Whether you're reading one of our articles or watching a video, you'll likely come across references to the three-factor model for investing formulated by professors Eugene Fama and Ken French. In fact, a discussion with an IFA wealth advisor about your unique financial planning goals at some point is probably going to touch on such a concept.

That leads to a natural question by many of our clients: Why do we keep talking about the three-factor model so much?

First, let's explore what it really means to investors. The model states that the expected return of a broadly diversified stock portfolio, in excess of a risk-free rate, is a function of that portfolio's sensitivity or exposure to three common risk factors:

1.) A market factor, as measured by the excess return of a broad equity market portfolio relative to a risk-free rate.

2.) A size factor, as measured by the difference between the returns of a portfolio of small stocks and the returns of a portfolio of large stocks.

3.) A value factor, as measured by the difference between the returns of a portfolio of high book-to-market (or value) stocks and the returns of a portfolio of low book-to-market (or growth) stocks.

The underlying premise of this model is that small cap and value stocks are riskier than large-cap and growth stocks — thus carrying higher expected returns.

For a diversified portfolio of domestic equities, the Fama/French three-factor model has been found to explain more than 90% of the variation of returns. For example, a regression analysis of the IFA Index Portfolio 100 (which is 100% invested in equities) found that nearly 99% of its domestic returns during an extended period could be explained by the portfolio's exposure to risk factors relating to market, size and value. (See chart below.)

This, however, does not mean that a passive portfolio manager should robotically buy the securities that meet such parameters and sell the securities that no longer do.

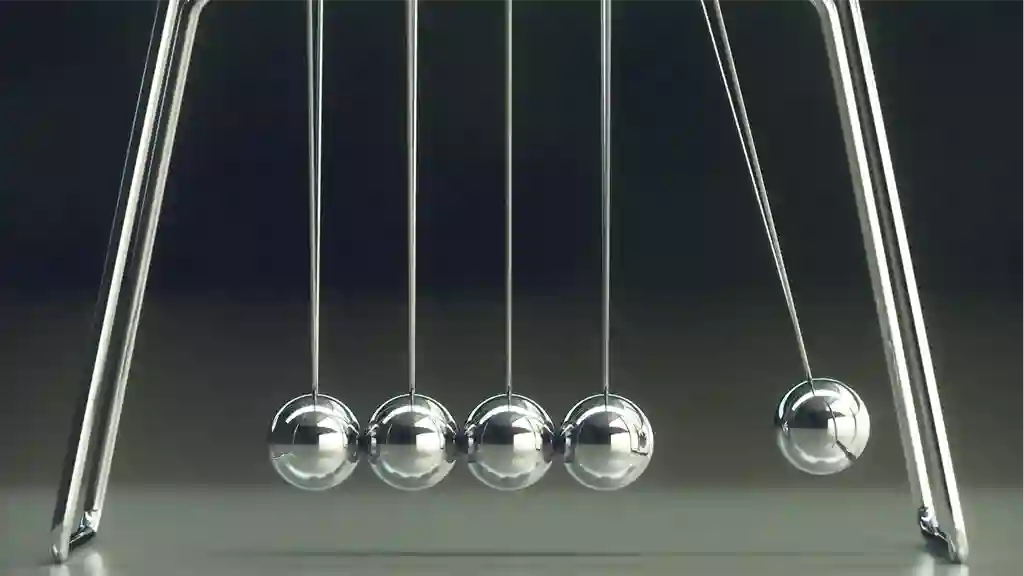

Narasimhan Jegadeesh and Sheridan Titman1 introduced the factor known as momentum — i.e., the tendency of securities that've outperformed (or underperformed) the market over a three- to 12-month period continue to outperform (or underperform) the market. In such a context, momentum represents such a relatively short timeframe in which past winners keep winning and losers continue to lose.

Fama, the Nobel laureate, referred to momentum as the biggest challenge to his theory of financial market efficiency.2 His reasoning: The very notion that investors can earn a sustainable premium by focusing on momentum implies that past prices of securities are irrelevant in the determination of future prices.

At IFA, we've found that unlike other factors (such as market, size and value), momentum has no adequate risk-based explanation. At the same time, we acknowledge academic research that points to a possible behavioral explanation of momentum — essentially, that price swings can cause an under-reaction to new information.

