In addition to the wonders of the holiday season, December brings with it year-end mutual fund dividend and capital gains distributions. At IFA, our portfolio management and research team follows an established strategy to tailor how client portfolios are handled during this time of year.

IFA follows strategies intended to reduce exposure to taxable events, although outcomes may vary depending on individual account circumstances. So, we thought it might be worthwhile to provide a deeper dive into IFA's basic operating procedure in terms of handling these distributions and how that can change individual client account values over this period.

Below is a table listing some of the mutual funds and exchange-traded funds (ETFs) used in many IFA client portfolos from Dimensional Fund Advisors (DFA). Dimensional Fund Advisors (DFA) is frequently used in IFA client portfolios based on their alignment with our evidence-based investment philosophy. This table includes the record date, ex-dividend date and payable date for each of these funds. Also, the remainder of this article explains the mechanics of these distributions — including the effects such activities have on the daily price of these funds.

| Funds | Ticker | Record Date | Ex-Div Date | Payable Date | Fund Type |

| US Equity Strategies | |||||

| US Equity ETF | AVUS | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| US Core Equity 2 I | DFQTX | 12/9/2024 | 12/10/2024 | 12/11/2024 | Mutual Fund |

| US Hi Relatv Profitability Instl | DURPX | 12/12/2024 | 12/13/2024 | 12/16/2024 | Mutual Fund |

| US Social Core Equity 2 Portfolio | DFUEX | 12/9/2024 | 12/10/2024 | 12/11/2024 | Mutual Fund |

| US Sustainability Core 1 | DFSIX | 12/12/2024 | 12/13/2024 | 12/16/2024 | Mutual Fund |

| US Equity Market ETF | DFUS | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| US High Profitability ETF | DUHP | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| S&P 500 Index | SWPPX | 12/12/2024 | 12/13/2024 | 12/13/2024 | Mutual Fund |

| S&P 500 ETF | VOO | 12/23/2024 | 12/23/2024 | 12/26/2024 | ETF |

| QQQ Trust | QQQ | 12/23/2024 | 12/23/2024 | 12/31/2024 | ETF |

| US Large Cap Value ETF | AVLV | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| US Large Cap Value ETF | DFLV | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| Portfolio S&P 500 Value ETF | SPYV | 12/23/2024 | 12/23/2024 | 12/26/2024 | ETF |

| U.S. Mid Cap Equity ETF | AVMC | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| Mid-Cap Value ETF | VOE | 12/23/2024 | 12/23/2024 | 12/26/2024 | ETF |

| US Small Cap Equity ETF | AVSC | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| US Small Cap Value ETF | AVUV | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| US Small Cap Value I | DFSVX | 12/12/2024 | 12/13/2024 | 12/16/2024 | Mutual Fund |

| US Small Cap ETF | DFAS | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| US Small Cap Value ETF | DFSV | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| Small Cap Index I | VSCIX | 12/20/2024 | 12/23/2024 | 12/24/2024 | Mutual Fund |

| Small-Cap ETF | VB | 12/23/2024 | 12/23/2024 | 12/26/2024 | ETF |

| Small-Cap Value ETF | VBR | 12/23/2024 | 12/23/2024 | 12/26/2024 | ETF |

| Non-US Equity Strategies* | |||||

| Emerging Markets Equity ETF | AVEM | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| Emerging Markets Sm Cp Eq ETF | AVEE | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| Emerging Markets Value ETF | AVES | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| Emerging Markets Small Cap I | DEMSX | 12/12/2024 | 12/13/2024 | 12/16/2024 | Mutual Fund |

| Emerging Markets Social Core Port | DFESX | 12/9/2024 | 12/10/2024 | 12/11/2024 | Mutual Fund |

| Emerging Core Equity Mkt ETF | DFAE | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| Emerging Markets Value ETF | DFEV | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| S&P Emerging Markets Small Cap ETF | EWX | 12/23/2024 | 12/23/2024 | 12/30/2024 | ETF |

| International Core Equity 2 I | DFIEX | 12/9/2024 | 12/10/2024 | 12/11/2024 | Mutual Fund |

| International Social Cor Eq Instl | DSCLX | 12/9/2024 | 12/10/2024 | 12/11/2024 | Mutual Fund |

| International Value ETF | DFIV | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| Core MSCI EAFE ETF | IEFA | 12/17/2024 | 12/17/2024 | 12/20/2024 | ETF |

| FTSE Developed Markets ETF | VEA | 12/20/2024 | 12/20/2024 | 12/24/2024 | ETF |

