Franklin Templeton is one of the largest active asset managers in the world. After struggling through years of net outflows, however, the California-based global funds giant completed a deal in mid-2020 to buy another major funds competitor, Legg Mason. The acquistion, which involved some $4.5 billion in cash and around $2 billion in debt assumption by the new owner, was expected at the time to more than double its asset base.1

By early 2022, the reconstructed funds company reported nearly $1.5 trillion in assets under management. It's still organized as a subsidiary of Franklin Resources Inc., a holding company that encompasses several past mergers including funds offered under the Franklin, Templeton, Mutual Series and Fiduciary brands. Franklin trades publicly on the New York Stock Exchange under the ticker symbol BEN.

Like Legg Mason, it's considered a pioneer of active funds management. Indeed, Franklin was started by a former broker in 1947 and Legg Mason traces its roots to 1899.

"A confluence of several issues — poor relative active investment performance, the growth of low-cost index-based products, and the expanding power of the retail-advised channel — has made it increasingly difficult for active asset managers to generate organic growth, leaving them more dependent on market gains to increase their assets under management, or AUM," noted Morningstar in reviewing Franklin Templeton's post-mega deal fortunes.

Even a few years after such an acquistion, Morningstar pointed out that Franklin Templeton "continues to focus on expense mitigation following the integration of Legg Mason." In its analysis, first published in May 2022, the independent funds researcher added:

"While we expect the Legg Mason deal to keep margins from deteriorating in the face of industrywide fee compression and rising costs (necessary to improve investment performance and enhance product distribution), near-term organic growth will struggle to stay positive (albeit better than the negative growth profile for a stand-alone Franklin)." 2

Once heavily leaning to fixed-income funds, Franklin Templeton's has worked through acquisitions to broaden its asset base. Besides Legg Mason, in early 2022 it completed a deal to buy Lexington Partners, a private equity funds investment firm that managed a reported $57 billion in AUM. That came on the heels of Franklin Templeton's purchase of O'Shaughnessy Asset Management, which had $6 billion-plus in AUM.

Given this firm's history as an active manager and expansion into equity and alternative investment strategies, we're putting Franklin Templeton's existing family of funds under our research microscope. This should help to provide investors with a better view of how this venerable asset manager's long-term performance track record stacks up against a backdrop of swallowing up fund shops — both large and small — in order to feed its growth in assets.

Controlling for Survivorship Bias

It's important for investors to understand the idea of survivorship bias. While there are 155 active mutual funds with five or more years of performance-related data currently offered by Franklin Templeton, it doesn't necessarily mean these are the only strategies this company has ever managed. In fact, there are 91 mutual funds that no longer exist. This can be for a variety of reasons including poor performance or the fact that they were merged with another fund. We will show what their aggregate performance looks like shortly.

Fees & Expenses

Let's first examine the costs associated with Franklin Templeton's surviving 155 strategies. It should go without saying that if investors are paying a premium for investment "expertise," then they should be receiving above average results consistently over time. The alternative would be to simply accept a market's return, less a significantly lower fee, via an index fund.

The costs we examine include expense ratios, front end (A), deferred (B) and level (C) loads, as well as 12b-1 fees. These are considered the "hard" costs that investors incur. Prospectuses, however, do not reflect the trading costs associated with mutual funds.

Commissions and market impact costs are real expenses associated with implementing a particular investment strategy and can vary depending on the frequency and size of the trades executed by portfolio managers.

We can estimate the costs associated with an investment strategy by looking at its annual turnover ratio. For example, a turnover ratio of 100% means that the portfolio manager turns over the entire portfolio in one year. This is considered an active approach and investors holding these funds in taxable accounts will likely incur a higher exposure to tax liabilities, such as short- and long-term capital gains distributions, than those incurred by passively managed funds.

The table below details the hard costs as well as the turnover ratio for all 155 surviving active funds offered by Franklin Templeton that have at least five years of complete performance history. (Since allocations between stocks and bonds fluctuate based on glide paths and specific retirement horizons, target-date retirement and lifecycle types of funds aren't included in this study.) You can search this table for a symbol or name by using Control F in Windows or Command F on a Mac. Then click the link to see the Alpha Chart. Also, remember that this is what is considered an in-sample test; the next level of analysis is to do an out-of-sample test (for more information see here).

| Fund Name | Ticker | Turnover Ratio % | Prospectus Net Expense Ratio | 12b-1 Fee | Deferred Load | Max Front Load | Global Broad Category Group |

| Franklin Corefolio Allocation Advisor | FCAZX | 3.58 | 0.81 | Allocation | |||

| Franklin Multi-Asset Growth A | SCHAX | 25.00 | 1.30 | 0.25 | 5.75 | Allocation | |

| Franklin Mutual Shares Z | MUTHX | 21.35 | 0.80 | Allocation | |||

| Franklin Global Allocation Adv | FFAAX | 97.19 | 0.73 | Allocation | |||

| Franklin Mutual Quest Z | MQIFX | 52.07 | 0.81 | Allocation | |||

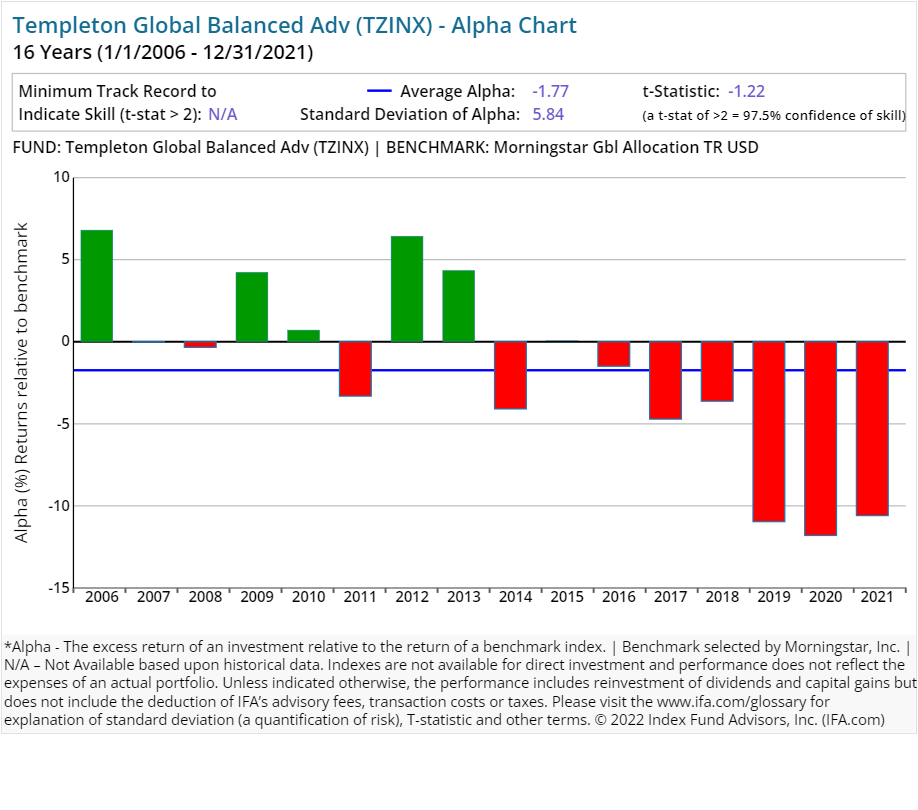

| Templeton Global Balanced Adv | TZINX | 52.63 | 0.98 | Allocation | |||

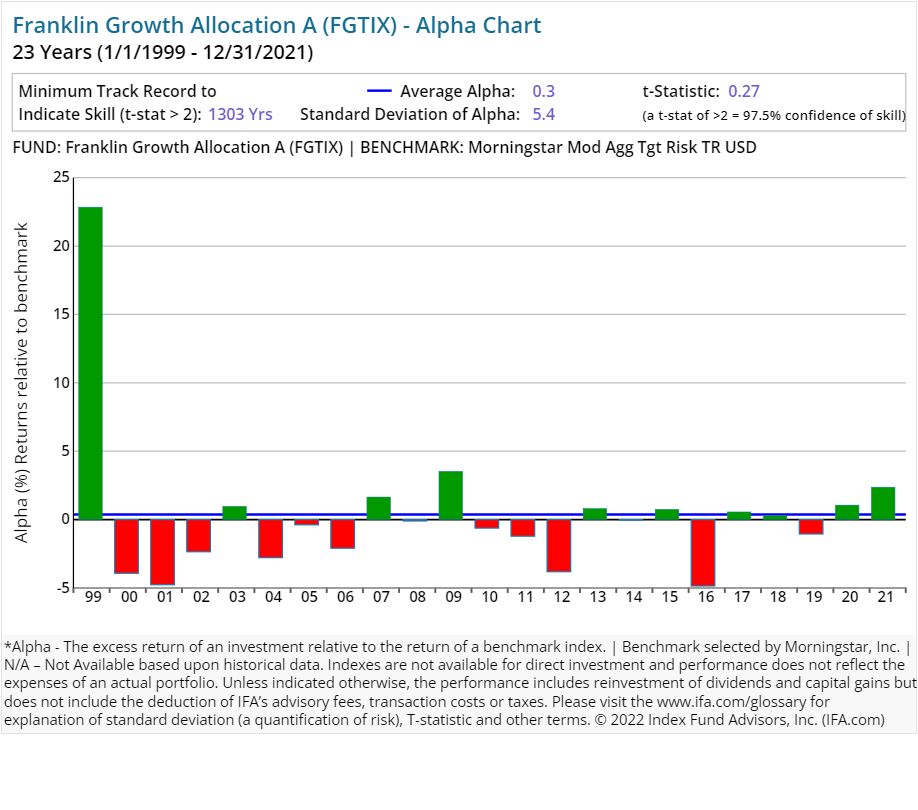

| Franklin Growth Allocation A | FGTIX | 59.90 | 0.93 | 0.25 | 5.50 | Allocation | |

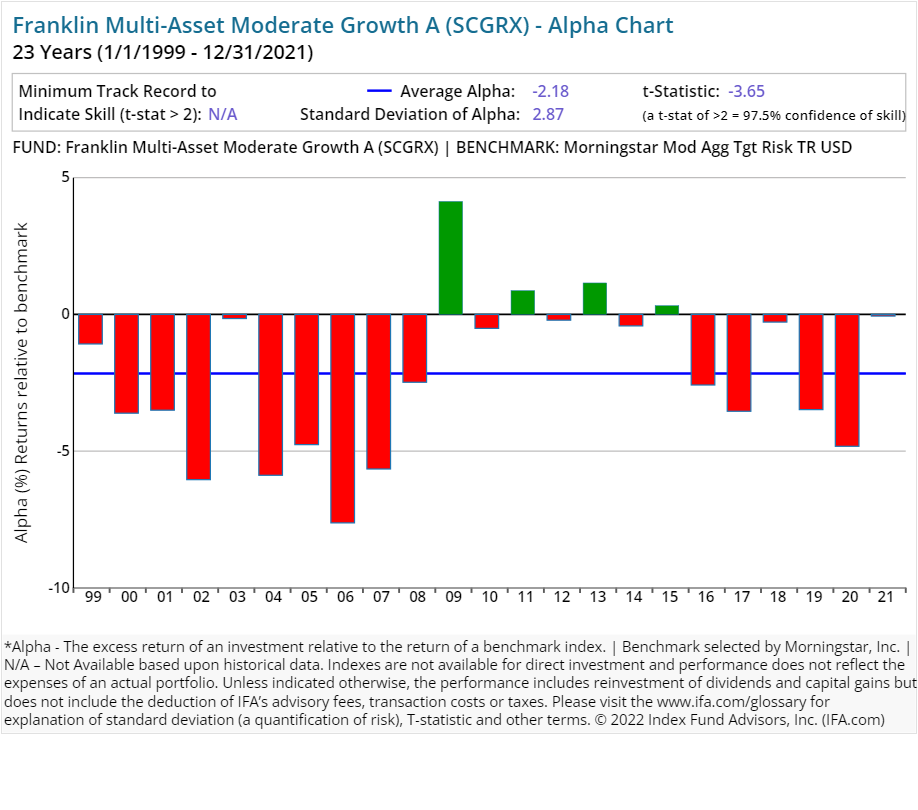

| Franklin Multi-Asset Moderate Growth A | SCGRX | 24.00 | 1.25 | 0.25 | 5.75 | Allocation | |

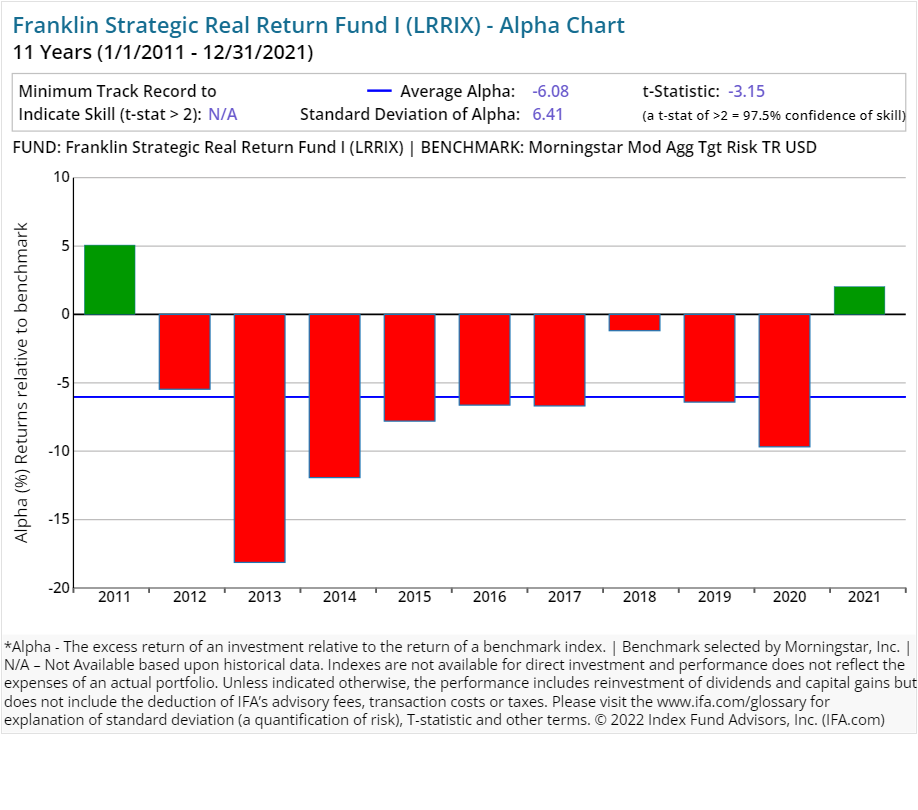

| Franklin Strategic Real Return Fund I | LRRIX | 41.00 | 1.10 | Allocation | |||

| Franklin Conservative Allocation A | FTCIX | 61.92 | 0.87 | 0.25 | 5.50 | Allocation | |

| Franklin Income A1 | FKINX | 68.93 | 0.62 | 0.15 | 3.75 | Allocation | |

| Franklin Multi-Asset Defensive Growth A | SBCPX | 19.00 | 1.21 | 0.25 | 4.25 | Allocation | |

| Franklin Managed Income Adv | FBFZX | 39.64 | 0.68 | Allocation | |||

| Franklin Moderate Allocation A | FMTIX | 44.49 | 0.88 | 0.25 | 5.50 | Allocation | |

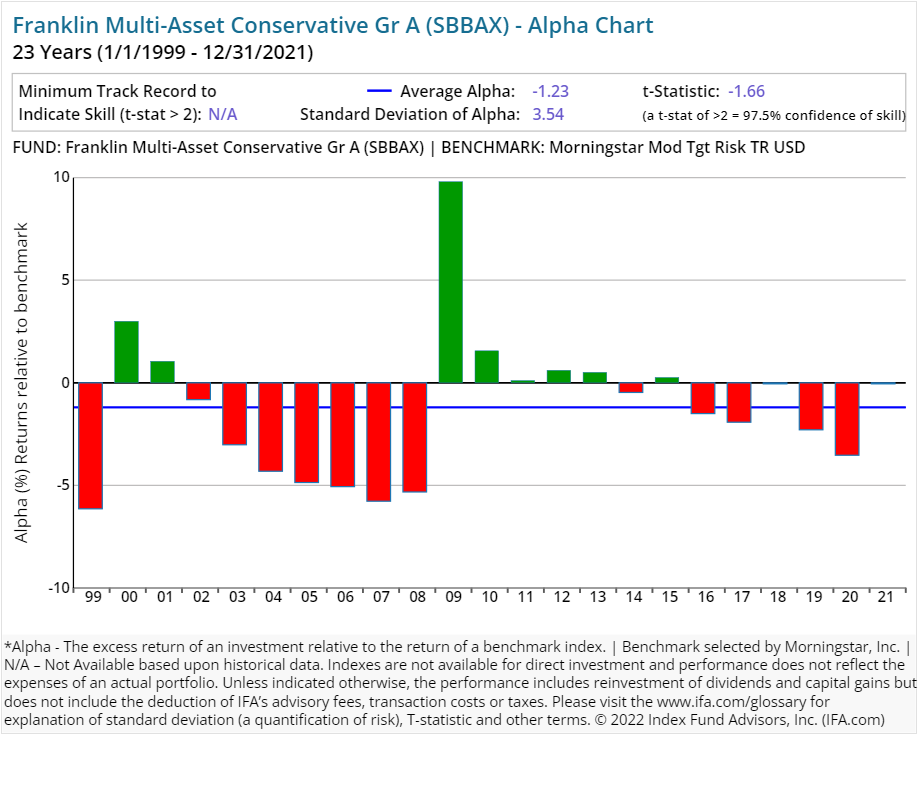

| Franklin Multi-Asset Conservative Gr A | SBBAX | 25.00 | 1.19 | 0.25 | 5.75 | Allocation | |

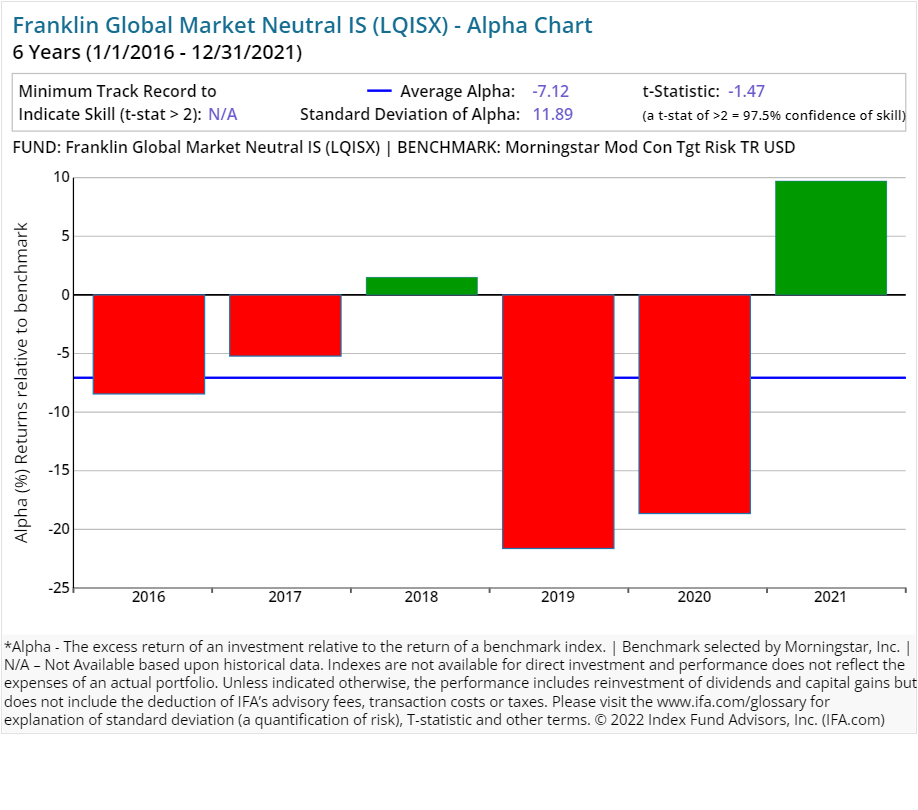

| Franklin Global Market Neutral IS | LQISX | 134.00 | 2.94 | Alternative | |||

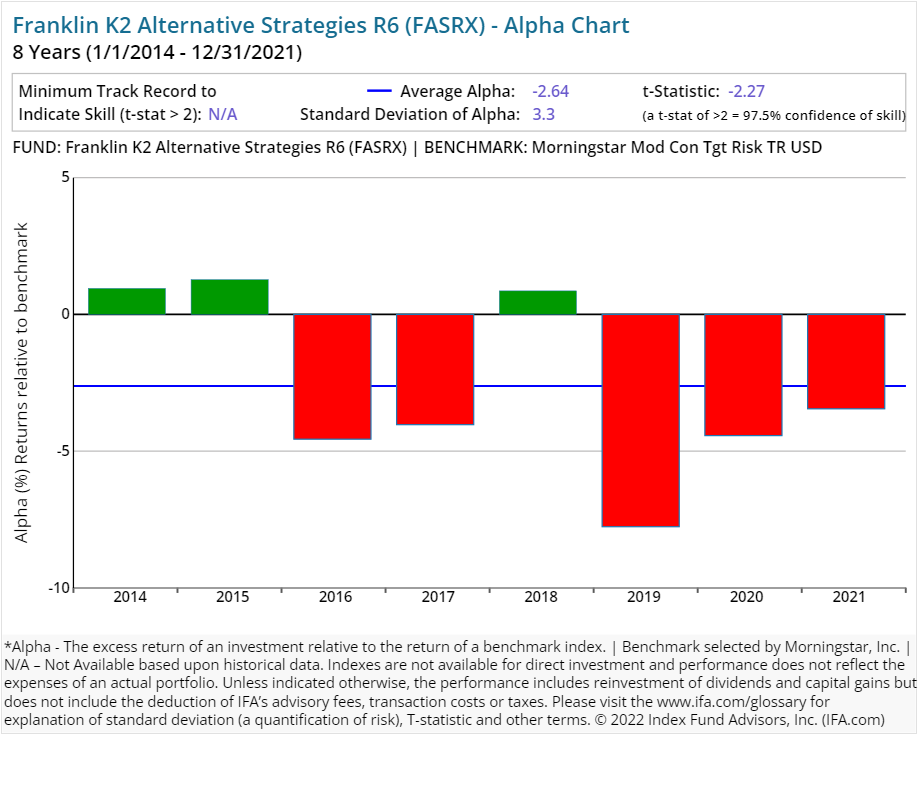

| Franklin K2 Alternative Strategies R6 | FASRX | 236.64 | 2.34 | Alternative | |||

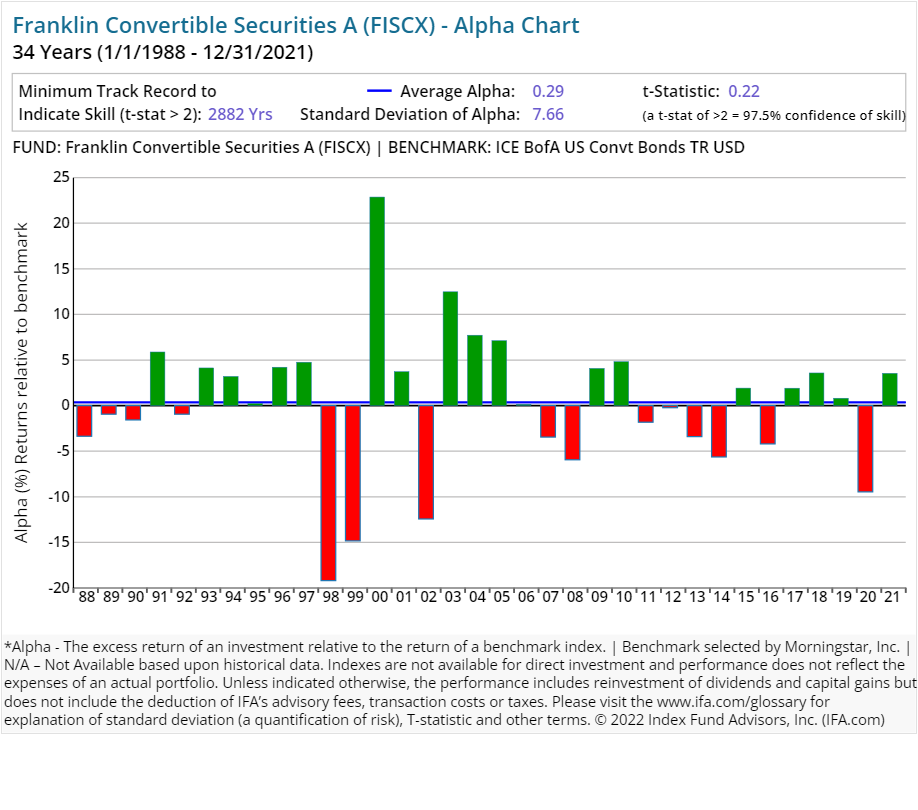

| Franklin Convertible Securities A | FISCX | 32.67 | 0.84 | 0.25 | 5.50 | Convertibles | |

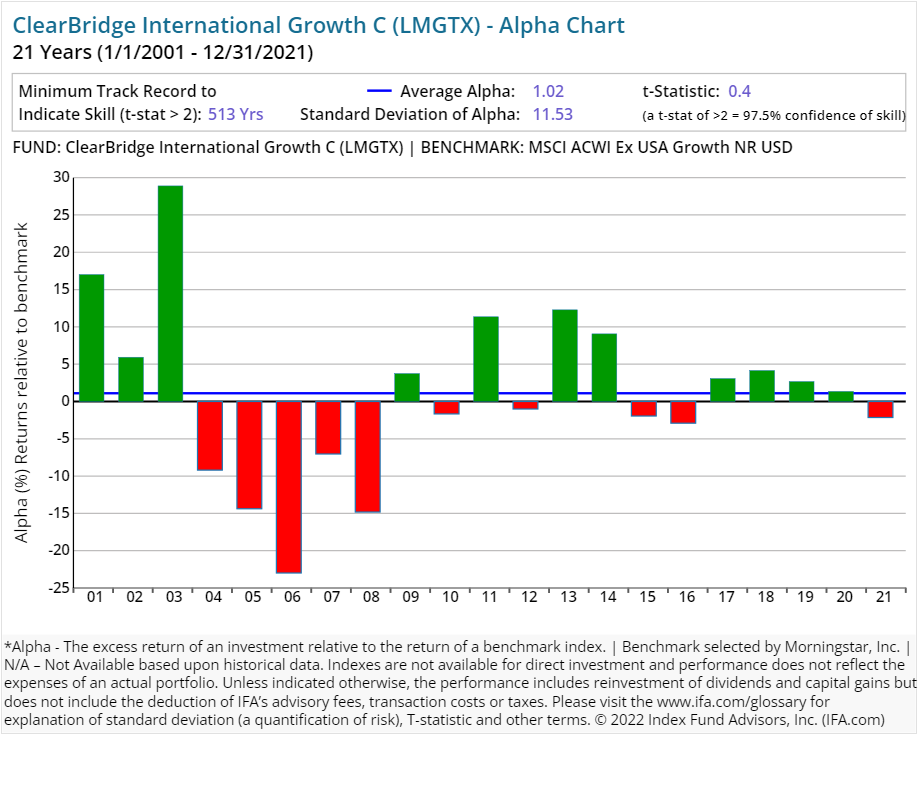

| ClearBridge International Growth C | LMGTX | 39.00 | 1.79 | 1.00 | 1.00 | Equity | |

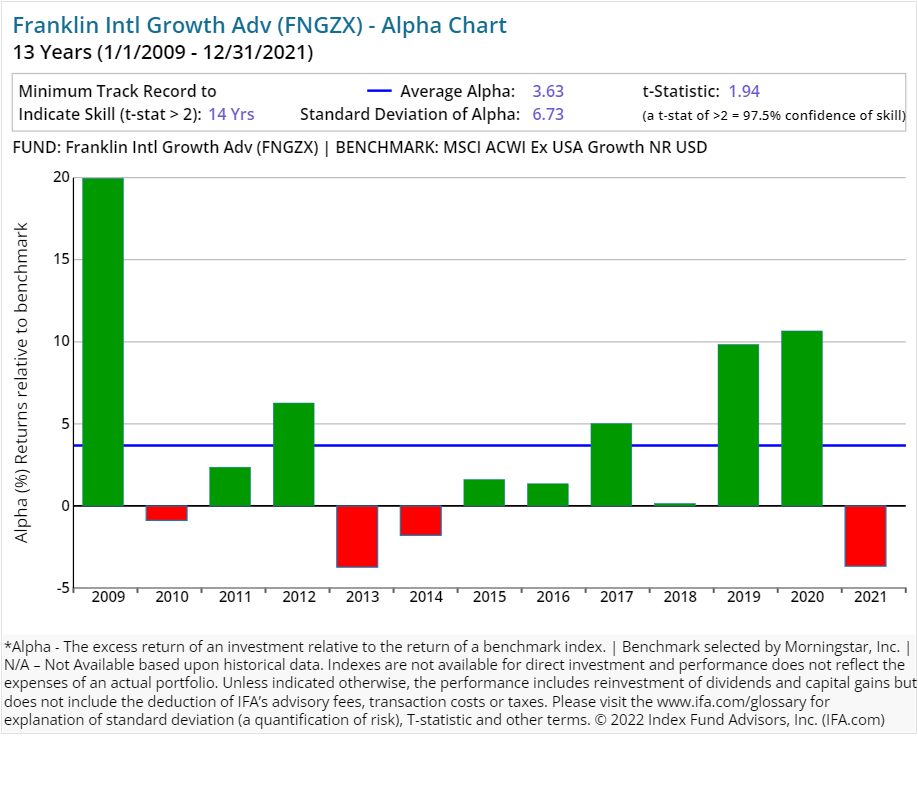

| Franklin Intl Growth Adv | FNGZX | 14.47 | 0.86 | Equity | |||

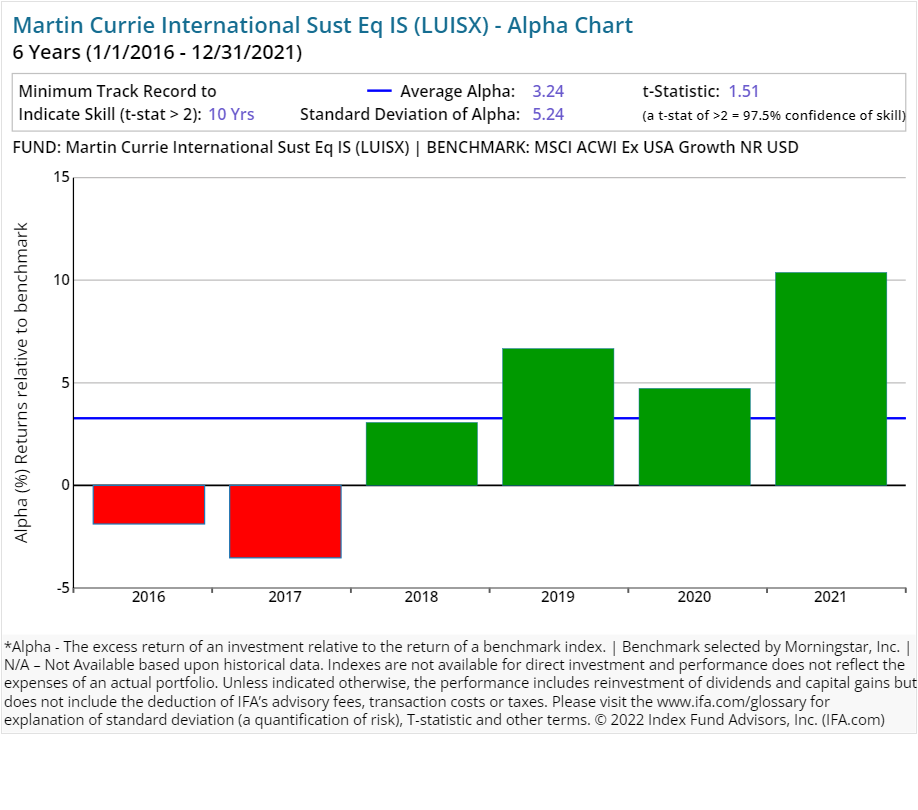

| Martin Currie International Sust Eq IS | LUISX | 49.00 | 0.75 | Equity | |||

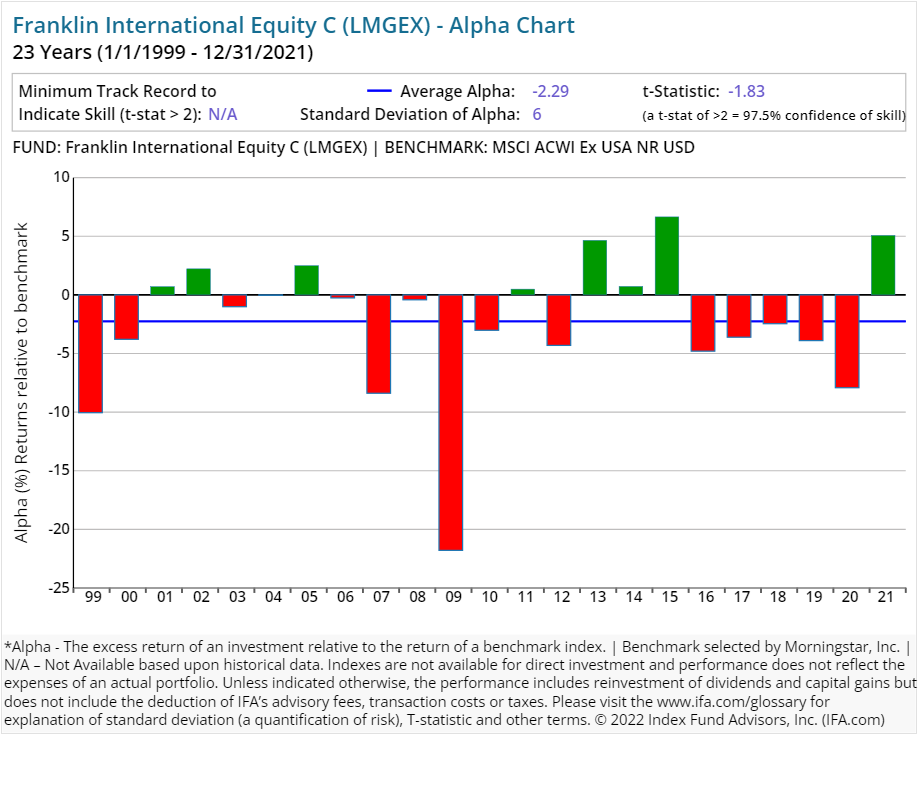

| Franklin International Equity C | LMGEX | 41.00 | 2.05 | 1.00 | 1.00 | Equity | |

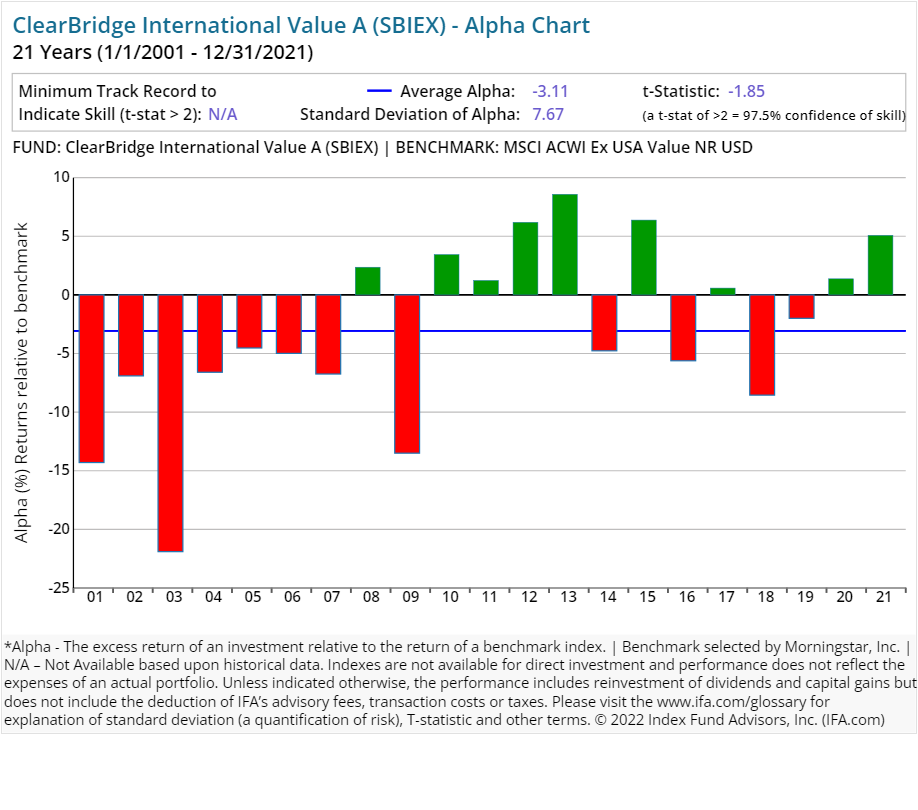

| ClearBridge International Value A | SBIEX | 25.00 | 1.25 | 0.25 | 5.75 | Equity | |

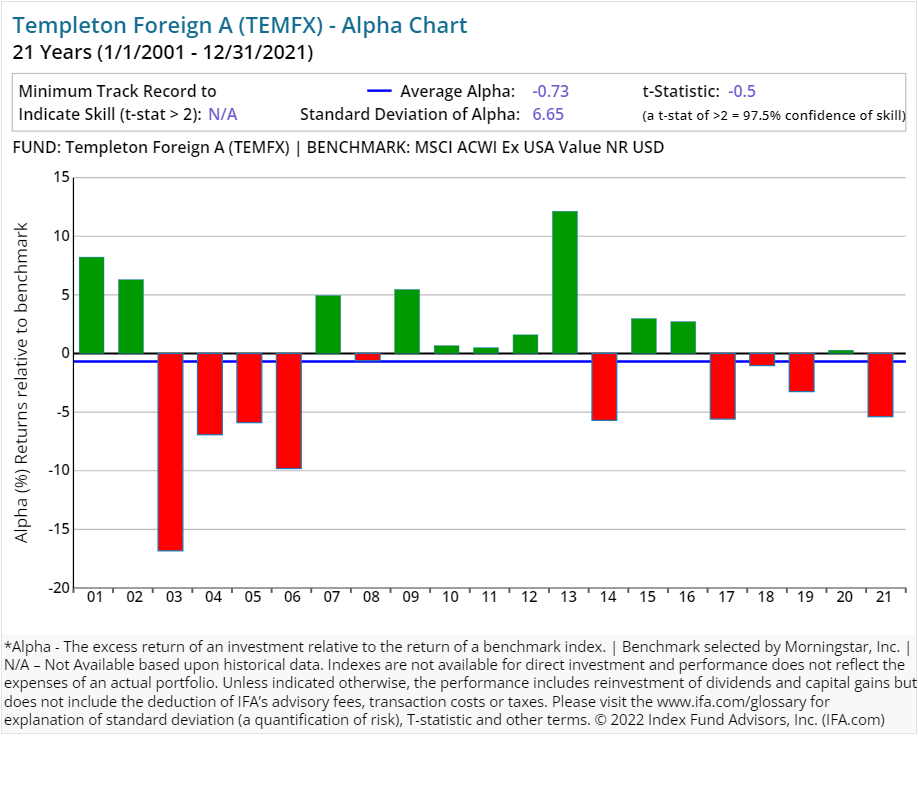

| Templeton Foreign A | TEMFX | 37.85 | 1.10 | 0.25 | 5.50 | Equity | |

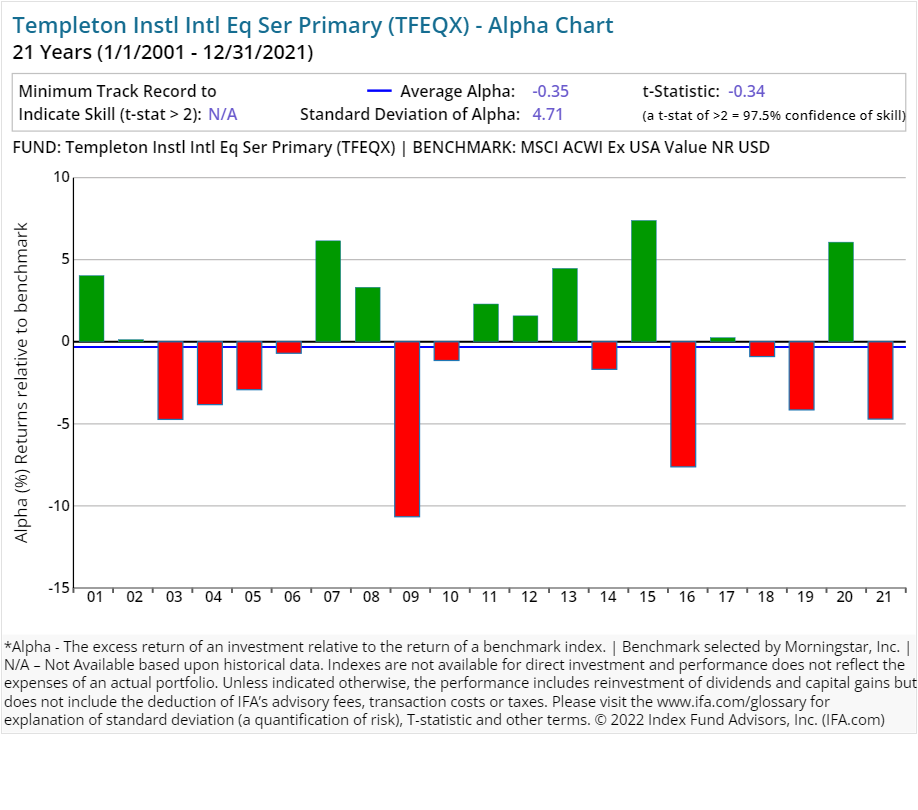

| Templeton Instl Intl Eq Ser Primary | TFEQX | 44.73 | 0.83 | Equity | |||

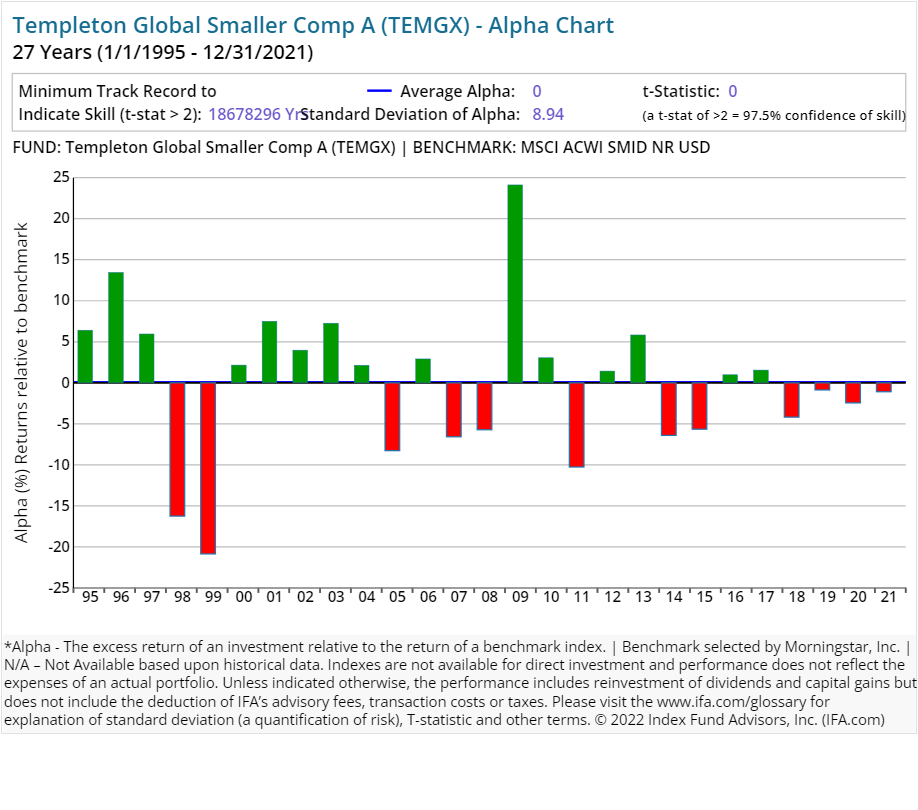

| Templeton Global Smaller Comp A | TEMGX | 20.47 | 1.31 | 0.25 | 5.50 | Equity | |

