This article originally appeared July 10, 2025, in the DFA's "Above the Fray" series. Writen by Karen Umland, Senior Investment Director and Vice President of DFA. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.