| International Small Cap Val ETF | AVDV | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| International Small Cap Value I | DISVX | 12/9/2024 | 12/10/2024 | 12/11/2024 | Mutual Fund |

| International Small Company I | DFISX | 12/12/2024 | 12/13/2024 | 12/16/2024 | Mutual Fund |

| International Sm Cp Val ETF | DISV | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| International Small Cap ETF | DFIS | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| International Small-Cap Eq ETF™ | SCHC | 12/13/2024 | 12/13/2024 | 12/18/2024 | ETF |

| FTSE All-Wld ex-US SmCp ETF | VSS | 12/20/2024 | 12/20/2024 | 12/24/2024 | ETF |

| Fixed Income | |||||

| One-Year Fixed-Income I | DFIHX | 12/9/2024 | 12/10/2024 | 12/11/2024 | Mutual Fund |

| Two-Year Global Fixed-Income I | DFGFX | 12/9/2024 | 12/10/2024 | 12/11/2024 | Mutual Fund |

| Five-Year Global Fixed-Income I | DFGBX | 12/9/2024 | 12/10/2024 | 12/11/2024 | Mutual Fund |

| Core Fixed Income ETF | AVIG | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| Short-Term Fixed Income ETF | AVSF | 12/17/2024 | 12/17/2024 | 12/19/2024 | ETF |

| Investment Grade I | DFAPX | 12/12/2024 | 12/13/2024 | 12/16/2024 | Mutual Fund |

| Global Core Plus Fixed Income Instl | DGCFX | 12/9/2024 | 12/10/2024 | 12/11/2024 | Mutual Fund |

| Short-Term Government I | DFFGX | 12/12/2024 | 12/13/2024 | 12/16/2024 | Mutual Fund |

| Total Bond Market ETF | BND | 12/24/2024 | 12/24/2024 | 12/27/2024 | ETF |

| Total Bond Market Index I | VBTIX | 12/31/2024 | --- | 01/02/2025 | Mutual Fund |

| CA Short-Term Municipal Bond I | DFCMX | 12/9/2024 | 12/10/2024 | 12/11/2024 | Mutual Fund |

| CA Interm-Term Tax-Exempt Adm | VCADX | 12/31/2024 | --- | 01/02/2025 | Mutual Fund |

| Long-Term Tax-Exempt Adm | VWLUX | 12/31/2024 | --- | 01/02/2025 | Mutual Fund |

| NY Long-Term Tax-Exempt Adm | VNYUX | 12/31/2024 | --- | 01/02/2025 | Mutual Fund |

At the end of each quarter, investors should expect dividend and/or capital gain distributions from their mutual funds. The mechanics may confuse some investors, however. As a result, we wanted to take an opportunity to review this process.

To keep our explanation simple, we'll stick to just reviewing dividend distributions — not repeating each time how long- and short-term capital gains distributions are handled in the same fashion.

Also, we're only going to consider the case where investors have elected to have their dividends automatically reinvested. (Another important point: while the screen captures shown below are of a Charles Schwab account, the presentation should be similar for Fidelity accounts.)

The Basics

Equity mutual funds are made up of individual stocks. When these stocks pay a dividend, it's passed through to investors just before the calendar quarter-end.

When a mutual fund pays a dividend, there are three dates that are particularly important to investors: the "Record Date," the "Ex-Dividend Date" and the "Payable Date."

The "Record Date" is the official date in which we must be a shareholder of the fund to receive the dividend.

The "Ex-Dividend Date" is the date in which the dividend is scheduled and we see a price reduction of the fund equal to the amount of the dividend and any market price change. For example, if a mutual fund pays a $0.25 dividend and the change in market price is a negative $0.10, investors will see the price of the fund decline by $0.35. This total change in the price of the fund is the reason for this article — i.e., the dollar value of that dividend and the change in the number of mutual fund shares in the account generally don't show up until the next morning. As a result, it might first appear to an investor that he or she lost more money on this ex-dividend date than the actual $0.10 market decline.

The "Payable Date" is the date in which the dividend is reinvested in more shares (with no transaction fee) and recorded as a transaction in the History & Statements tab of an investor's account. Generally, the cash dividend will be reinvested in more shares as of the closing price on the "Ex-Dividend Date," resulting in more shares than the investor had on the "Ex-Dividend Date" (the day before). This brings the account back to its record date value, except for market price changes. The only difference for taxable accounts is that the dividend created a tax liability for the investor.

Many IFA clients don't watch their accounts on a daily basis, so they might not notice these changes we're going to discuss. However, some people do watch their accounts more closely. As a result, we wanted to explain what happens in accounts during this time of dividend distribution and reinvestment.