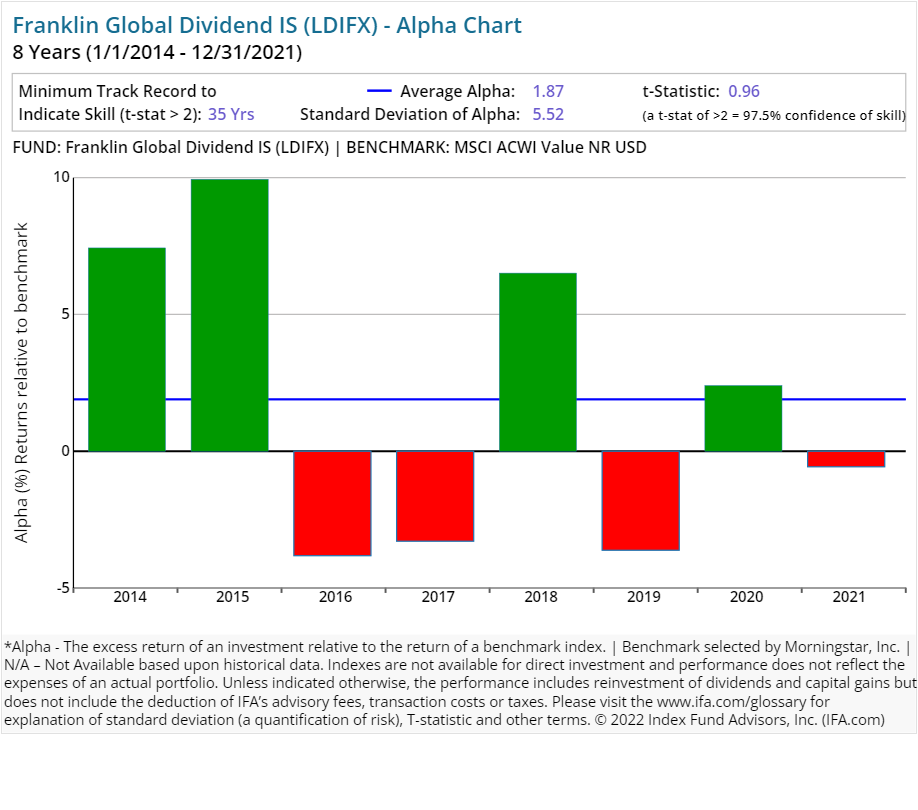

| Franklin Global Dividend IS | LDIFX | 22.00 | 0.74 | Equity | |||

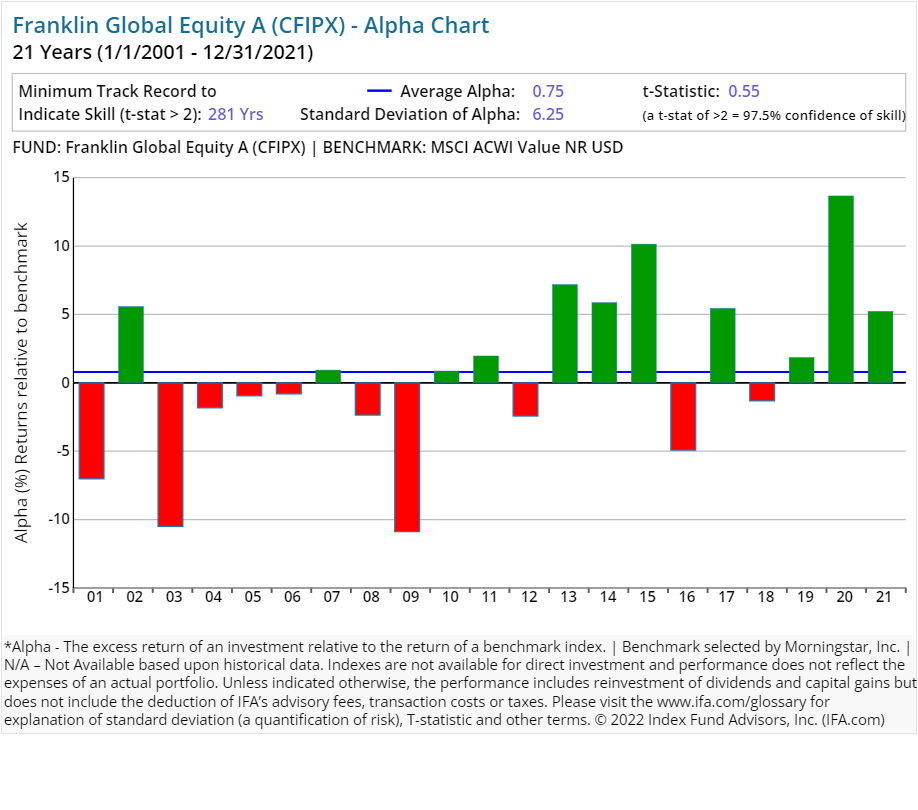

| Franklin Global Equity A | CFIPX | 36.00 | 1.30 | 0.25 | 5.75 | Equity | |

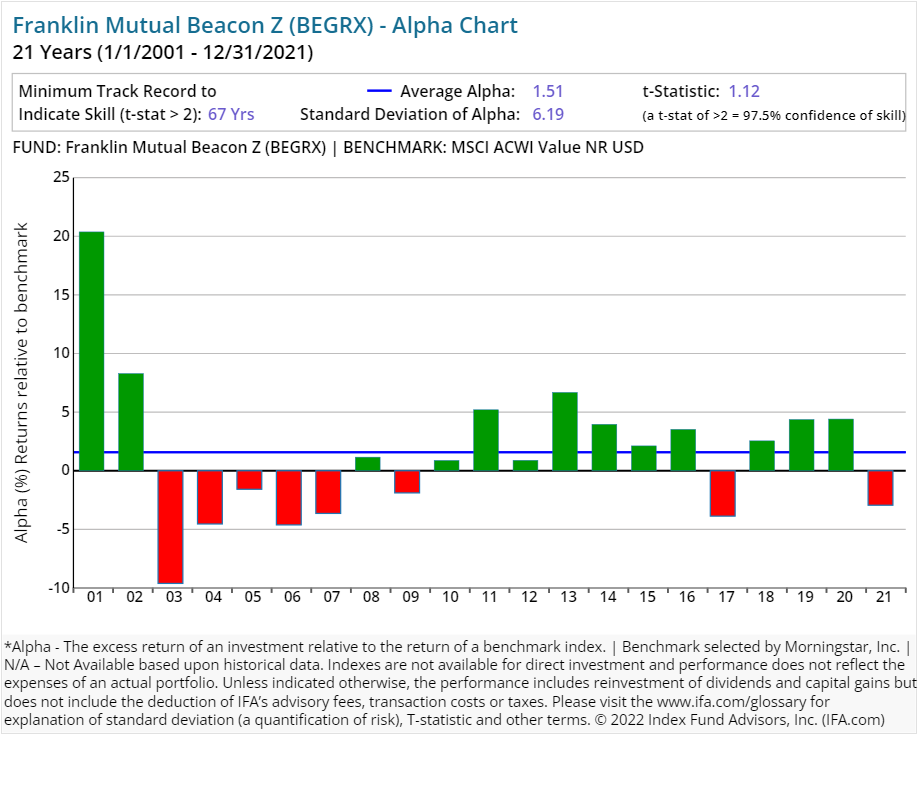

| Franklin Mutual Beacon Z | BEGRX | 40.89 | 0.82 | Equity | |||

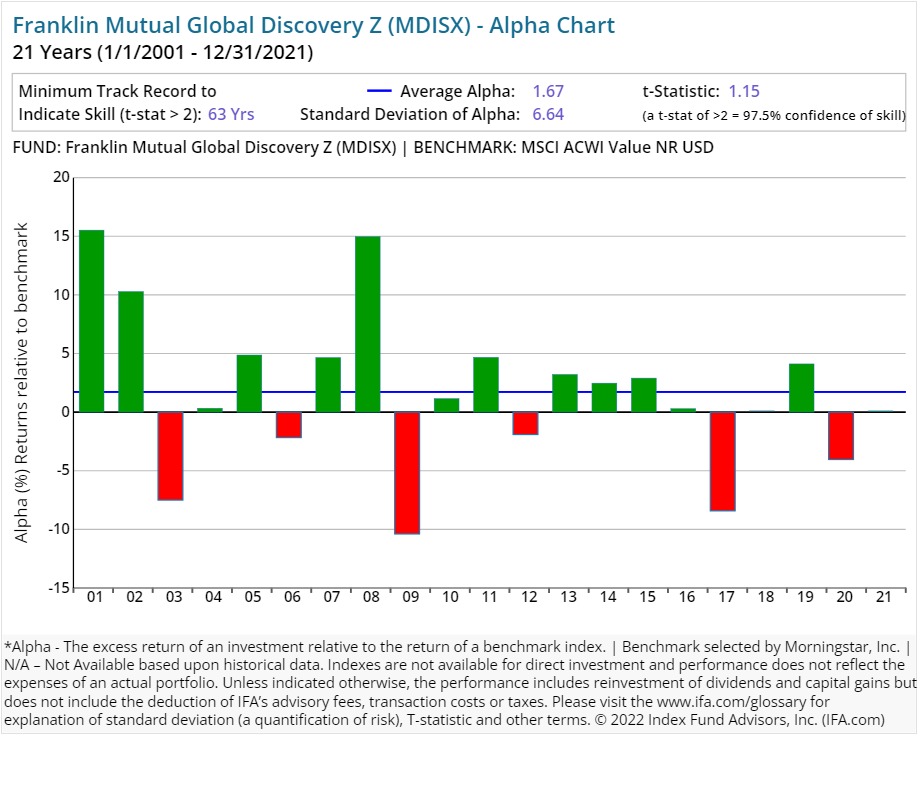

| Franklin Mutual Global Discovery Z | MDISX | 40.67 | 1.01 | Equity | |||

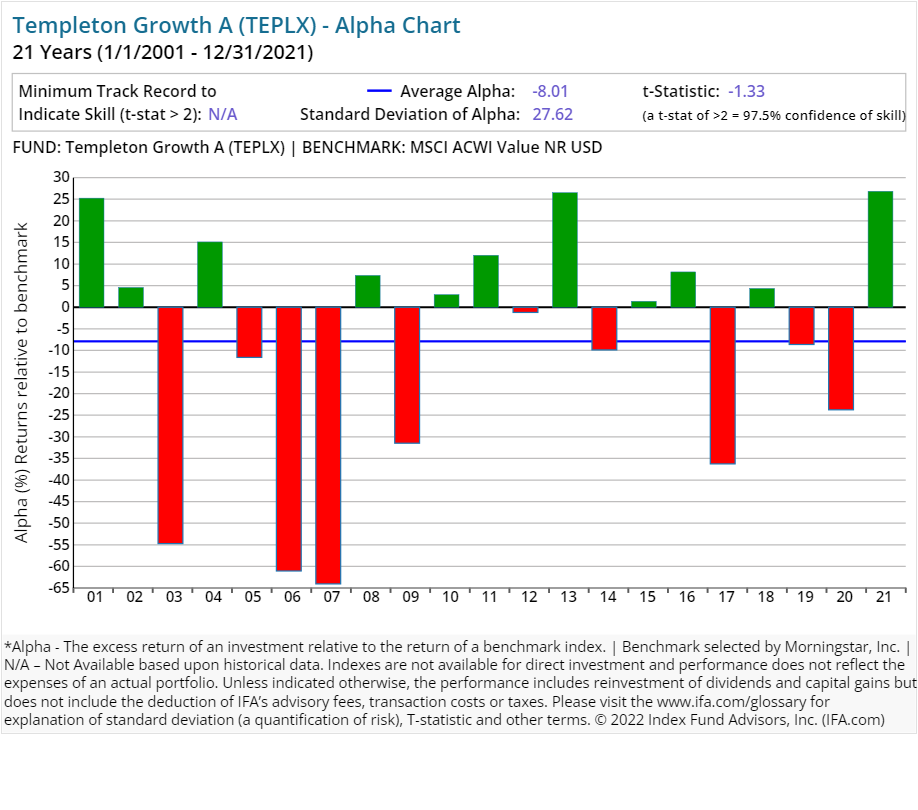

| Templeton Growth A | TEPLX | 44.14 | 1.05 | 0.25 | 5.50 | Equity | |

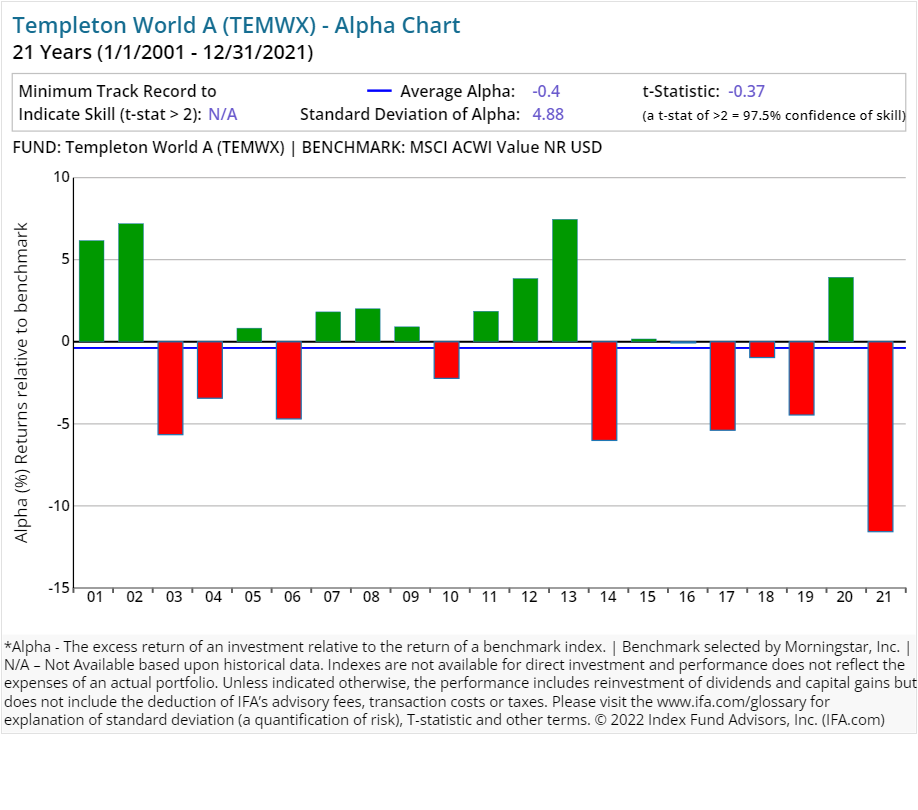

| Templeton World A | TEMWX | 41.83 | 1.05 | 0.25 | 5.50 | Equity | |

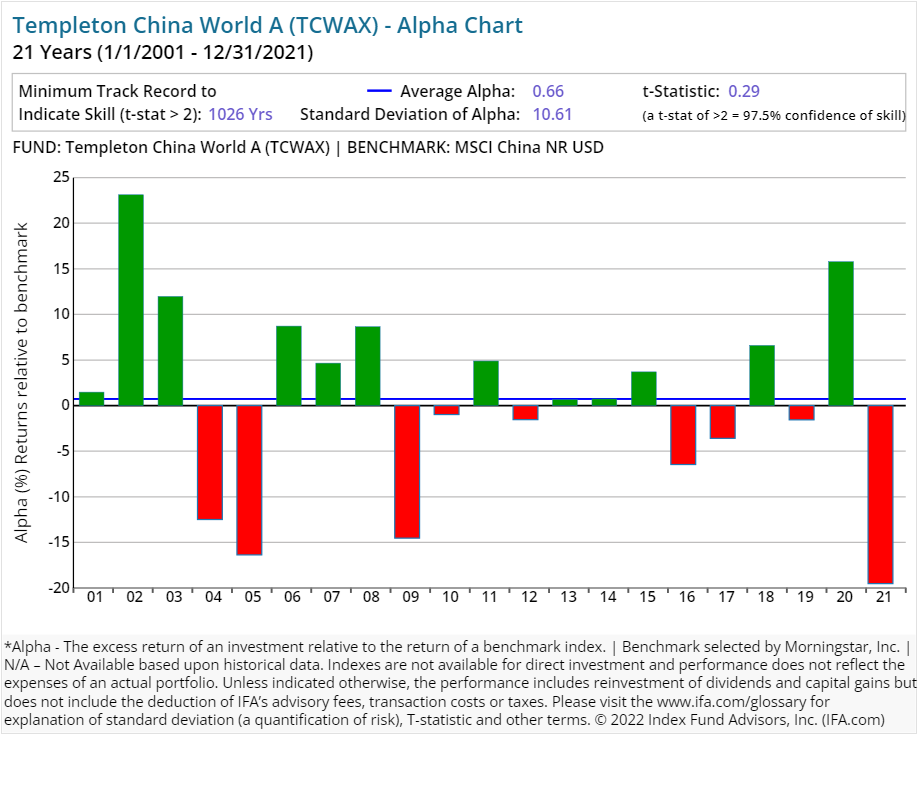

| Templeton China World A | TCWAX | 27.52 | 1.73 | 0.25 | 5.50 | Equity | |

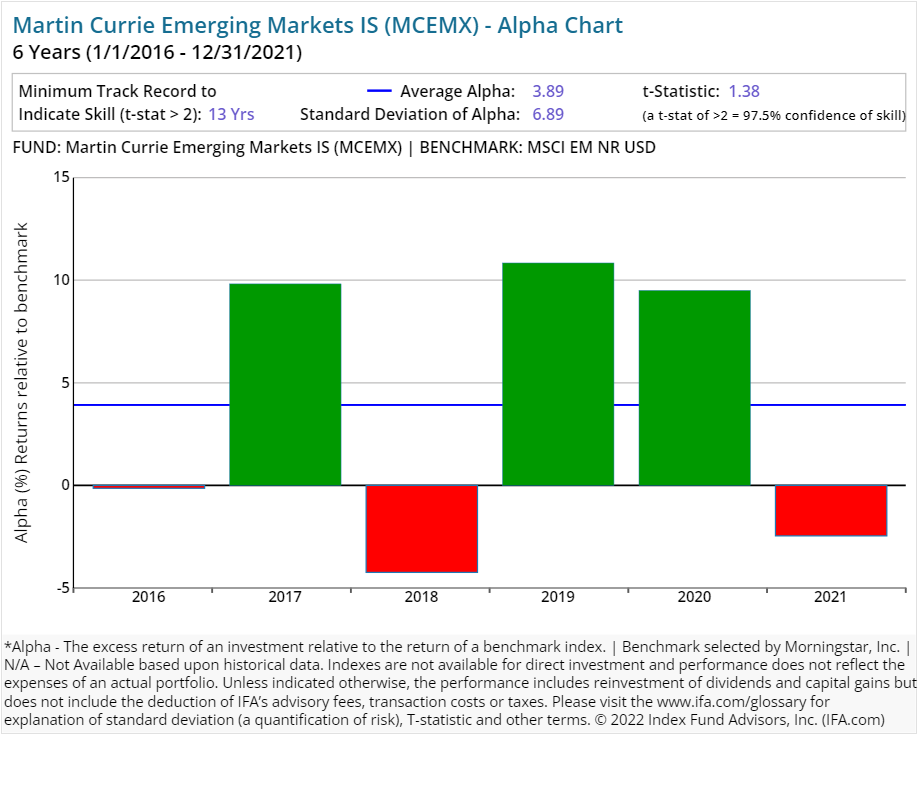

| Martin Currie Emerging Markets IS | MCEMX | 23.00 | 0.85 | Equity | |||

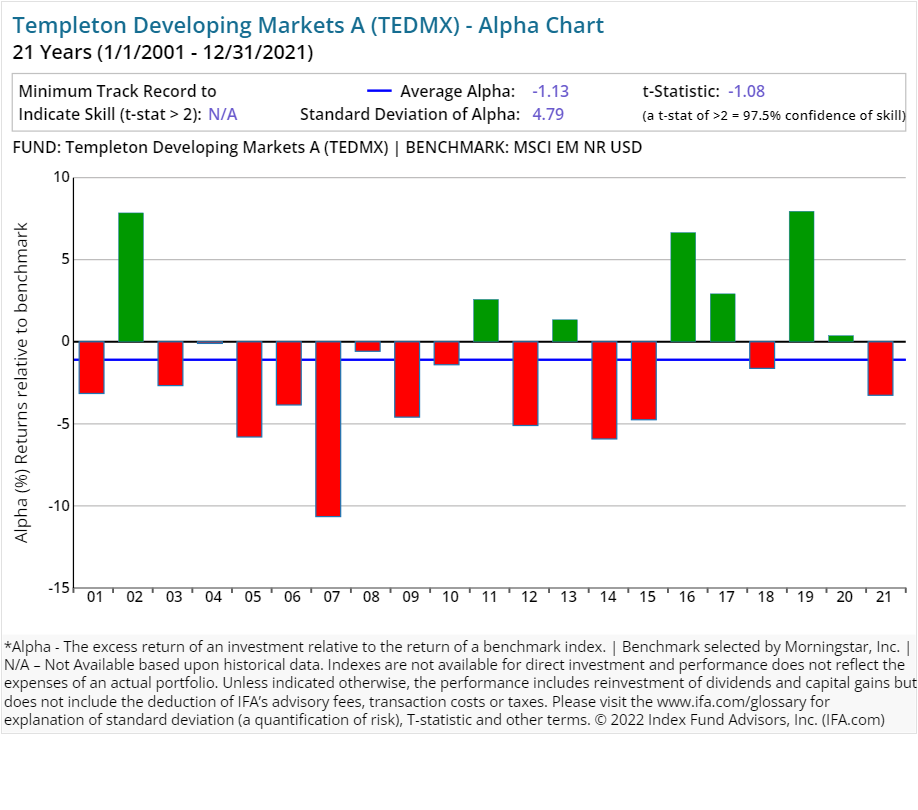

| Templeton Developing Markets A | TEDMX | 21.89 | 1.38 | 0.25 | 5.50 | Equity | |

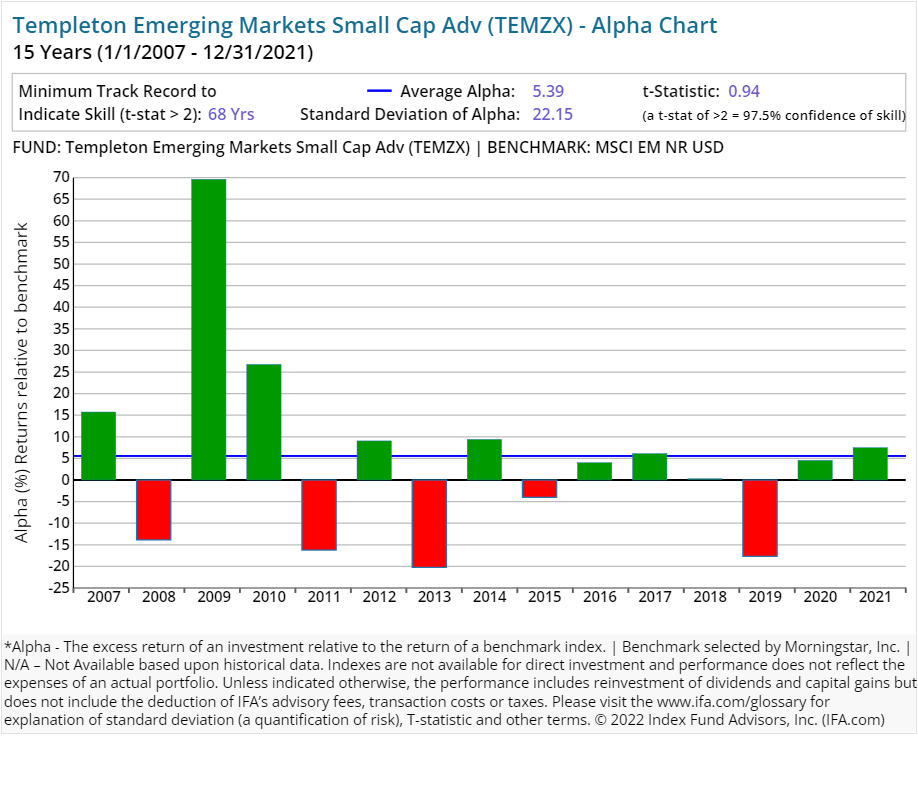

| Templeton Emerging Markets Small Cap Adv | TEMZX | 31.70 | 1.50 | Equity | |||

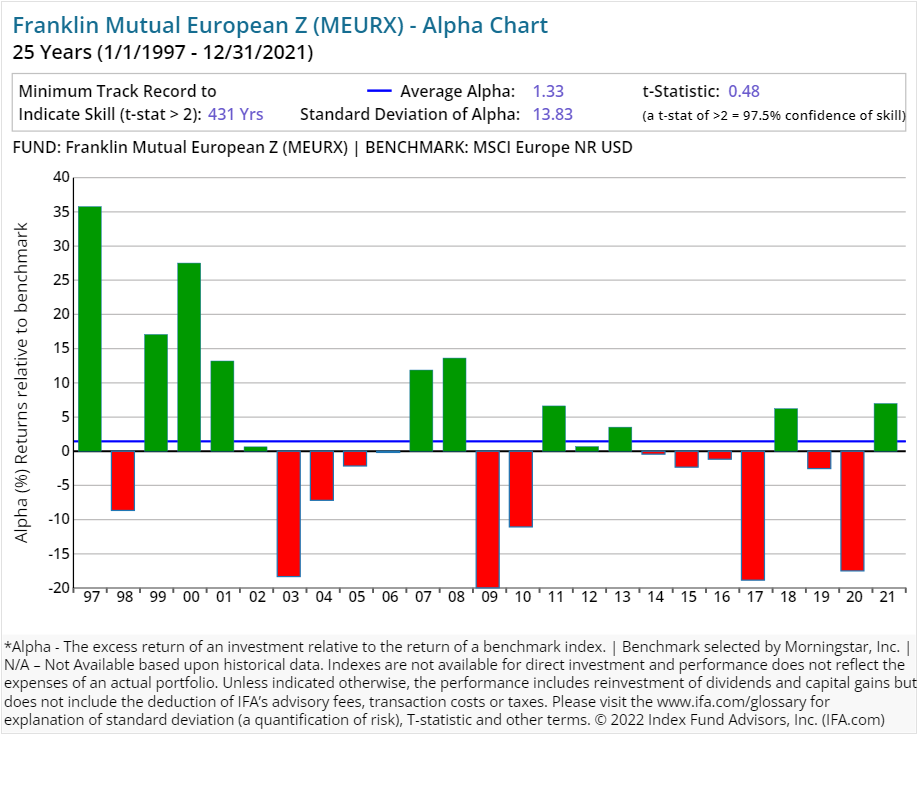

| Franklin Mutual European Z | MEURX | 32.03 | 1.08 | Equity | |||

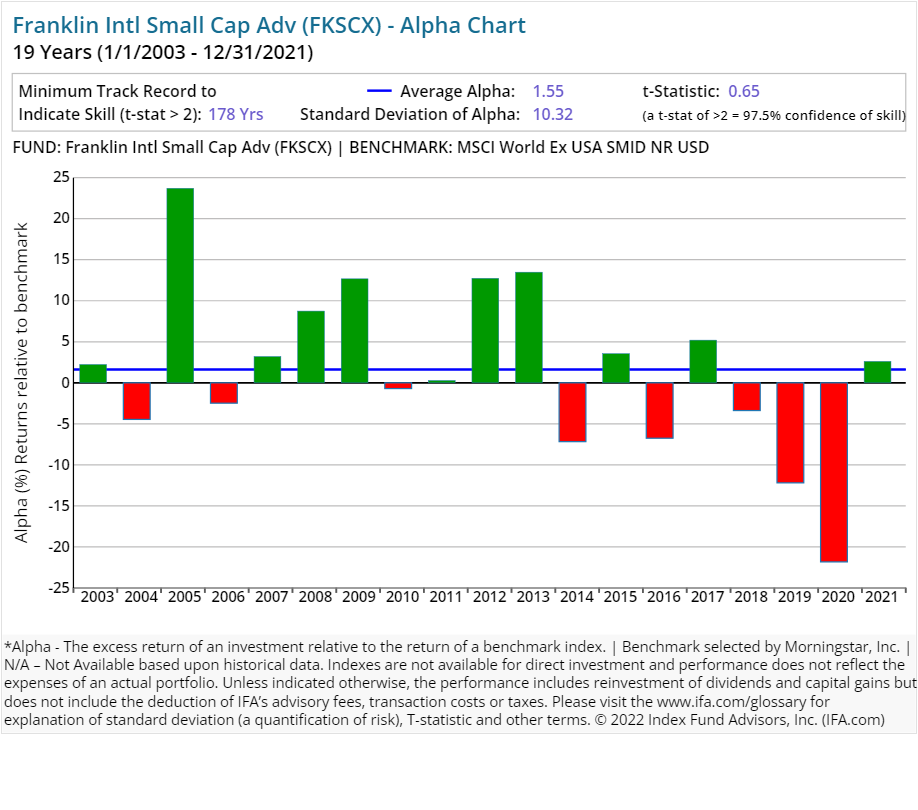

| Franklin Intl Small Cap Adv | FKSCX | 114.68 | 1.05 | Equity | |||

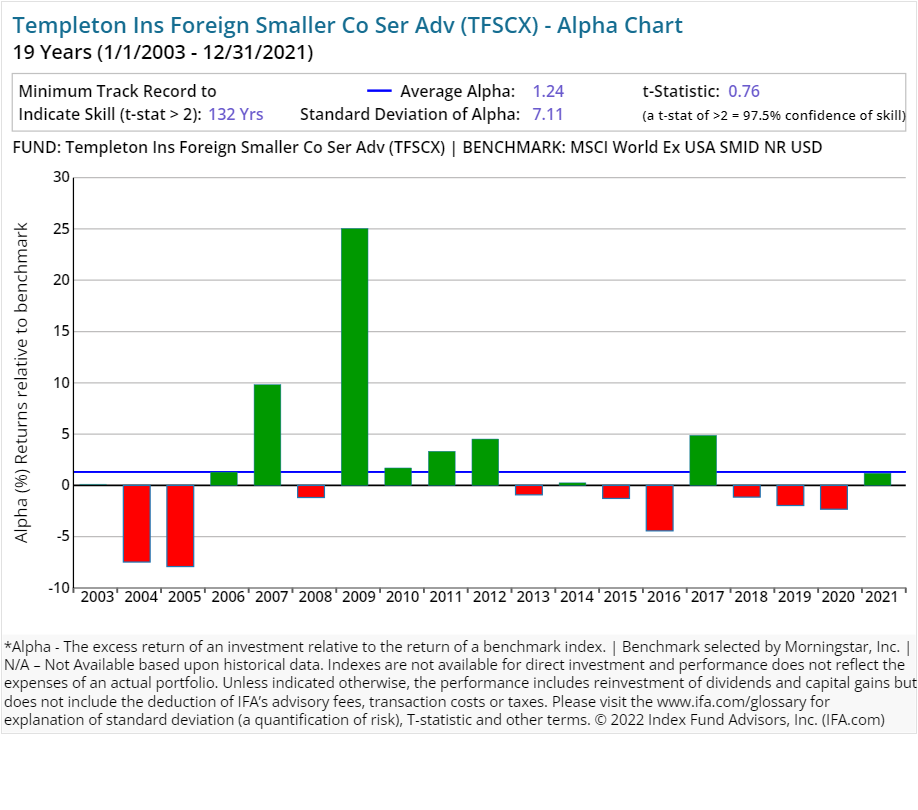

| Templeton Ins Foreign Smaller Co Ser Adv | TFSCX | 31.09 | 1.03 | Equity | |||

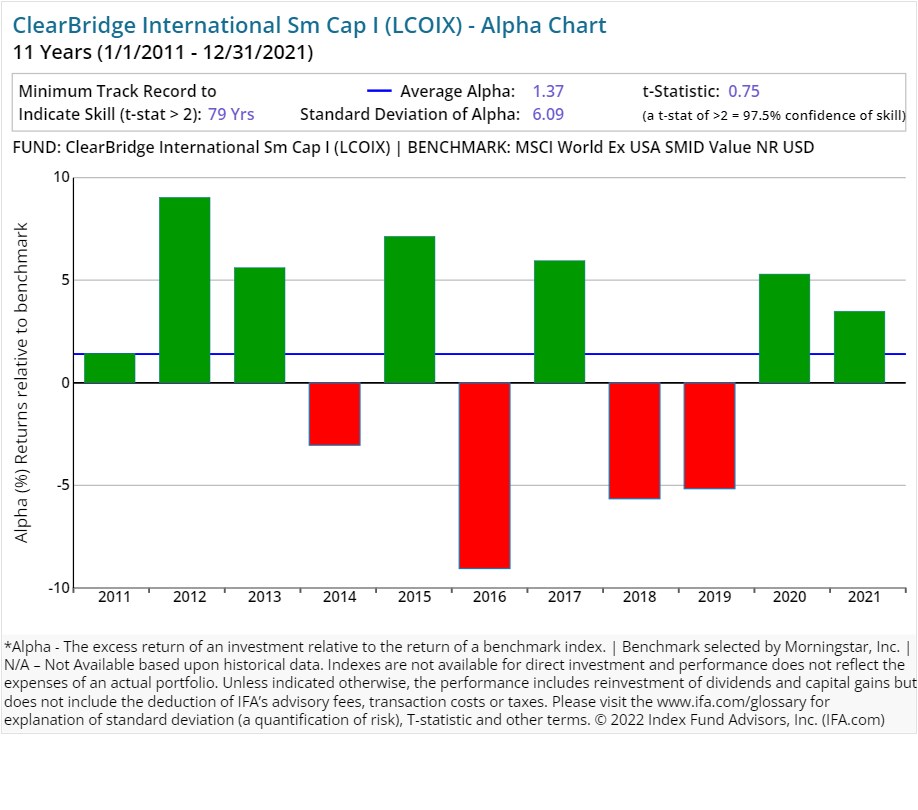

| ClearBridge International Sm Cap I | LCOIX | 25.00 | 1.09 | Equity | |||

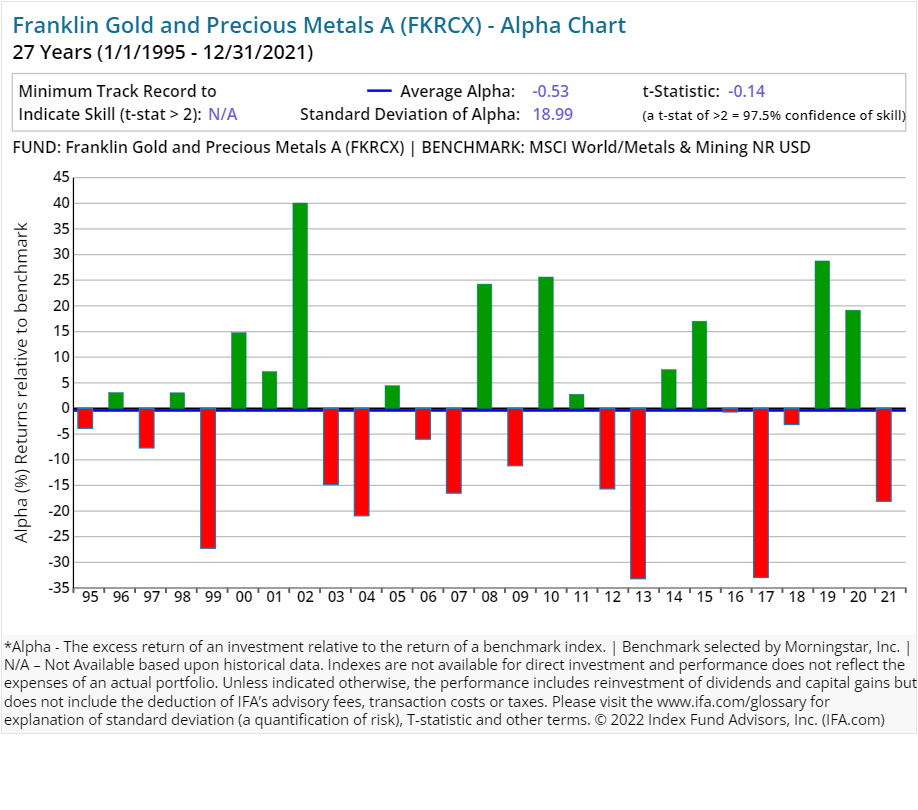

| Franklin Gold and Precious Metals A | FKRCX | 18.91 | 0.90 | 0.25 | 5.50 | Equity | |

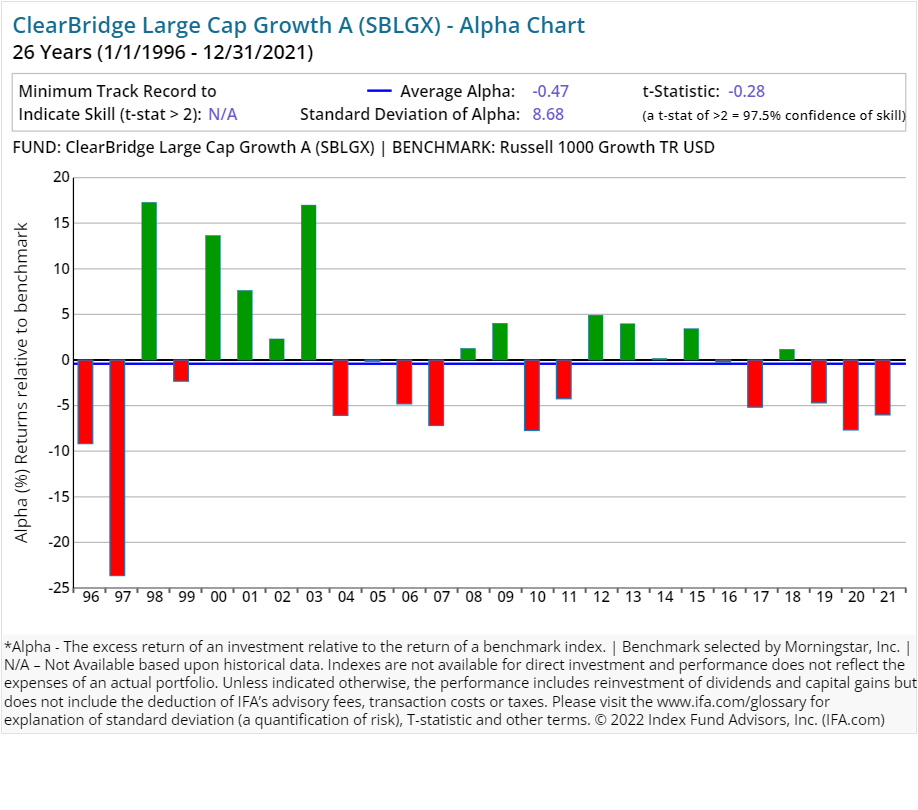

| ClearBridge Large Cap Growth A | SBLGX | 16.00 | 1.00 | 0.25 | 5.75 | Equity | |

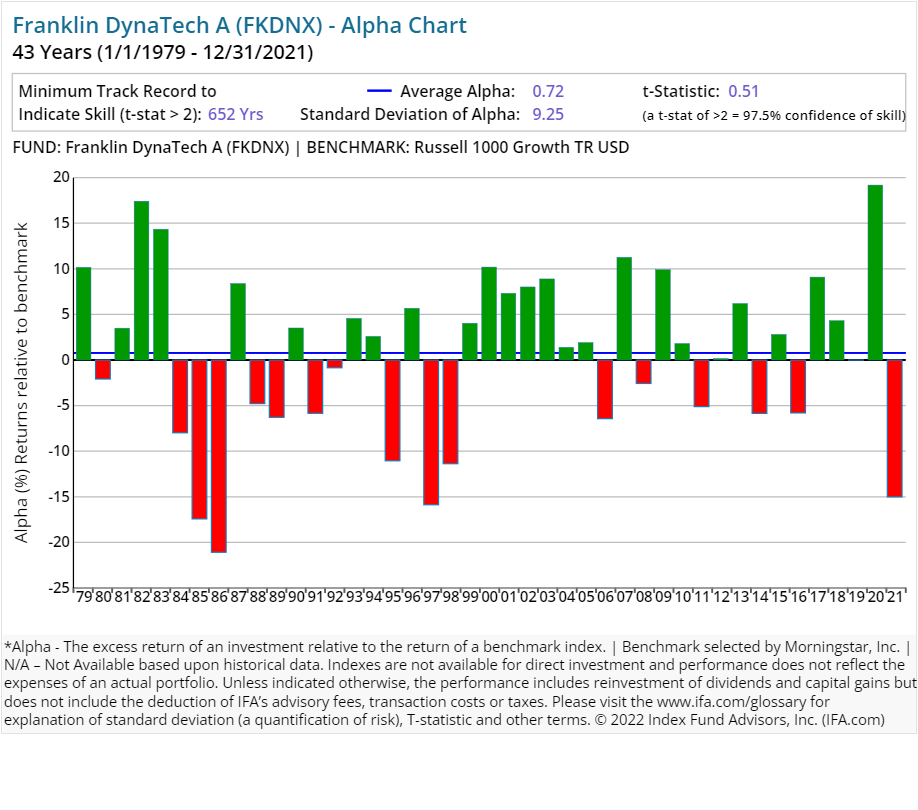

| Franklin DynaTech A | FKDNX | 18.77 | 0.79 | 0.25 | 5.50 | Equity | |

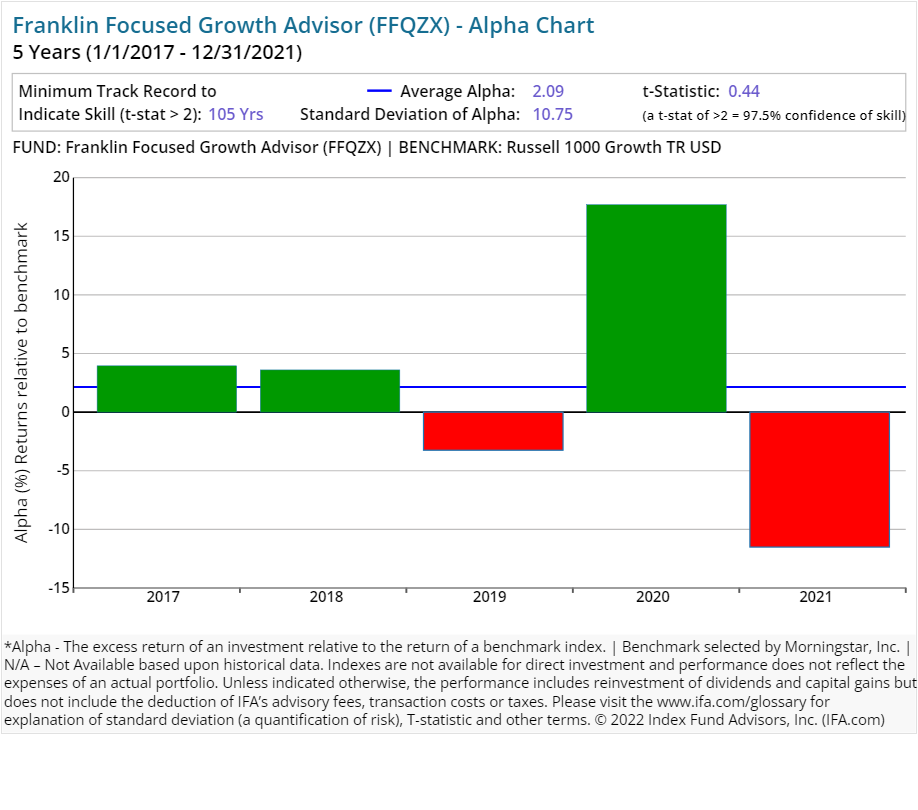

| Franklin Focused Growth Advisor | FFQZX | 22.77 | 0.85 | Equity | |||

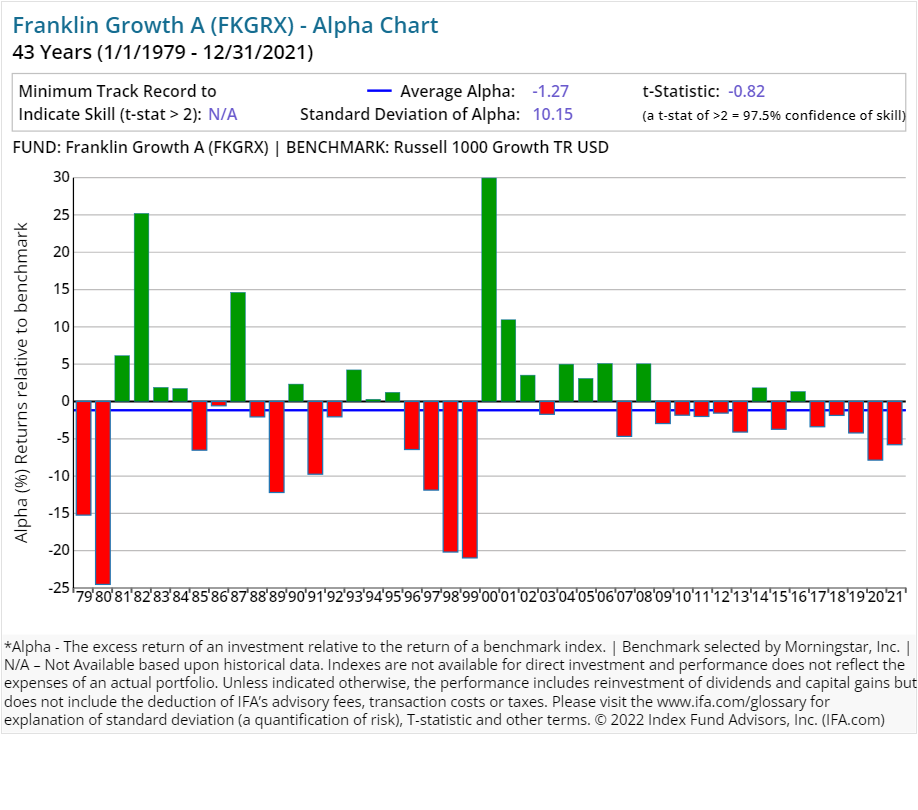

| Franklin Growth A | FKGRX | 6.04 | 0.79 | 0.25 | 5.50 | Equity | |

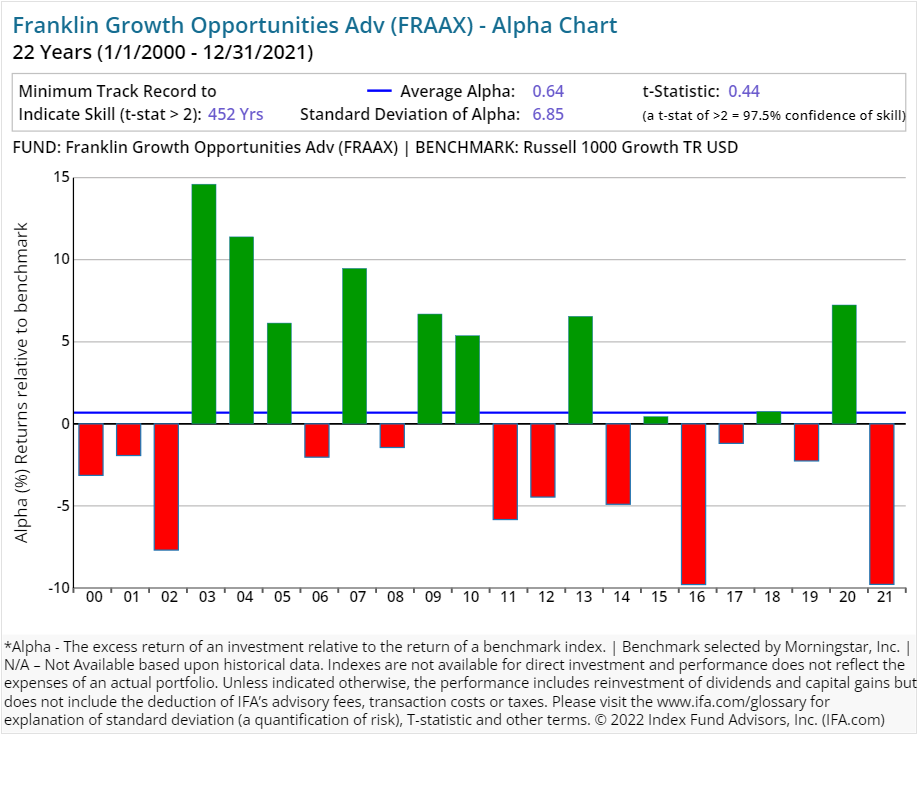

| Franklin Growth Opportunities Adv | FRAAX | 17.54 | 0.66 | Equity | |||

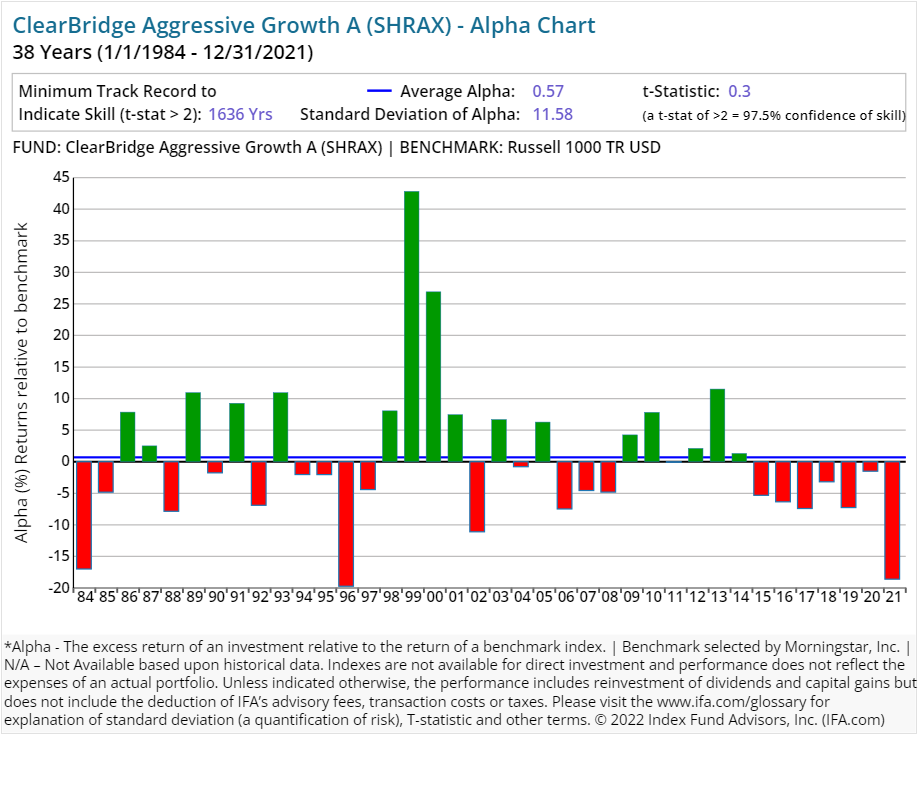

| ClearBridge Aggressive Growth A | SHRAX | 8.00 | 1.11 | 0.25 | 5.75 | Equity | |

