When Mark Hebner first published Index Funds: The 12-Step Recovery Program for Active Investors in 2003, he made a bold claim that many in the financial industry found provocative: active investing shares characteristics with gambling, and research suggests certain speculative behaviors may mimic addictive tendencies. At the time, this assertion seemed more like colorful rhetoric than scientific fact. Today, however, a growing body of academic research has validated Hebner's insight with remarkable precision.

The Neuroscience of Financial Addiction

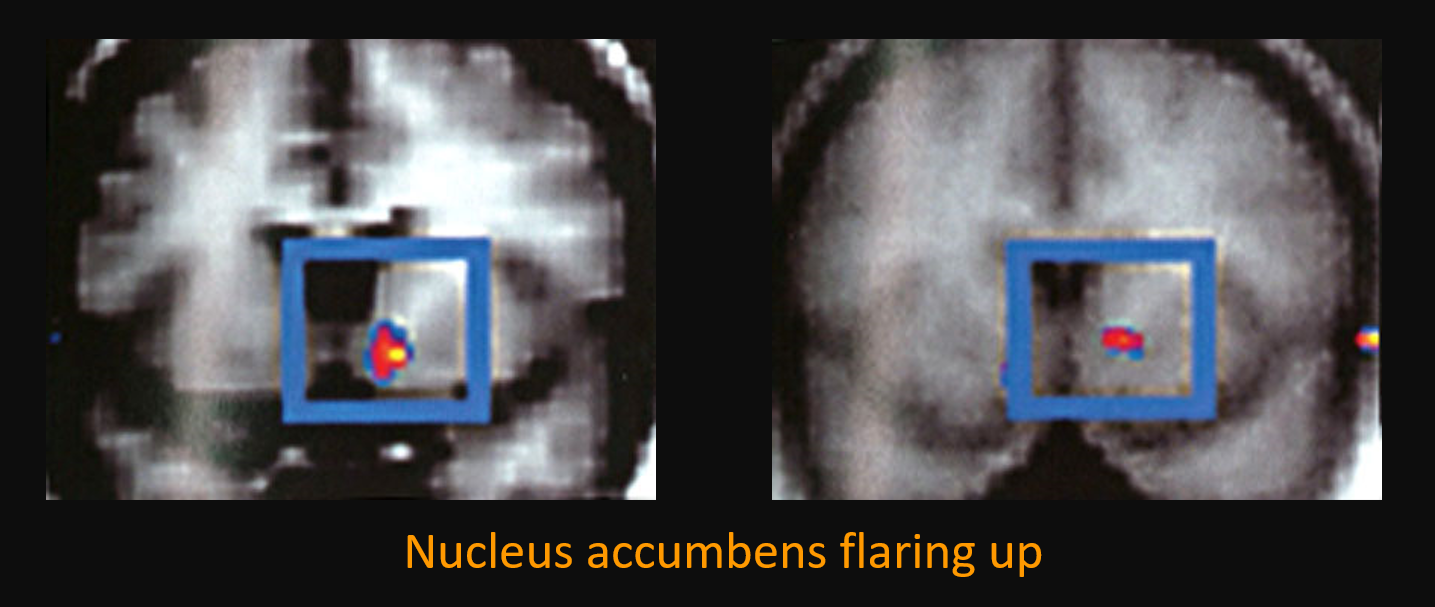

The connection between investing and gambling isn't just metaphorical — it's neurological. Jason Zweig, author of Your Money & Your Brain, notes that "the neural activity of someone whose investments are making money is indistinguishable from that of someone who is high on cocaine or morphine." This finding helps explain why the sage advice of the late Nobel laureate Paul Samuelson, that investing should be "more like watching paint dry or watching grass grow," feels so counterintuitive to many investors.

Research in neuroeconomics has identified striking similarities between the brain's reaction to cocaine and the anticipation of financial rewards. Hans Breiter at Northwestern Medical School and other researchers have shown that "the dopamine rush we get from long shots is why we play the lotto, invest in IPOs, keep too much money in too few stocks, and invest with active portfolio managers instead of index funds."

This biological imperative — what Zweig calls "the prediction addiction" — helps explain why so many intelligent people make consistently poor investment decisions. Their brains are literally wired to seek the thrill of potential big wins, even when the odds are stacked against them.