A common question we are asked is: "Why did the price of this fund go down when a comparable index was up or why did my fund go down more than the comparable index?" In short, it has to do with the dividend payment and the overnight lag in the reinvestment of those dividends. Here are a series of illustrations to explain the process of dividend payment and reinvestment.

The Date of Record

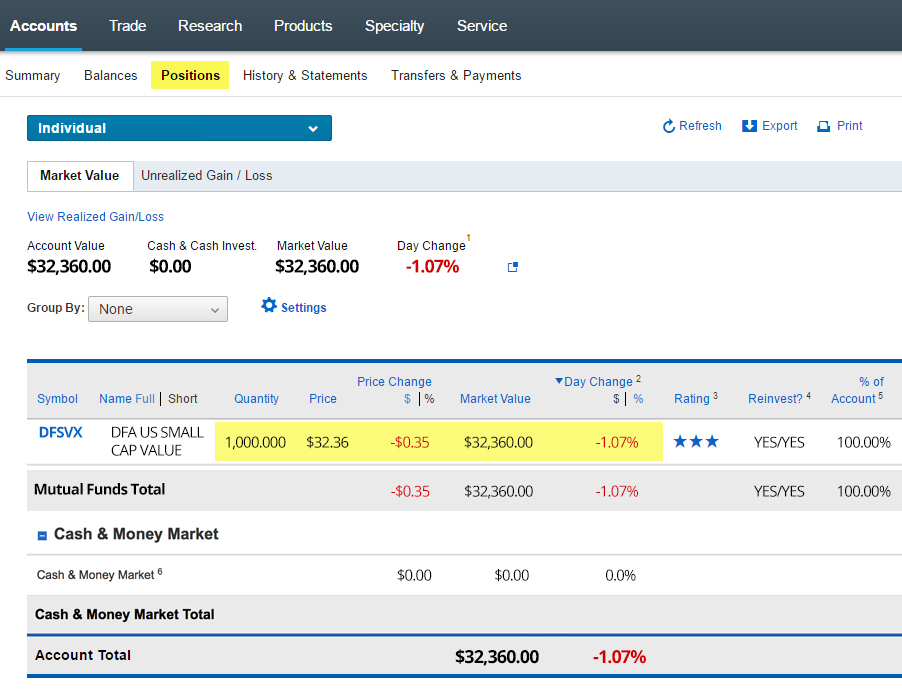

As an example of how this all plays out, let's look at the "Date of Record" for the DFA U.S. Small Cap Value Fund (DFSVX). As part of such a schedule of events, let's suppose that this fund's date of record was Sept. 26. The image below shows a hypothetical "Positions" page for a client whose assets are held at Charles Schwab. (Since each client can set up their own displays to view such information, your screen view might appear a bit differently.)

In looking at the DFSVX position, we see a hypothetical closing price of $32.36. With a "Quantity" of 1,000 shares, the total "Market Value" is shown as $32,360.00

The price change is minus $0.35 because the price is $0.35 less than it was at the close of the market the day before. In terms of a percentage, this equates to a 1.07% decrease in the value of DFSVX. (Again, this is an example of how the process works and not designed to represent any actual numbers you might see.)

Sept. 26 Replication:

