If you're like most people, you probably don't look in detail at your cell phone bill. But, if you did, you might be surprised at all of the different items it includes.

The biggest cost is the monthly plan charge, which likely includes a certain amount of minutes, text messages, and data. But there will be several other costs as well, such as data coverage charges, roaming charges, taxes, carrier fees, and charges for add-on services like insurance or premium voicemail.

Investment costs are very similar. People tend to focus on the headline charge, the fund management fee, which is typically expressed as a percentage of the assets managed. But there are, in fact, a whole range of additional costs that investors incur. And, unlike cell phone customers, investors are very rarely, if ever, presented with an actual bill that breaks everything down.

In his book Index Funds: The 12-Step Recovery Program for Active Investors, Mark Hebner provides a list of what he calls "silent partners" investors pay money to. These include stockbrokers, investment advisors, accountants, market makers, transfer agents, mutual fund distributors, and income tax agencies.

"Your investment portfolio is vulnerable to these silent partners," writes Hebner. "Ideally, a silent partner would provide some sort of benefit, but in the case of your investments, these silent partners add little value."

It's your money

Think about that for a moment. This is your money we're talking about. As an investor, it's you who provides all of the capital, and it's you who takes all of the risk. But instead of keeping all of your returns for yourself, you may well be sharing those returns with third parties you know little about and do next to nothing to deserve it.

It's rather like choosing a recipe for a tasty pie, buying all of the ingredients, carefully preparing it, and patiently waiting for it to cook — only to have a bunch of strangers each help themselves to a slice of it!

One of the reasons why investors struggle to comprehend the impact that fees and charges have on their investment returns is that, seen in isolation, the costs look fairly modest. What they forget is that, when you add them together, the total is much more substantial. Also, crucially, investors don't just pay these fees and charges once — they pay them again and again, year after year, for decades.

Far too often, in the words of Vanguard founder and index fund champion John Bogle, "the miracle of compounding returns is overwhelmed by the tyranny of compounding costs."

What's the answer?

What, then, can investors do to keep more of their investment pie for themselves? The simplest and most effective way is to invest in index funds rather than actively managed funds.

"While fees, transaction costs, and taxes eat up active investors' returns," writes Mark Hebner, "index fund investors maximize asset growth by avoiding the major impacts of costs and taxes. No investment is completely free from silent partners, but passive investors use index funds, tax-managed index funds, and ETFs to retain as much money as possible."

There are three main reasons why index funds are more cost-effective than actively managed funds:

- First, management fees for active funds are generally much higher than they are for index funds.

- Secondly, because active funds generally trade far more frequently than index funds, the transaction costs involved are very much greater.

- Thirdly, there are tax advantages to using index funds, particularly for those in higher tax brackets or those seeking to minimize their tax liability in taxable accounts.

How much difference does cost-efficiency make?