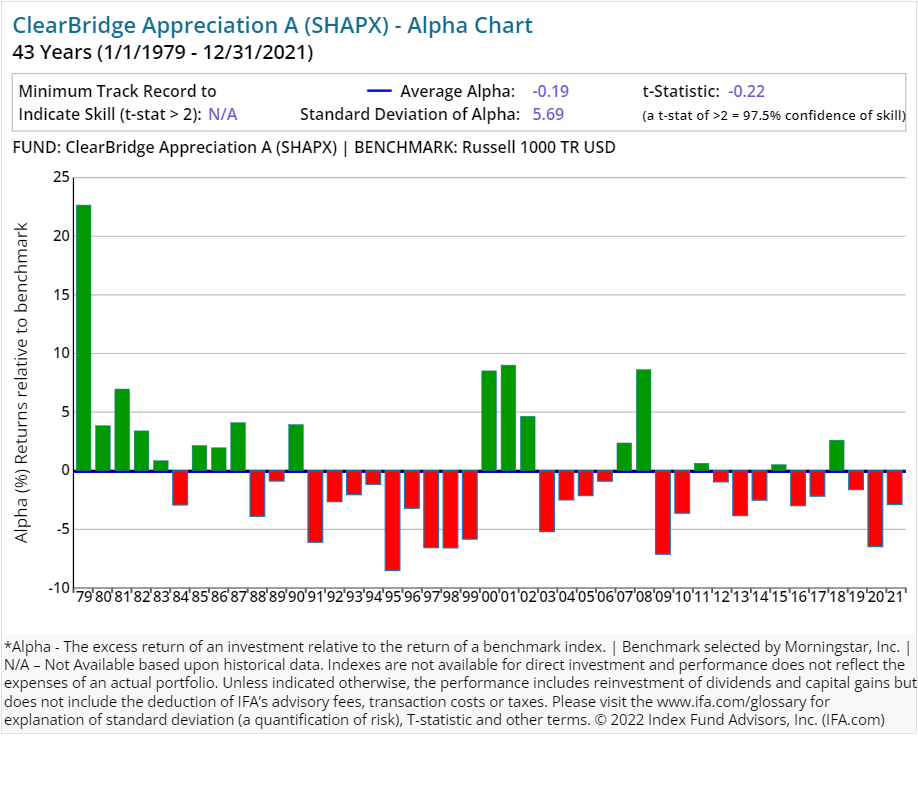

| ClearBridge Appreciation A | SHAPX | 6.00 | 0.93 | 0.25 | 5.75 | Equity | |

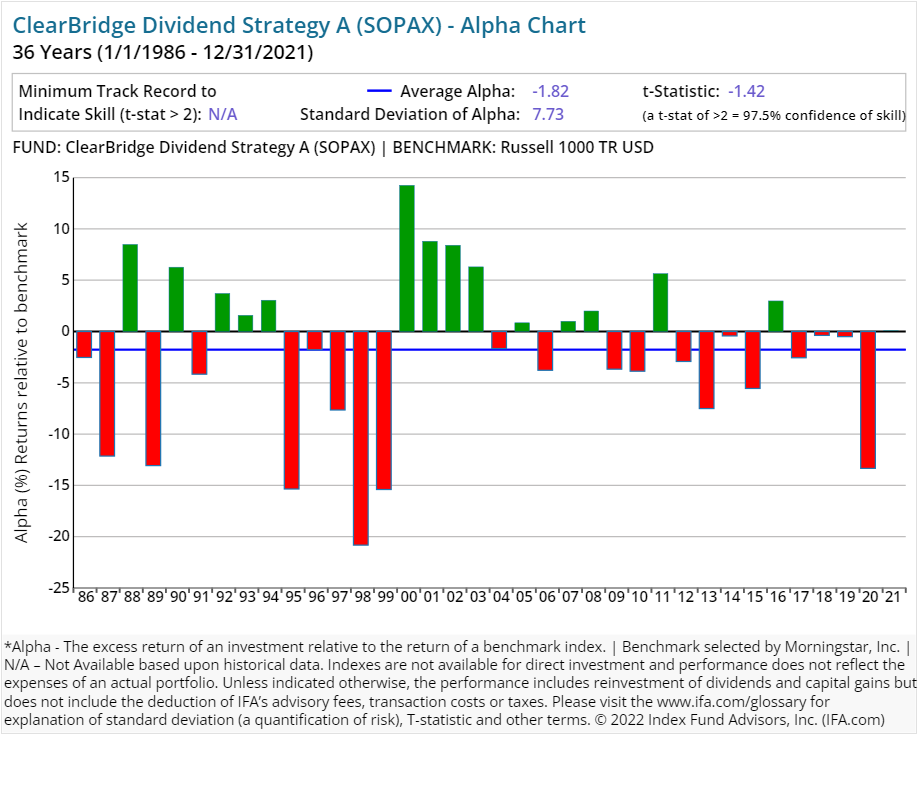

| ClearBridge Dividend Strategy A | SOPAX | 10.00 | 1.05 | 0.25 | 5.75 | Equity | |

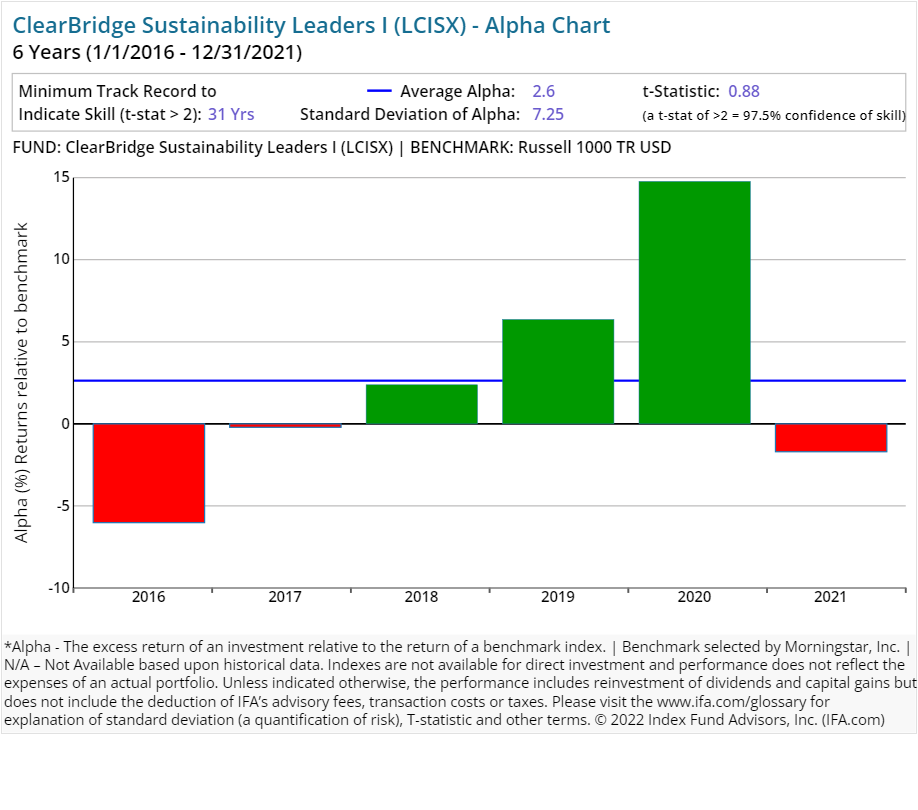

| ClearBridge Sustainability Leaders I | LCISX | 22.00 | 0.85 | Equity | |||

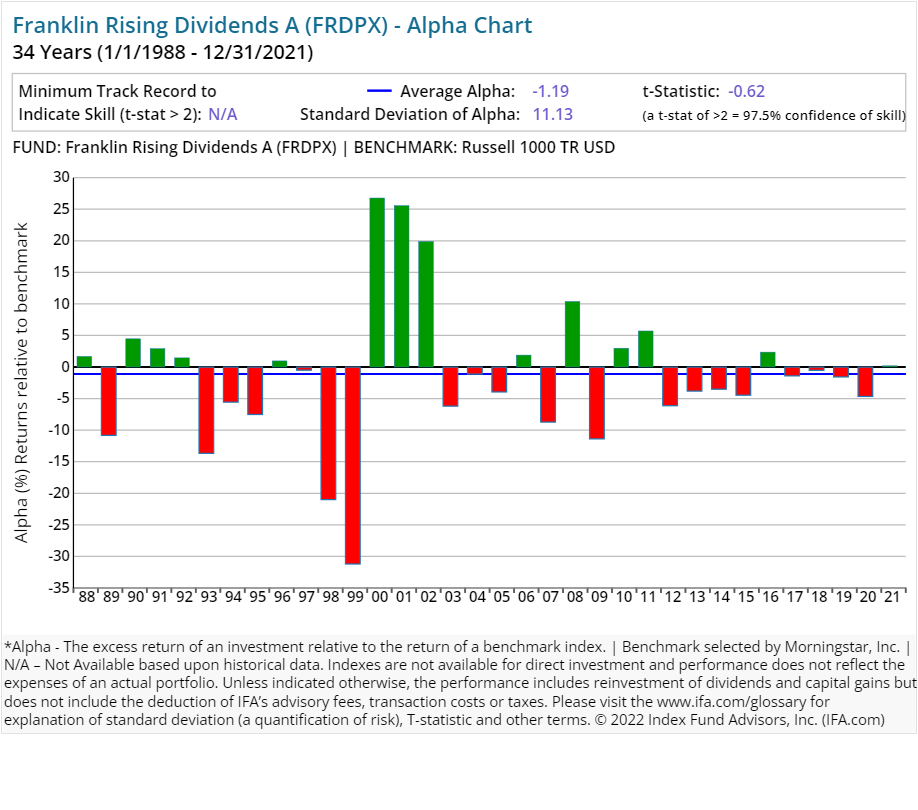

| Franklin Rising Dividends A | FRDPX | 5.04 | 0.85 | 0.25 | 5.50 | Equity | |

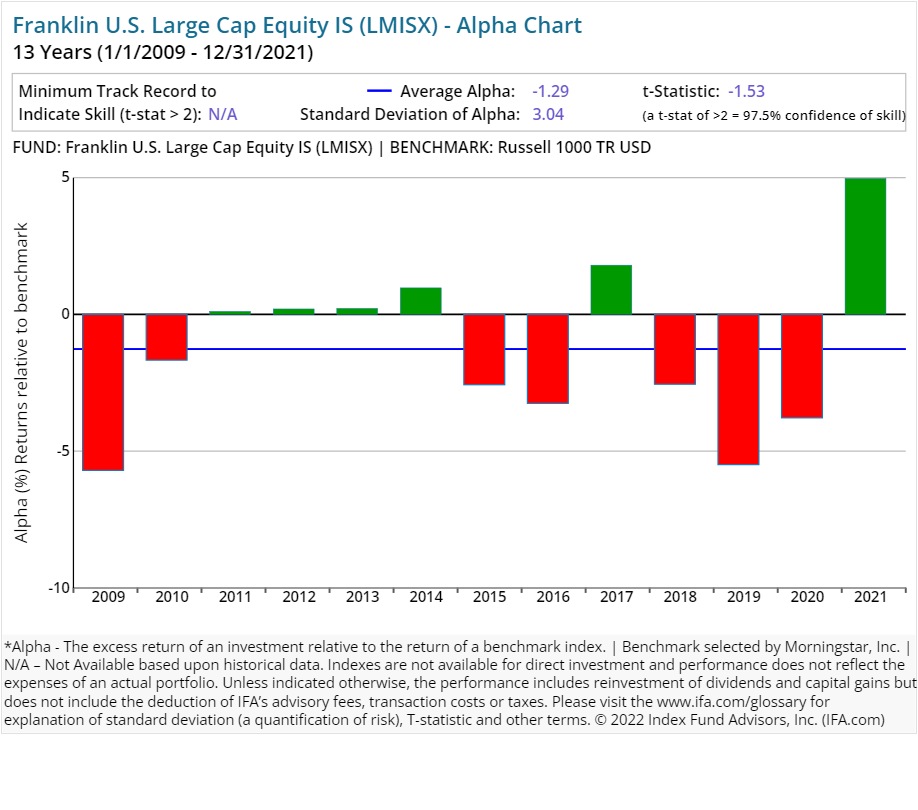

| Franklin U.S. Large Cap Equity IS | LMISX | 38.00 | 0.70 | Equity | |||

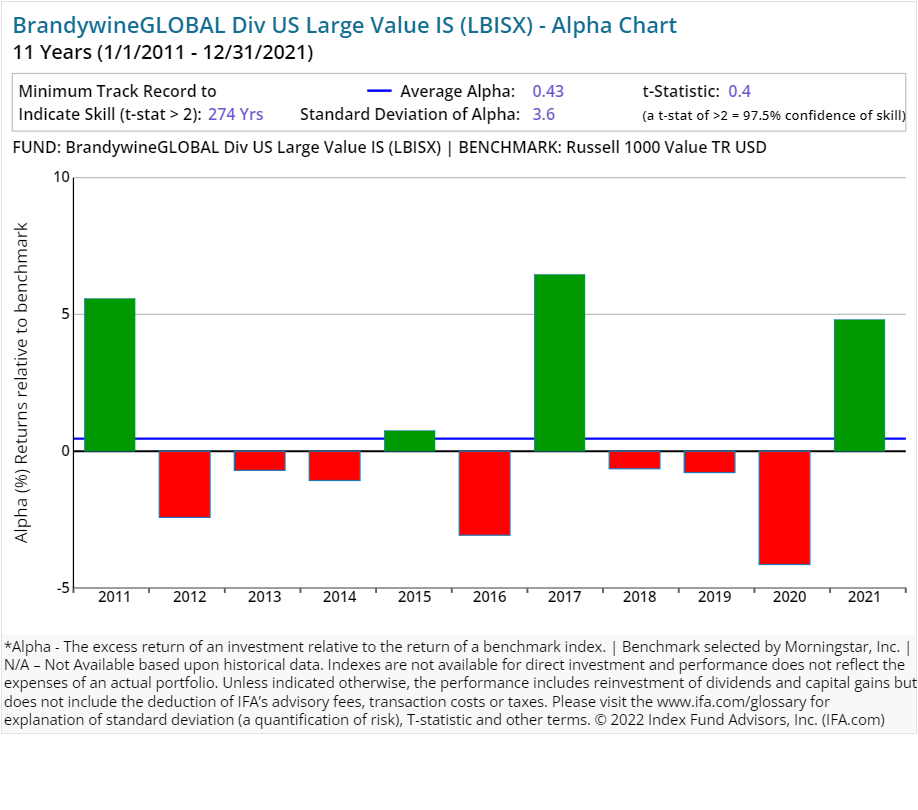

| BrandywineGLOBAL Div US Large Value IS | LBISX | 75.00 | 0.70 | Equity | |||

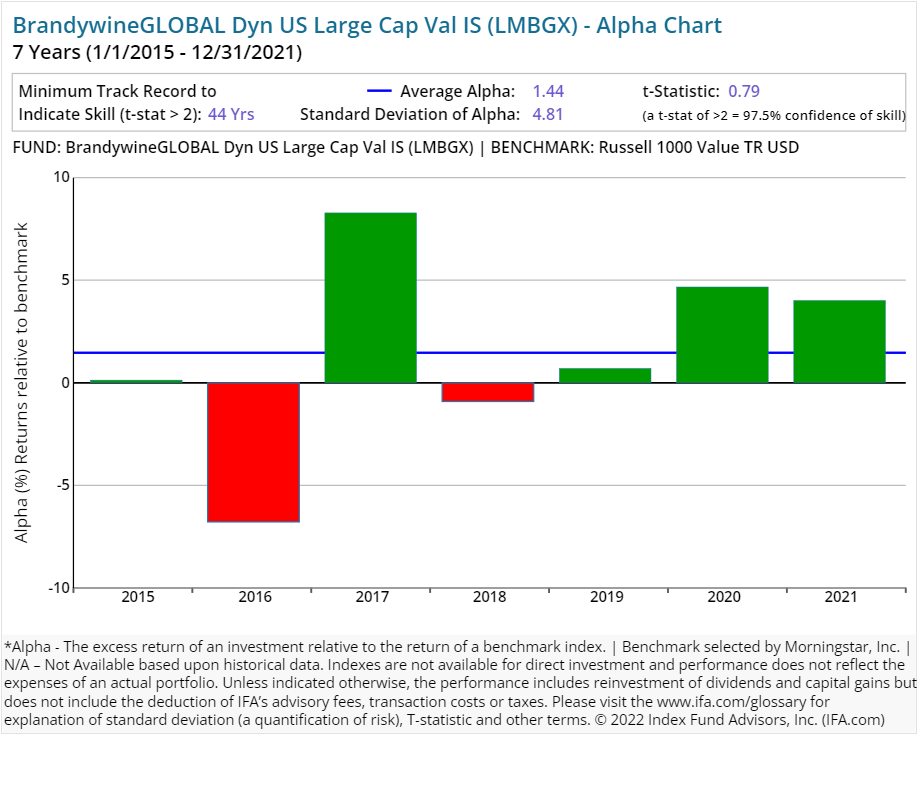

| BrandywineGLOBAL Dyn US Large Cap Val IS | LMBGX | 83.00 | 0.65 | Equity | |||

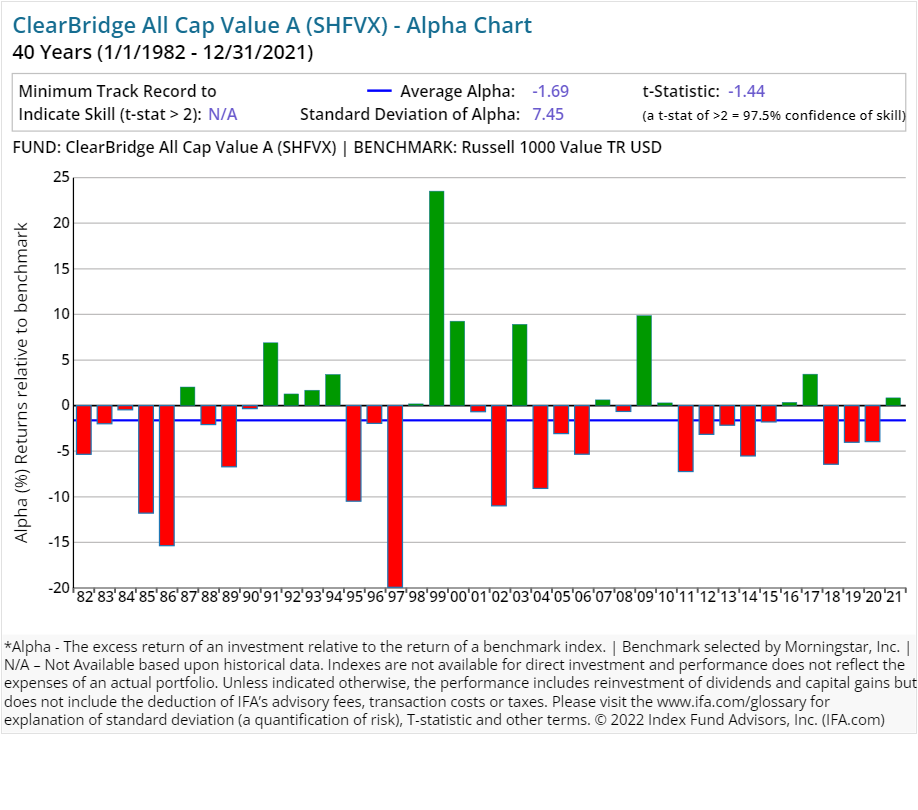

| ClearBridge All Cap Value A | SHFVX | 28.00 | 1.16 | 0.25 | 5.75 | Equity | |

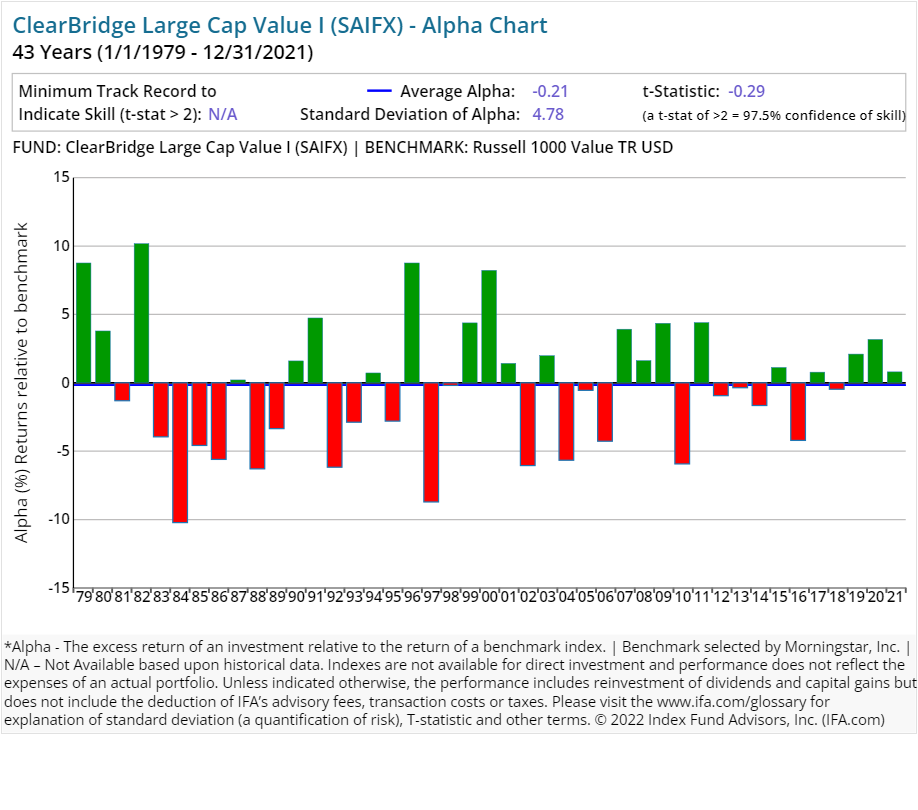

| ClearBridge Large Cap Value I | SAIFX | 22.00 | 0.56 | Equity | |||

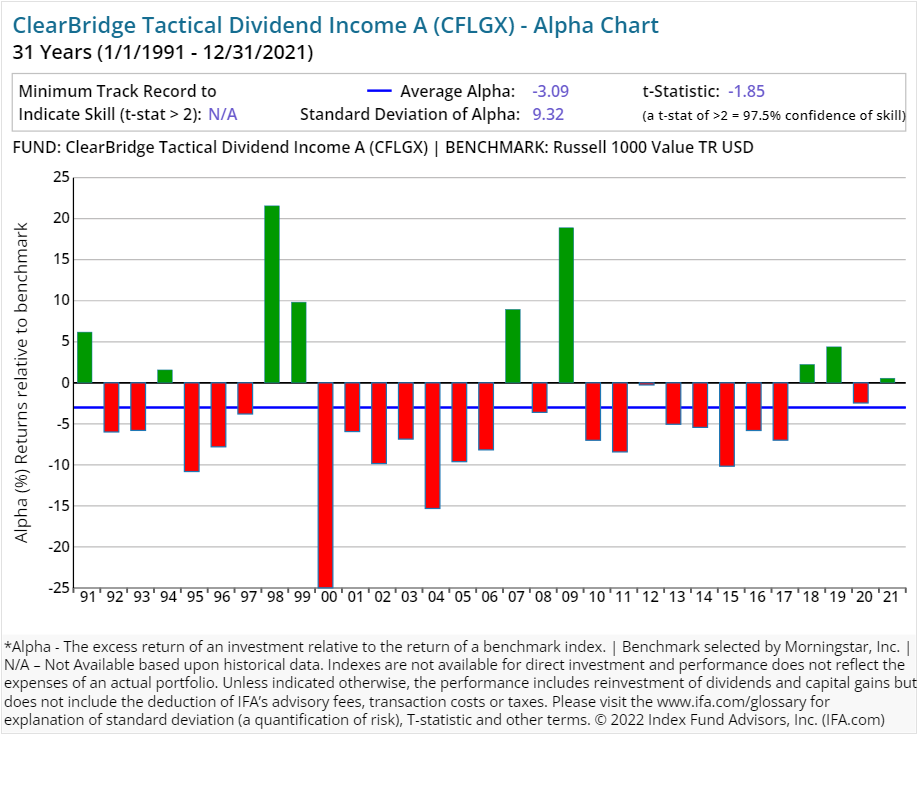

| ClearBridge Tactical Dividend Income A | CFLGX | 38.00 | 1.44 | 0.25 | 5.75 | Equity | |

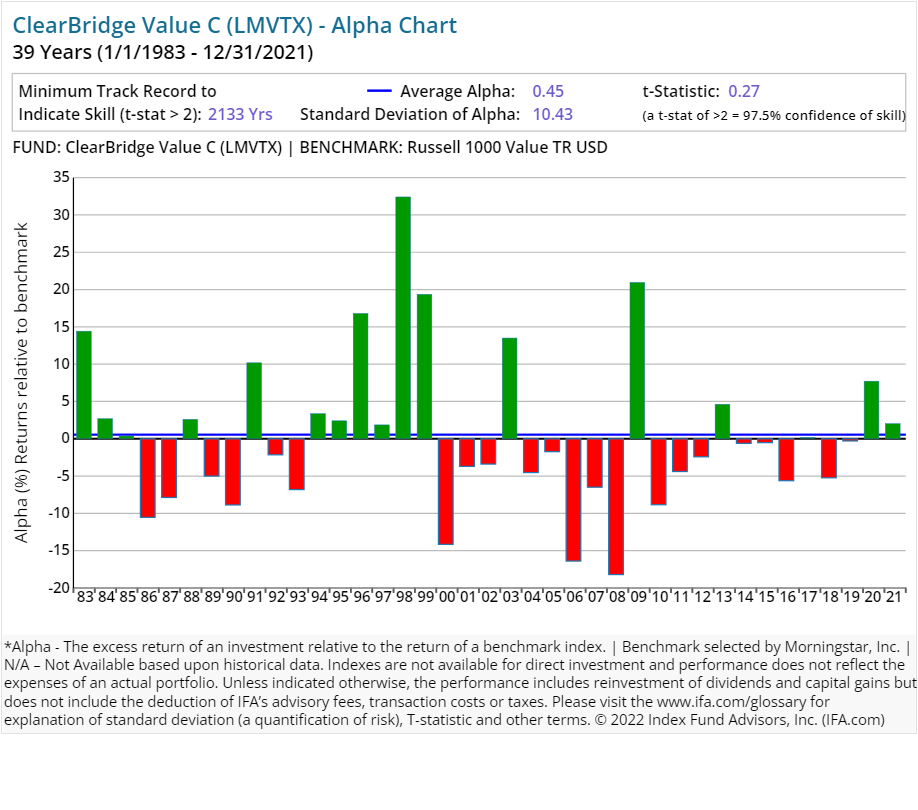

| ClearBridge Value C | LMVTX | 54.00 | 1.74 | 0.95 | 0.95 | Equity | |

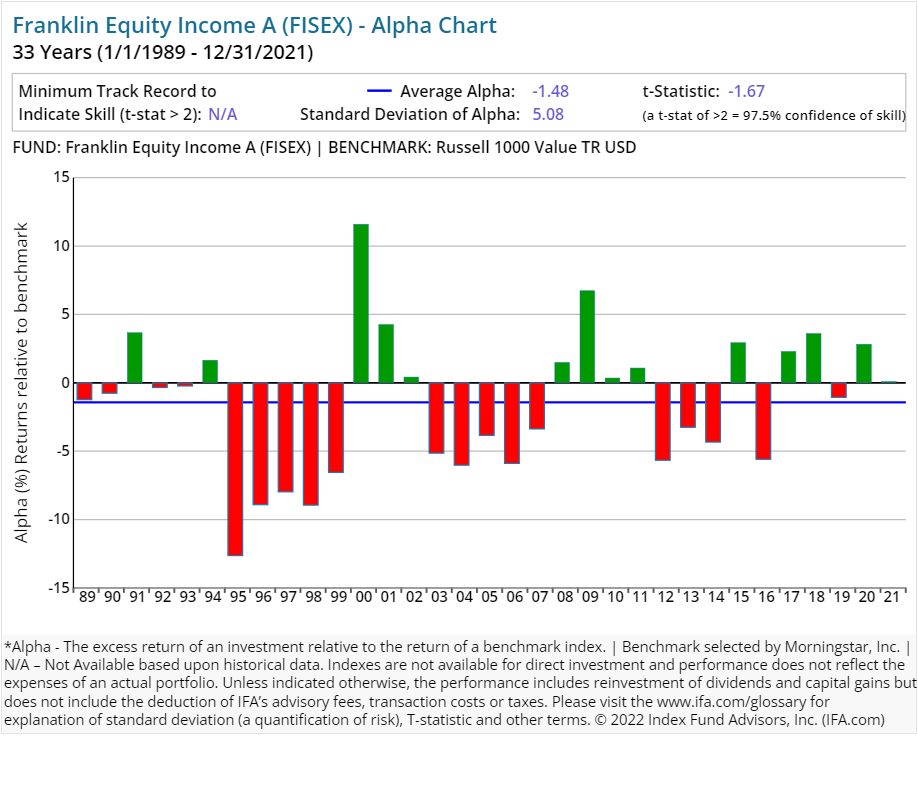

| Franklin Equity Income A | FISEX | 25.49 | 0.85 | 0.25 | 5.50 | Equity | |

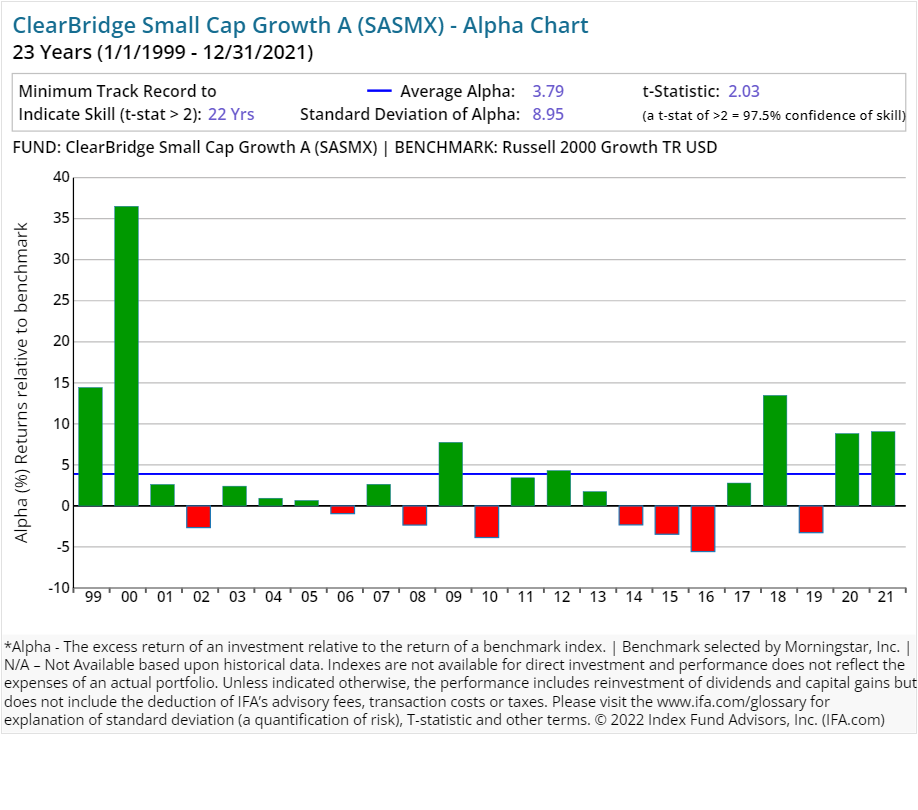

| ClearBridge Small Cap Growth A | SASMX | 19.00 | 1.16 | 0.25 | 5.75 | Equity | |

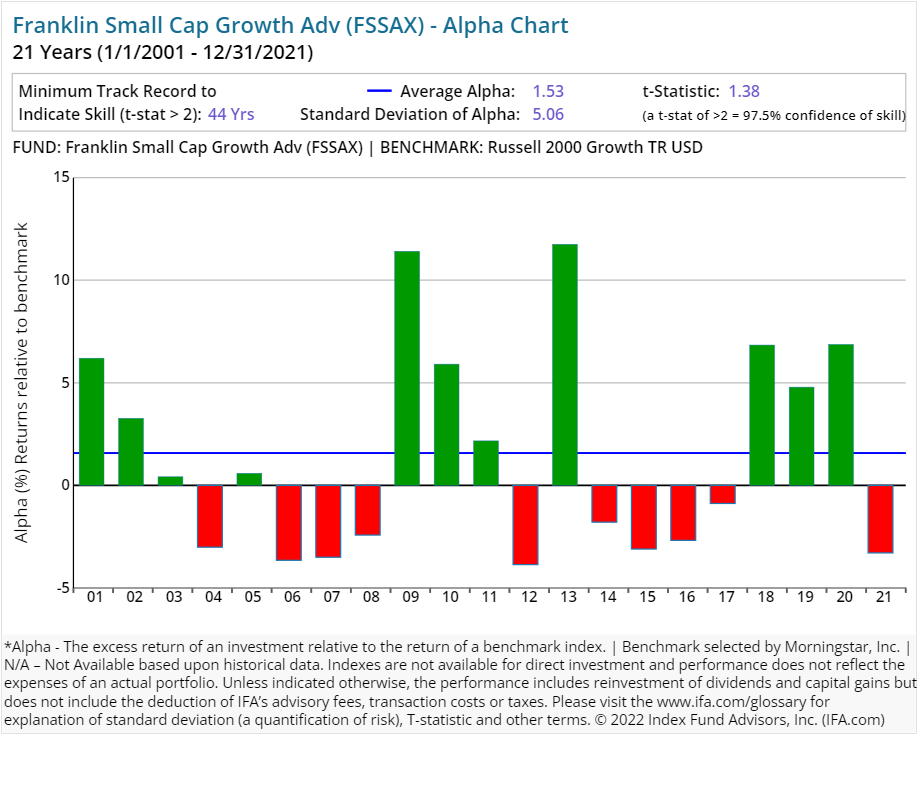

| Franklin Small Cap Growth Adv | FSSAX | 47.80 | 0.78 | Equity | |||

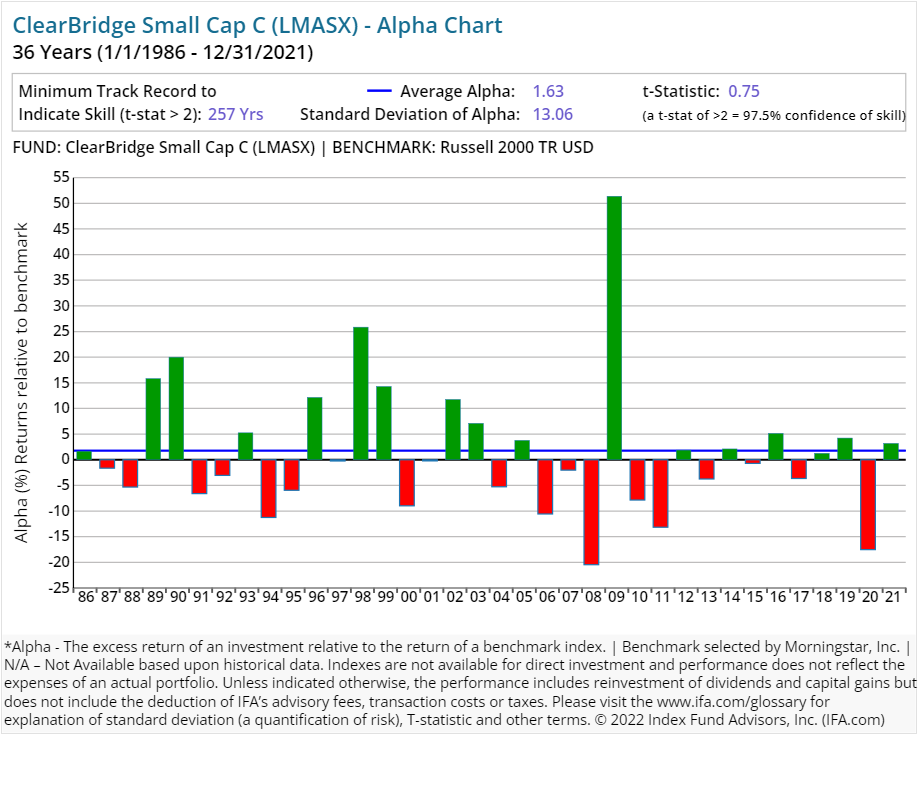

| ClearBridge Small Cap C | LMASX | 42.00 | 1.83 | 1.00 | 1.00 | Equity | |

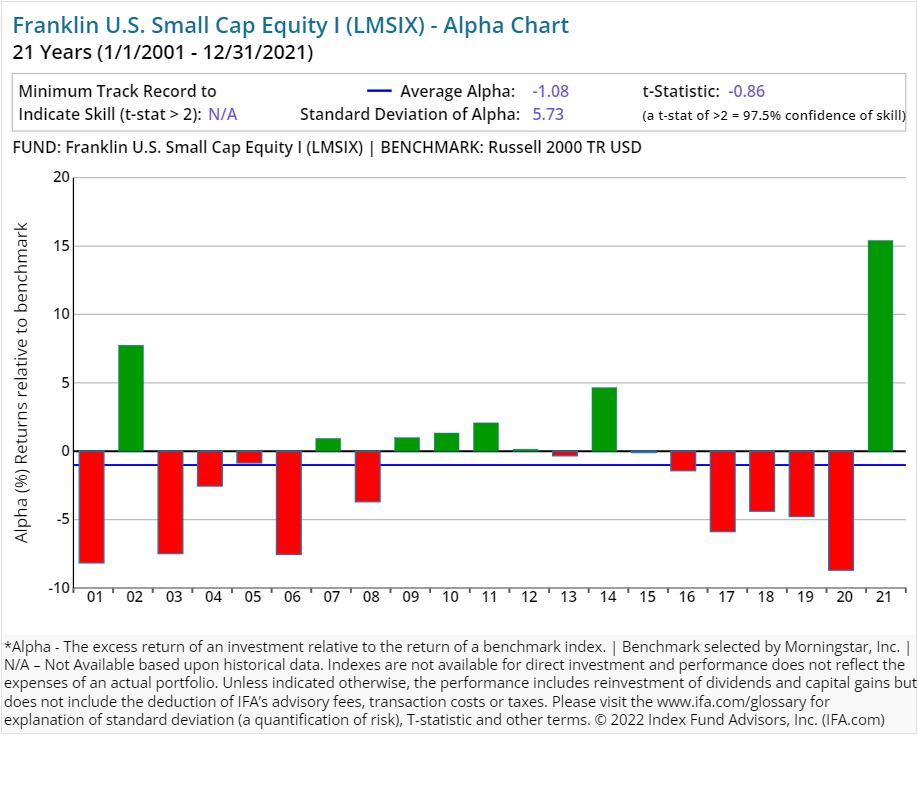

| Franklin U.S. Small Cap Equity I | LMSIX | 39.00 | 1.00 | Equity | |||

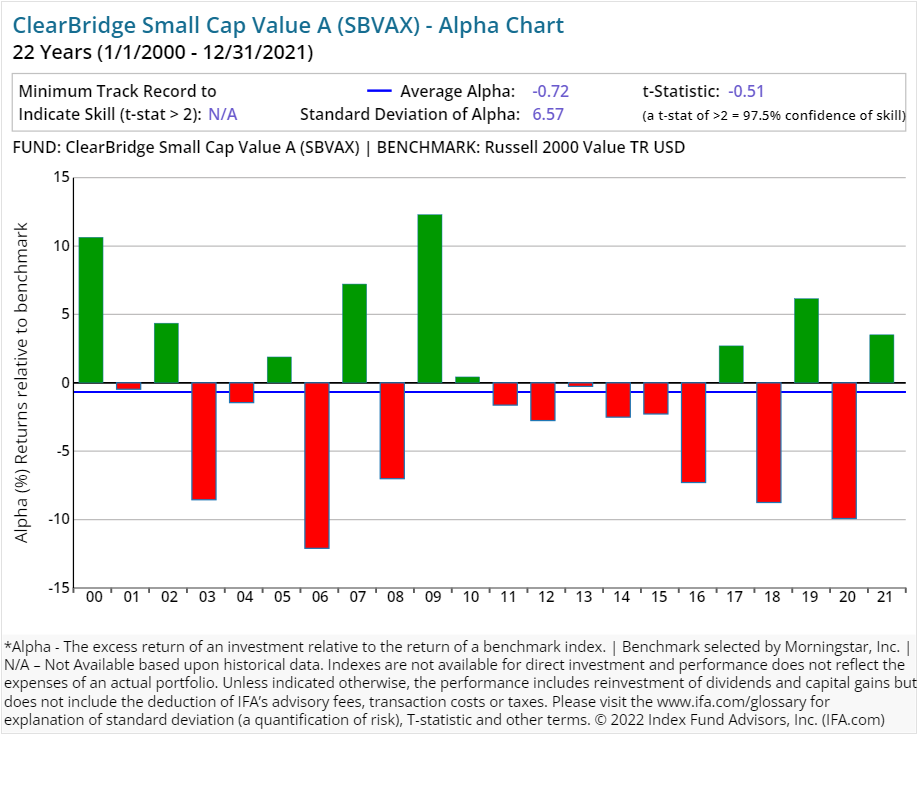

| ClearBridge Small Cap Value A | SBVAX | 53.00 | 1.35 | 0.25 | 5.75 | Equity | |