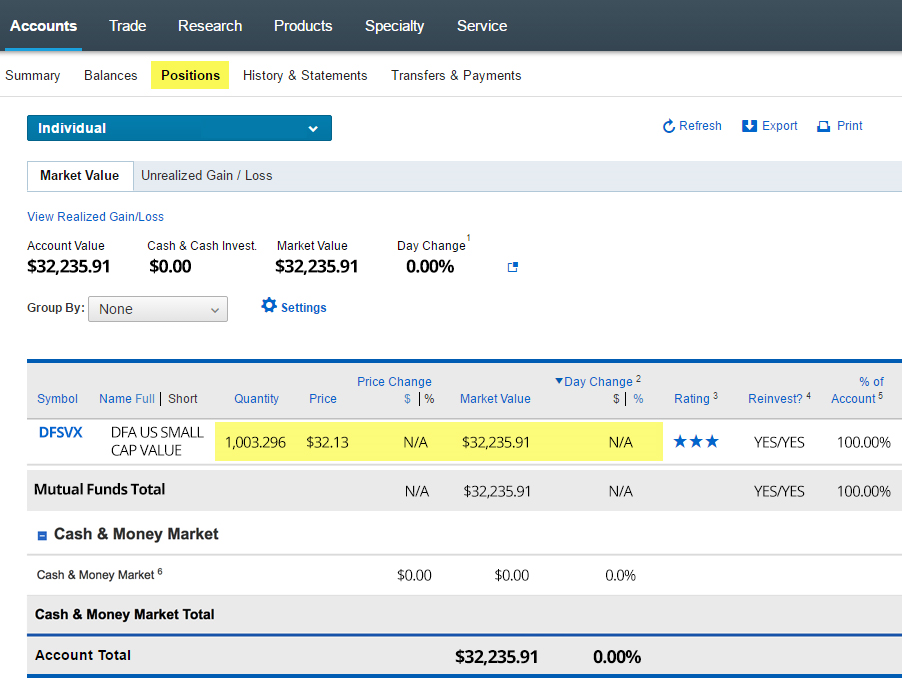

The Ex-Dividend Date

In this example, the next day (Sept. 27th) was the "Ex-Dividend Date" for DFSVX shareholders of record. Let's suppose that DFSVX closed at $32.13 per share on this date, or $0.23 less than the day before. This decrease of $0.23 was made up of the subtraction of $0.106 for the dividend payment and a $0.12409 market price decrease from the day before.

In such a scenario, we'll figure that a dividend of $0.106 per share was scheduled. It's important to note, however, the cash or reinvested dividends will not be visible to an investor looking in the evening. (See graphic below). As you will see in a minute, the reinvested dividend won't be visible until the next morning. So, with 1,000 shares of DFSVX we'd expect to receive approximately $1.06 in total dividends. Hypothetically supposing that today's closing price was $32.13 per share, we should get 3.296 additional shares on the morning of Sept. 30 — i.e., the next day in which the market is open.

The image below shows the same "Positions" page as of the evening of the market close on Sept. 27, the ex-dividend date.

Sept. 27 (Evening) Hypothetical Account View:

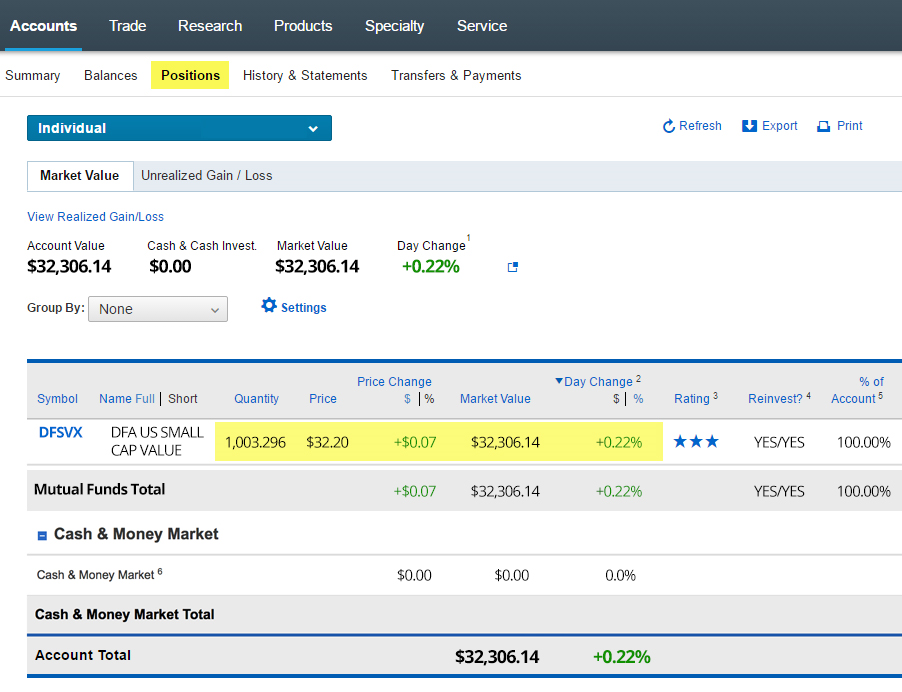

The Payable Date (Morning)

The image below shows the same hypothetical "Positions" page on the morning of Sept. 30 — referred to as the "Payable Date." Overnight, Schwab completed the transaction to the purchase of more shares of DFSVX from the cash dividend. The $1.06 in dividend payments on Sept. 30 was reinvested at the Sept. 30 closing price of $32.20, so the new quantity of shares increased by 3.296 ($1.06 of cash divided by the $32.20 per share). As a result, the "Quantity" of shares increased from 1,000.000 to 1,003.296. At that point in time, the pre-dividend and post-dividend "Market Values" are the same, except for the market price change.

If you take the $32,235.91 "Market Value" from the morning of Sept. 30 and add back the market decline of Sept. 27 (-$0.12409 times 1,000 shares = -$124.09), you get the exact same value of $32,235.91, which was the closing "Market Value" of Sept. 26. So the dividend payment did not add anything to the investor's "Market Value."

