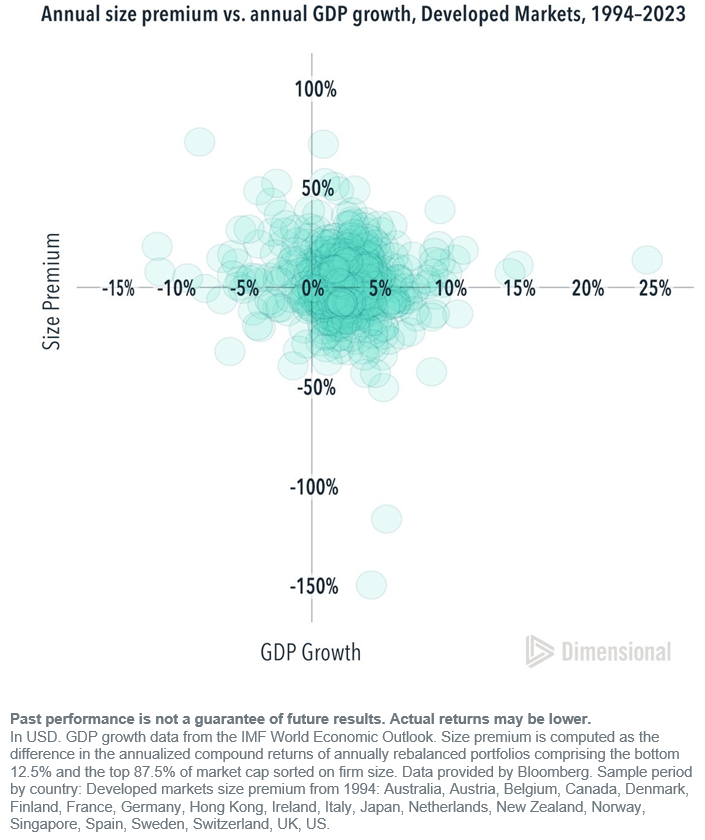

Historically, the broad stock market has often been positive even starting in economic recessions. But what about small cap stocks? Conventional wisdom holds that smaller companies often bear the brunt of economic downturns. So, what does the data tell us about the size premium when GDP growth slows?

Plotting annual return differences between small cap and large cap stocks against contemporaneous GDP growth for developed markets shows no discernible relation between the two. For example, there were 73 instances of a country experiencing a decline in GDP for the year. Small caps outperformed large caps in that country/year 47 out of those 73, or 64% of the time. That's higher than the frequency across all country/year observations, which was 54%.

These results shouldn't be too surprising since markets are forward-looking. As expectations for the future change, market prices continuously reset to a level where investors can expect positive premiums, including the size premium. This means small caps can still outperform, even if we eventually find ourselves in an environment unfavorable to small company success.

This article originally appeared in Above the Fray, a weekly newsletter for Dimensional clients. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Disclosures

All expressions of opinion are subject to change. Historical data and information presented in this article are provided for illustrative purposes only and do not guarantee future results. The information is based on third-party research conducted by Dimensional Fund Advisors LP and is republished with their permission. Investors should understand that past performance is not indicative of future performance and that investing involves risks, including the possible loss of principal.

Diversification does not eliminate risk or ensure investment success. While diversification can help smooth returns and reduce overall portfolio risk, it does not guarantee positive outcomes or protect against loss in declining markets or unfavorable conditions.

This information does not constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale. Readers should not rely solely on this information to make an investment decision. The size premium and performance data referenced are based on historical analysis of global developed markets and may not accurately reflect future conditions or results. Before making any investment decision, investors should consult with a financial professional regarding their unique circumstances.