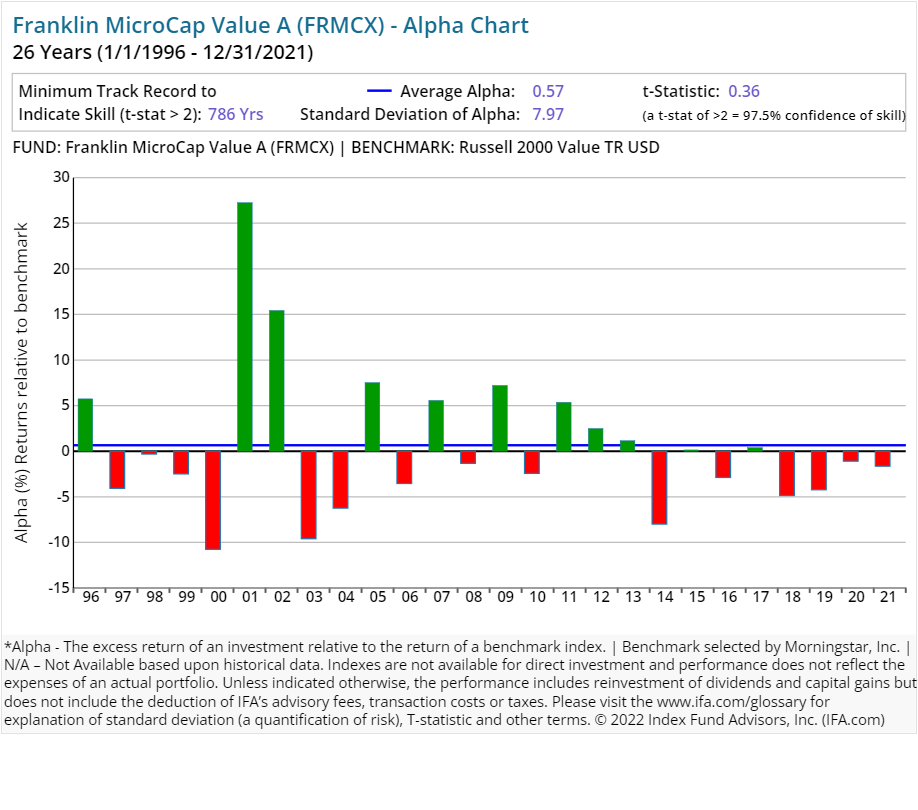

| Franklin MicroCap Value A | FRMCX | 31.98 | 1.28 | 0.25 | 5.50 | Equity | |

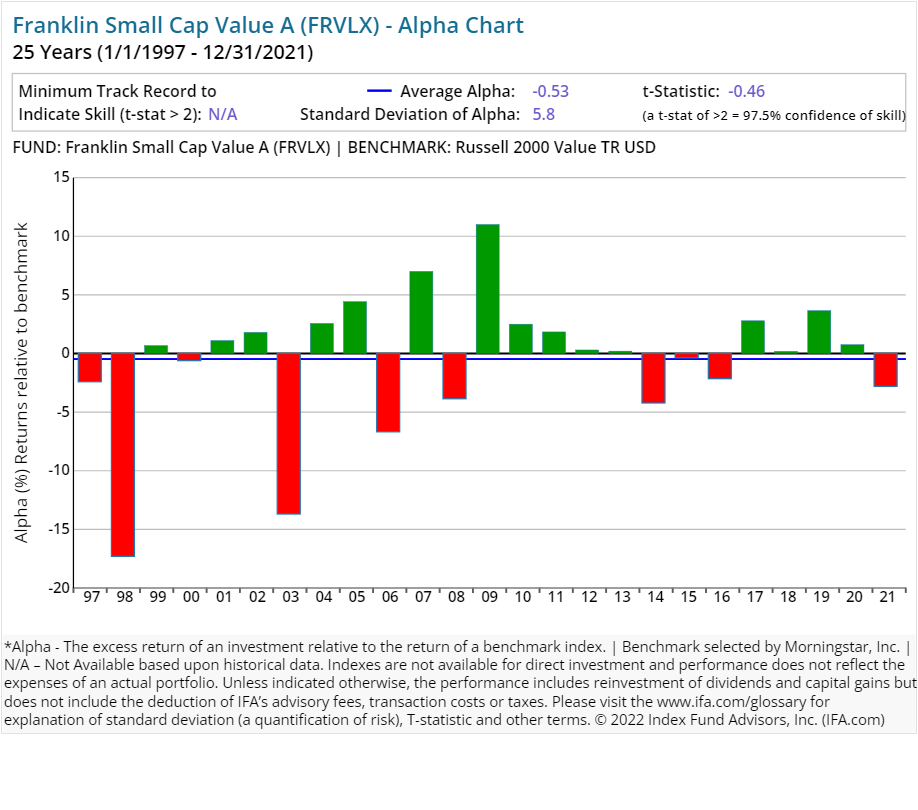

| Franklin Small Cap Value A | FRVLX | 52.76 | 1.08 | 0.25 | 5.50 | Equity | |

| ClearBridge Mid Cap Growth I | LBGIX | 15.00 | 0.85 | Equity | |||

| ClearBridge Select I | LBFIX | 25.00 | 1.08 | Equity | |||

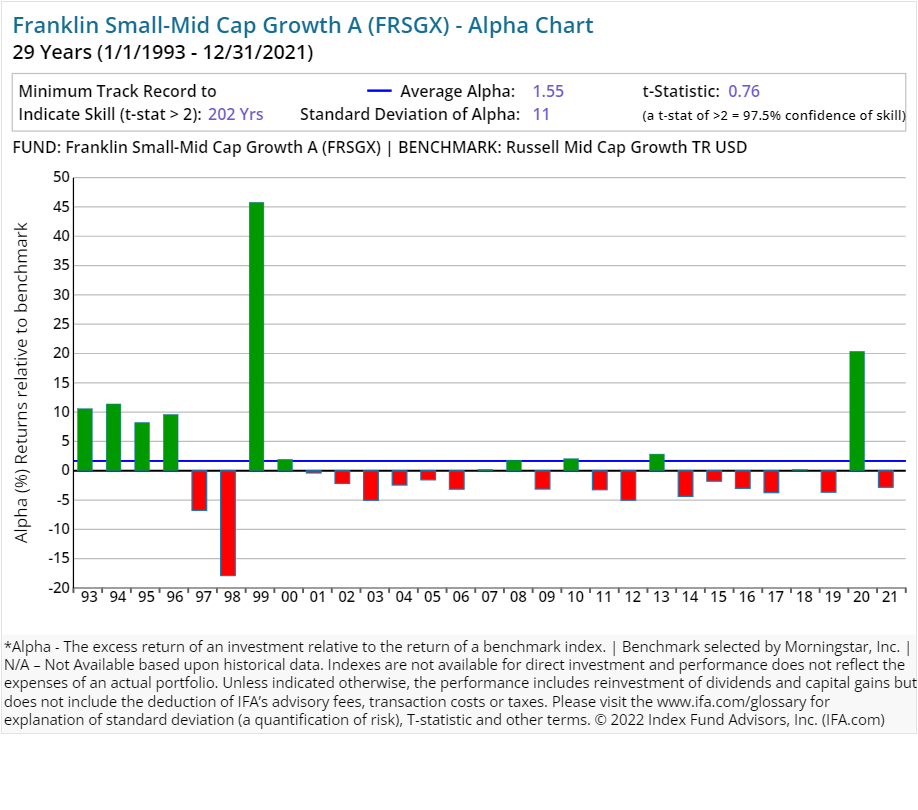

| Franklin Small-Mid Cap Growth A | FRSGX | 53.69 | 0.86 | 0.25 | 5.50 | Equity | |

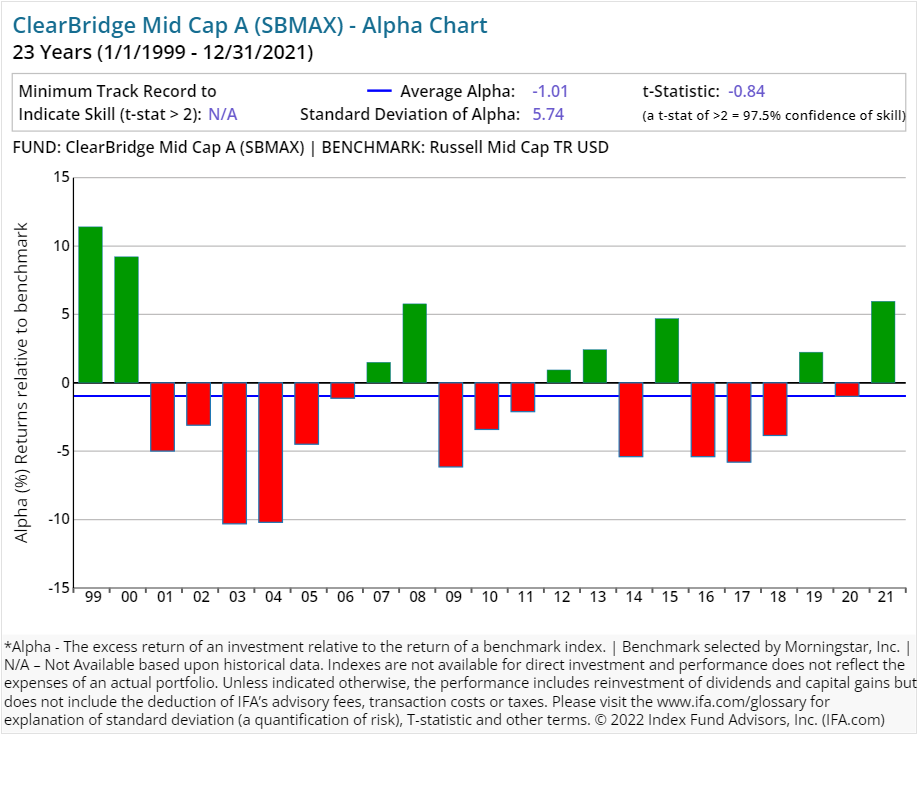

| ClearBridge Mid Cap A | SBMAX | 30.00 | 1.13 | 0.25 | 5.75 | Equity | |

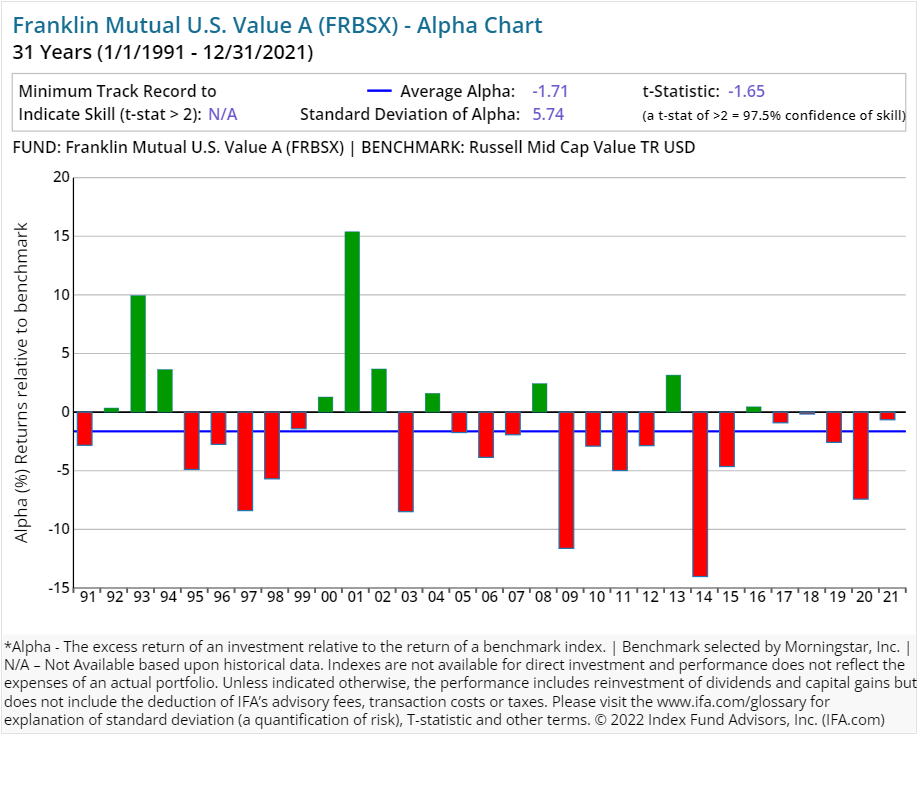

| Franklin Mutual U.S. Value A | FRBSX | 60.45 | 0.96 | 0.25 | 5.50 | Equity | |

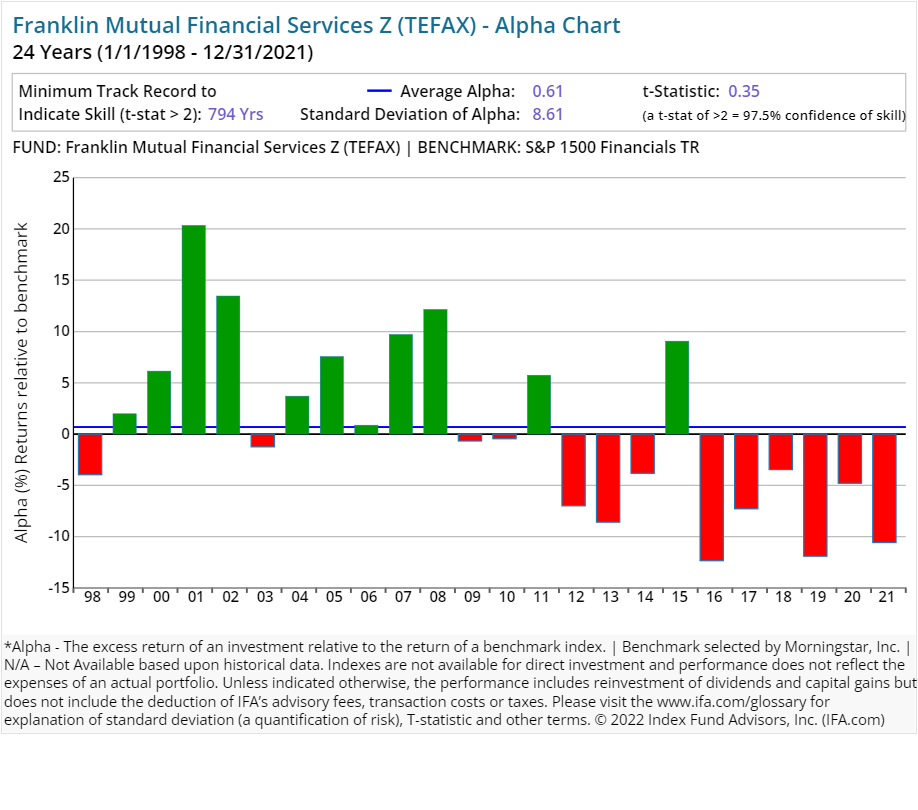

| Franklin Mutual Financial Services Z | TEFAX | 28.18 | 1.14 | Equity | |||

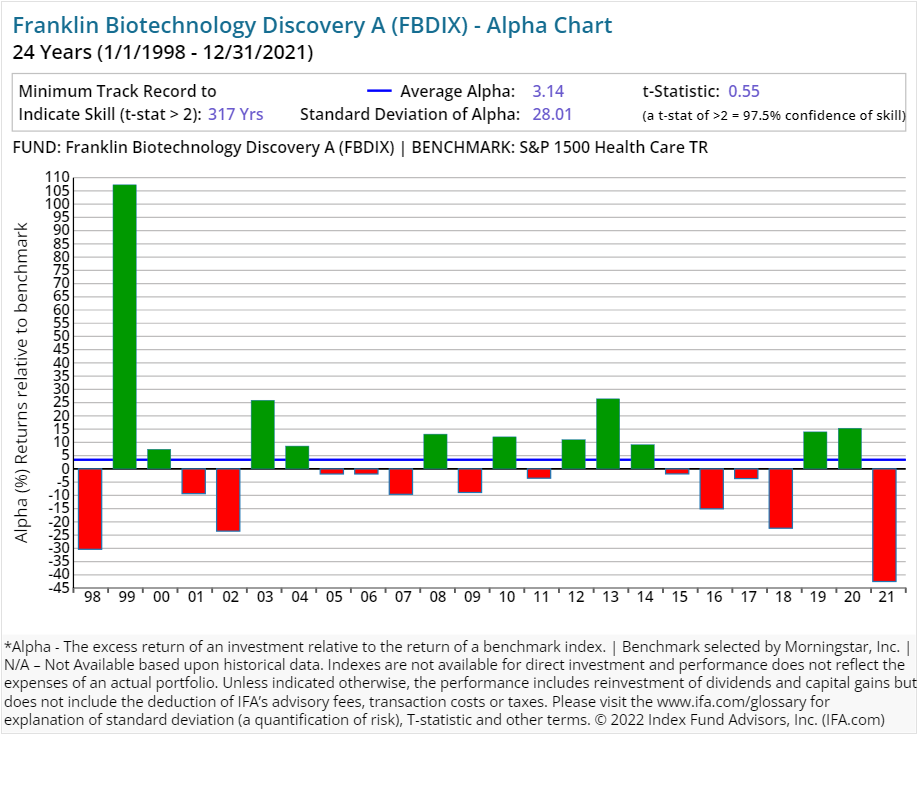

| Franklin Biotechnology Discovery A | FBDIX | 47.30 | 0.98 | 0.25 | 5.50 | Equity | |

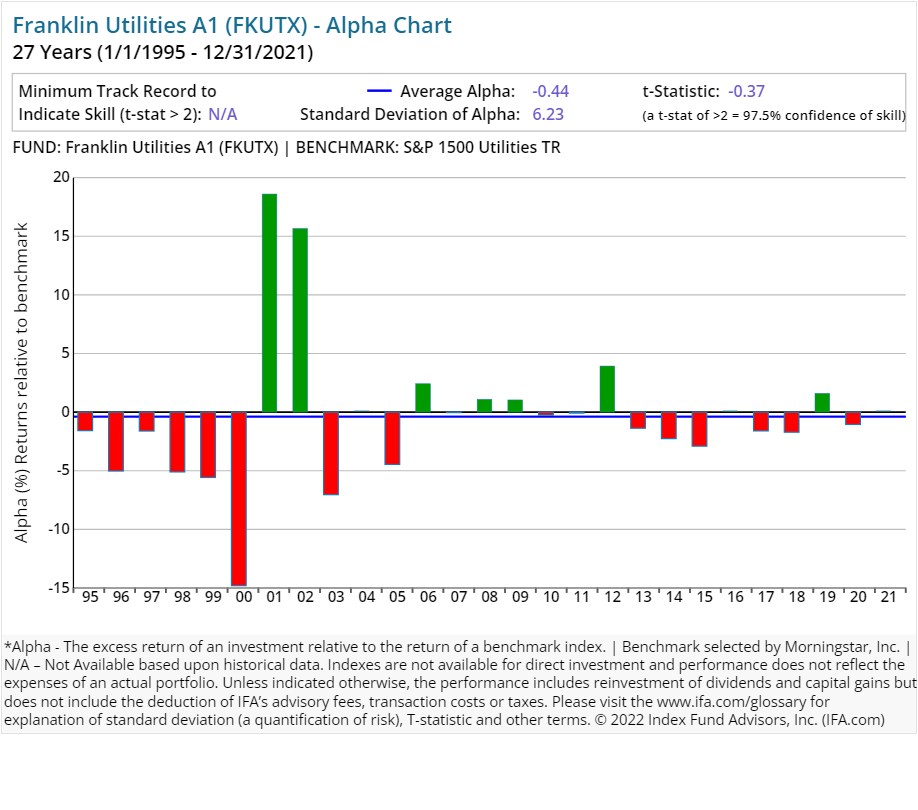

| Franklin Utilities A1 | FKUTX | 5.18 | 0.72 | 0.15 | 3.75 | Equity | |

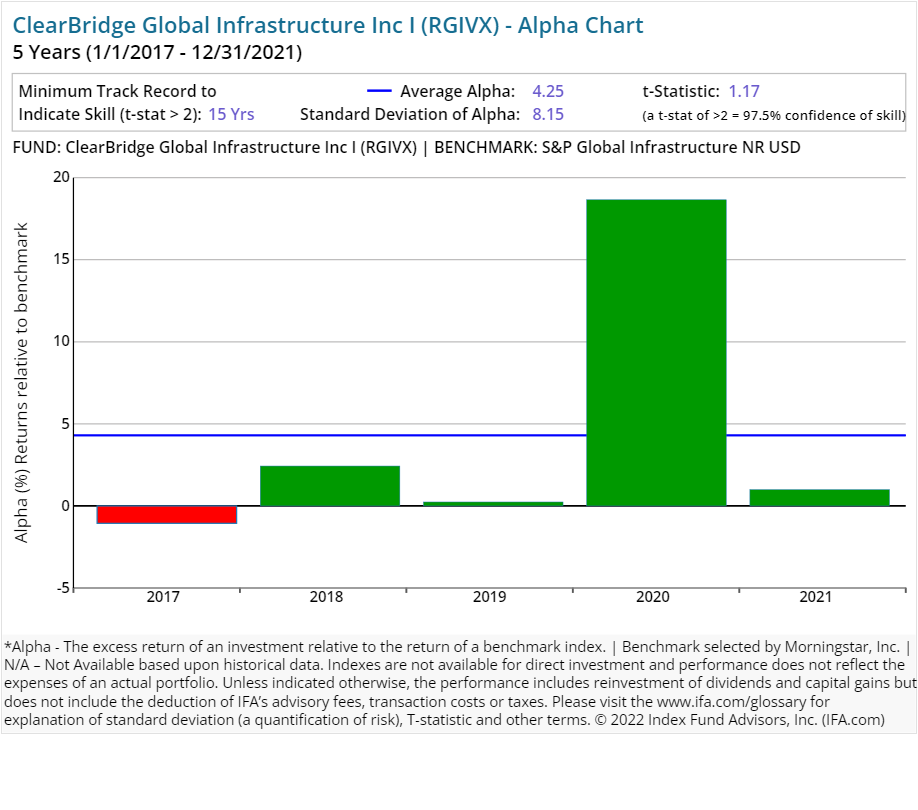

| ClearBridge Global Infrastructure Inc I | RGIVX | 86.00 | 1.00 | Equity | |||

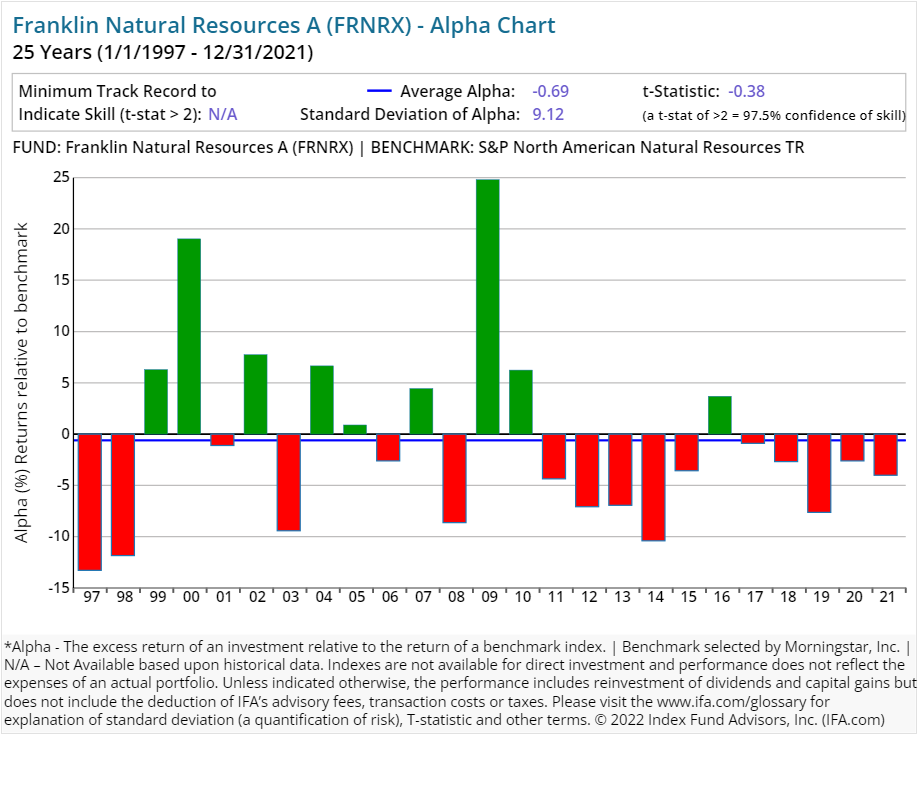

| Franklin Natural Resources A | FRNRX | 49.23 | 1.25 | 0.25 | 5.50 | Equity | |

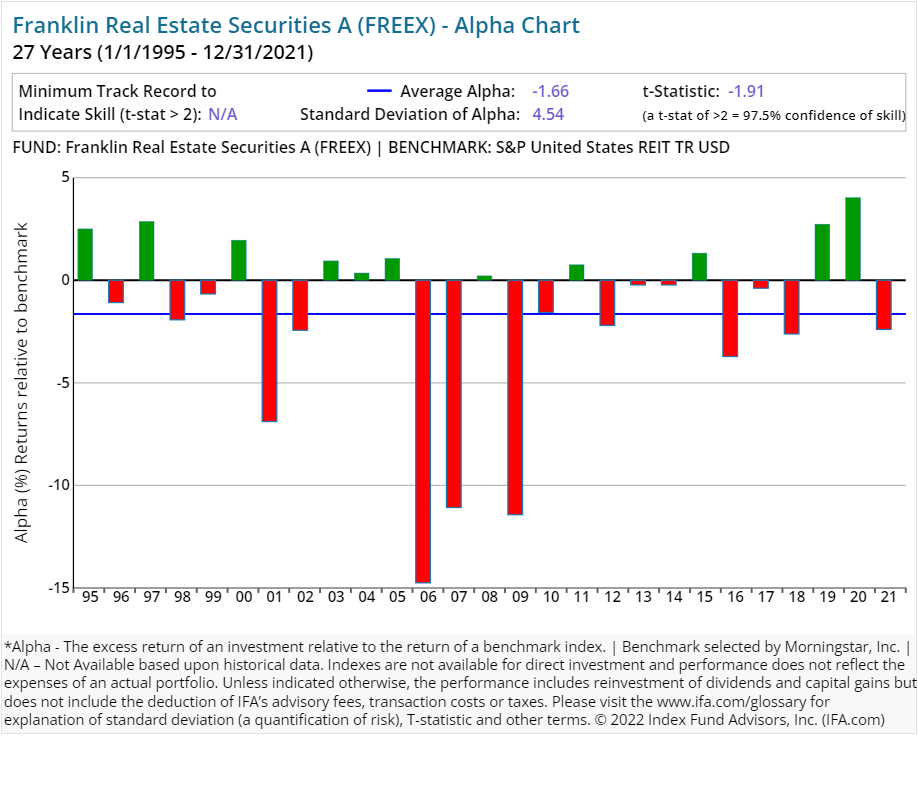

| Franklin Real Estate Securities A | FREEX | 19.61 | 1.07 | 0.25 | 5.50 | Equity | |

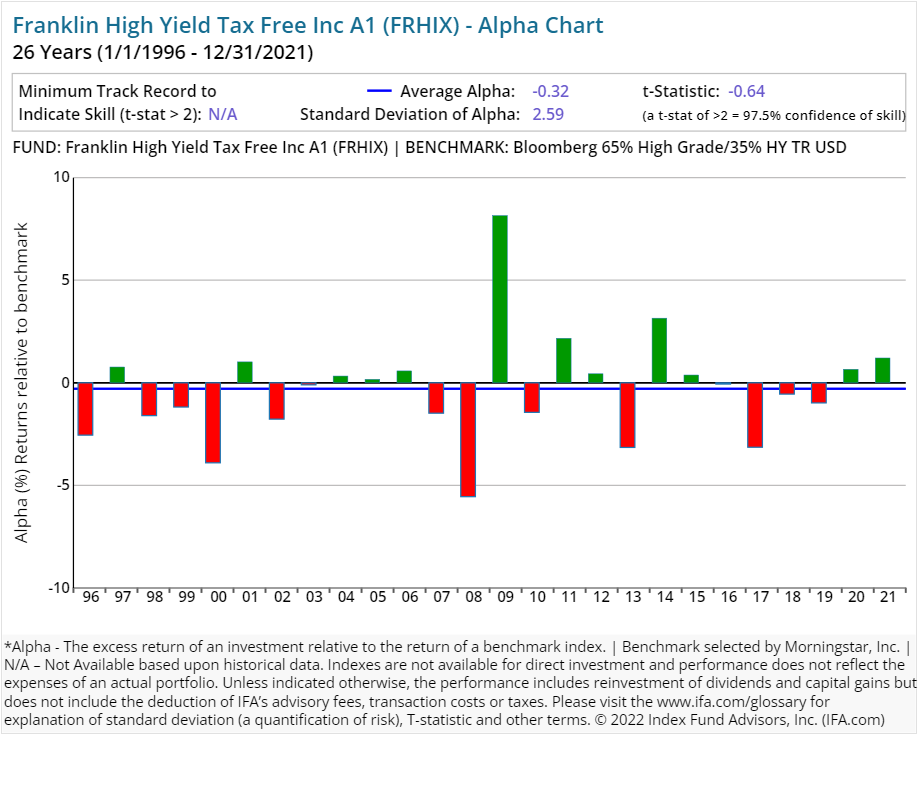

| Franklin High Yield Tax Free Inc A1 | FRHIX | 38.24 | 0.64 | 0.10 | 3.50 | Fixed Income | |

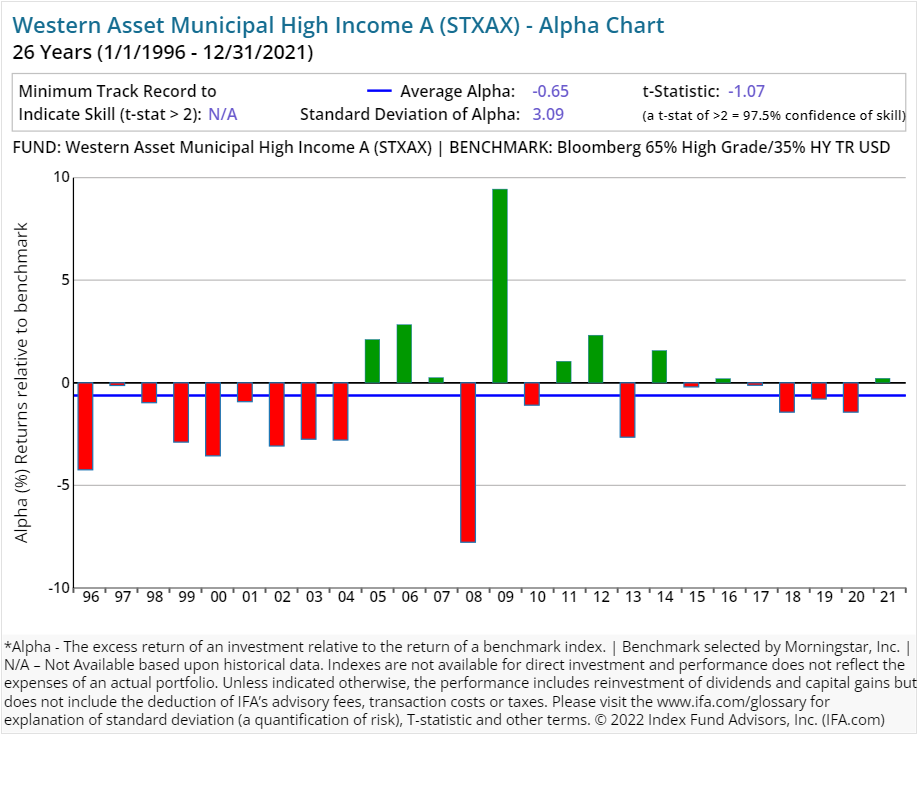

| Western Asset Municipal High Income A | STXAX | 21.00 | 0.82 | 0.15 | 4.25 | Fixed Income | |

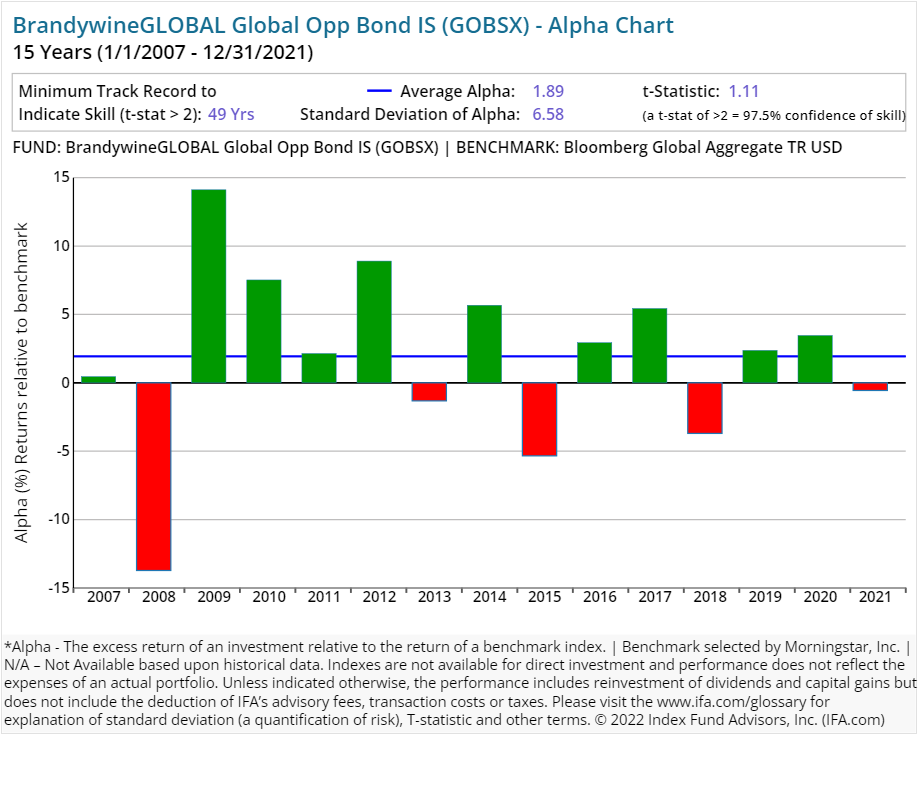

| BrandywineGLOBAL Global Opp Bond IS | GOBSX | 51.00 | 0.59 | Fixed Income | |||

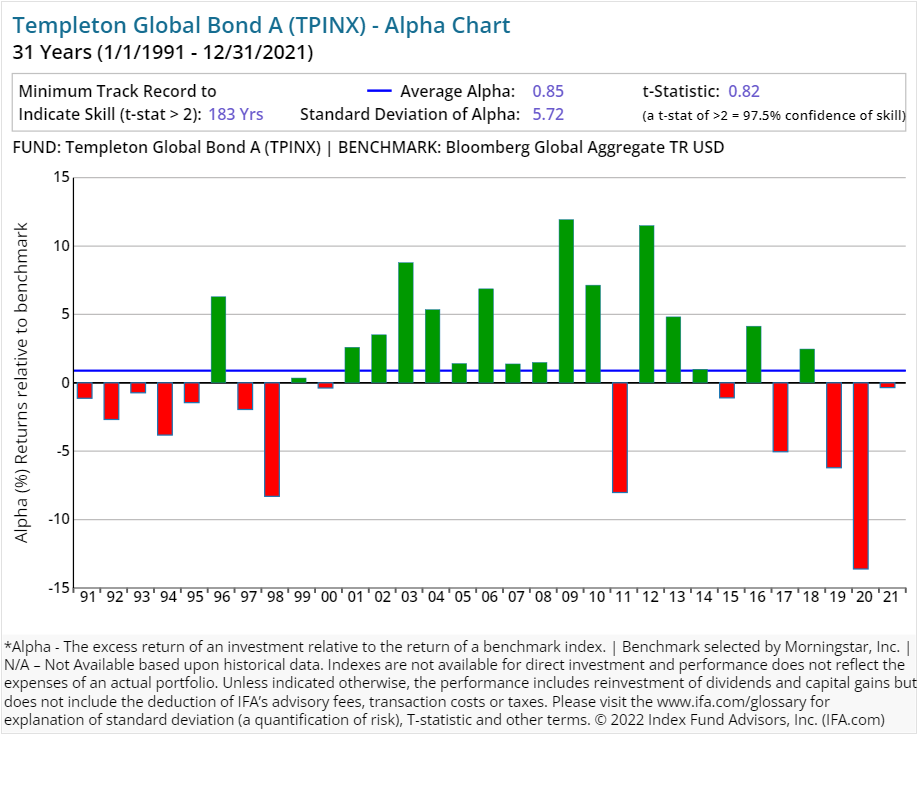

| Templeton Global Bond A | TPINX | 28.44 | 0.92 | 0.25 | 3.75 | Fixed Income | |

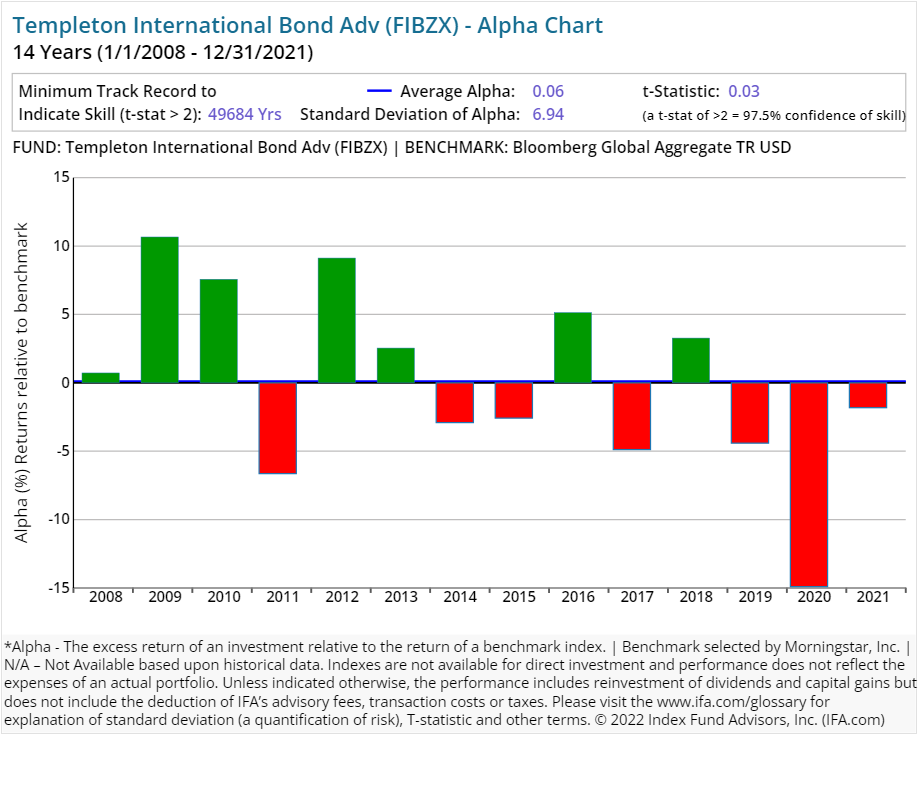

| Templeton International Bond Adv | FIBZX | 60.68 | 0.78 | Fixed Income | |||

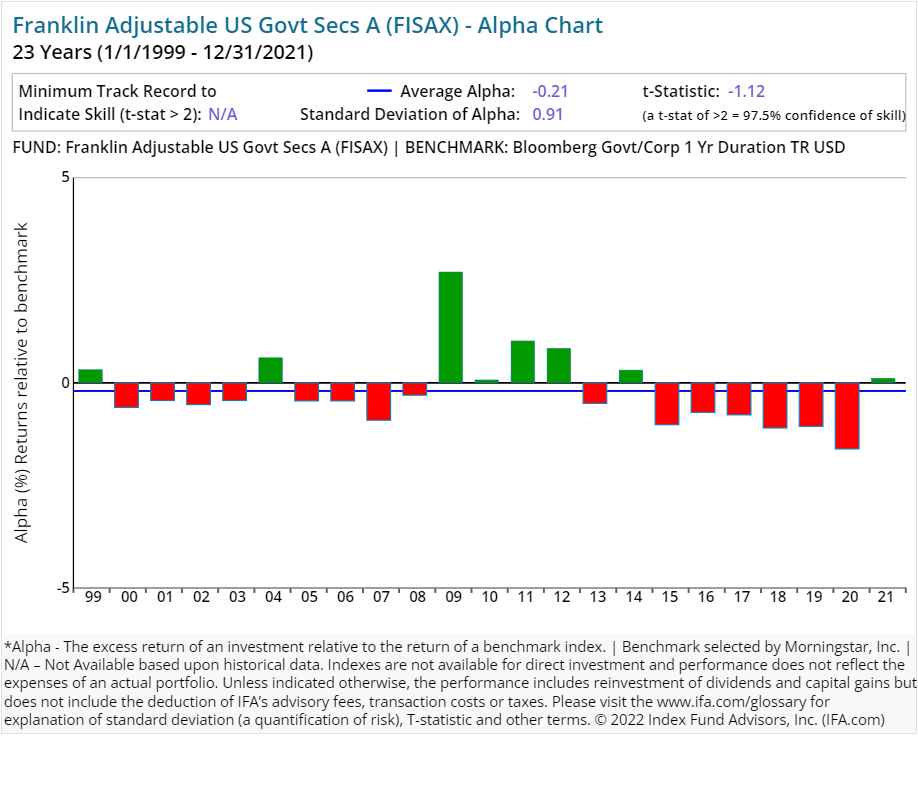

| Franklin Adjustable US Govt Secs A | FISAX | 68.61 | 0.98 | 0.25 | 2.25 | Fixed Income | |

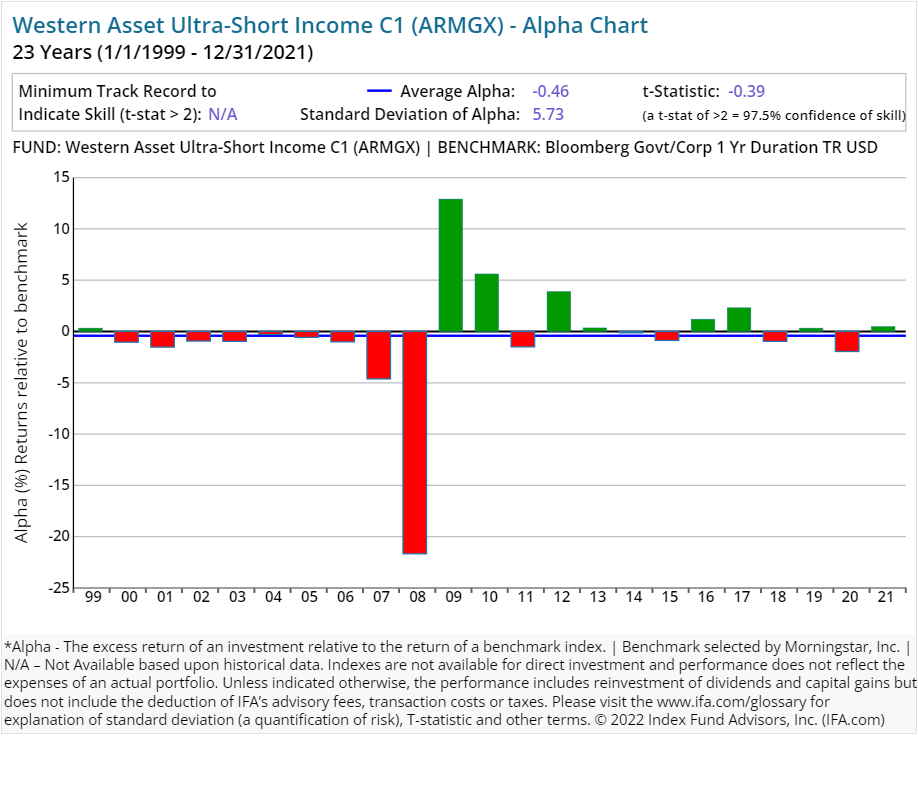

| Western Asset Ultra-Short Income C1 | ARMGX | 47.00 | 1.39 | 0.75 | Fixed Income | ||

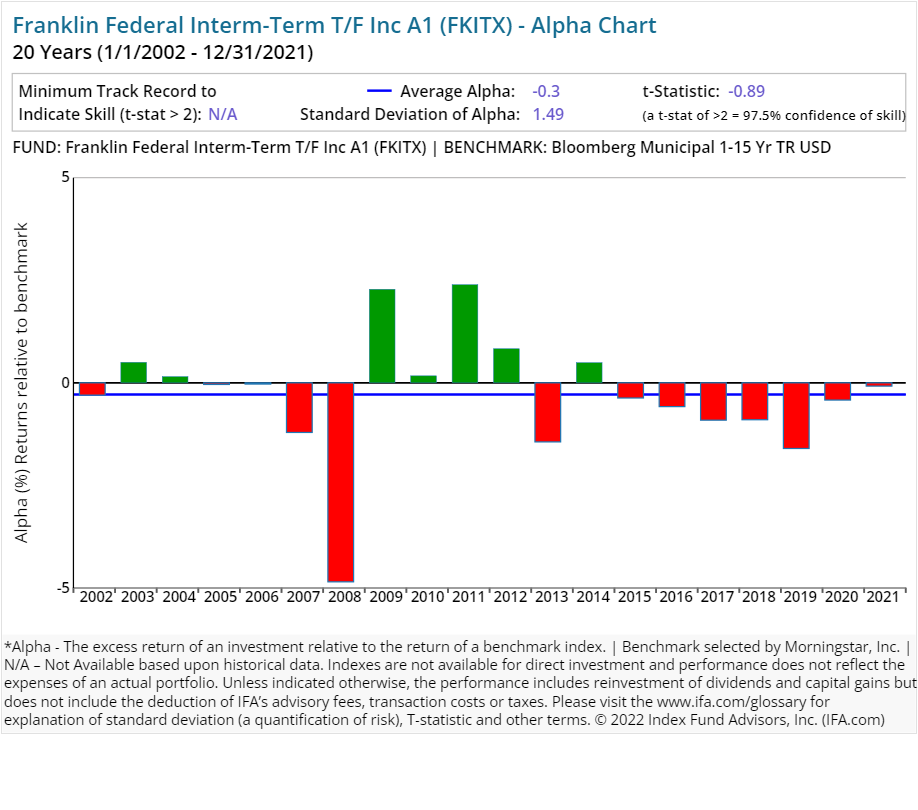

| Franklin Federal Interm-Term T/F Inc A1 | FKITX | 18.84 | 0.56 | 0.10 | 2.00 | Fixed Income | |

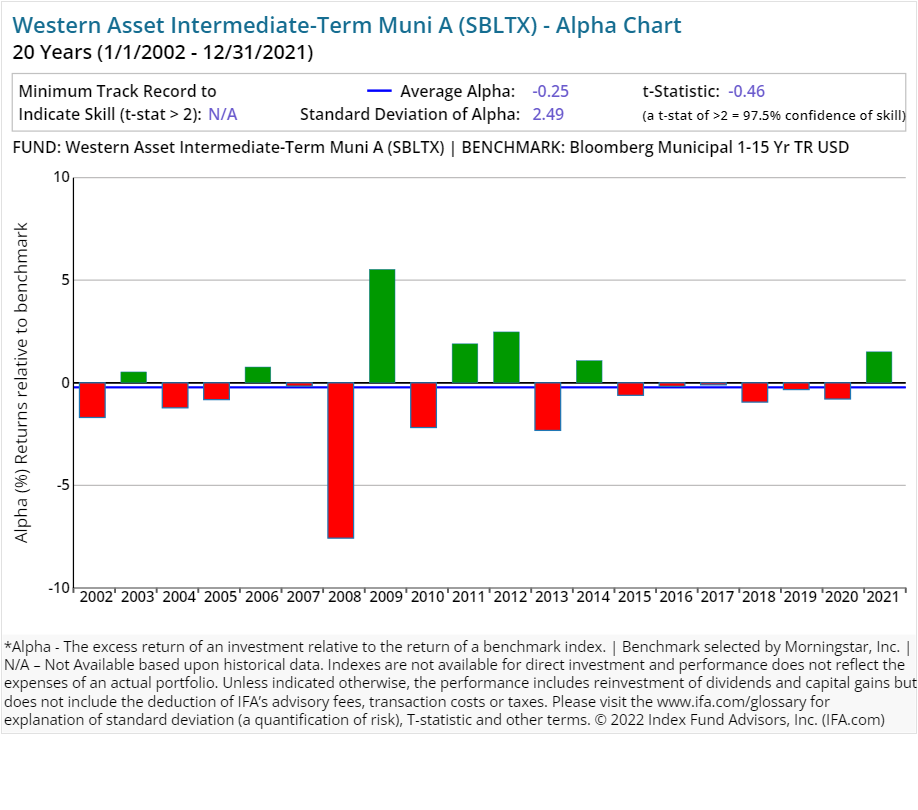

| Western Asset Intermediate-Term Muni A | SBLTX | 16.00 | 0.59 | 0.15 | 2.25 | Fixed Income | |