Indeed, Fama and French found in a landmark study first published in 2011 ("Size, Value, and Momentum in International Stock Returns") that momentum was present in most of the major international markets they reviewed. The key lone exception was Japan.3

Momentum has been a hot area of study by market economists and financial behavioral scientists in the past few decades. From such a growing body of evidence, we've been tracking for years some of the more comprehensive and intellectually robust research on this front. As part of such an ongoing review, an overarching takeaway stands out to us as critical in applying any theoretical gains that momentum might bring:

Since a security that is identified as having positive or negative momentum usually only retains it for a few months, directly trading to capture the momentum premium may not be a viable strategy because the cost of trading is likely to exceed the intended benefit.

It's clear to us that buying funds that pursue momentum only serves to add an extra layer of costs to an otherwise efficiently constructed IFA Index Portfolio. In practical terms, chasing stocks exhibiting strong momentum impresses our portfolio managers as an overly expensive trading strategy.

Of course, what happened in the past is no guarantee such tendencies will persist into the future. Given this fact of investing and momentum's shorter-term focus, however, it still can be educational to take a look at one sobering example4 from a particularly volatile period.

Although it took place years ago, purely for illustrative purposes, we could point to what happened in a rather isolated period — from March through May of 2009, when the lowest decile (past losers) rose by 156%, while the highest decile (past winners) gained only 6.5%.

Again, this is just one example from a very defined point-in-time to help show how volatile trying to capture any momentum premium can prove over short stretches. This is our emphasis in giving such a specific history lesson: Whenever these types of bouts of market volatility take place, would-be momentum traders expose themselves to the possibility of severe losses by landing on the wrong side of a trade.

In fact, an academic paper5 published in 2012 still resonates with us for its robust research on this topic. Its basic conclusions to this day can hold educational value for passive index fund investors to generally keep in-mind when considering trying to take advantage of such a factor.

This research project makes a case that since the late 1990s, the excess profits from momentum have become statistically less and less significant, primarily due to losses generated during periods of high market volatility over the past several decades.

It's interesting to note, though, that a preferred fund provider utilitized by IFA — Dimensional Fund Advisors — does track and tap into any momentum premium.

The primary way that Dimensional, (commonly known by its acronym of DFA), takes advantage of momentum is by not placing a trade when the momentum computation would argue against it.

For example, suppose a large-cap growth company runs into problems and takes a substantial hit on its share price to the point where it now meets the definition of a small-cap (or value) company. DFA's portfolio managers won't immediately buy those shares in their small-cap and value funds because of the desire to avoid negative price momentum.

In the case of a company on its way to bankruptcy (e.g., Enron in 2001), this strategy may protect DFA's fundholders.

Another highly interesting paper6 on momentum (circa 2012) that still serves to advance our application of momentum as a risk factor addresses its negative correlation with the value risk factor. It indicates to us that a portfolio incorporating both of these factors is likely to have higher risk-adjusted returns relative to the market. Unfortunately, such research comes with an important caveat — it's just not possible to maximize both of them simultaneosly.

As an investment fiduciary, IFA will continue to keep abreast of developments in finance to ensure that our clients have the best possible investment experience that we can provide.

1 Narasimhan Jegadeesh and Sheridan Titman, "Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency," Journal of Finance 48 (1993): 65-91.

2 Interview with Eugene Fama, Federal Reserve Bank of Minneapolis, Dec. 2007.

3 Fama, Eugene F. and French, Kenneth R., Size, Value, and Momentum in International Stock Returns (June 21, 2011). Fama-Miller Working Paper; Tuck School of Business Working Paper No. 2011-85; Chicago Booth Research Paper No. 11-10. Available at SSRN: http://ssrn.com/abstract=1720139

4 Kent Daniel and Tobias Moskowitz, "Momentum Crashes," (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2371227), Dec. 24, 2013.

5 Bhattacharya, Debarati, Kumar, Raman and Sonaer, Gokhan, Momentum Loses its Momentum: Implications for Market Efficiency (November 7, 2012). Midwest Finance Association 2012 Annual Meetings Paper. Available at SSRN: http://ssrn.com/abstract=1928764

6 Asness, Clifford S., Moskowitz, Tobias J. and Pedersen, Lasse Heje, Value and Momentum Everywhere (June 1, 2012). Chicago Booth Research Paper No. 12-53. Available at SSRN: http://ssrn.com/abstract=2174501

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. IFA Index Portfolios are recommended based on time horizon and risk tolerance. Take the IFA Risk Capacity Survey (www.ifa.com/survey) to determine which portfolio captures the right mix of stock and bond funds best suited to you. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/