The Rise of Retail Trading as Gambling

The connection between gambling and stock trading has become even more pronounced in recent years. The U.S. is currently experiencing a rise both in retail trading in the stock market and in all types of gambling including sports betting. This isn't coincidence — it's substitution.

Warren Buffett agrees. In his 2023 letter to Berkshire Hathaway shareholders he wrote: "For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants."

The pandemic provided a natural experiment in this substitution effect. When sports betting disappeared during lockdowns, many turned to day trading instead. Dave Portnoy of Barstool Sports became emblematic of this shift, "With the volatility, it is kind of like watching a sports game," said Portnoy, 43, who started live streaming as "Davey Day Trader Global" to his 1.5 million Twitter followers after sports betting was suspended.

Academic Evidence: The Systematic Research

A comprehensive systematic review by Lee, Lewis, and Mills, published in 2023, analyzed twelve studies examining the relationship between gambling and financial trading. Their findings were unequivocal: financial trading is associated with an increased risk for problem gambling, and the risks are amplified for those engaging in more speculative trading behaviors such as day-trading and cryptocurrency trading.

The prevalence of problem gambling among financial traders is striking. The prevalence of problem gambling ranged from 1.4% to 47.2% with 7.6% of median across the samples who engage in trading financial products in all the articles, which is higher than the general prevalence of problem gambling.

The Psychology of High-risk Traders

Research by Arthur et al. (2016) found that high-risk stock traders are more likely to engage in frequent gambling, participate in a wider range of gambling activities, and exhibit problem gambling behaviors. These traders don't just gamble more — they gamble differently, preferring skill-based games like casino table games, sports betting, and poker over chance-based activities like slot machines.

Research by Arthur et al. (2016) found that high-risk stock traders are more likely to engage in frequent gambling, participate in a wider range of gambling activities, and exhibit problem gambling behaviors. These traders don't just gamble more — they gamble differently, preferring skill-based games like casino table games, sports betting, and poker over chance-based activities like slot machines.

Studies consistently show that the type of gambling activities that high-risk stock traders participate in suggests that they are a sub-group of skill-based gamblers who also prefer gambling on casino table games, sports betting, dog and horse race betting, and games of skill for money over chance-based games such as electronic gaming machines, bingo, and instant win tickets.

The Cryptocurrency Connection

Cryptocurrency trading has emerged as a particularly problematic form of speculative behavior. Real-time stock trading and cryptocurrency trading are linked to higher rates of excessive behavior and mental health issues compared to regular investing.

Research by Oksanen et al. (2022) found that both real-time trading platform use and crypto market trading were associated with higher scores of addictive behavior measures. Crypto market traders in particular reported significantly higher scores in excessive gambling, gaming, internet use, and alcohol use. While research highlights problematic behaviors associated with cryptocurrency trading for some market participants, not all investors experience these outcomes. Individuals should carefully assess their risk tolerance and consult with advisors to make informed choices.

The Behavioral Patterns of Speculation

The research reveals consistent patterns among excessive traders that mirror classic gambling behaviors:

Loss chasing: Traders with higher problem gambling scores are more likely to engage in short-term trading, chase losses, and experience high sensations when trading.

Overconfidence: Multiple studies document how both gamblers and active traders suffer from overconfidence bias, believing they can predict future market movements despite overwhelming evidence to the contrary.

Addiction-like symptoms: Research by Grall-Bronnec et al. (2017) found that excessive traders seeking treatment in problem gambling units exhibited "high event frequency and short event duration in financial trading, which are characteristics frequently found in gambling disorder."

The Cost of Speculation

The financial consequences of this gambling-like behavior are severe. The famous Dalbar study, which has tracked investor behavior for decades, shows that the average equity fund investor earned returns of only 9.24 percent, while a buy-and-hold investment in the S&P 500 Index returned 10.35 percent over a 20-year period ending in 2024.

Research from Taiwan provides even more stark evidence that regularly trading individual stocks results in large and systematic losses. Using a complete trading history of all investors in Taiwan, researchers showed that the aggregate portfolio of individuals suffered an annual performance penalty of 3.8%. Individual investor losses were equivalent to 2.2% of Taiwan's gross domestic product.