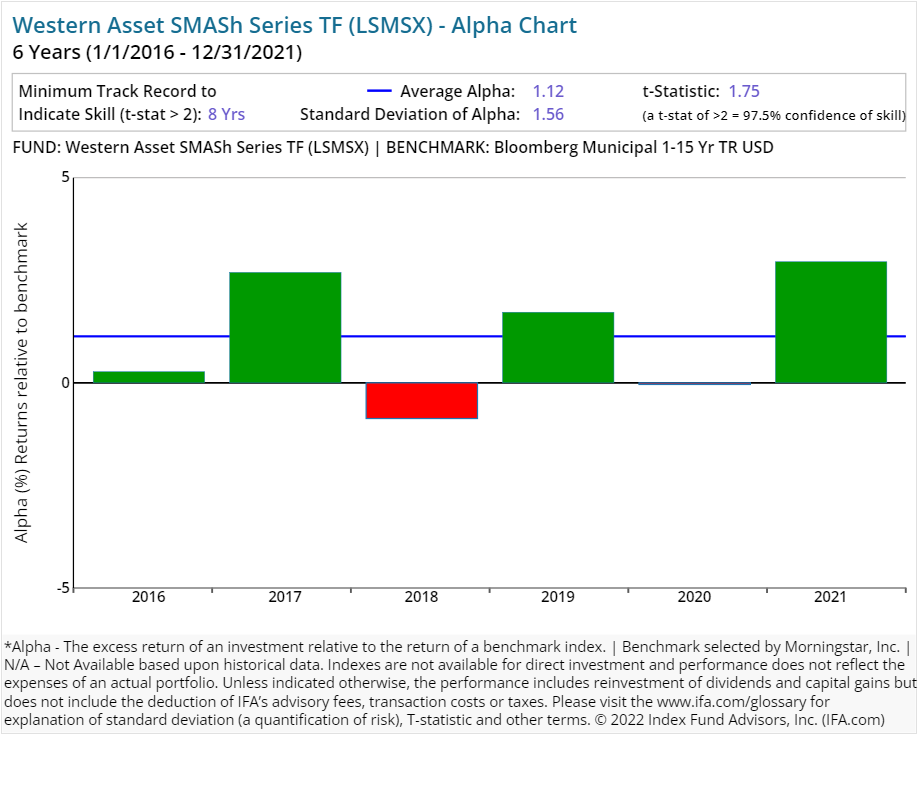

| Western Asset SMASh Series TF | LSMSX | 35.00 | 0.00 | Fixed Income | |||

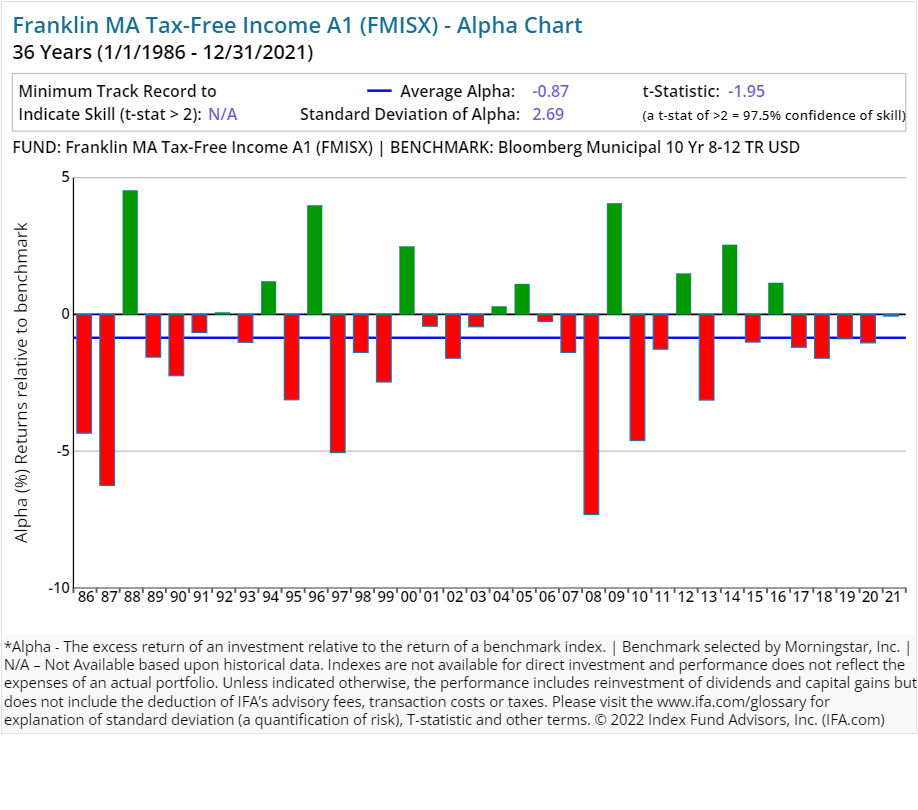

| Franklin MA Tax-Free Income A1 | FMISX | 18.21 | 0.71 | 0.10 | 3.50 | Fixed Income | |

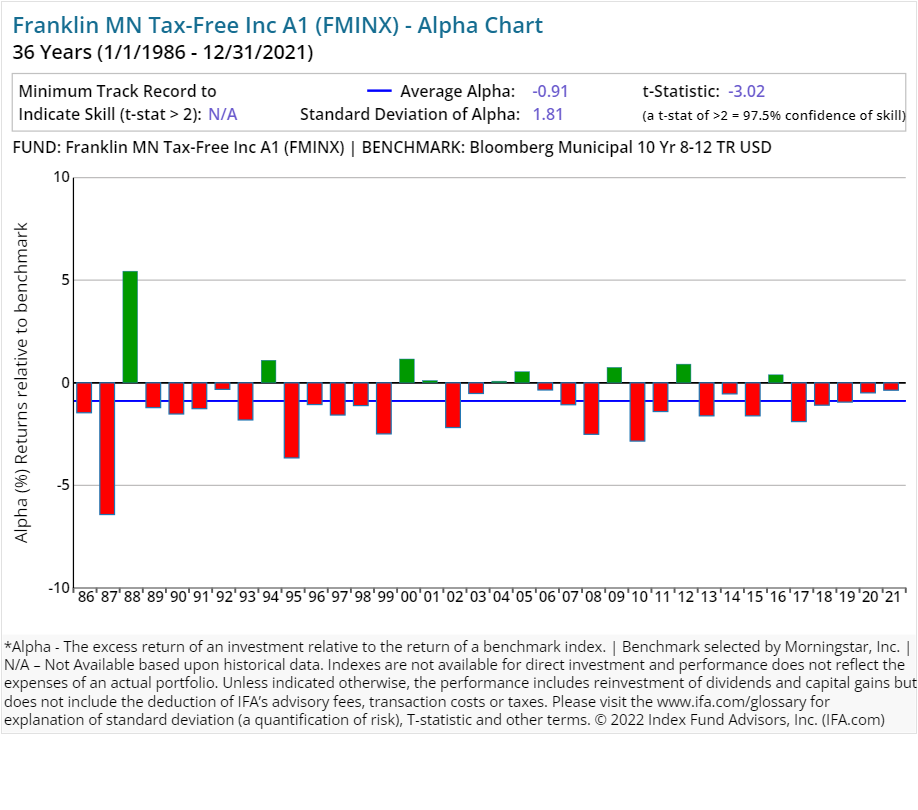

| Franklin MN Tax-Free Inc A1 | FMINX | 9.45 | 0.68 | 0.10 | 3.75 | Fixed Income | |

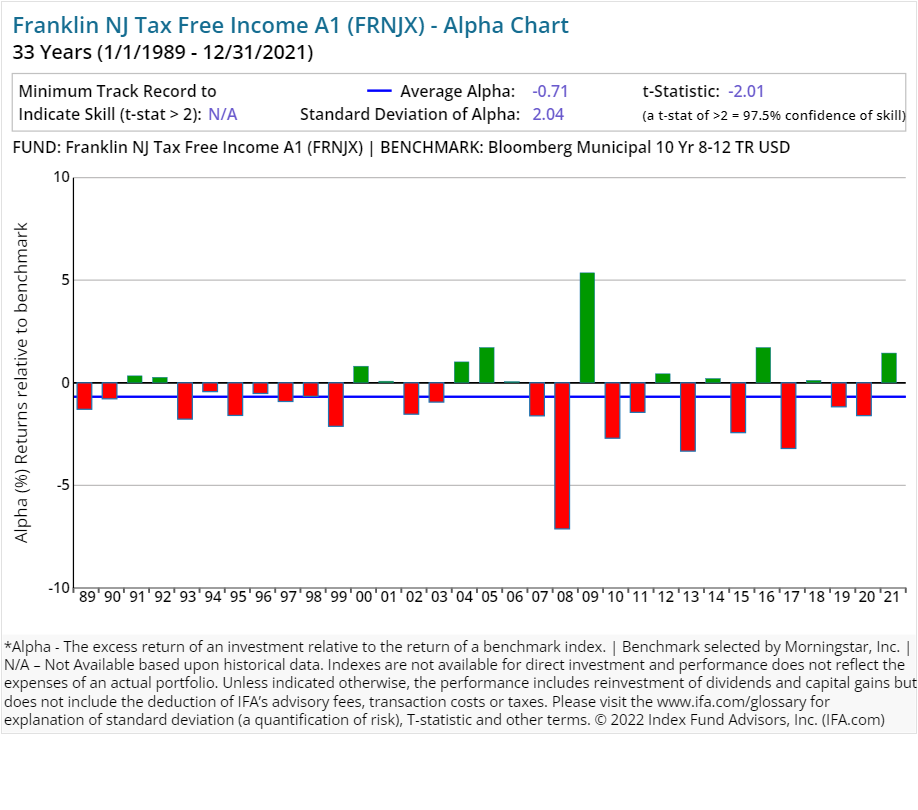

| Franklin NJ Tax Free Income A1 | FRNJX | 15.41 | 0.67 | 0.10 | 3.50 | Fixed Income | |

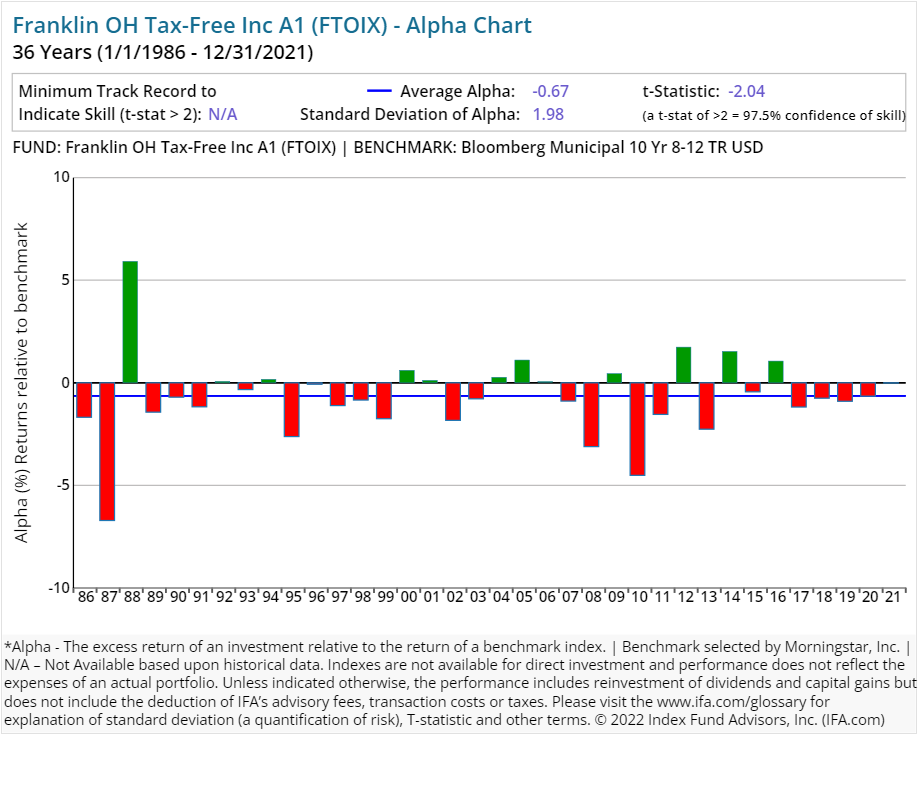

| Franklin OH Tax-Free Inc A1 | FTOIX | 20.64 | 0.65 | 0.10 | 3.75 | Fixed Income | |

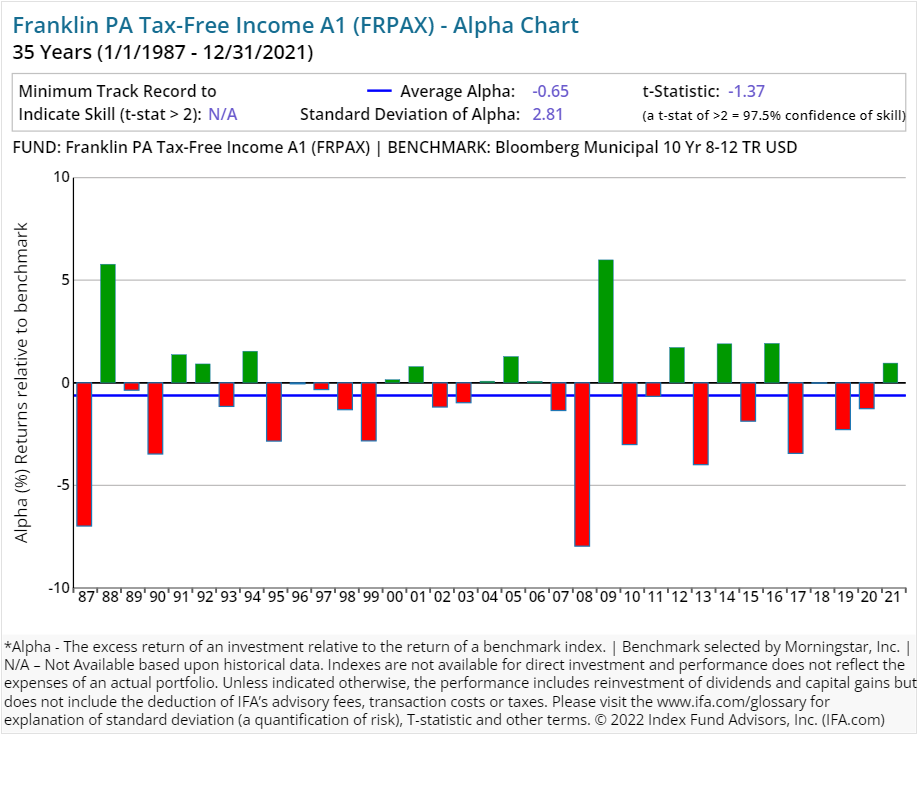

| Franklin PA Tax-Free Income A1 | FRPAX | 28.44 | 0.66 | 0.10 | 3.75 | Fixed Income | |

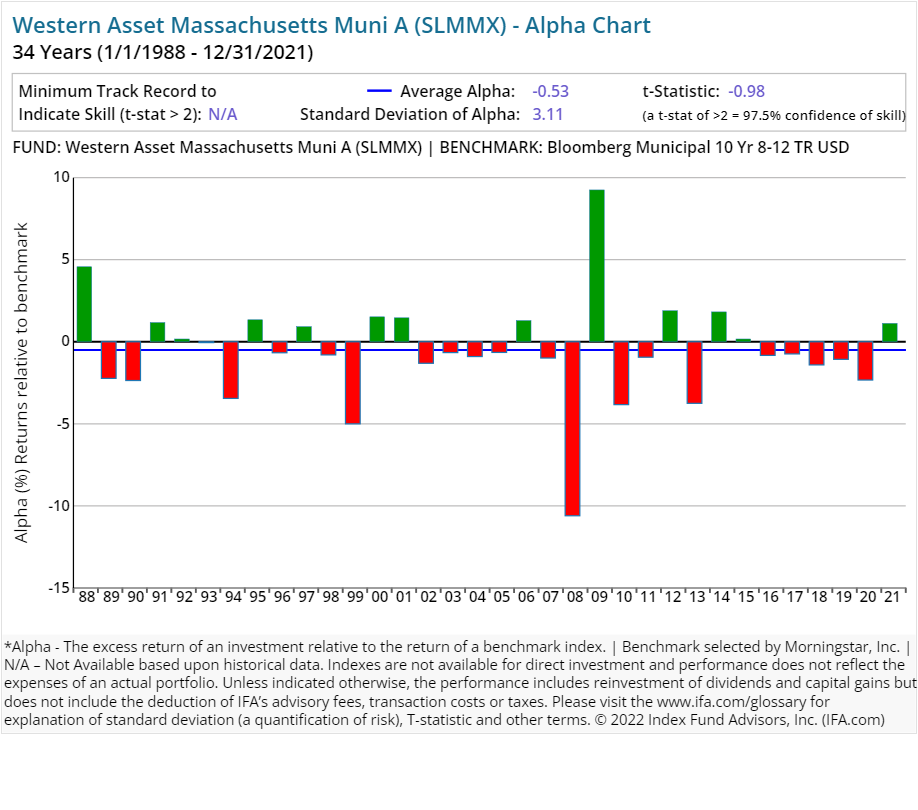

| Western Asset Massachusetts Muni A | SLMMX | 26.00 | 0.75 | 0.15 | 4.25 | Fixed Income | |

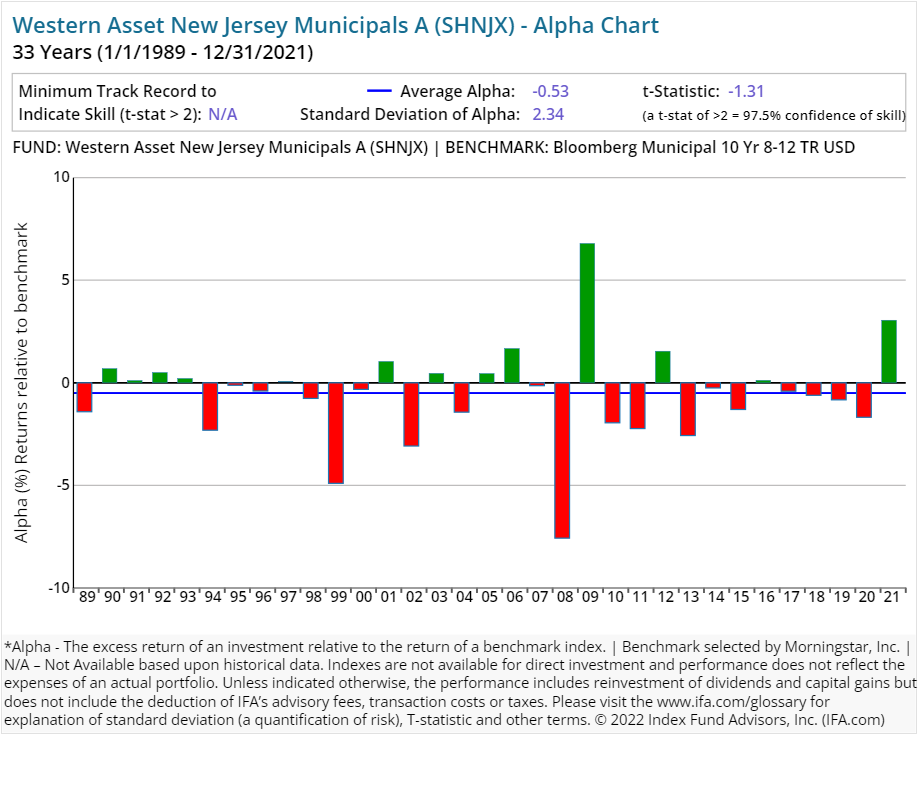

| Western Asset New Jersey Municipals A | SHNJX | 14.00 | 0.83 | 0.15 | 4.25 | Fixed Income | |

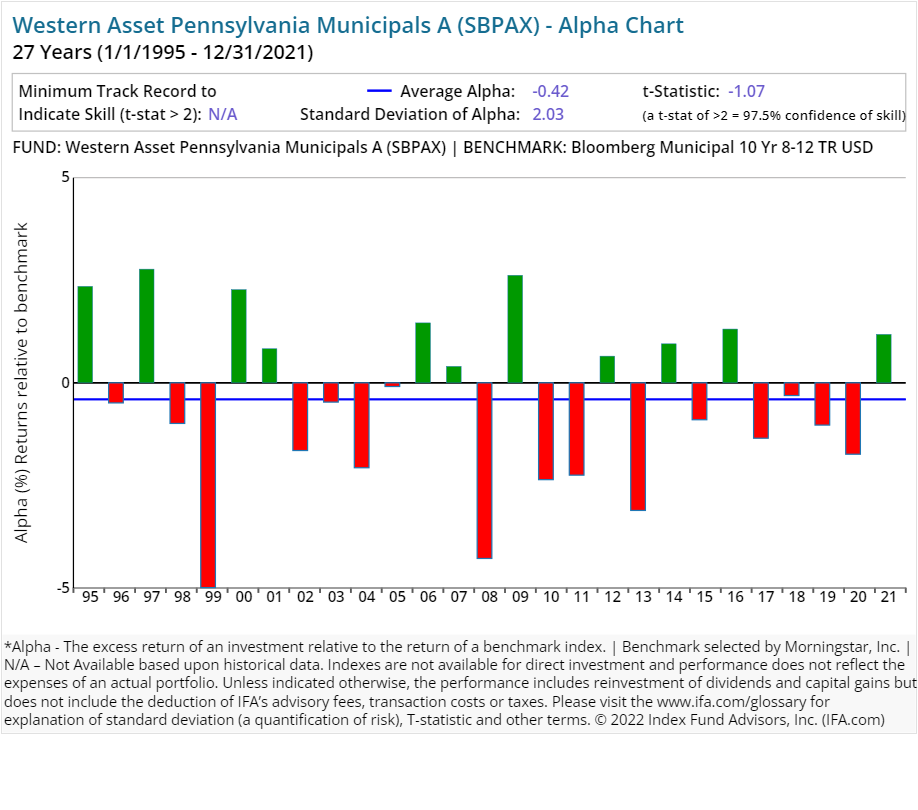

| Western Asset Pennsylvania Municipals A | SBPAX | 8.00 | 0.78 | 0.15 | 4.25 | Fixed Income | |

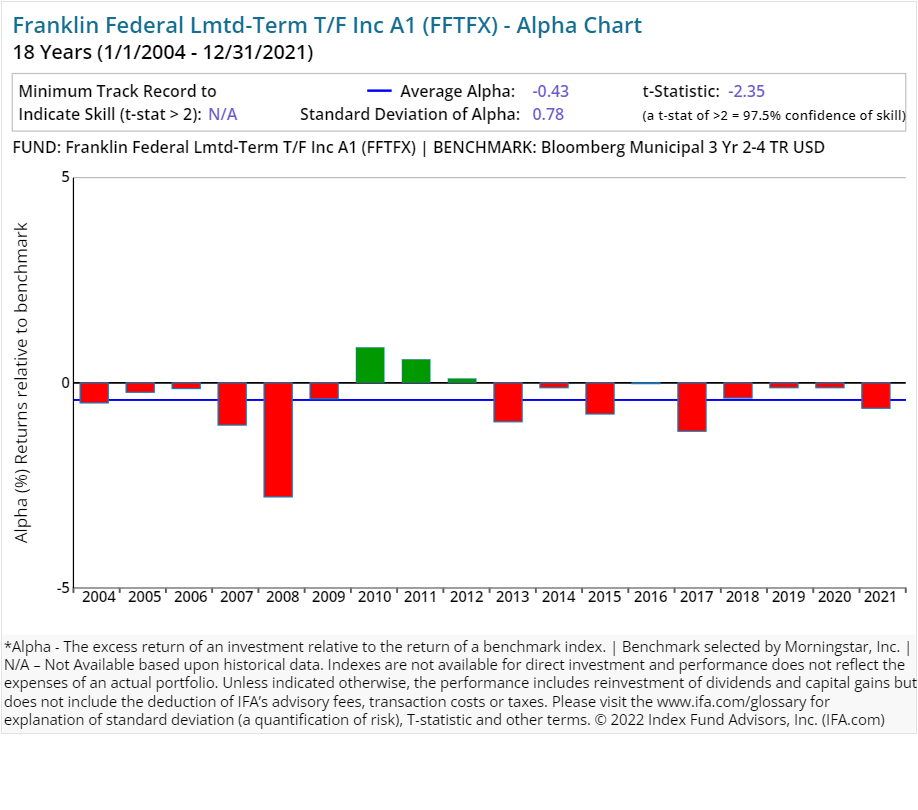

| Franklin Federal Lmtd-Term T/F Inc A1 | FFTFX | 19.85 | 0.56 | 0.15 | 2.00 | Fixed Income | |

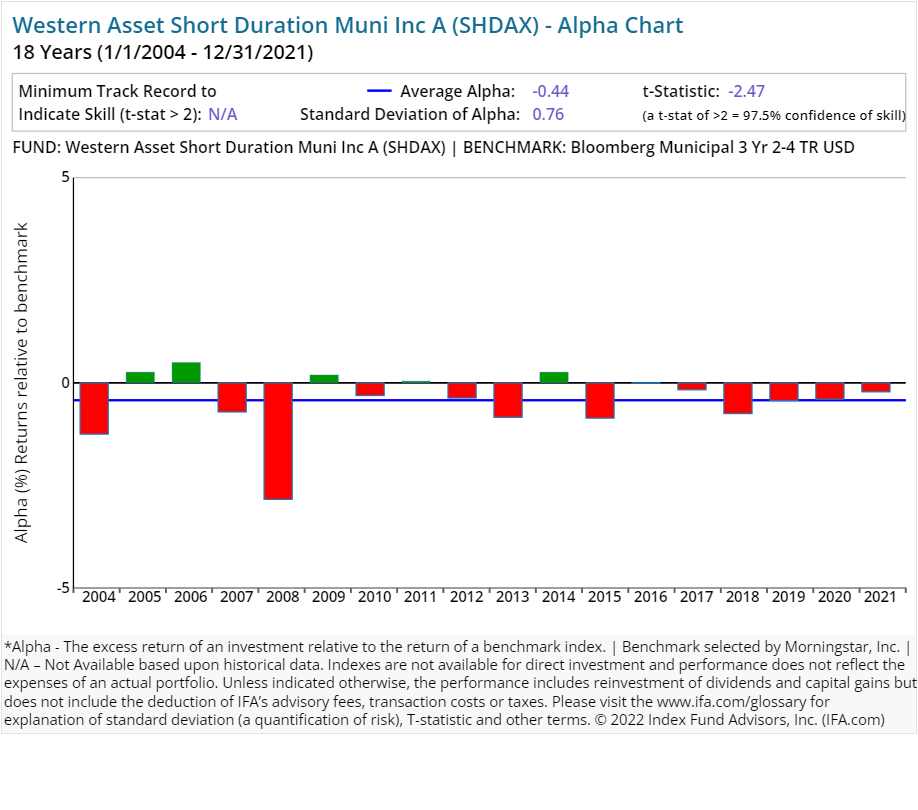

| Western Asset Short Duration Muni Inc A | SHDAX | 50.00 | 0.55 | 0.15 | 2.25 | Fixed Income | |

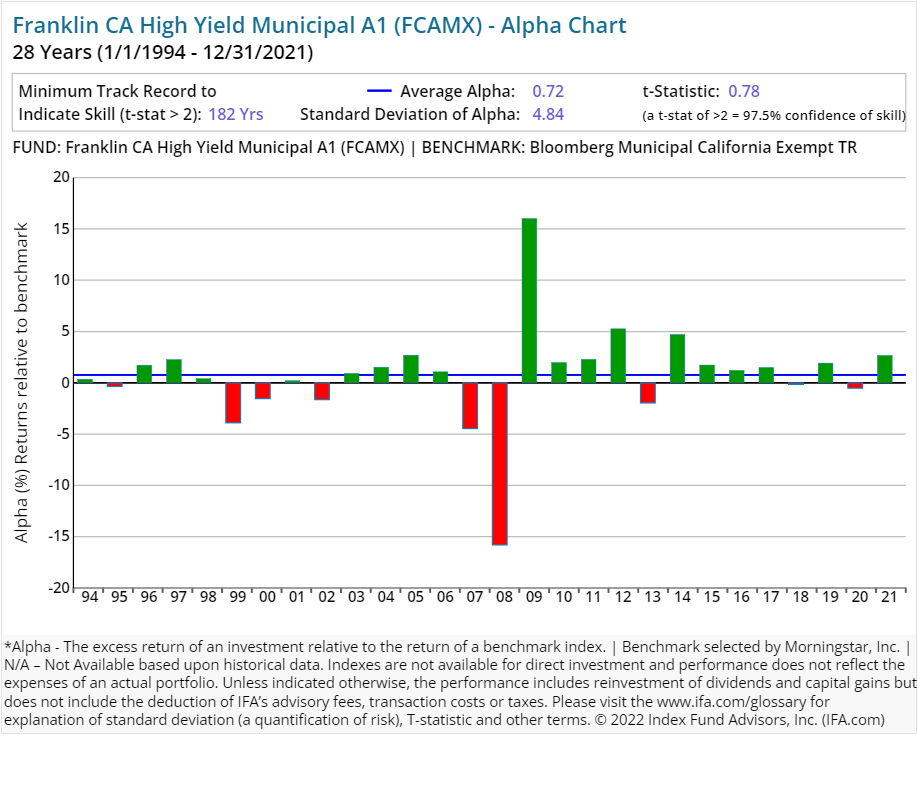

| Franklin CA High Yield Municipal A1 | FCAMX | 9.20 | 0.64 | 0.10 | 3.75 | Fixed Income | |

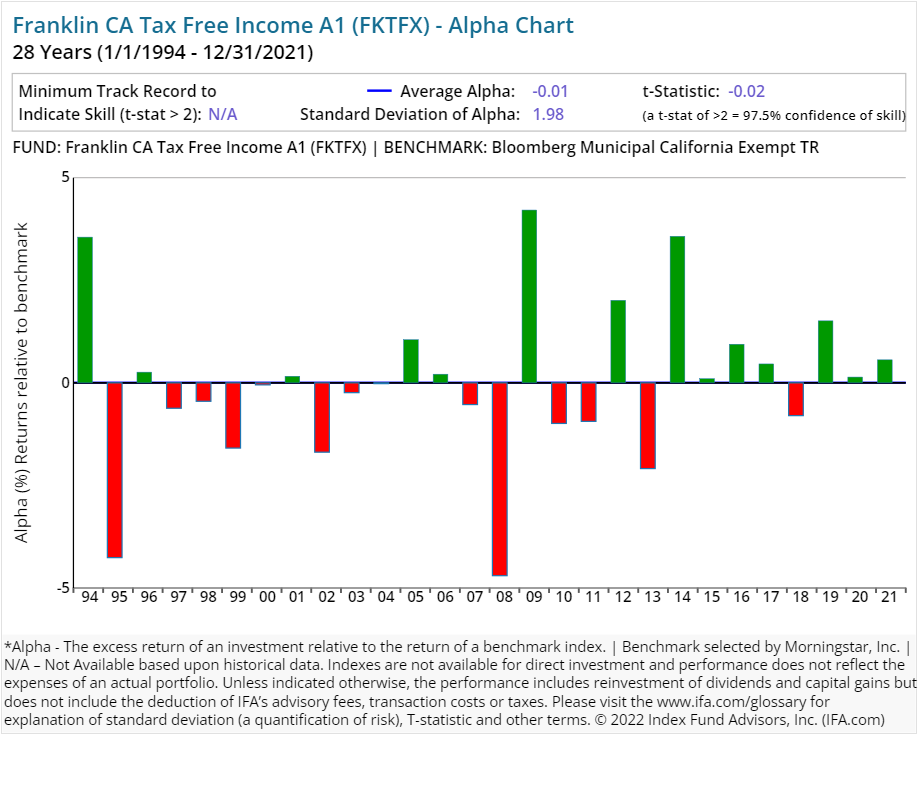

| Franklin CA Tax Free Income A1 | FKTFX | 14.41 | 0.61 | 0.10 | 3.75 | Fixed Income | |

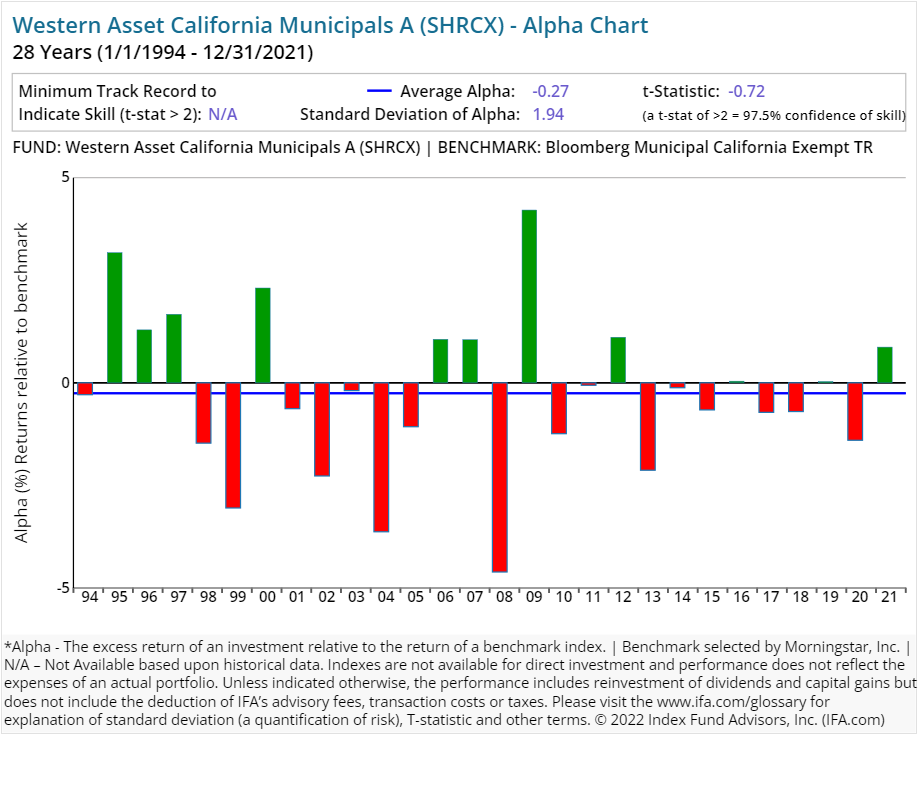

| Western Asset California Municipals A | SHRCX | 16.00 | 0.77 | 0.15 | 4.25 | Fixed Income | |

| Franklin CA Interm-Term Tx-Fr Inc A1 | FKCIX | 9.20 | 0.59 | 0.10 | 2.25 | Fixed Income | |

| Western Asset Interm Maturity CA Muni A | ITCAX | 21.00 | 0.75 | 0.15 | 2.25 | Fixed Income | |

| Franklin NY Intermediate T/F Income A1 | FKNIX | 18.90 | 0.68 | 0.10 | 2.25 | Fixed Income | |

| Franklin NY Tax Free Income A1 | FNYTX | 12.15 | 0.63 | 0.10 | 3.75 | Fixed Income | |

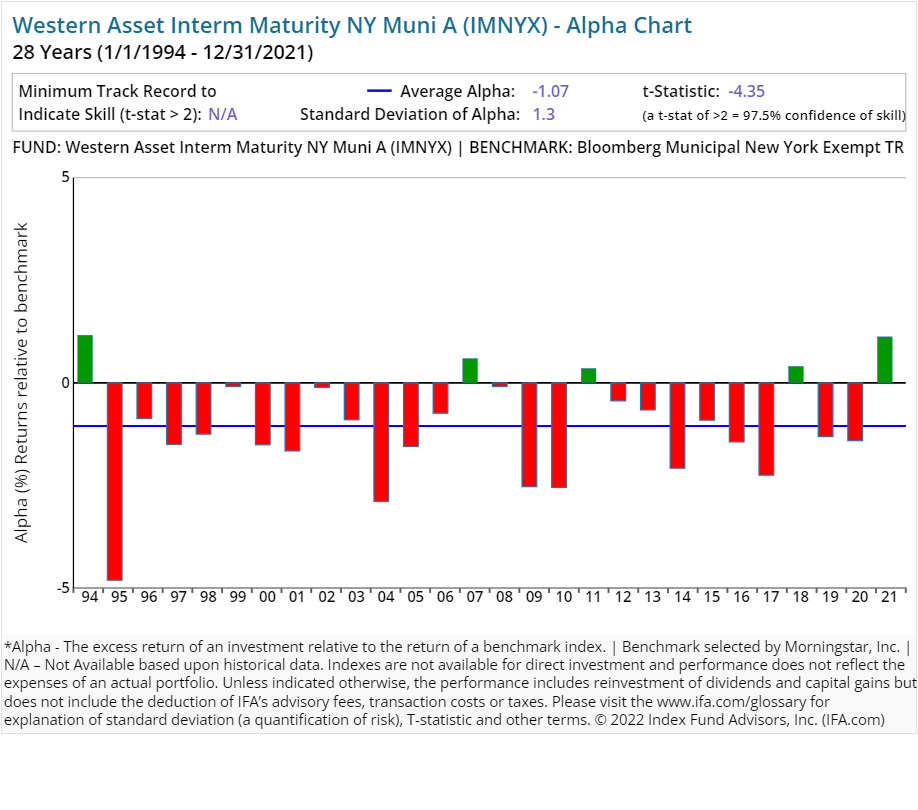

| Western Asset Interm Maturity NY Muni A | IMNYX | 20.00 | 0.75 | 0.15 | 2.25 | Fixed Income | |

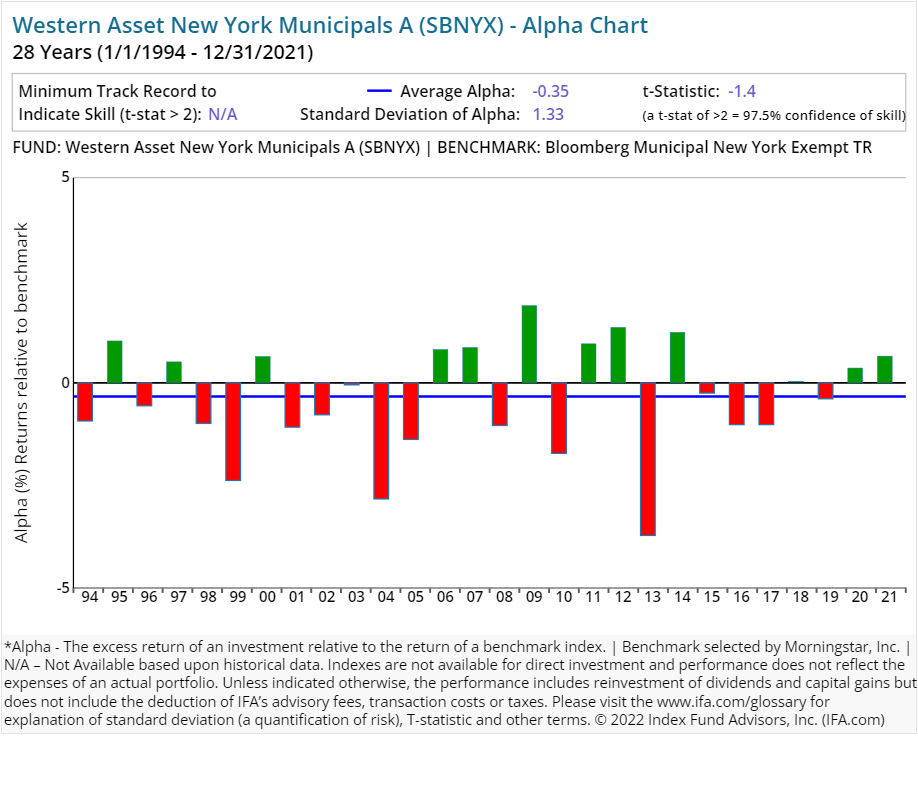

| Western Asset New York Municipals A | SBNYX | 26.00 | 0.75 | 0.15 | 4.25 | Fixed Income | |

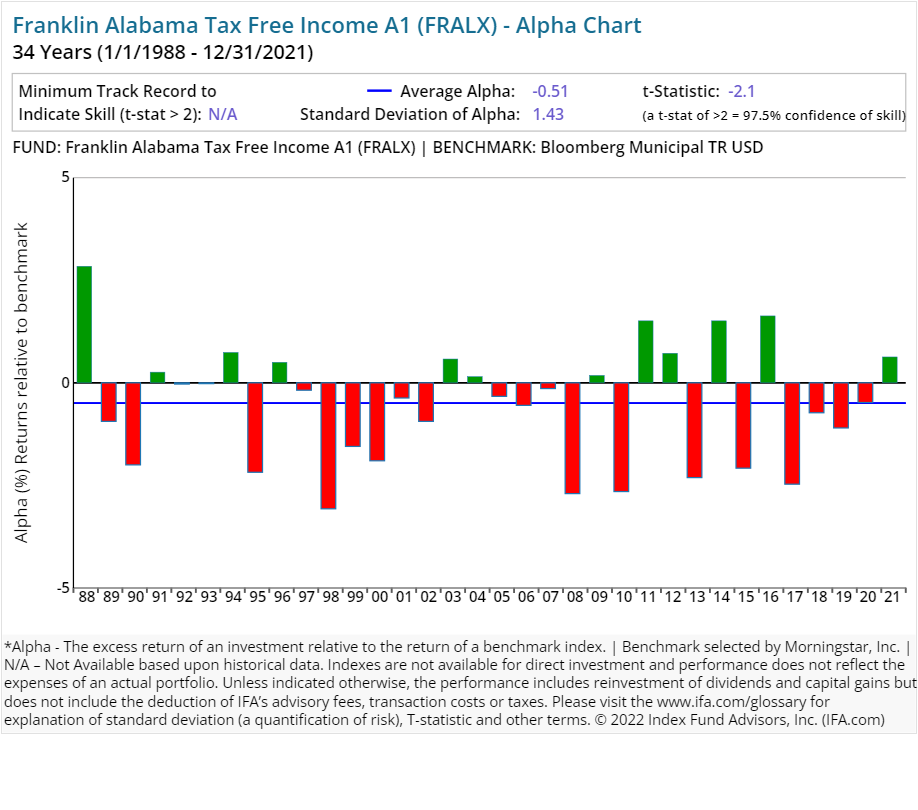

| Franklin Alabama Tax Free Income A1 | FRALX | 24.03 | 0.76 | 0.10 | 1.00 | 3.75 | Fixed Income |

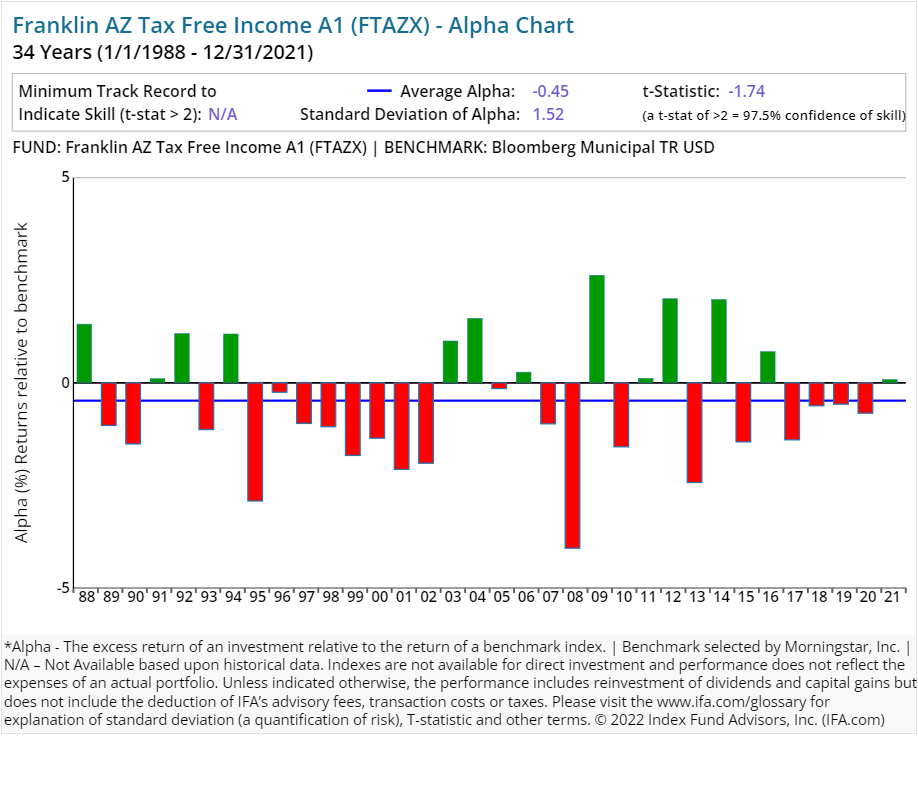

| Franklin AZ Tax Free Income A1 | FTAZX | 13.66 | 0.66 | 0.10 | 3.75 | Fixed Income | |

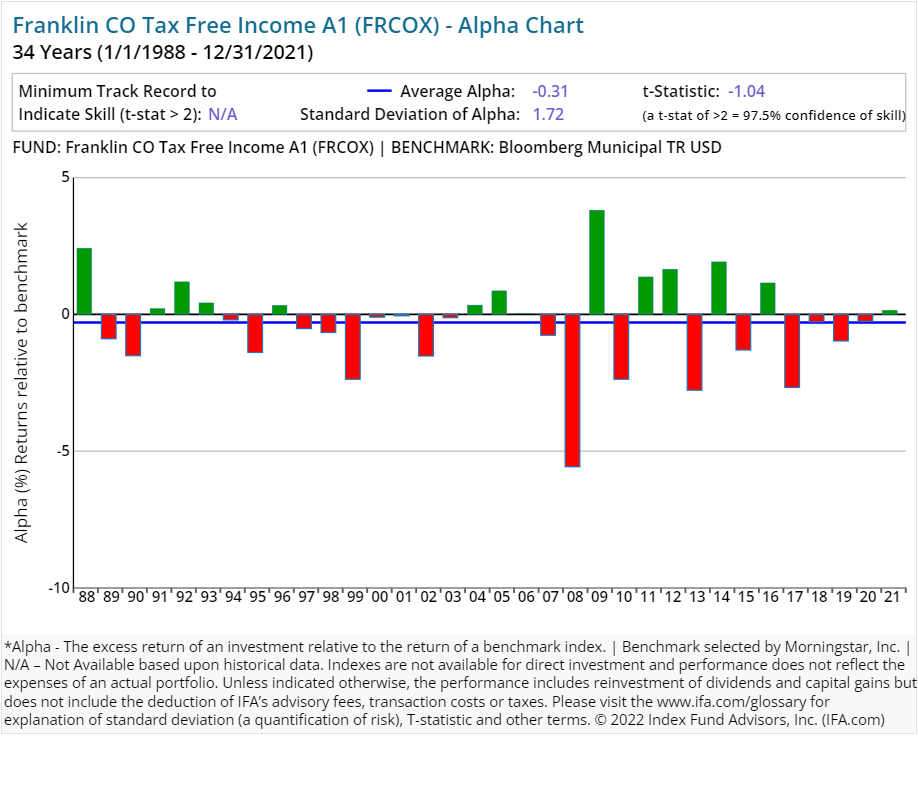

| Franklin CO Tax Free Income A1 | FRCOX | 19.32 | 0.68 | 0.10 | 3.75 | Fixed Income | |