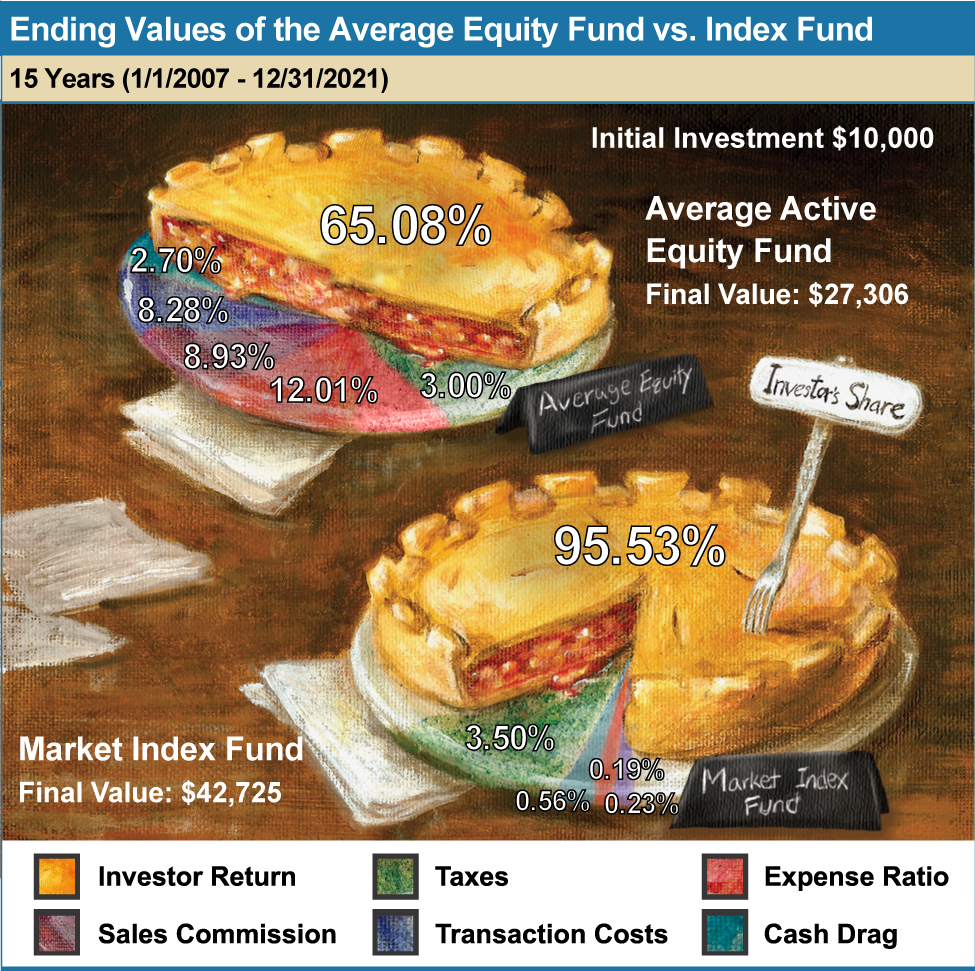

So, what sort of difference can you expect to see from investing in index funds rather than active funds? Well, the chart below gives you an indication.

Say you had invested $20,000 on January 1, 2007, and put half of that money in an average actively managed equity mutual fund, and the other half in an S&P 500 index fund.

By December 31, 2021, based on data reviewed by IFA, the $10,000 in the active fund would have grown to $27,306, which you may think is a decent enough return. But the $10,000 invested in the index fund would by then have been worth $42,725. In other words, you would have kept 95% of the growth of the index fund, compared to just 65% of the growth of the active fund.

This illustration is for informational purposes only and should not be considered investment advice. Indexes are not available for direct investment. The search criteria includes the oldest share class of any US domiciled equity fund with an inception date prior prior to 1/1/2007. Funds with missing data point were excluded from the analysis. Schwab S&P 500 Index (SWPPX) is used as a proxy for index funds. Data sourced from Morningstar Direct on 8/26/2022.

What about active funds that outperform?

Advocates of active money management like to downplay the importance of costs. It doesn't matter that an active fund is more expensive, they'll say, as long as it outperforms the market.

But there lies a big problem. Why? Because, on a properly cost- and risk-adjusted basis, only a tiny proportion of active funds have outperformed over meaningful periods of time, and identifying those funds, in advance, is extremely difficult.

As Mark Hebner explains in his book, the cost involved with active management and the overwhelming likelihood of underperformance are closely related.

"The costs associated with identifying mispriced securities are burdensome." Hebner writes. "Detailed stock analysis, frequent buying and selling inside the fund, and compensation to the funds' managers for their perceived skill all add up to impose a hefty fee and a high hurdle for fund managers to beat their benchmarks net of fees.

"Active managers rarely beat their index benchmarks (and) these higher fees are a primary culprit."

Fees never falter

The most famous advocate for index funds alive today is Warren Buffett. In 2007, Buffett famously bet $1 million that, over a ten-year period, a Vanguard S&P 500 index fund would outperform a portfolio of hedge funds.

Over the next ten years, the index fund consistently outperformed the hedge funds. By the end of 2017, the index fund had an average annual return of about 7.1%; the hedge funds only managed an average of about 2.2%.

In the 2017 Annual Report for his company, Berkshire Hathaway, Buffett explained that the reason he won the bet was that, although active funds will inevitably outperform from time to time, the higher costs entailed make it very hard for them to beat index funds in the long run.

"Performance comes, performance goes," Buffett concluded. "Fees never falter."

So, if you still fancy your chances, go ahead and try to pick an active fund that will outperform for the next decade or two. But you're unlikely to succeed.

If, on the other hand, you want to fund your lifestyle and retirement rather than other people's, you're much better off with a portfolio of index funds.

Robin Powell is the Creative Director at Index Fund Advisors (IFA). He is also a financial journalist and the editor of The Evidence-Based Investor. This article reflects IFA's investment philosophy and is intended for informational purposes only.

This article is intended for informational purposes only and reflects the perspective of Index Fund Advisors (IFA), with which the author is affiliated. It should not be interpreted as an offer, solicitation, recommendation, or endorsement of any specific security, product, or service. Readers are encouraged to consult with a qualified Investment Advisor for personalized guidance. Please note that there are no guarantees that any investment strategies will be successful, and all investing involves risks, including the potential loss of principal. Quotes and images included are for illustrative purposes only and should not be considered as endorsements, recommendations, or guarantees of any particular financial product, service, or advisor. IFA does not endorse or guarantee the accuracy of third-party content. For additional information about Index Fund Advisors, Inc., please review our brochure at https://www.adviserinfo.sec.gov/ or visit our website at www.ifa.com.