Technology Amplifies the Problem

Modern technology has made speculative trading easier and more addictive than ever. Commission-free trading apps use game-like interfaces to encourage frequent trading. In addition, the elimination of commissions by most retail brokerages has given the impression that stock market trading is free, even though consumers still pay for it through bid-ask spreads and payment for order flow.

As John Maynard Keynes presciently observed: "It is usually agreed that casinos should, in the public interest, be inaccessible and expensive. And perhaps the same is true of Stock Exchanges." Instead, we've moved in the opposite direction, making both more accessible than ever.

The Index Fund Solution

The research consistently points to a better way: systematic, passive investing through index funds. As Mark Hebner explains in Step 1 of his book, passive investors don't try to pick stocks, times, managers, or styles. Instead, they buy and hold globally diversified portfolios of passively managed funds.

This approach offers multiple advantages:

● Lower costs: Index funds typically have expense ratios well below 0.1%, compared to actively managed funds that often charge 1% or more

● Better tax efficiency: Lower turnover means fewer taxable events

● Reduced behavioral risk: Less opportunity for emotional decision-making

● Superior long-term returns: The evidence suggests that passive strategies frequently outperform active ones over time, but past performance is not indicative of future outcomes.

Studies by Vanguard suggest that working with a passive advisor can add up to 3% annually in returns through better behavior management, disciplined rebalancing, and tax-efficient strategies.

Breaking the Addiction Cycle

For investors caught in the speculation trap, recognition is the first step toward recovery. As Benjamin Graham noted in his famous book The Intelligent Investor, "The investor's chief problem, and even his worst enemy, is likely to be himself."

The solution isn't to try harder at stock picking or market timing—it's to abandon these futile activities entirely. Paul Samuelson put it perfectly when he said: "There is something in people; you might even call it a little bit of a gambling instinct... I tell people investing should be dull. It shouldn't be exciting… If you want excitement, take $800 and go to Las Vegas."

The Path Forward

The academic evidence is clear: excessive stock trading can exhibit psychological patterns similar to problem gambling in some investors, which may carry fiancial conequences if left unaddressed. The solution isn't to gamble smarter — it's to stop gambling with your financial future entirely.

Index fund investing offers a proven alternative: boring, systematic, and remarkably effective. By accepting market returns rather than chasing them, investors can avoid the behavioral traps that ensnare so many active traders.

At Index Fund Advisors, we've spent more than 25 years helping investors escape the speculation cycle and embrace evidence-based investing. If you're interested in exploring evidence-based investing to achieve your long-term financial goals, we're here to guide you to personalized advice. Connect with an IFA Wealth Advisor today.

The choice is yours: continue feeding the addiction of active trading or embrace the discipline of passive investing. The research couldn't be clearer about which path leads to better outcomes.

ROBIN POWELL is the Creative Director at Index Fund Advisors (IFA). He is also a financial journalist and the Editor of The Evidence-Based Investor. This article reflects IFA's investment philosophy and is intended for informational purposes only.

References to gambling or addiction-like tendencies are based on academic research focused on certain trading behaviors. These characteristics may not apply to all active investors, and individual behaviors vary. This article is intended for informational purposes only, and readers are encouraged to assess their own circumstances with a financial professional

This article is intended for informational purposes only and reflects the perspective of Index Fund Advisors (IFA), with which the author is affiliated. It should not be interpreted as an offer, solicitation, recommendation, or endorsement of any specific security, product, or service. Readers are encouraged to consult with a qualified Investment Advisor for personalized guidance. Please note that there are no guarantees that any investment strategies will be successful, and all investing involves risks, including the potential loss of principal. This article references third-party studies. While these findings have been reported accurately, they are not exhaustive, and results may vary depending on time frame or methodology. Investors should consider consulting recent research to make informed decisions.

Quotes and images included are for illustrative purposes only and should not be considered as endorsements, recommendations, or guarantees of any particular financial product, service, or advisor. IFA does not endorse or guarantee the accuracy of third-party content. For those seeking additional insights into the challenges of market timing, Step 4 of Mark Hebner's award-winning book ‘Index Funds: The 12-Step Recovery Program for Active Investors' offers a detailed perspective. This book is available free of charge here. References to third-party resources, including books, are informational and do not constitute endorsements or solicitations. IFA does not receive compensation related to this recommendation

For additional information about Index Fund Advisors, Inc., please review our brochure at https://www.adviserinfo.sec.gov/ or visit our website at www.ifa.com.