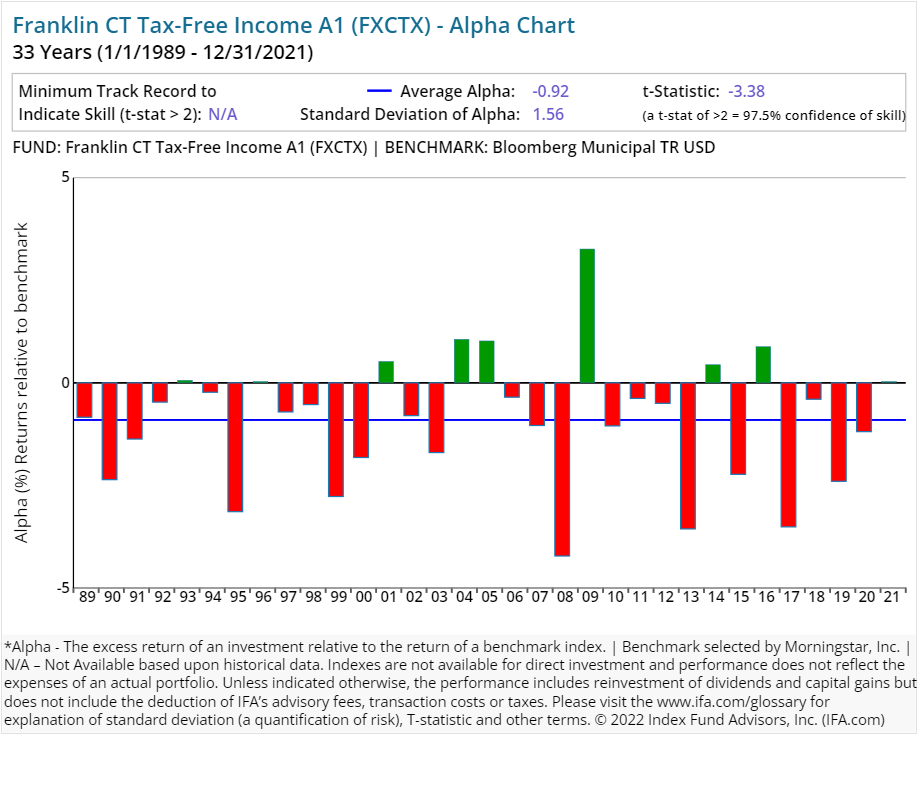

| Franklin CT Tax-Free Income A1 | FXCTX | 20.73 | 0.79 | 0.10 | 3.75 | Fixed Income | |

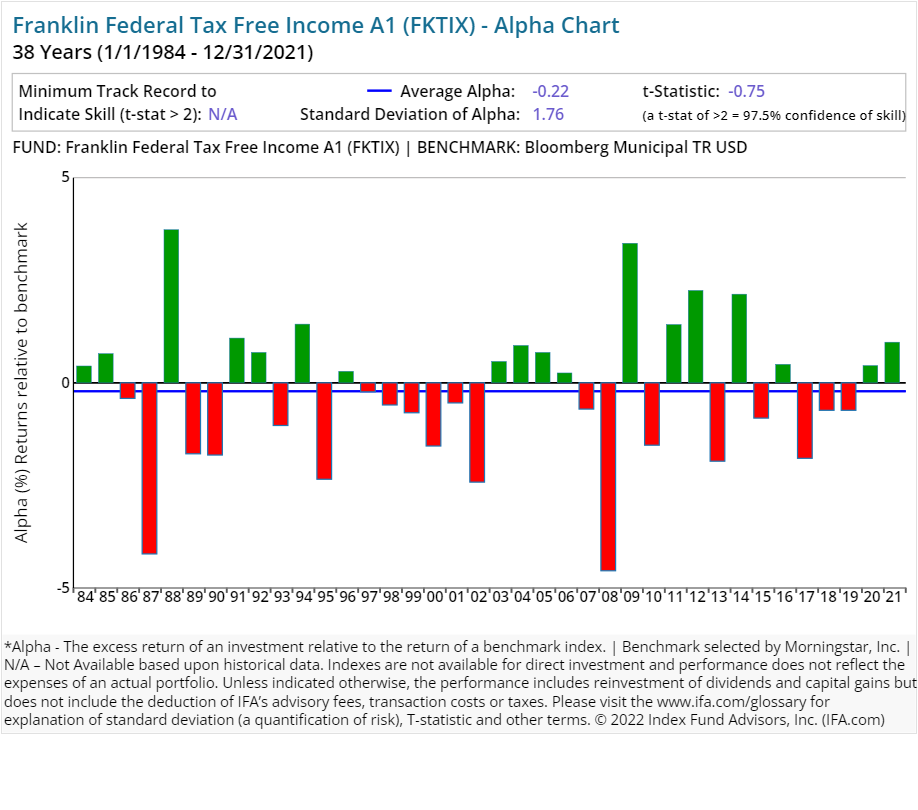

| Franklin Federal Tax Free Income A1 | FKTIX | 16.18 | 0.63 | 0.10 | 3.75 | Fixed Income | |

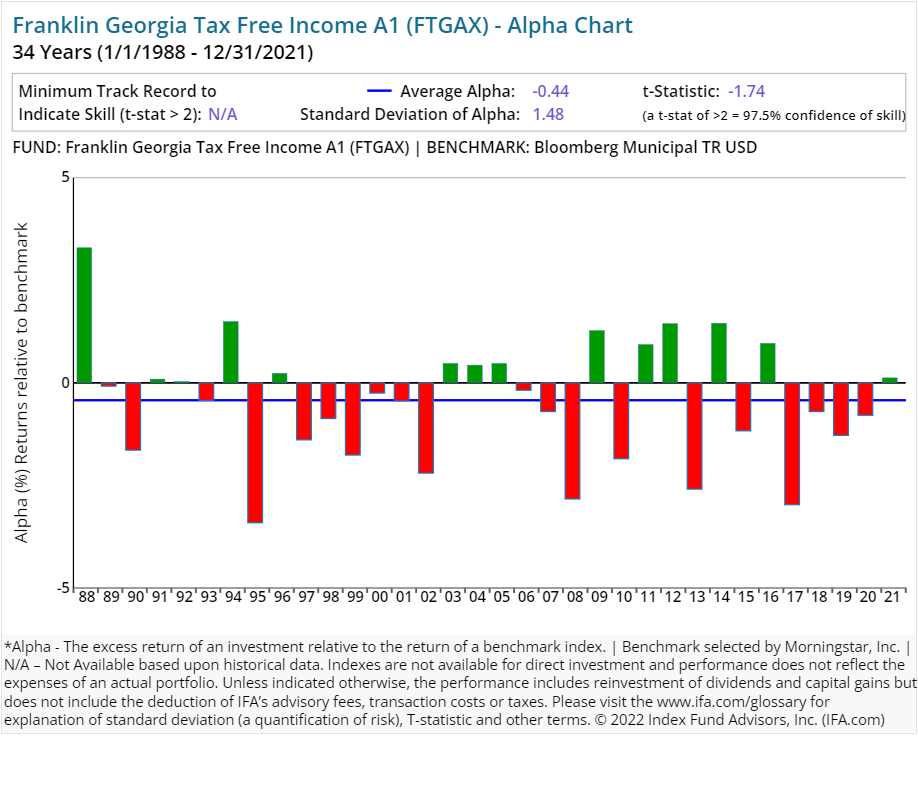

| Franklin Georgia Tax Free Income A1 | FTGAX | 16.89 | 0.71 | 0.10 | 1.00 | 3.75 | Fixed Income |

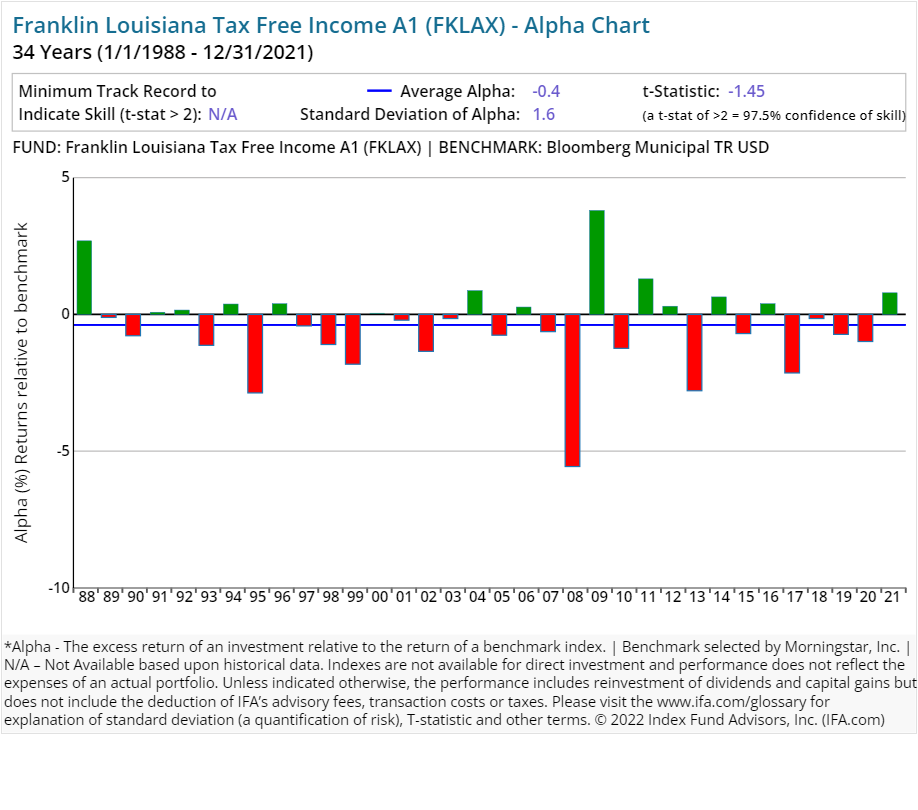

| FKLAX | 22.66 | 0.72 | 0.10 | 1.00 | 3.75 | Fixed Income | |

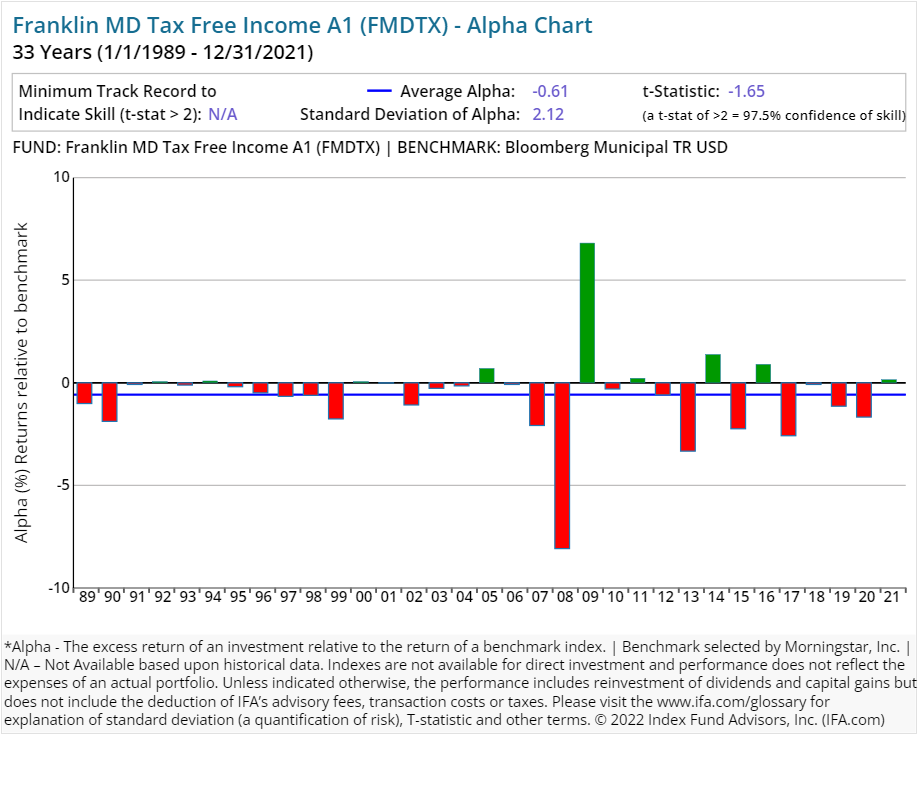

| Franklin MD Tax Free Income A1 | FMDTX | 18.20 | 0.72 | 0.10 | 1.00 | 3.75 | Fixed Income |

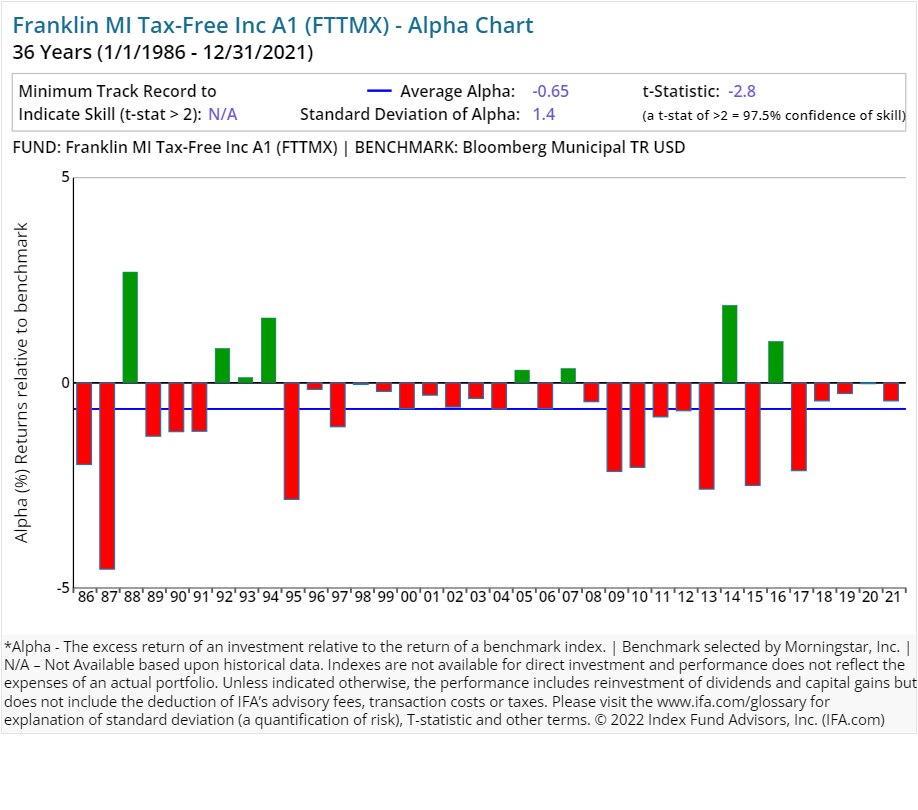

| Franklin MI Tax-Free Inc A1 | FTTMX | 10.86 | 0.67 | 0.10 | 3.75 | Fixed Income | |

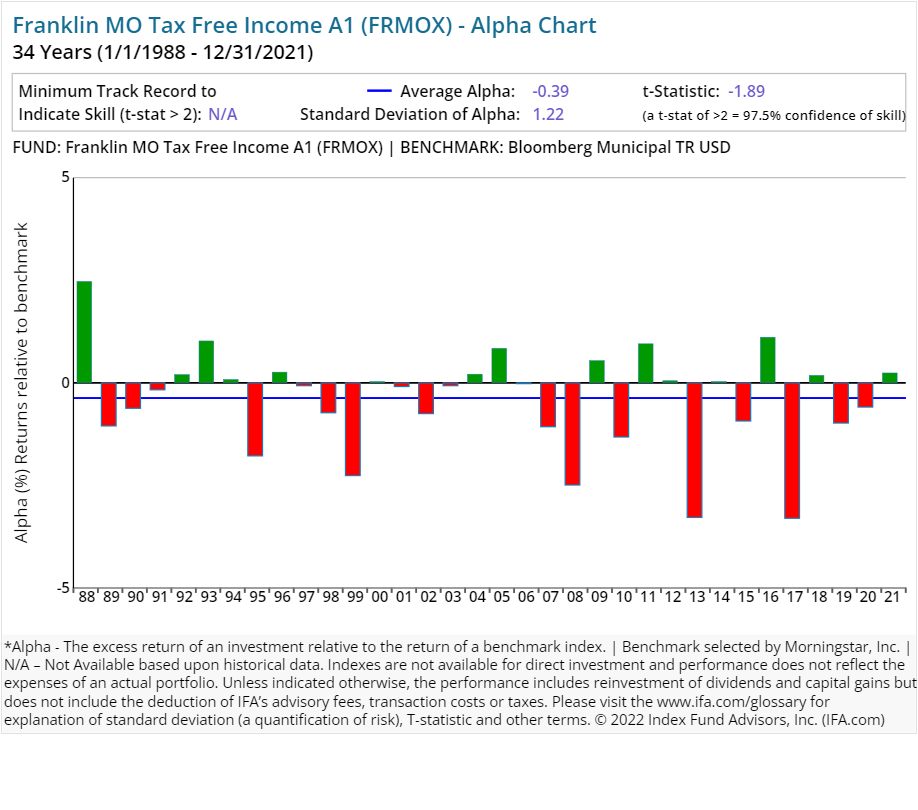

| Franklin MO Tax Free Income A1 | FRMOX | 18.20 | 0.66 | 0.10 | 1.00 | 3.75 | Fixed Income |

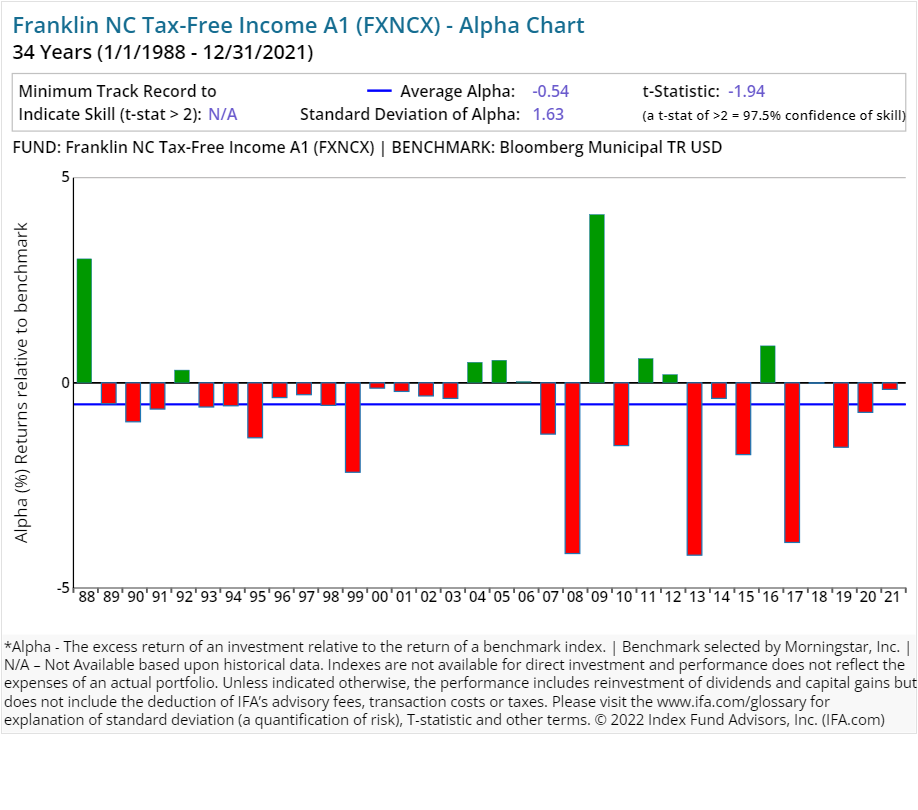

| Franklin NC Tax-Free Income A1 | FXNCX | 15.09 | 0.66 | 0.10 | 1.00 | 3.75 | Fixed Income |

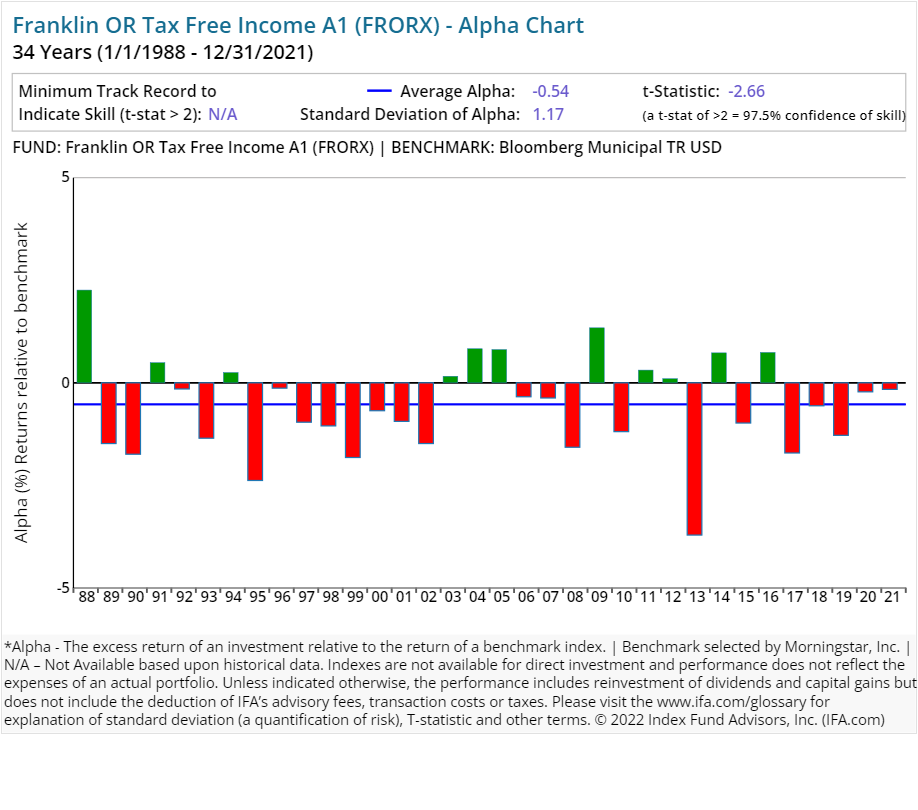

| Franklin OR Tax Free Income A1 | FRORX | 18.23 | 0.65 | 0.10 | 3.75 | Fixed Income | |

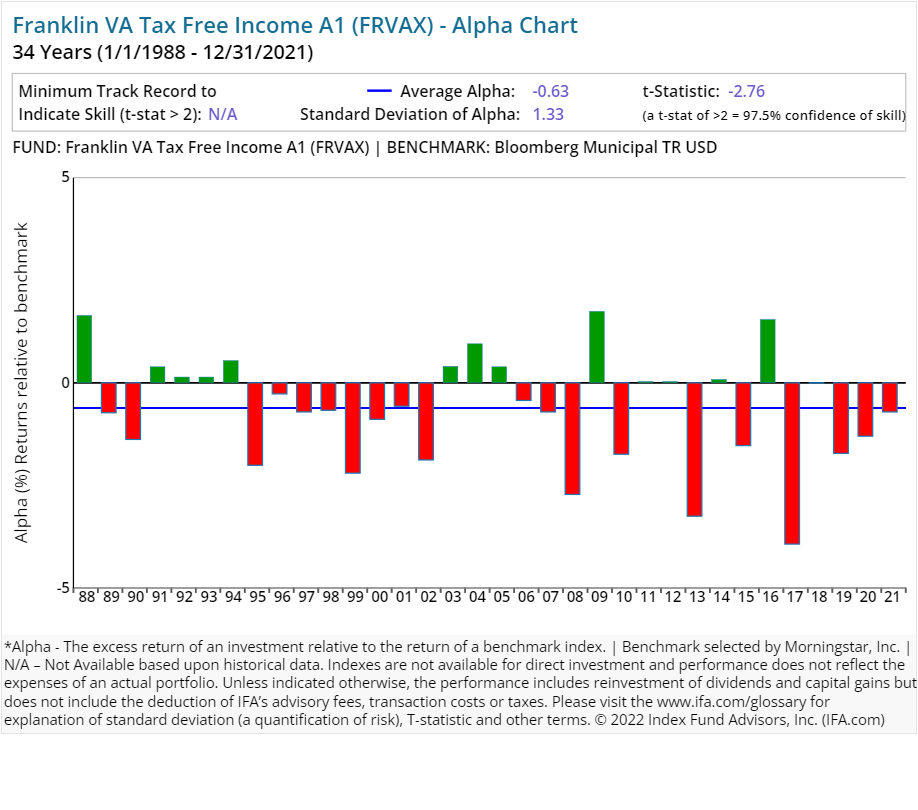

| Franklin VA Tax Free Income A1 | FRVAX | 31.54 | 0.69 | 0.10 | 1.00 | 3.75 | Fixed Income |

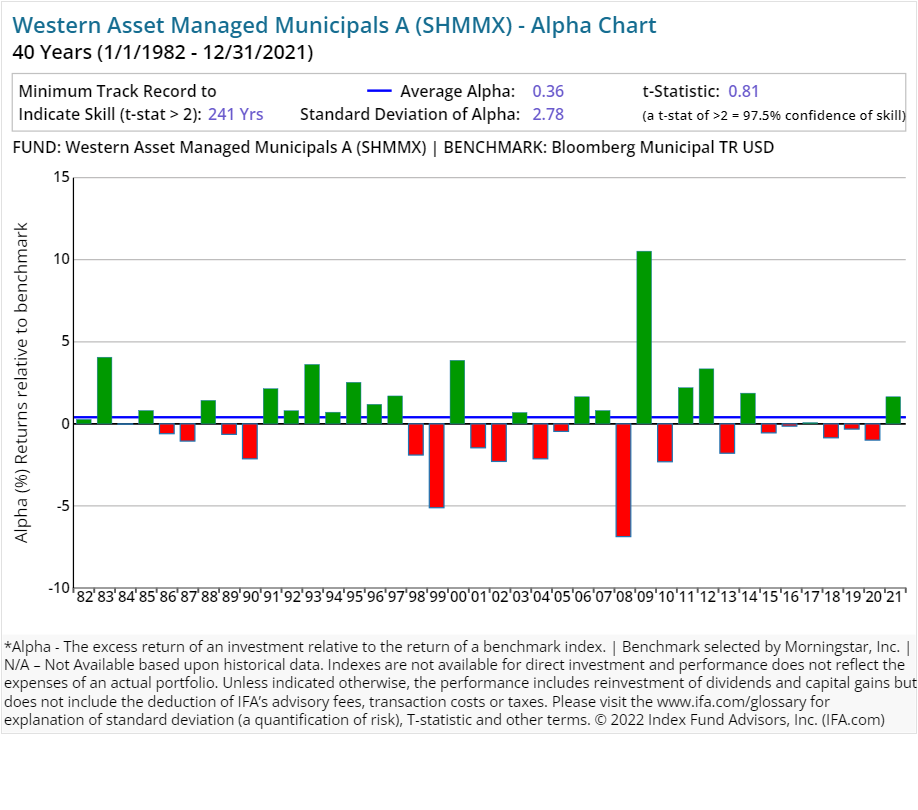

| Western Asset Managed Municipals A | SHMMX | 27.00 | 0.64 | 0.15 | 4.25 | Fixed Income | |

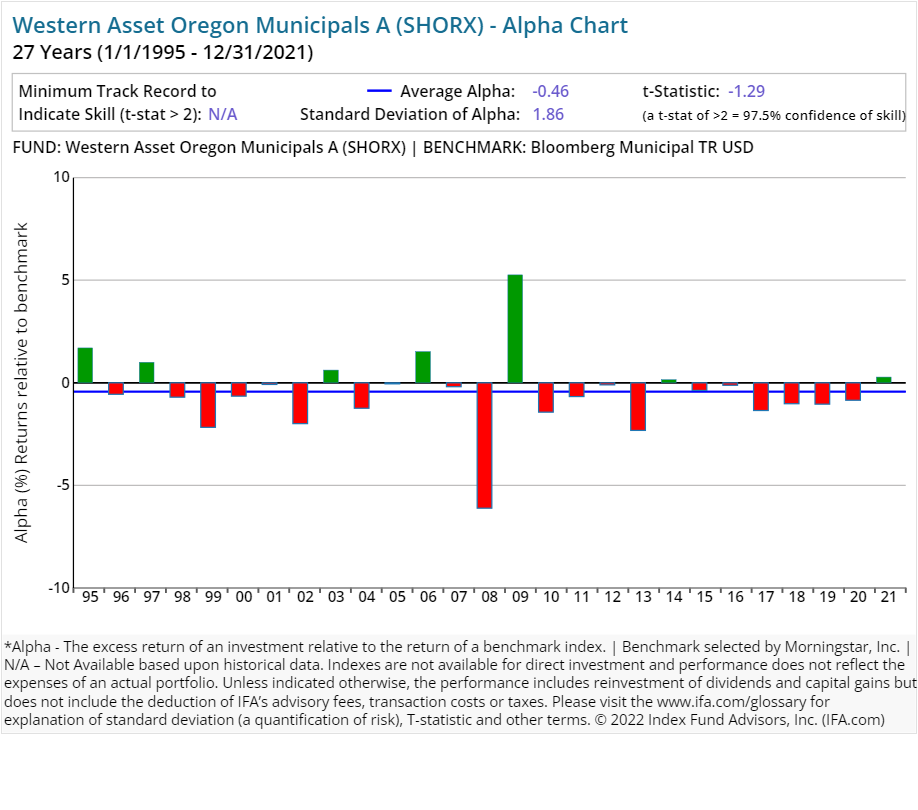

| Western Asset Oregon Municipals A | SHORX | 8.00 | 0.75 | 0.15 | 4.25 | Fixed Income | |

| Western Asset Core Bond I | WATFX | 72.00 | 0.46 | Fixed Income | |||

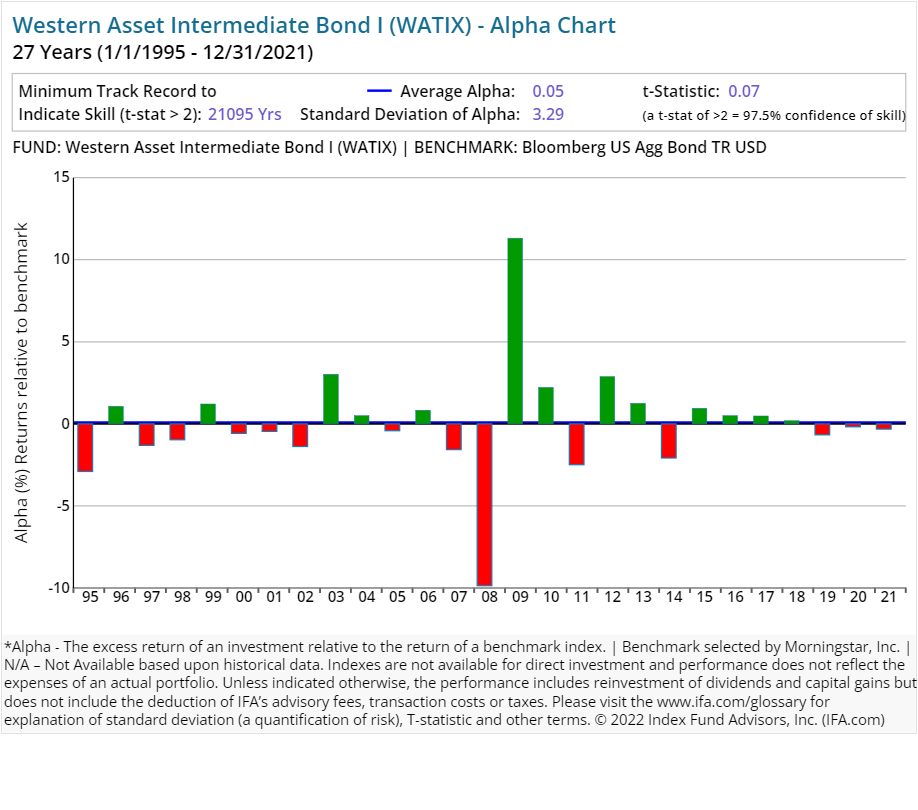

| Western Asset Intermediate Bond I | WATIX | 60.00 | 0.55 | Fixed Income | |||

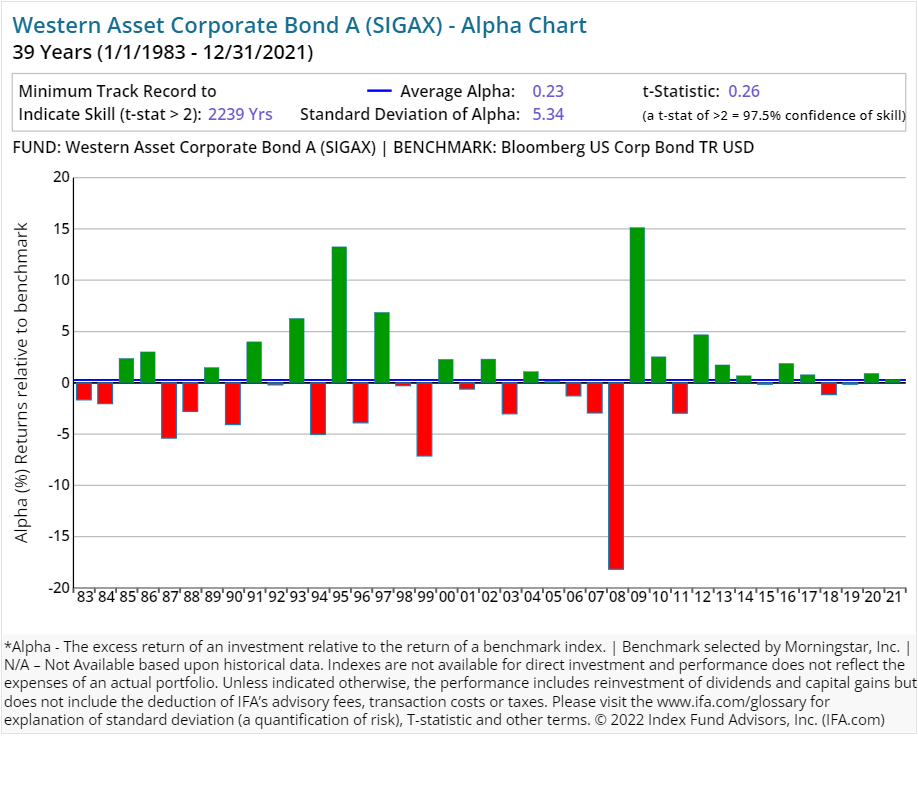

| Western Asset Corporate Bond A | SIGAX | 63.00 | 0.91 | 0.25 | 4.25 | Fixed Income | |

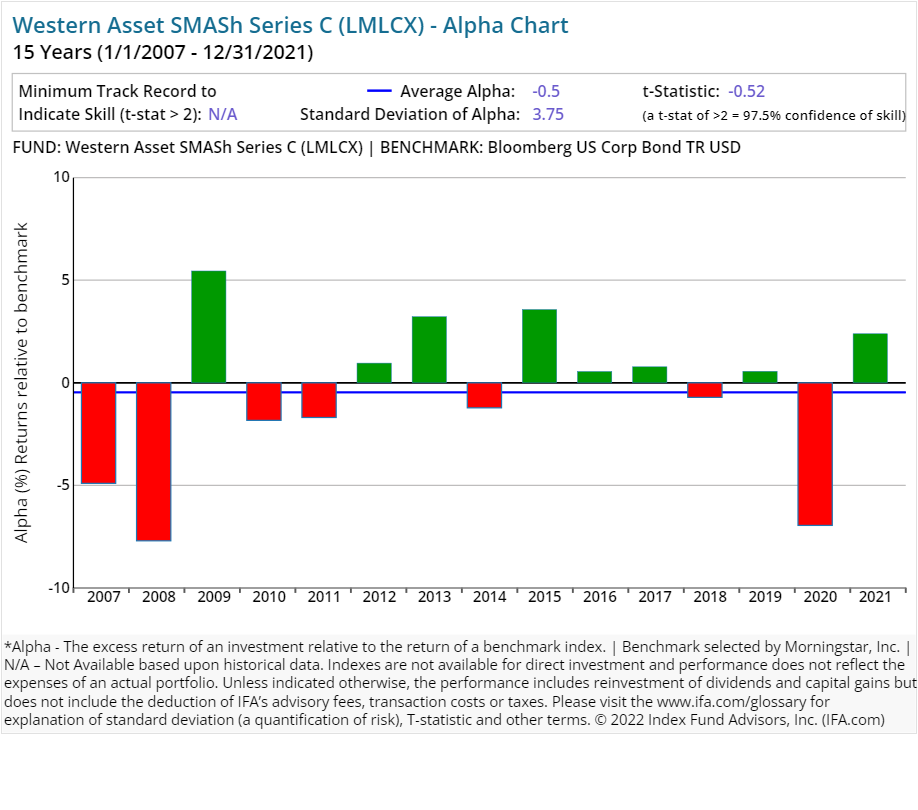

| Western Asset SMASh Series C | LMLCX | 13.00 | 0.00 | Fixed Income | |||

| Franklin US Government Secs A1 | FKUSX | 89.16 | 0.77 | 0.15 | 3.75 | Fixed Income | |

| Franklin Low Duration Total Return A | FLDAX | 85.02 | 0.71 | 0.25 | 2.25 | Fixed Income | |

| Western Asset Short-Term Bond A | SBSTX | 58.00 | 0.71 | 0.25 | 2.25 | Fixed Income | |

| Western Asset Inflation Idxd Plus Bd I | WAIIX | 80.00 | 0.35 | Fixed Income | |||

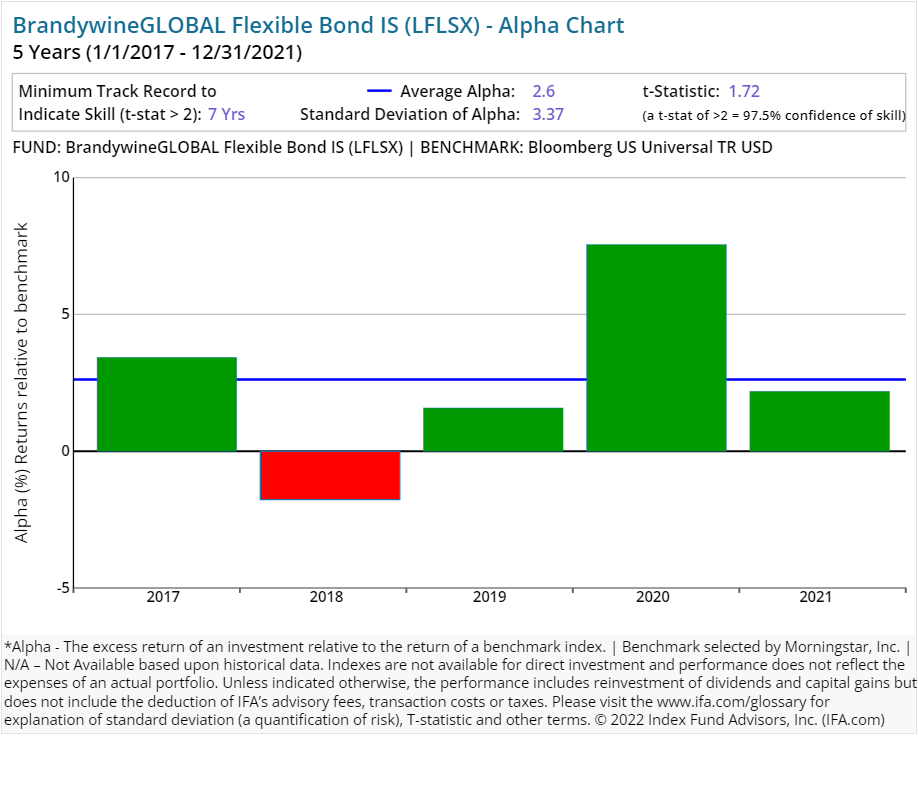

| BrandywineGLOBAL Flexible Bond IS | LFLSX | 55.00 | 0.66 | Fixed Income | |||

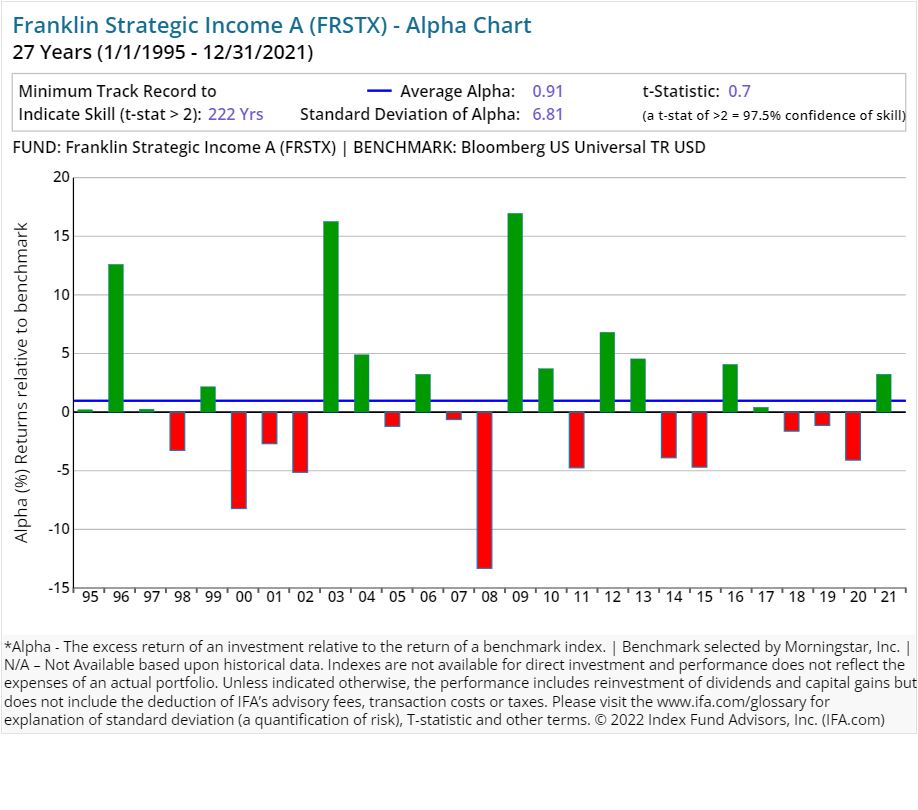

| Franklin Strategic Income A | FRSTX | 111.72 | 0.87 | 0.25 | 3.75 | Fixed Income | |

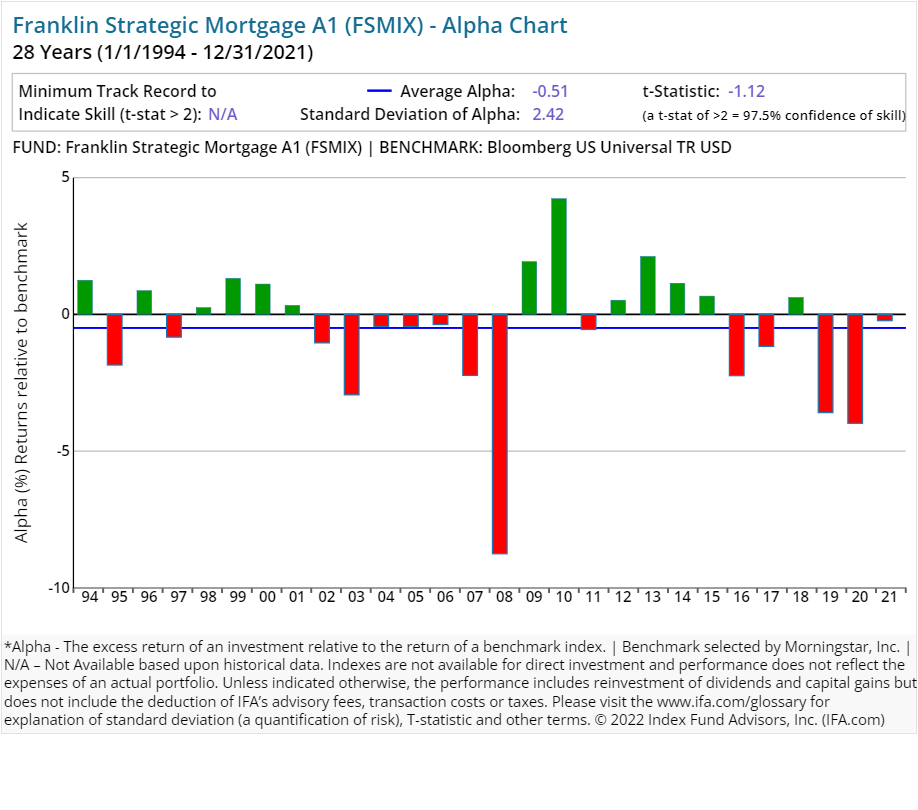

| Franklin Strategic Mortgage A1 | FSMIX | 278.91 | 0.75 | 3.75 | Fixed Income | ||

