What's New

Maybe we're just a bunch of geeks. But each year, we look forward to this latest collection of market data.

There are very few certainties with investing. But there is, thankfully, one controlling principle that is incontrovertible. Financial Journalist Norma Cohen calls it the Iron Law of Compound Interest.

In Part Three of our series, The Value of Fiduciary Advice we discuss the three things you should look for in an advisor.

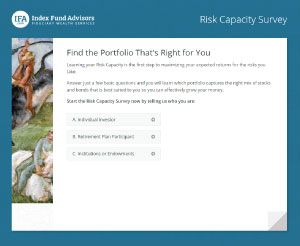

There's no getting around it, all investing involves risk, and equity investing in particular. But is investment risk something to be frightened of?

What if we told you that understanding how markets work could be distilled down to three simple variables? Uncertainty, Return and Price.

Discover key insights from 2025 market performance that underline the advantages of international diversification for long-term investors.

Discover Jacob Bernoulli’s contributions to math and probability and how MarketCoin flips align with the Bernoulli process and trials.A sequence of MarketCoin flips is a Bernoulli process, with each flip a Bernoulli trial, due to its binary outcomes (Up/Down) and independence, with (p = 0.5) based on the median return split, reflecting Bernoulli's foundational concepts in probability.

To help choose the best retirement savings option that fits your needs, here's a look at some options.

Learn how high-risk traders exhibit gambling behaviors, prefer skill-based games, and face mental health challenges tied to speculative trading.

Key options exist for handling required minimum distributions (RMD), including tax rules impacting qualified charitable contributions.

Become An IFA Client

your investments. We assist clients daily

with tailored solutions designed to support you.

step in tailoring portfolios to align with your

financial goals.