However, if you held this fund in a taxable account, a dividend payment would've resulted in an overall negative event because you ended up with a tax liability for the dividend. Most investors think they are getting something extra for their dividend, but they are not — and for taxable investors, it actually has a negative impact after we account for taxes. Our total market value in this example has now increased to $32,235.91.

Sept. 30 (Morning) Hypothetical Screen Capture:

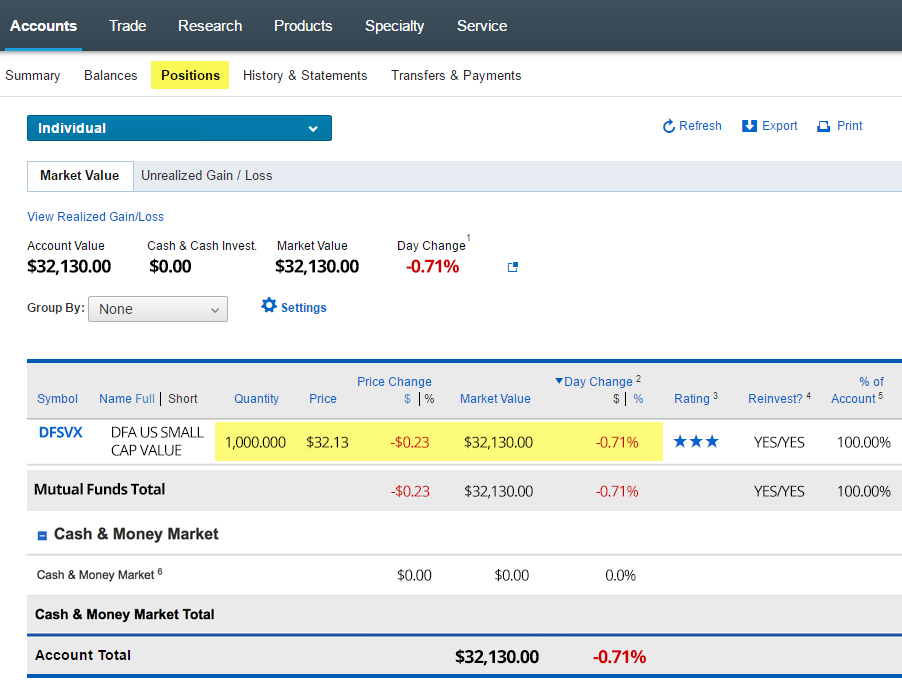

The Payable Date (Market Close)

The image below shows the same hypothetical "Positions" page as of the market close on Sept. 30, which is known as the "Payable Date."

If we look at the DFSVX position, in such a scenario we see a closing price of $32.20. Due to a change in market prices, this represents a price that is $0.07 higher than it was the day before. With 1,003.296 shares in our hypothetical account, our total "Market Value" now comes out to $32,306.14. In terms of a percentage, this equates to a 0.22% increase in the value of DFSVX.

Sept. 30th (Market Close) Hypothetical Screen Capture:

Our dividend payment and reinvestment process is now complete from "Date of Record" to "Ex-Dividend Date," and finally, to the morning and evening of the "Payable Date."

Capital Gains Distributions

As we mentioned in the introduction, the same process can be applied to long term and short term capital gains distributions. Throughout the year, fund managers buy and sell securities. They earn distributable capital gains when the gains exceed losses, which accumulate and add to the price of the fund until they are distributed. Once they are distributed, the price of the fund will decrease by the amount of the capital gains.

Most capital gains are distributed at the year-end and when dividends are added, this creates a much larger total distribution versus other quarters. Similar to dividends, investors do not lose or gain any money in the process. But there are tax liabilities created by both distributions, which is one good reason to take advantage of tax loss harvesting opportunities when they exist.

If you have further questions regarding dividends and capital gains distributions and their effect on the price of a fund, please contact your IFA wealth advisor at 888-643-3133.

Disclosure

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only and does not represent actual performance of any client portfolio or account. Hypothetical examples included do not reflect actual outcomes and should not be interpreted as indicative of future results. Mutual funds and ETFs mentioned are used in client portfolios based on alignment with IFA's investment philosophy. Prospective investment recommendations are determined based on individual risk tolerance, time horizon, and other factors identified using IFA's Risk Capacity Survey (www.ifa.com/survey).

Past performance of the funds or strategies mentioned does not guarantee future results. Index Fund Advisors, Inc. makes no guarantees regarding the price movement or dividend reinvestment outcomes of the funds listed.

For more information about Index Fund Advisors, Inc., please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.

.