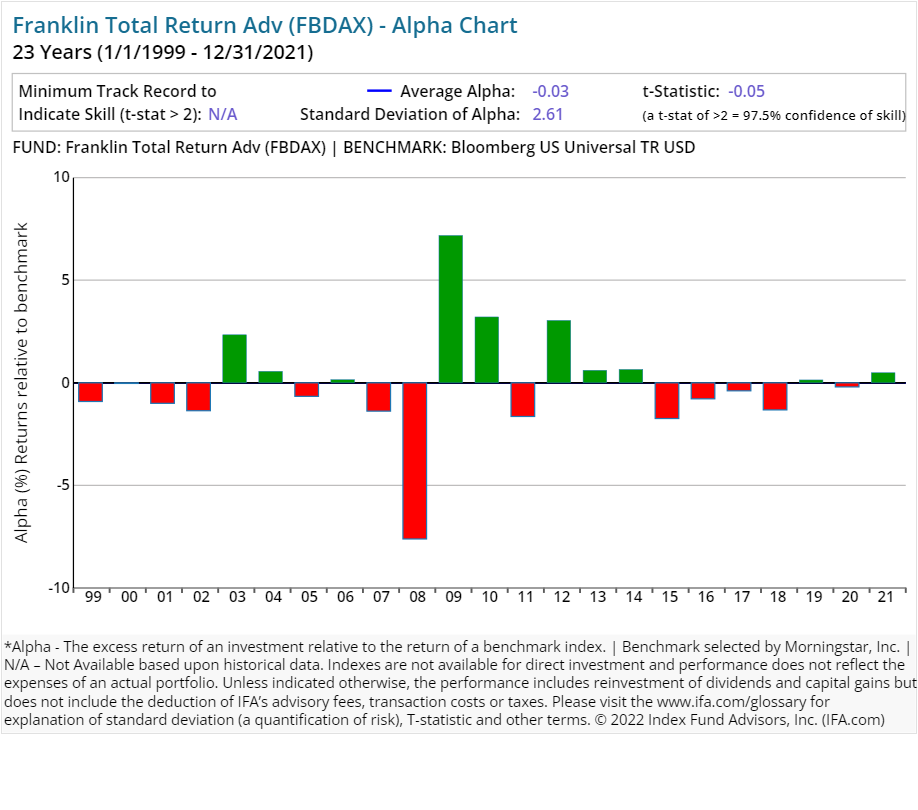

| Franklin Total Return Adv | FBDAX | 184.44 | 0.65 | Fixed Income | |||

| Western Asset Core Plus Bond I | WACPX | 79.00 | 0.45 | Fixed Income | |||

| Western Asset Income A | SDSAX | 71.00 | 0.95 | 0.25 | 4.25 | Fixed Income | |

| Western Asset Mortgage Total Ret A | SGVAX | 52.00 | 0.96 | 0.25 | 4.25 | Fixed Income | |

| Western Asset SMASh Series M | LMSMX | 381.00 | 0.00 | Fixed Income | |||

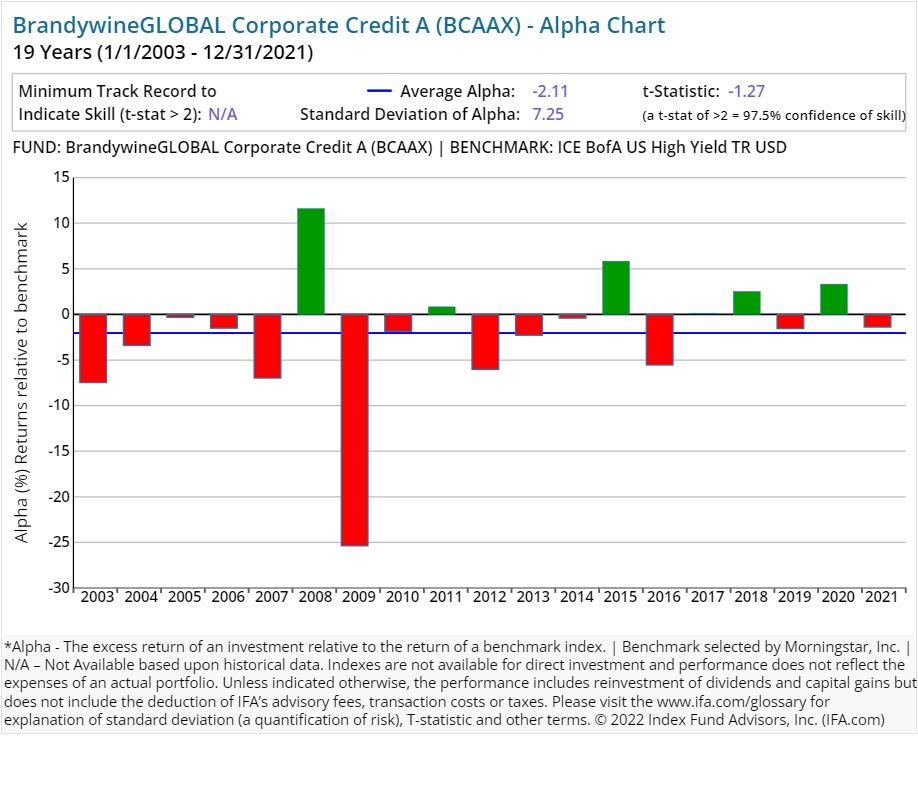

| BrandywineGLOBAL Corporate Credit A | BCAAX | 145.00 | 0.85 | 0.25 | 3.50 | Fixed Income | |

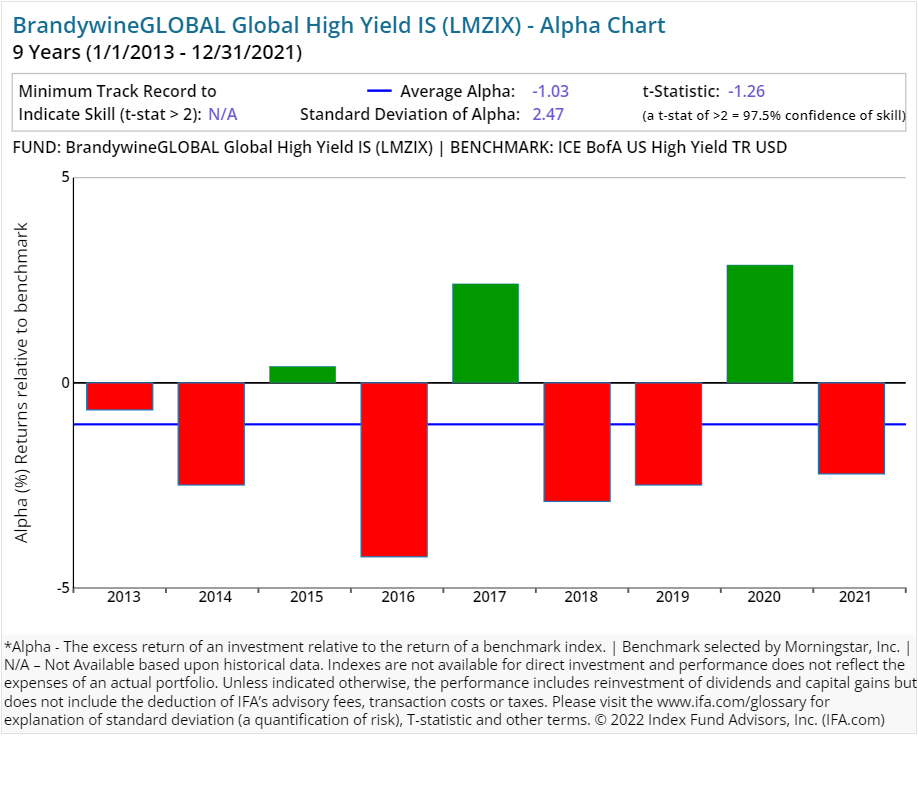

| BrandywineGLOBAL Global High Yield IS | LMZIX | 76.00 | 0.75 | Fixed Income | |||

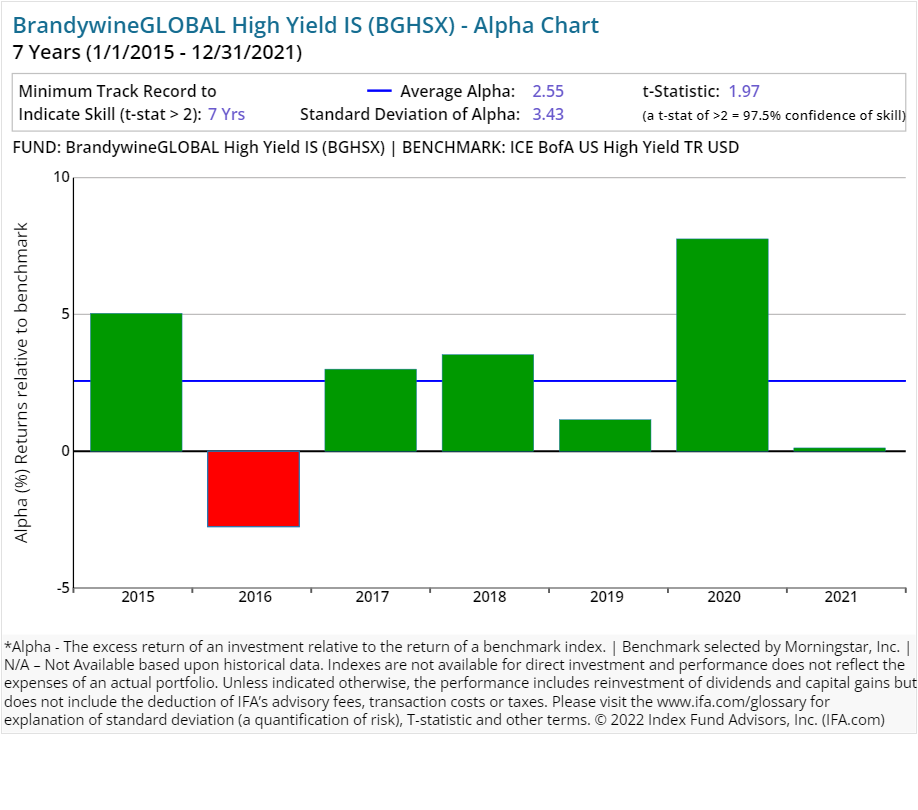

| BrandywineGLOBAL High Yield IS | BGHSX | 151.00 | 0.56 | Fixed Income | |||

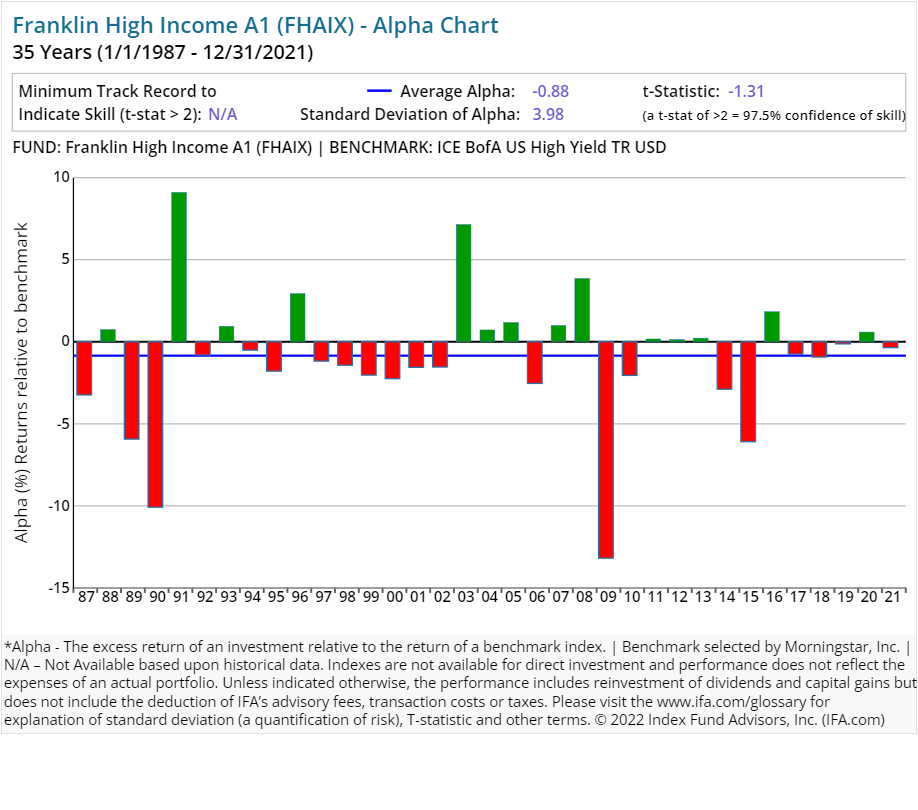

| Franklin High Income A1 | FHAIX | 55.37 | 0.76 | 0.15 | 3.75 | Fixed Income | |

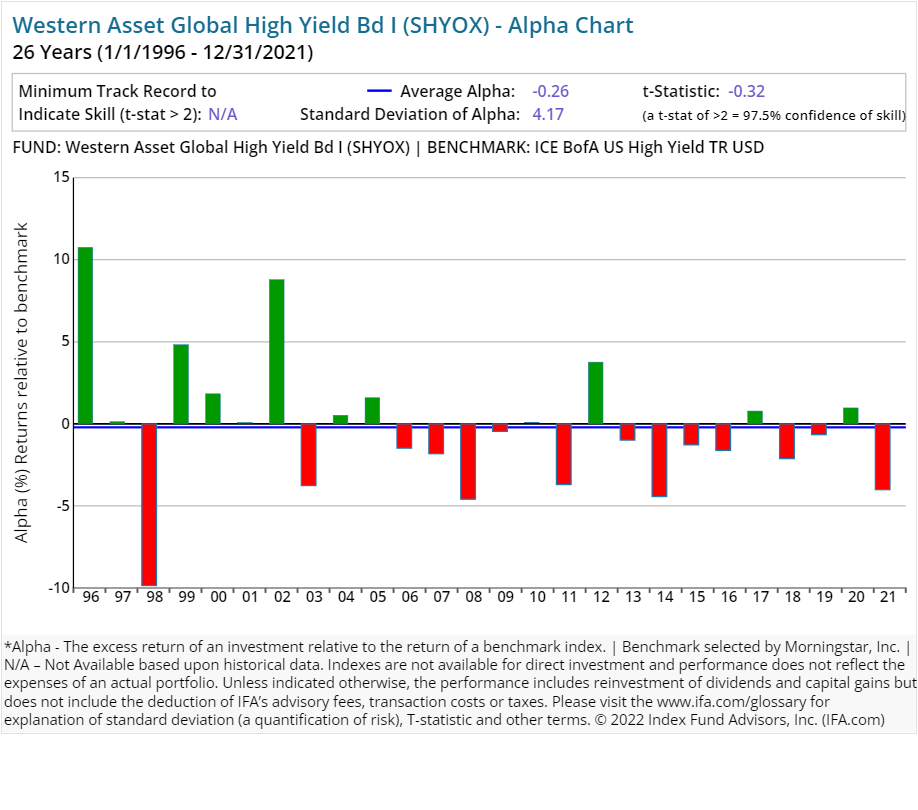

| Western Asset Global High Yield Bd I | SHYOX | 81.00 | 0.91 | Fixed Income | |||

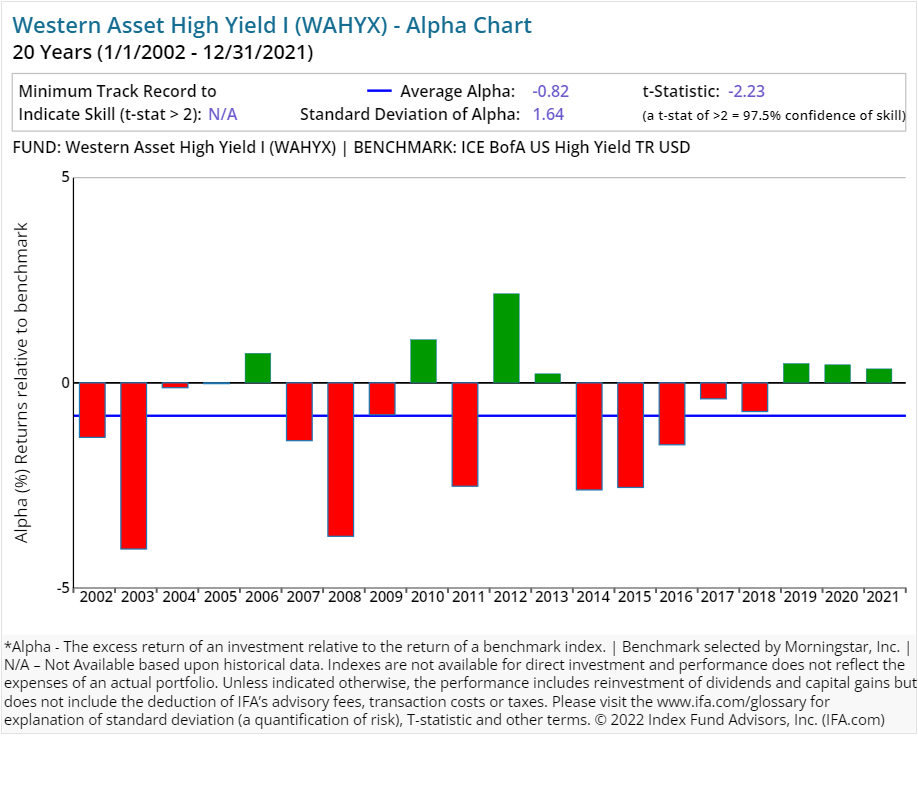

| Western Asset High Yield I | WAHYX | 101.00 | 0.81 | Fixed Income | |||

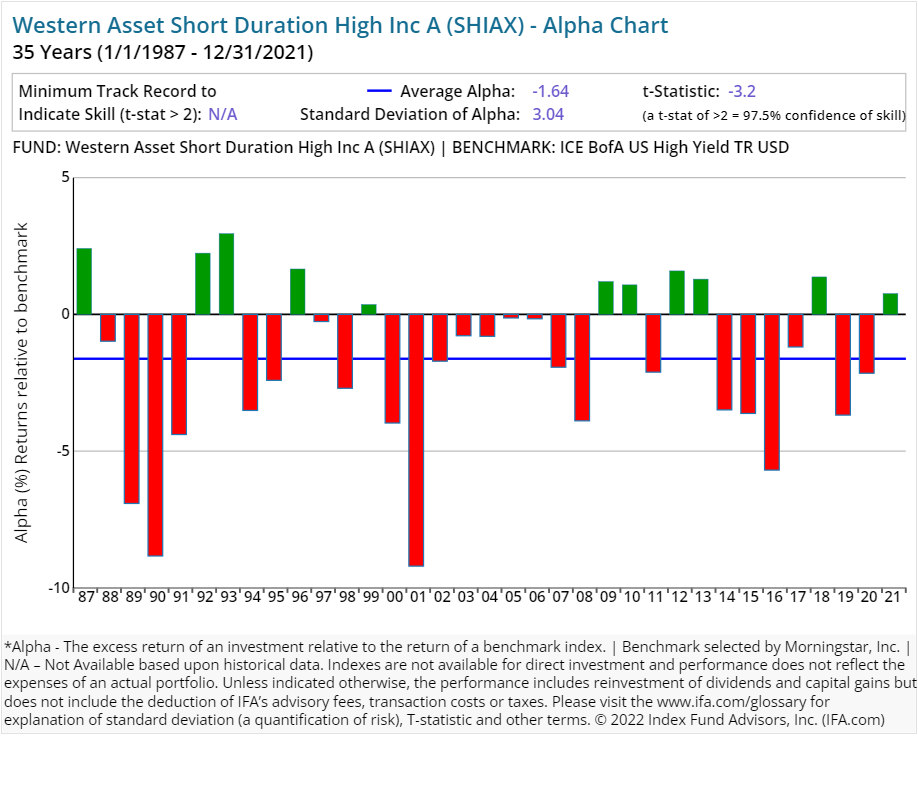

| Western Asset Short Duration High Inc A | SHIAX | 88.00 | 1.01 | 0.25 | 2.25 | Fixed Income | |

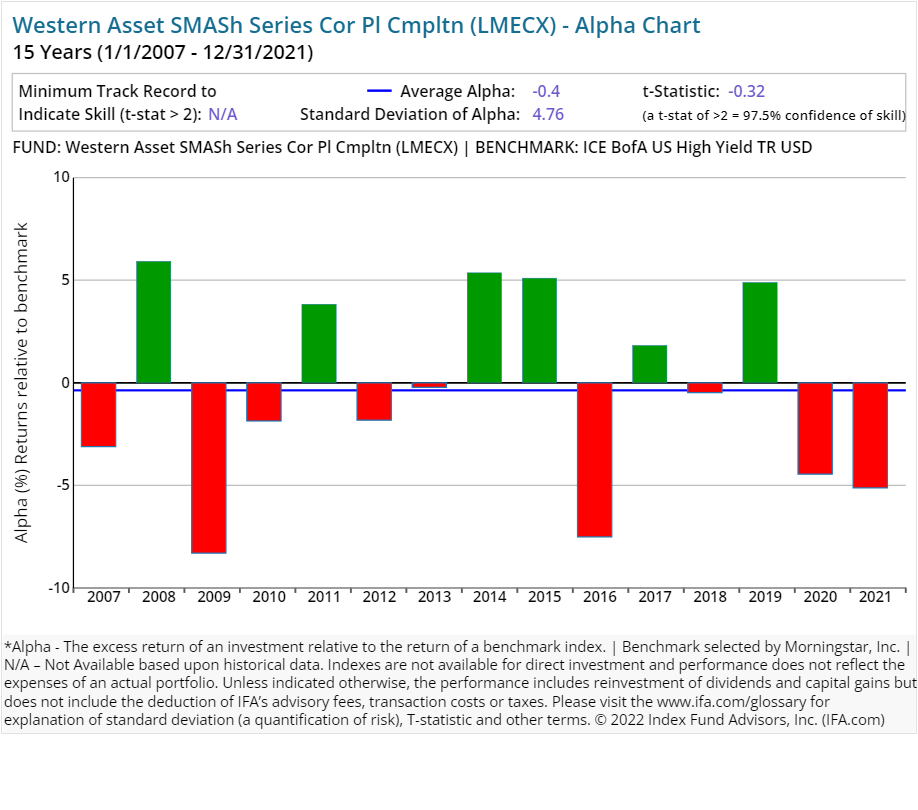

| Western Asset SMASh Series Cor Pl Cmpltn | LMECX | 69.00 | 0.00 | Fixed Income | |||

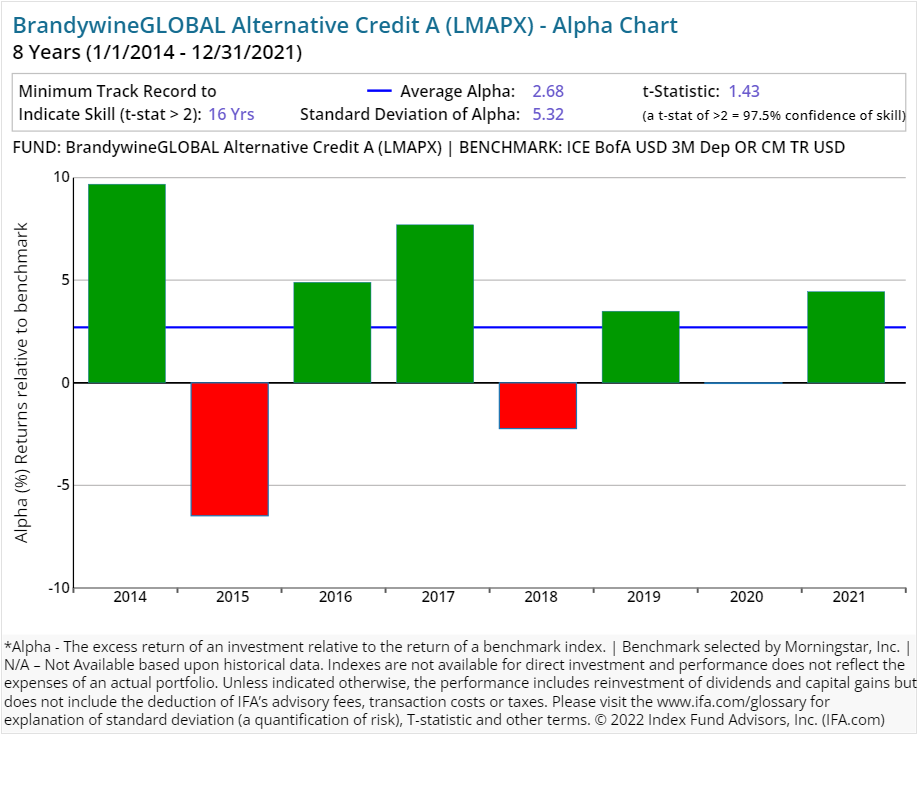

| BrandywineGLOBAL Alternative Credit A | LMAPX | 187.00 | 1.65 | 0.25 | 4.25 | Fixed Income | |

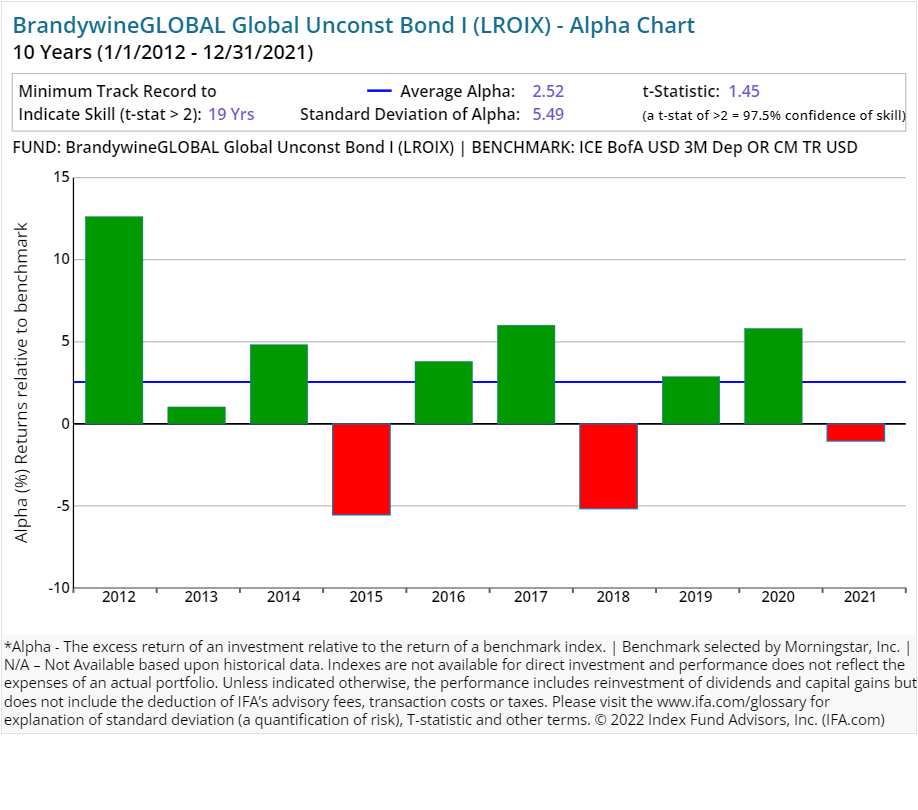

| BrandywineGLOBAL Global Unconst Bond I | LROIX | 79.00 | 0.85 | Fixed Income | |||

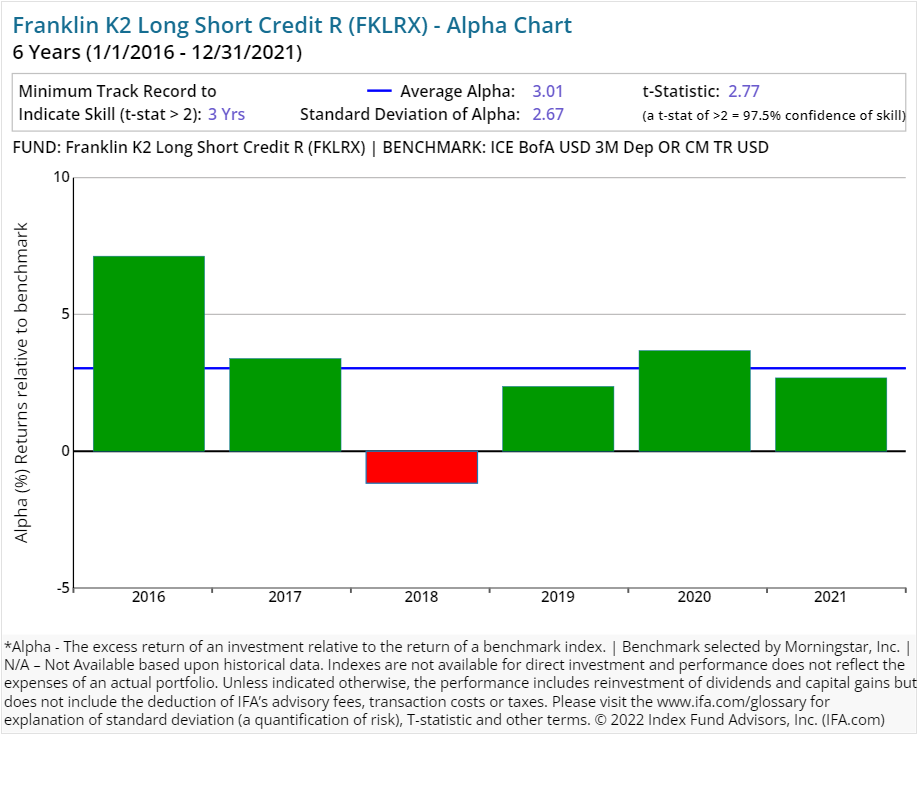

| Franklin K2 Long Short Credit R | FKLRX | 194.81 | 2.58 | 0.50 | Fixed Income | ||

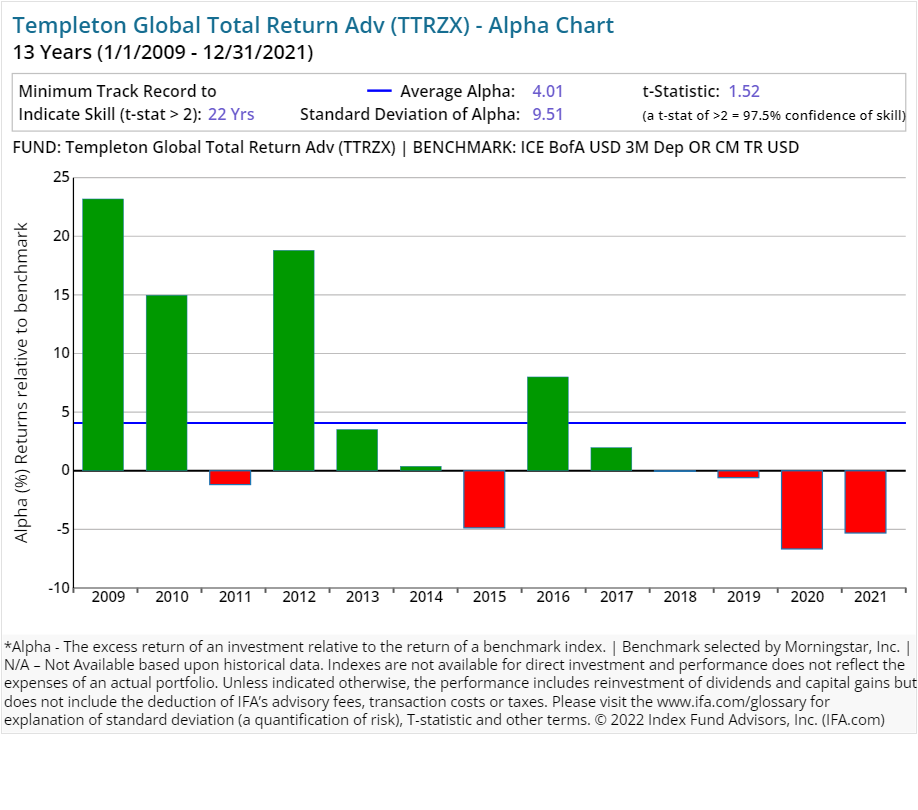

| Templeton Global Total Return Adv | TTRZX | 23.94 | 0.80 | Fixed Income | |||

| Western Asset Macro Opportunities IS | LAOSX | 70.00 | 1.21 | Fixed Income | |||

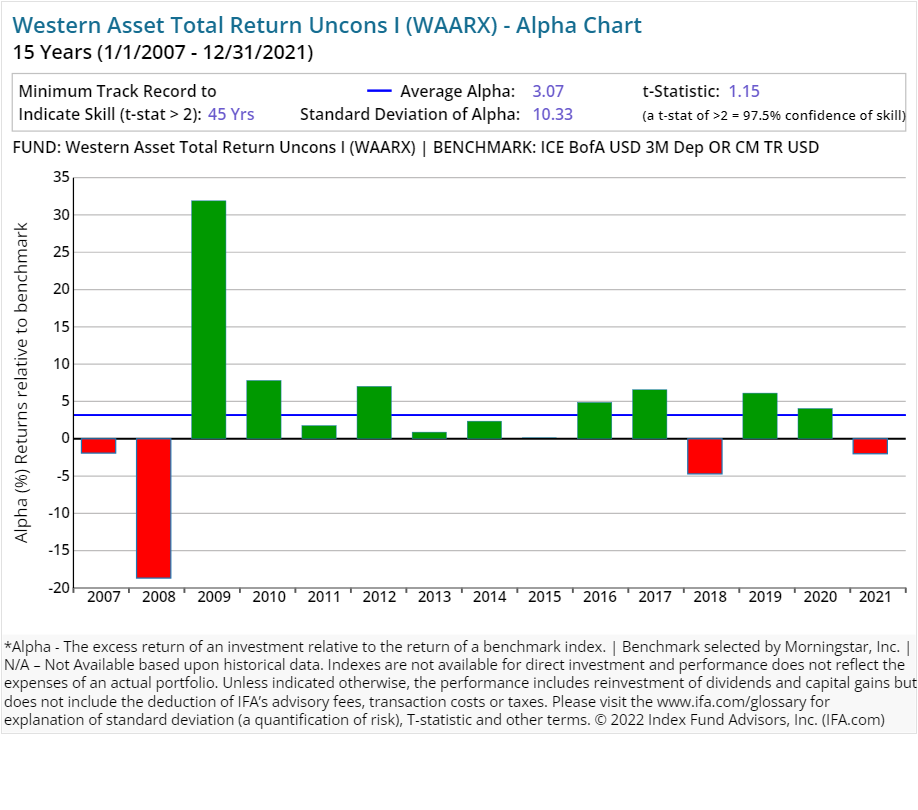

| WAARX | 67.00 | 0.73 | Fixed Income | ||||

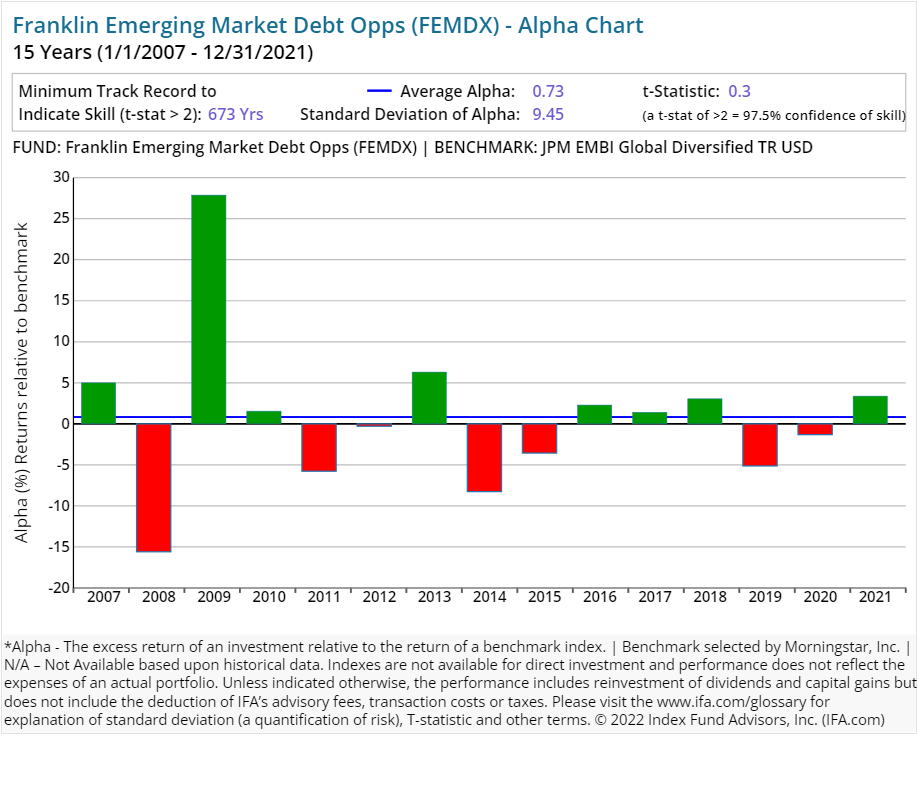

| Franklin Emerging Market Debt Opps | FEMDX | 61.28 | 1.01 | Fixed Income | |||

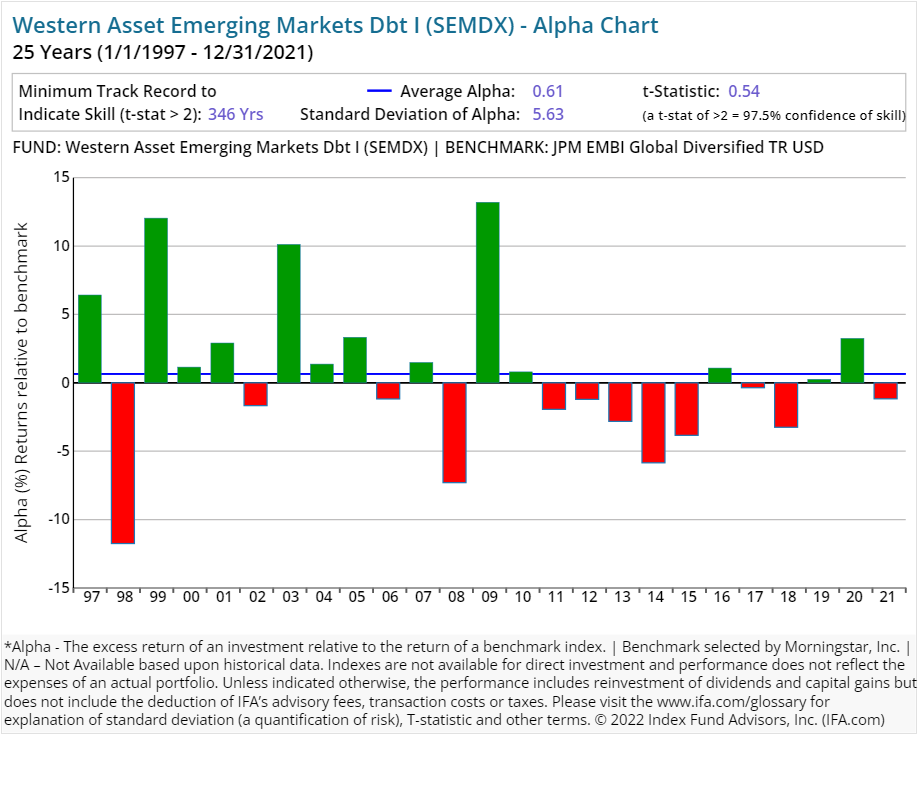

| Western Asset Emerging Markets Dbt I | SEMDX | 140.00 | 0.80 | Fixed Income | |||

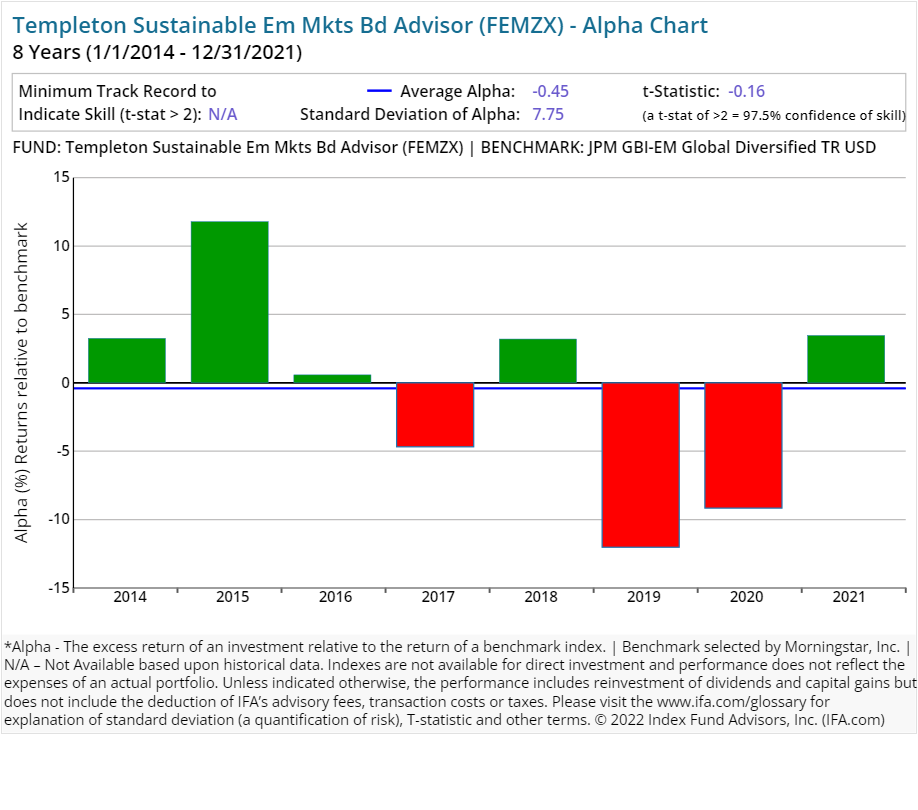

| Templeton Sustainable Em Mkts Bd Advisor | FEMZX | 40.55 | 0.94 | Fixed Income | |||

| Franklin Floating Rate Daily Access Adv | FDAAX | 66.03 | 0.71 | Fixed Income |

Consider the investment objectives, risks, charges and expenses of the mutual funds carefully before investing. Prospectuses are available at Franklin Templeton Prospectus Library

On average, an investor who utilized a surviving active equity mutual fund strategy from Franklin Templeton experienced a 1.06% expense ratio. Similarly, an investor who utilized a surviving active bond strategy from the company experienced a 0.74% expense ratio.

These expenses can have a substantial impact on an investor's overall accumulated wealth if they are not backed by superior performance. The average turnover ratios for surviving active equity and bond strategies from Franklin Templeton were 34.30% and 57.07%, respectively. This implies an average holding period of 21.03 to 34.99 months.

In contrast, most index funds have very long holding periods — decades, in fact. Such relatively longer holding periods, in effect, serve to help index fund investors lower exposure to the market's random noise that accompanies short-term portfolio movements. Again, turnover is a cost that isn't itemized to the investor but is definitely embedded in a fund's overall performance.

Performance Analysis

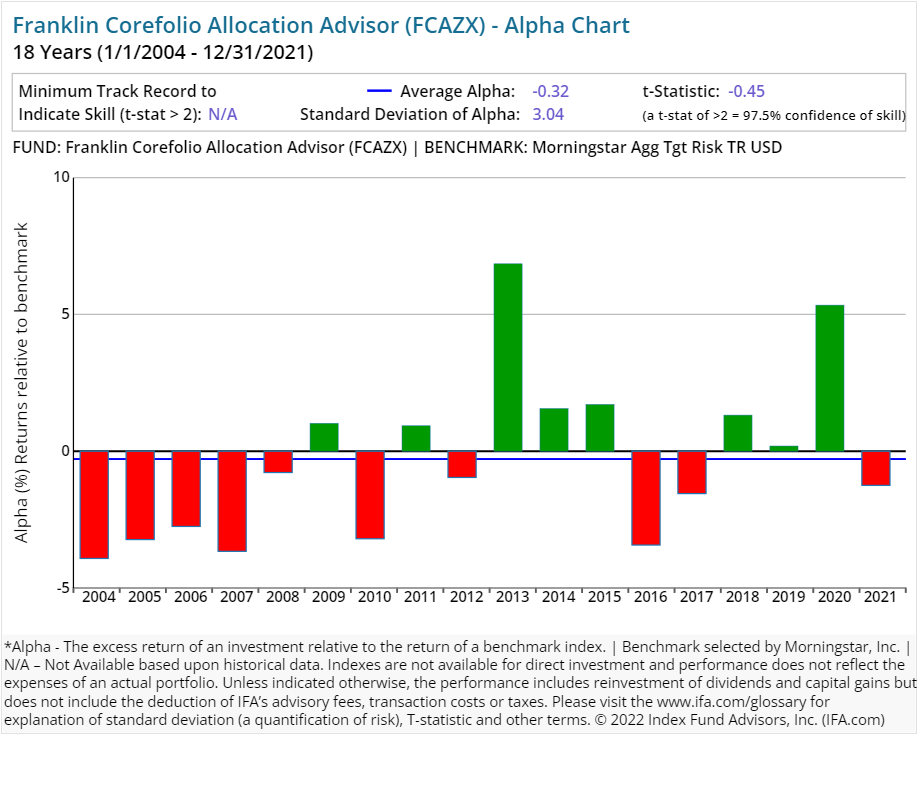

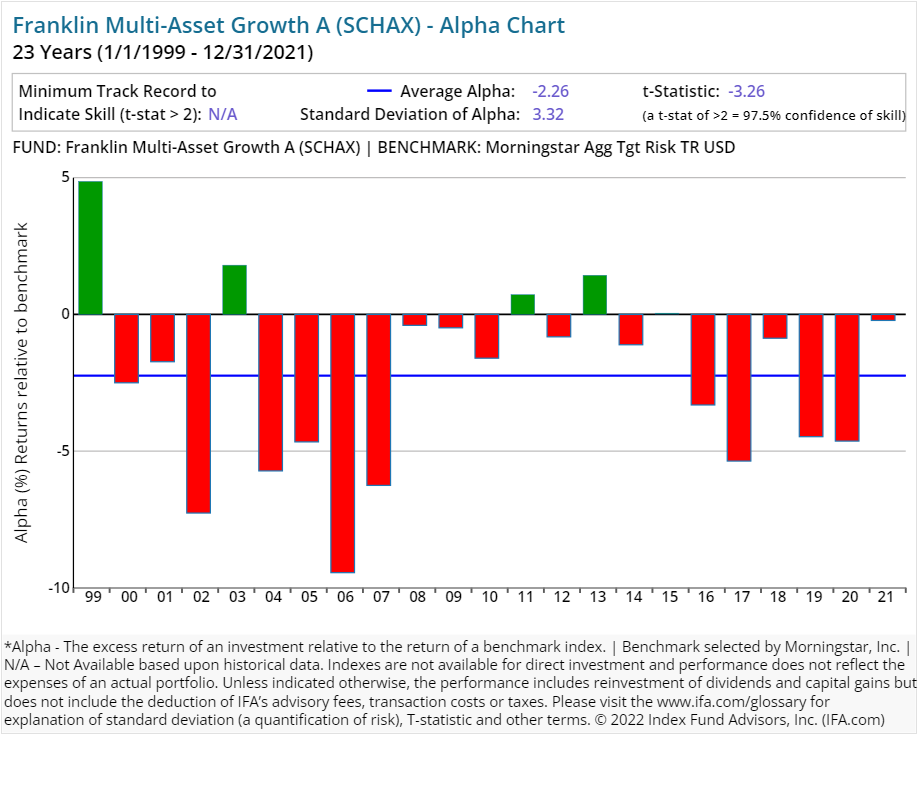

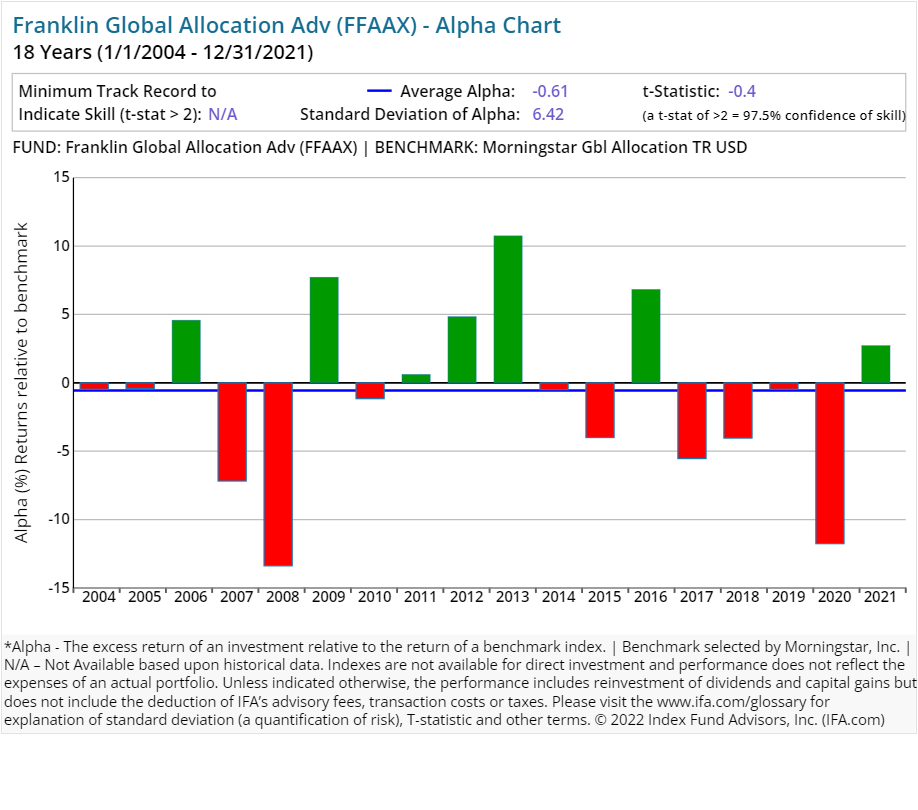

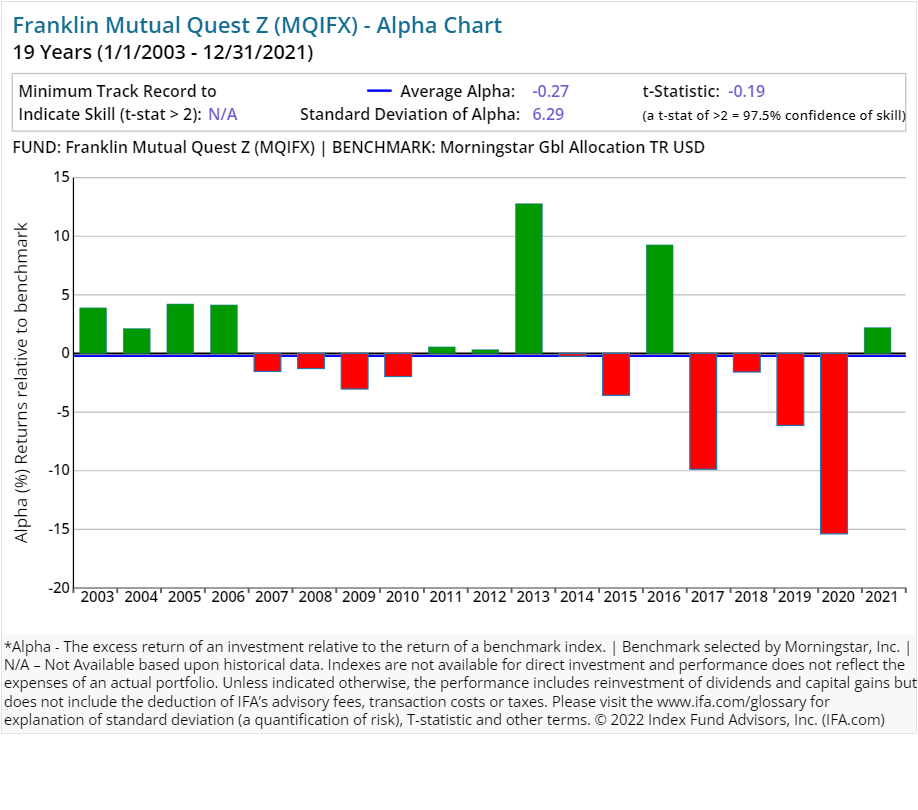

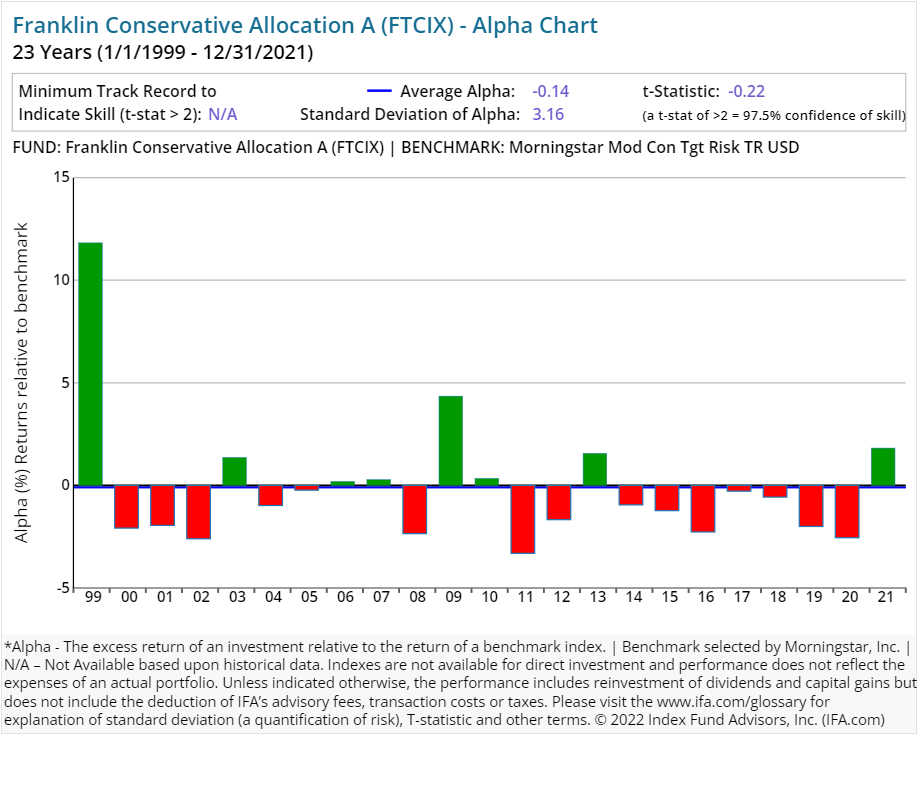

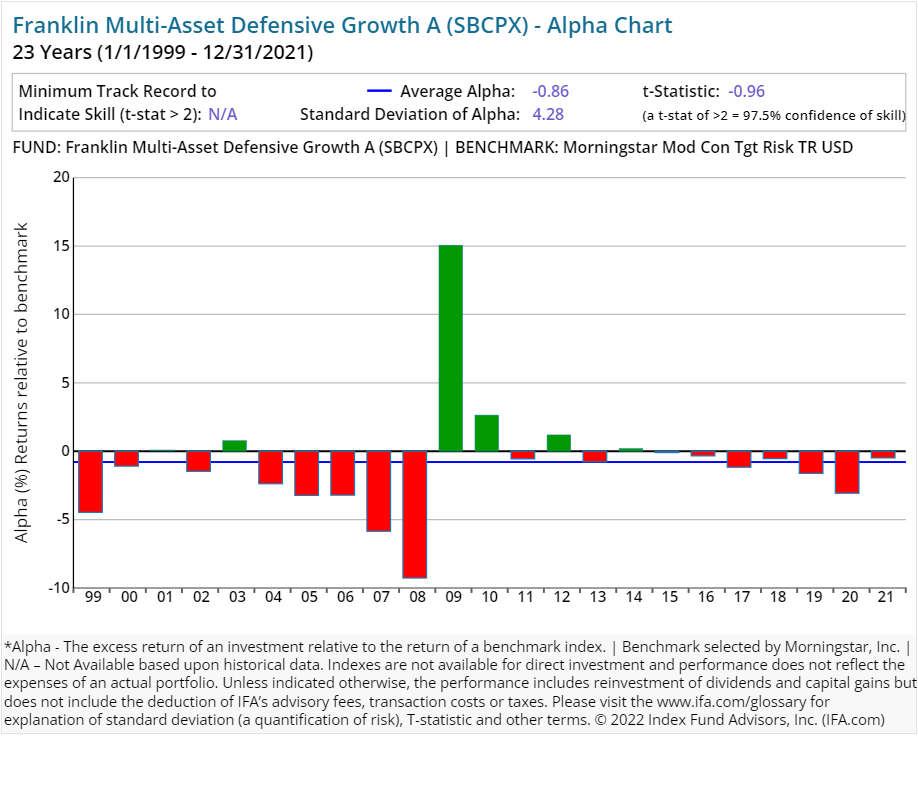

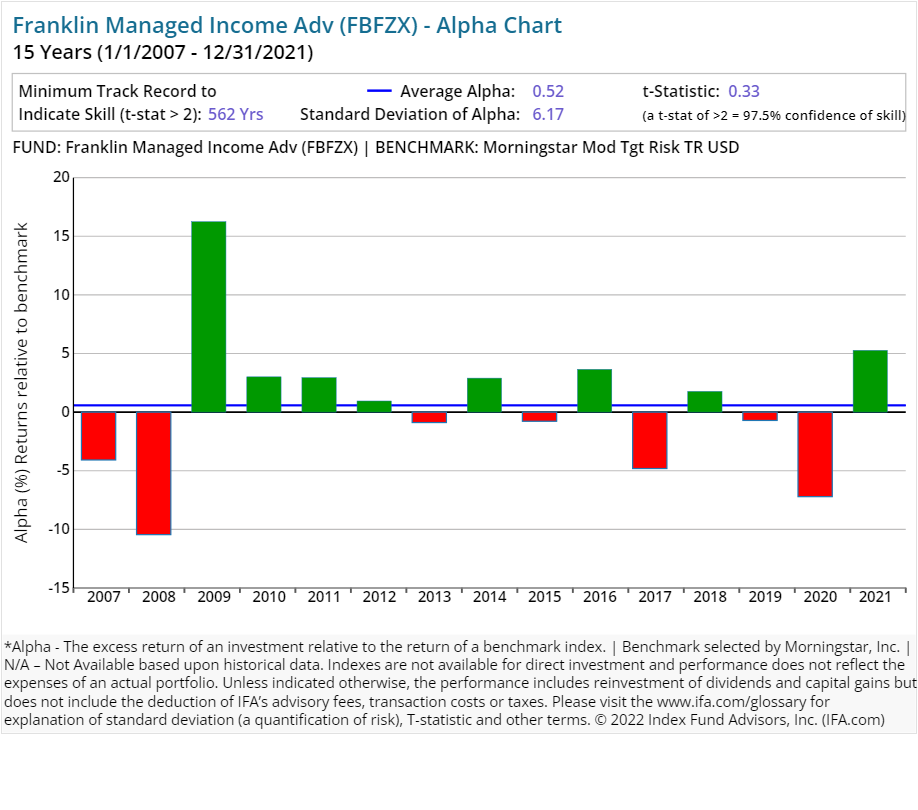

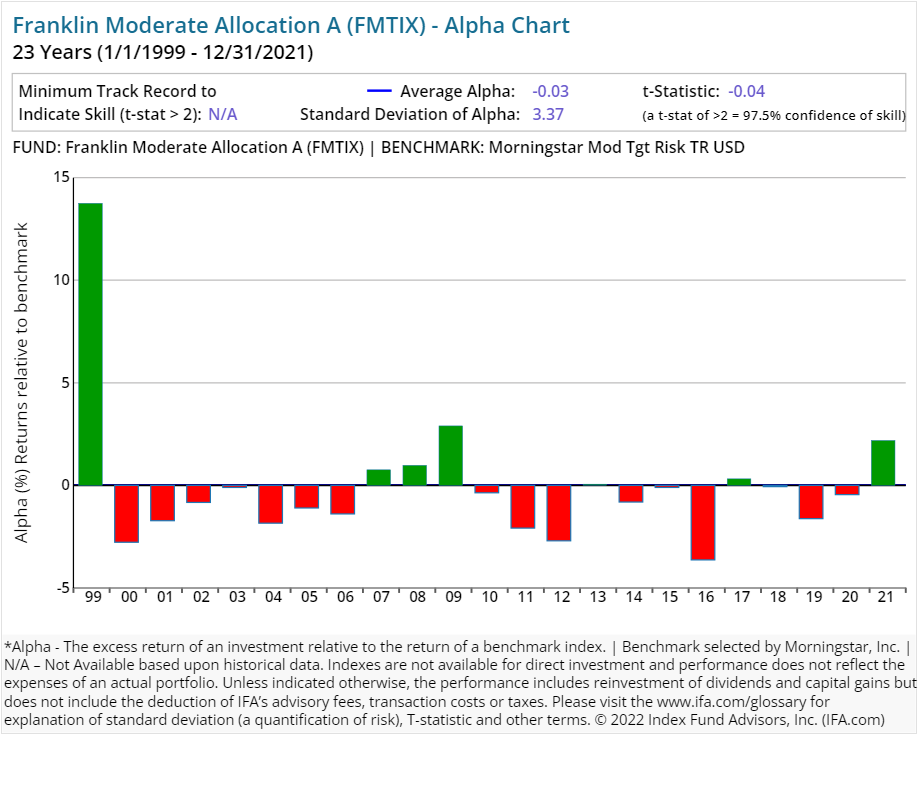

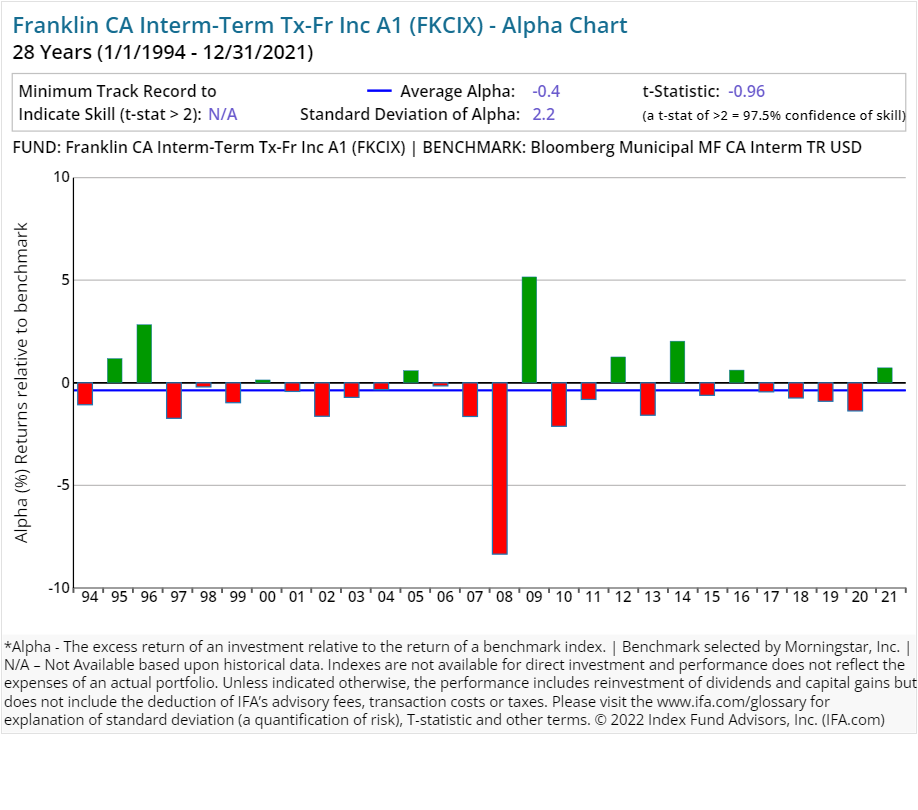

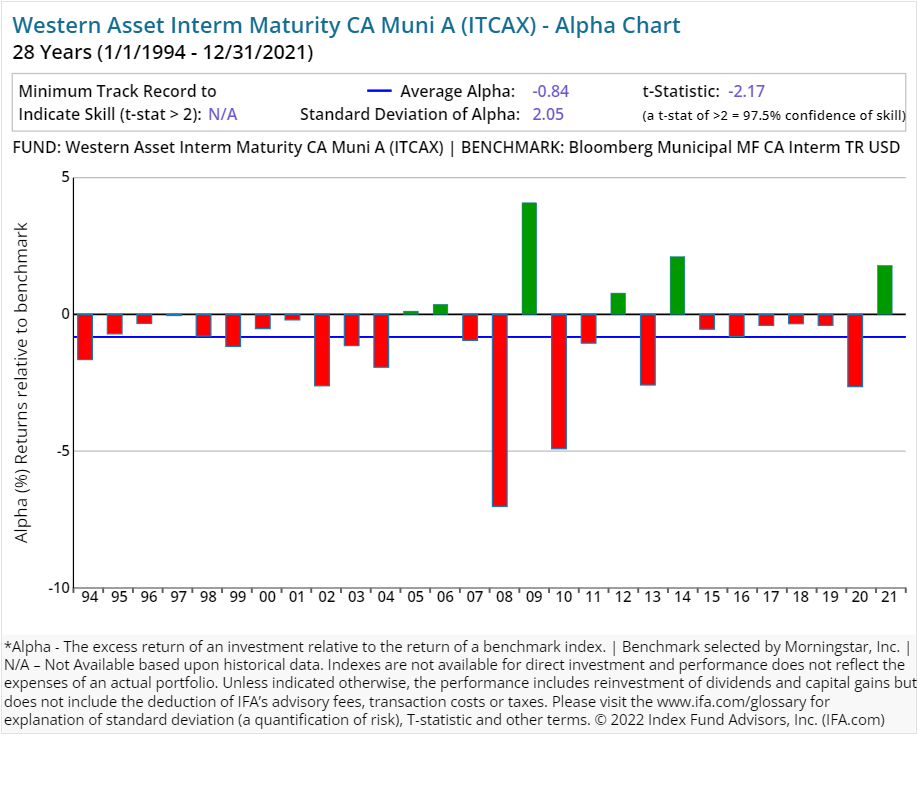

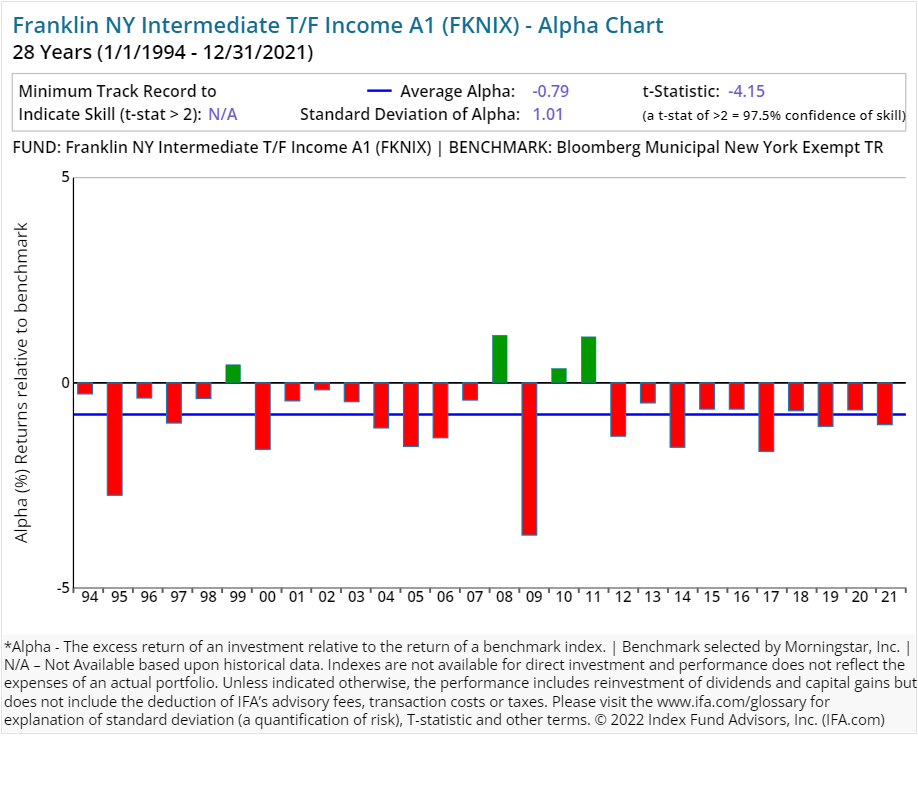

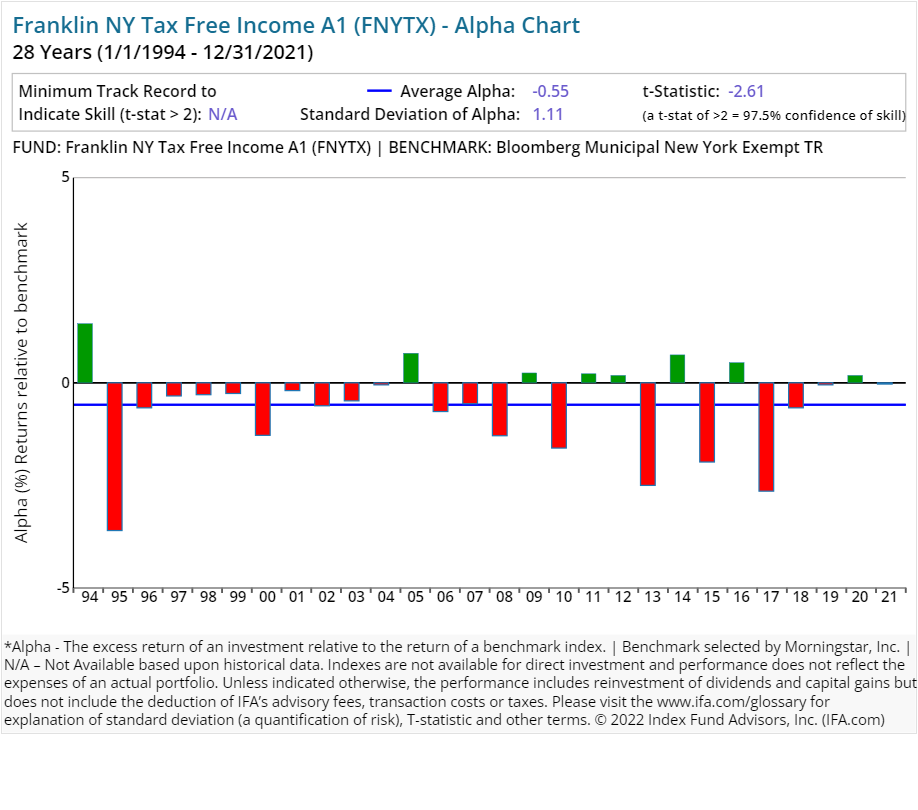

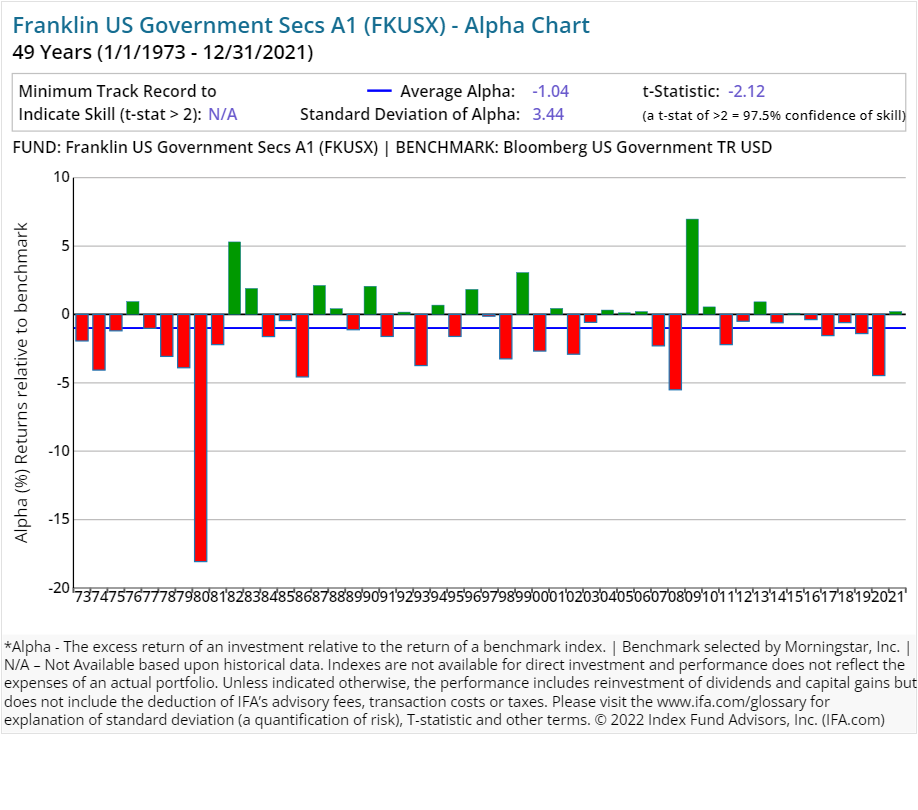

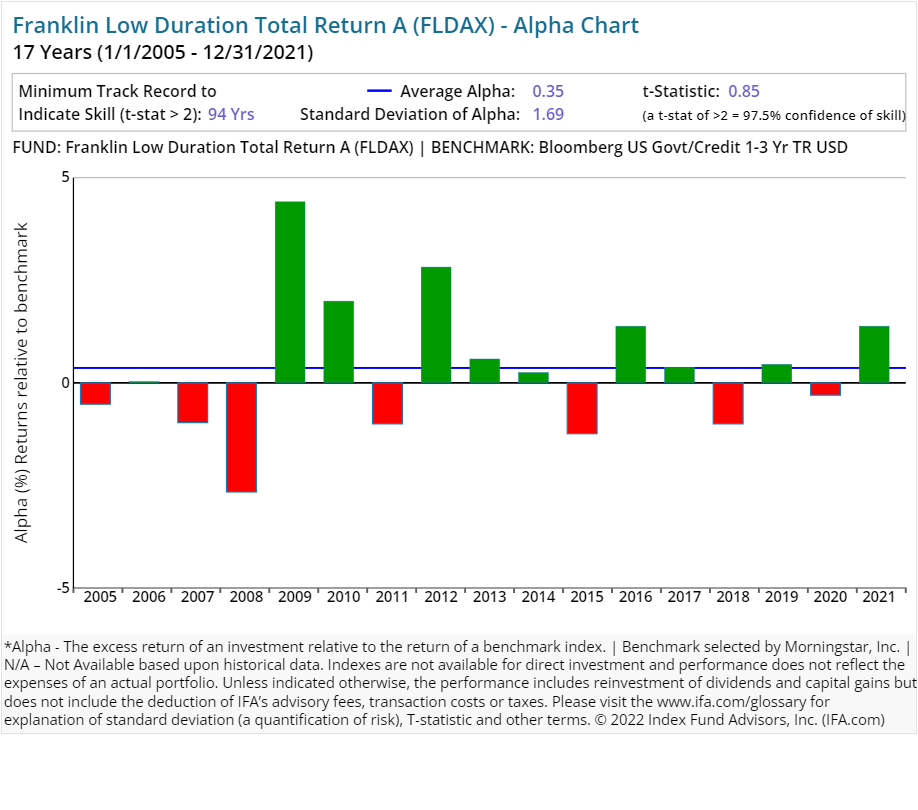

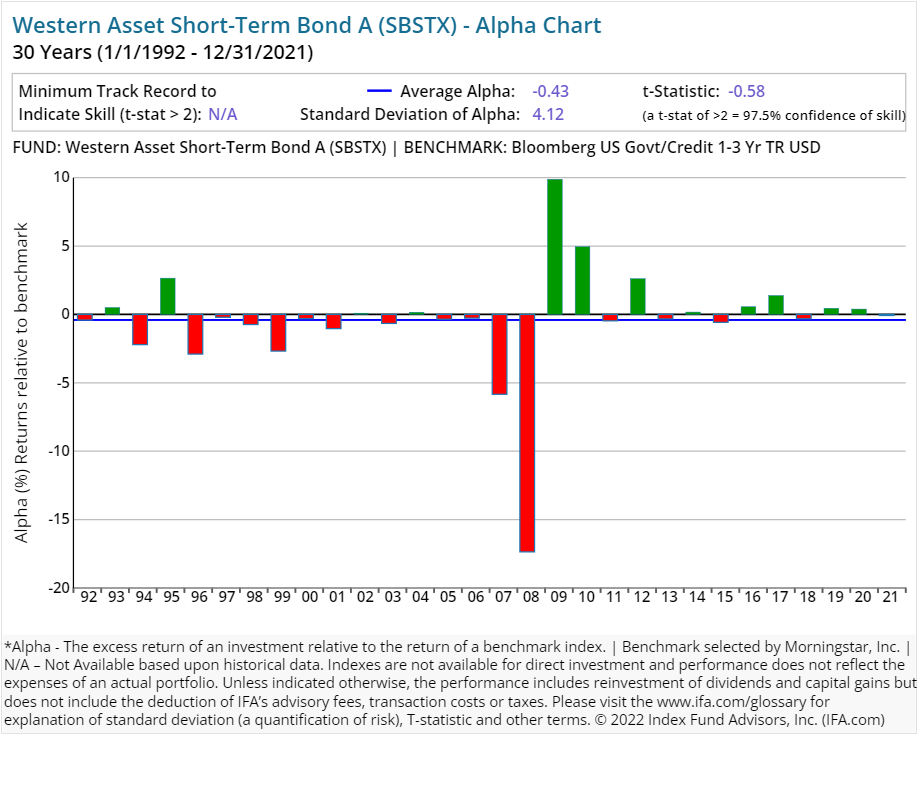

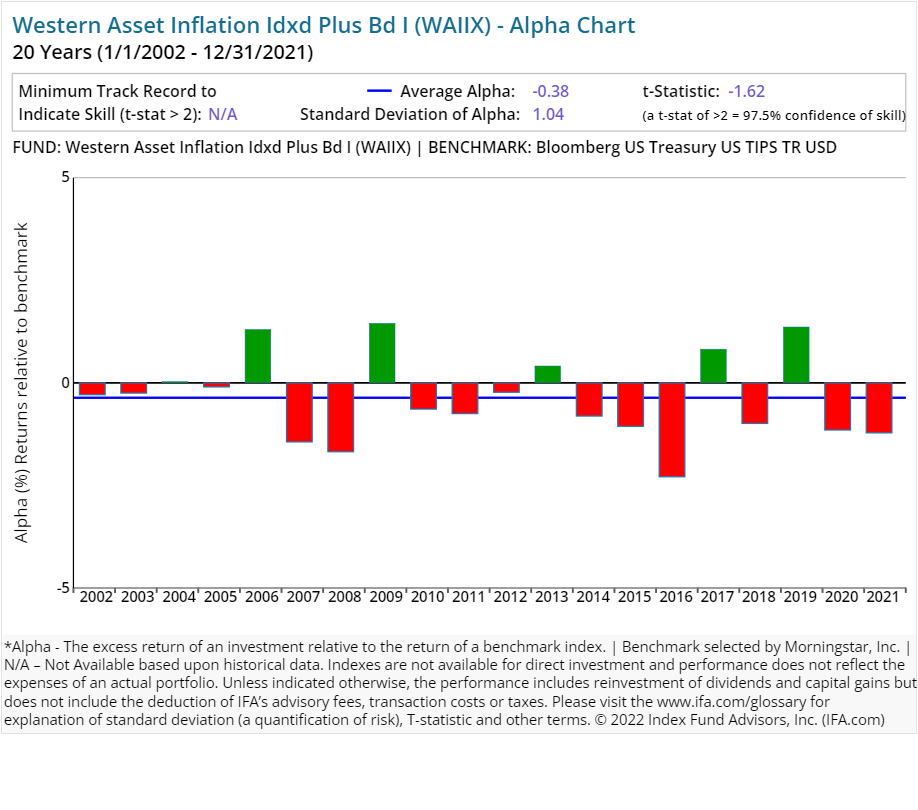

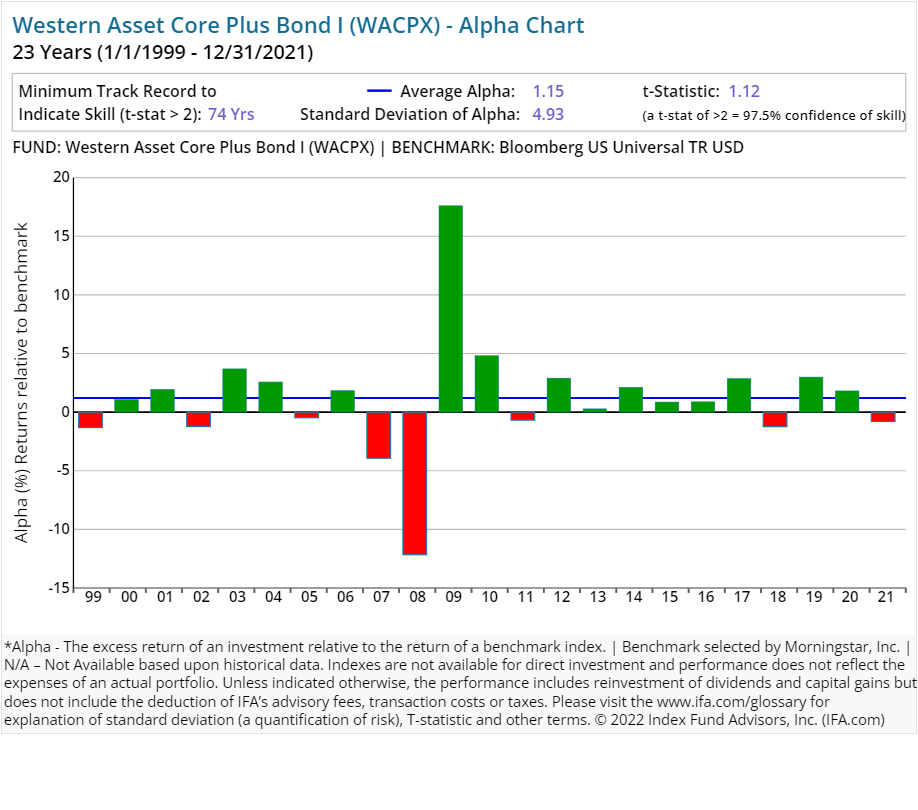

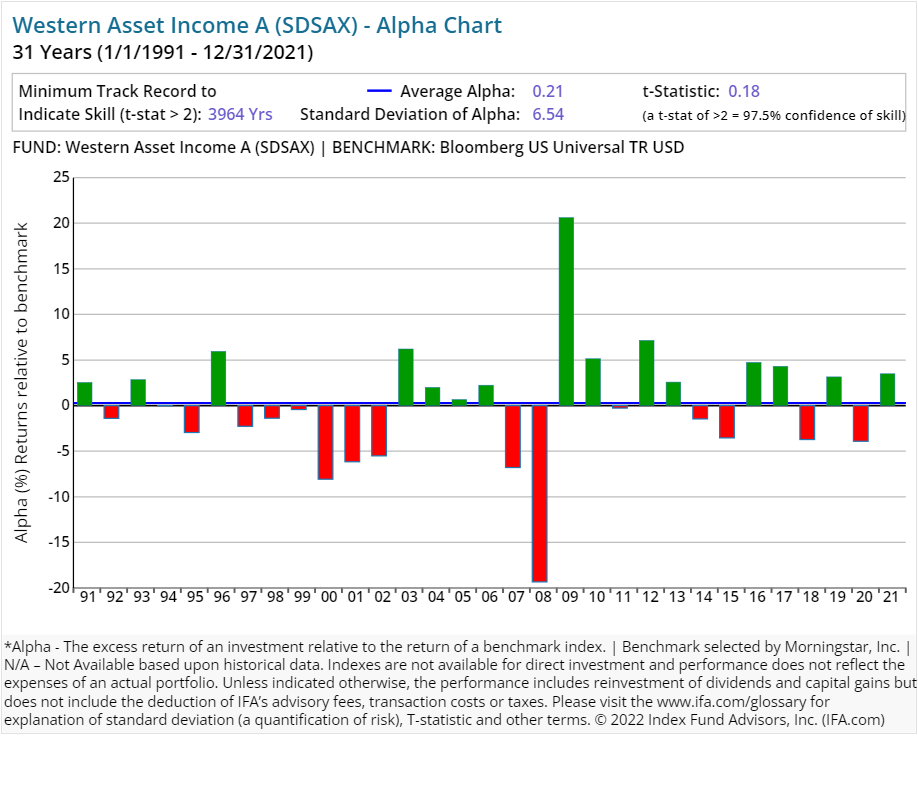

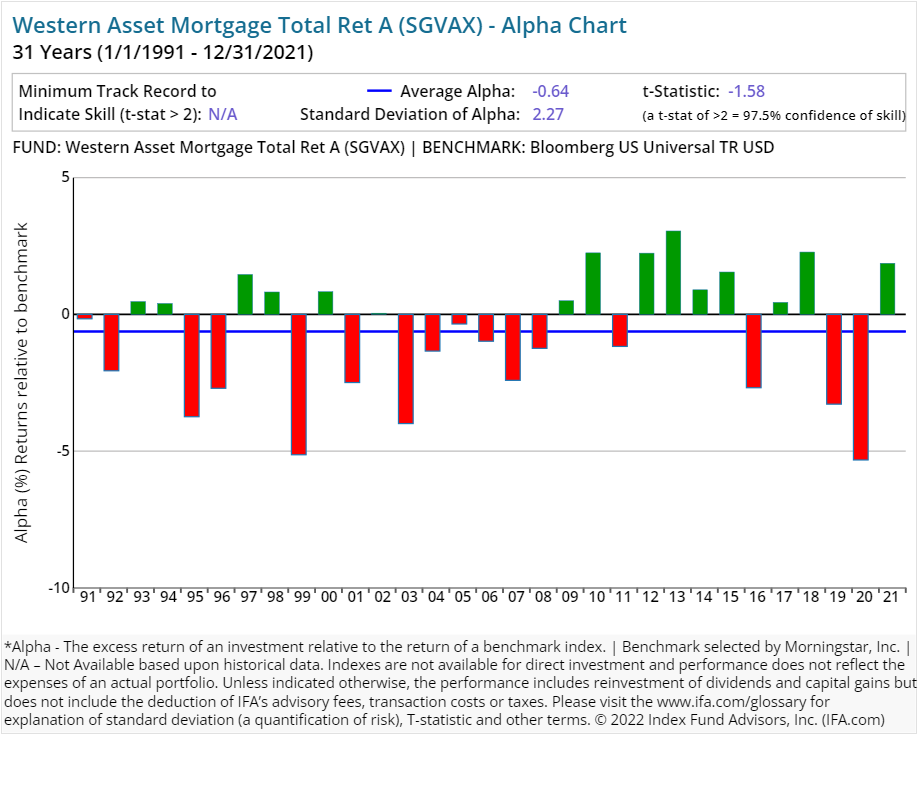

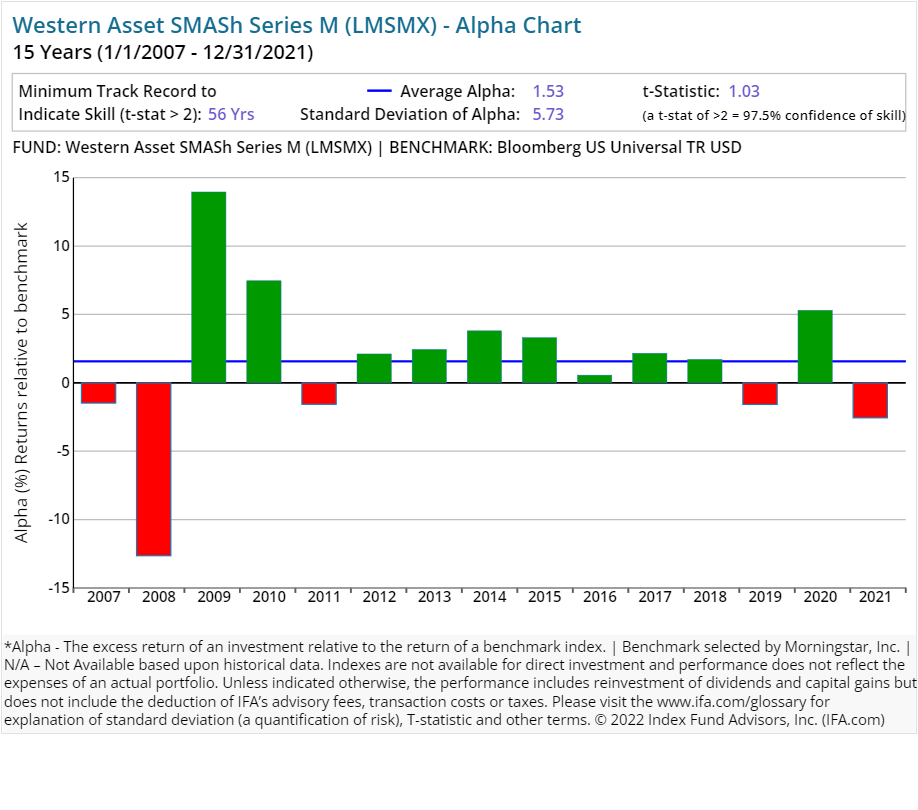

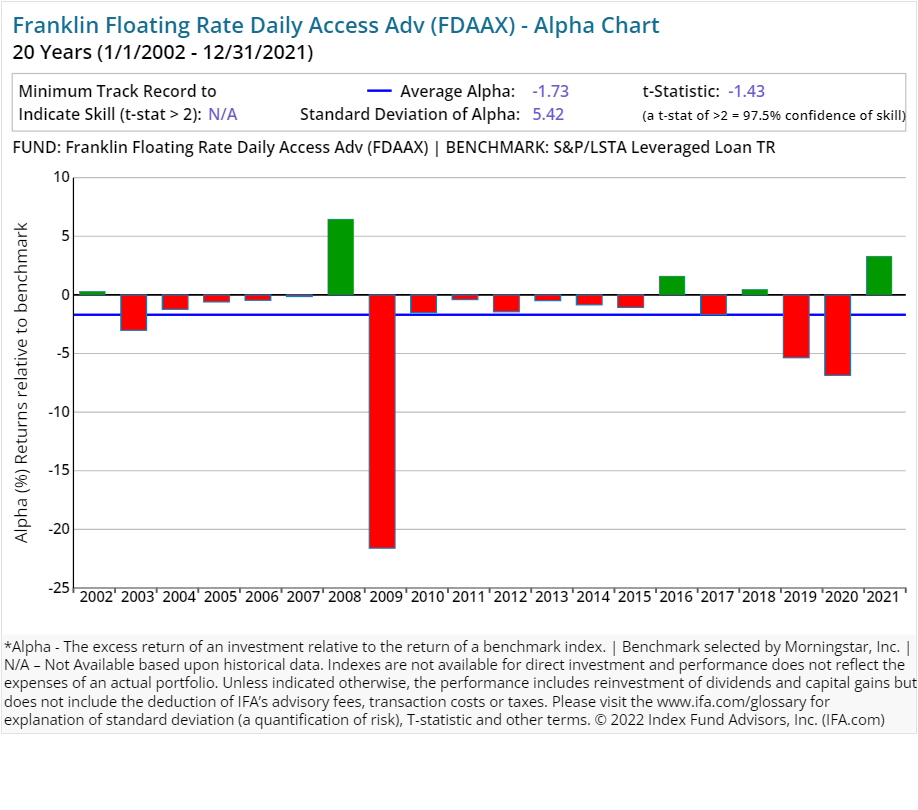

The next question we address is whether investors can expect superior performance in exchange for the higher costs associated with Franklin Templeton's implementation of active management. We compare each of its 246 strategies, which includes both current funds and funds no longer in existence, against its Morningstar assigned benchmark to see just how well each has delivered on their perceived value proposition.

We have included alpha charts for each of their current strategies at the bottom of this article. Here is what we found:

-

75.20% (185 of 246 funds) have underperformed their respective benchmarks or did not survive the period since inception.

-

24.80% (61 of 246 funds) have outperformed their respective benchmarks since inception, having delivered a POSITIVE alpha.

Here's the real kicker, however:

- 1.22% (3 of 246 funds) have outperformed their respective benchmarks consistently enough since inception to provide 97.5% confidence that such outperformance will persist as opposed to being based on random outcomes.

As a result, this study shows that a majority of funds offered by Franklin Templeton have not outperformed their Morningstar-assigned benchmark. The inclusion of the statistical significance of alpha is key to this exercise, as it indicates which outcomes are due to a skill that is likely to repeat and those that are more likely due to a random-chance outcome.

Regression Analysis

How we define or choose a benchmark is extremely important. If we relied solely on commercial indexes assigned by Morningstar, then we may form a false conclusion that Franklin Templeton has the "secret sauce" as active managers.

Since Morningstar is limited in terms of trying to fit the best commercial benchmark with each fund in existence, there is of course going to be some error in terms of matching up proper characteristics such as average market capitalization or average price-to-earnings ratio.

A better way of controlling these possible discrepancies is to run multiple regressions where we account for the known dimensions (betas) of expected return in the U.S. (i.e., market, size, relative price, etc.).

For example, if we were to look at all of the U.S.-based strategies from Franklin Templeton that've been around for the past 10 years, we could run multiple regressions to see what each fund's alpha looks like once we control for the multiple betas that are being systematically priced into the overall market.

The chart below displays the average alpha and standard deviation of that alpha for the past 10 years through 2021. Screening criteria includes funds with holdings of 90% or greater in U.S. equities and uses the oldest available share classes.

As shown above, although three mutual funds had a positive excess return over the stated benchmarks, none of the equity funds reviewed produced a statistically significant level of alpha, based on a t-stat of 2.0 or greater. (For a review of how to calculate a fund's t-stat, see the section of this study that follows the individual Franklin Templeton alpha charts.)

Why is this important? Given the lower costs associated with index funds, we'd have greater confidence of experiencing a more desirable result using a passively managed portfolio of funds compared to one constructed around more expensive actively managed funds.

Conclusion

Like many of the other largest financial institutions, a deep analysis into the performance of Franklin Templeton has yielded a not so surprising result: Active management is likely to fail many investors. We believe this is due to market efficiency, costs and increased competition in the financial services sector.

As we always like to remind investors, a more reliable investment strategy for capturing the returns of global markets is to buy, hold and rebalance a globally diversified portfolio of index funds.

Below are the individual alpha charts for the existing Franklin Templeton actively managed mutual funds that have five years or more of a track record.

Here is a calculator to determine the t-stat. Don't trust an alpha or average return without one.

The Figure below shows the formula to calculate the number of years needed for a t-stat of 2. We first determine the excess return over a benchmark (the alpha) then determine the regularity of the excess returns by calculating the standard deviation of those returns. Based on these two numbers, we can then calculate how many years we need (sample size) to support the manager's claim of skill.

Footnotes:

1.) McKinsey & Company, "How an acquisition invigorated an asset management leader," Dec. 16, 2021.

2.) Morningstar, Franklin Templeton quarterly review, May 3, 2022.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such performance. IFA Index Portfolios are recommended based on time horizon and risk tolerance. Take the IFA Risk Capacity Survey (www.ifa.com/survey) to determine which portfolio captures the right mix of stock and bond funds best suited to you. For more information about Index Fund Advisor, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.