In a year of rising stock prices, it's not unusual to hear of investor angst about how much they're going to owe the IRS.

For investors who aren't familiar with a strategy known as asset location, putting money into funds through brokerage accounts that aren't as tax-efficient as others can wind up hiking their tax bills, either in the coming tax season or down-the-line.

In a nutshell, here's how it works: Mutual fund managers might sell underlying securities that hold "embedded" capital gains tied to those shares. If they can't find other investments in a portfolio that produced capital losses to offset such gains, they're going to need to distribute those capital gains to shareholders.

So what does this mean to you? If the investments sold were owned by the fund for less than one year, the proceeds are considered short-term and taxed as ordinary income — at the investor's highest tax bracket (up to 37% in 2021). And that doesn't include any state income taxes that might be owed on such gains.

If the securities sold were held for longer than 12-months by the fund, however, those are considered by the IRS as long-term gains and are taxed at a lower (20%) rate.

Exceptions exist, of course. A prime example might be a municipal bond fund held in a non-retirement account. In general, though, making asset allocation decisions in different types of brokerage accounts will carry some sort of tax implication. This is particuarly true for assets held in taxable brokerage accounts.

That's why IFA's wealth advisors try to stress to their clients the importance of implementing a portfolio management process designed to take advantage of the most tax-efficient asset location strategies.

We construct portfolios which are designed to produced the greatest expected return for the risk taken. Along those lines, our portfolio management team understands that taxes are an important factor to take into account when allocating client assets across accounts.

A Systematic Approach

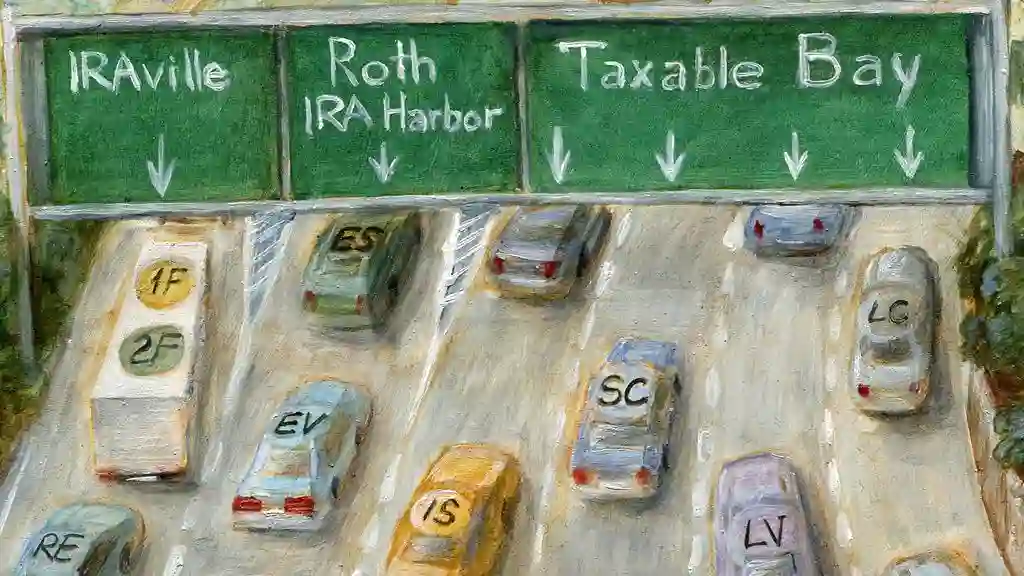

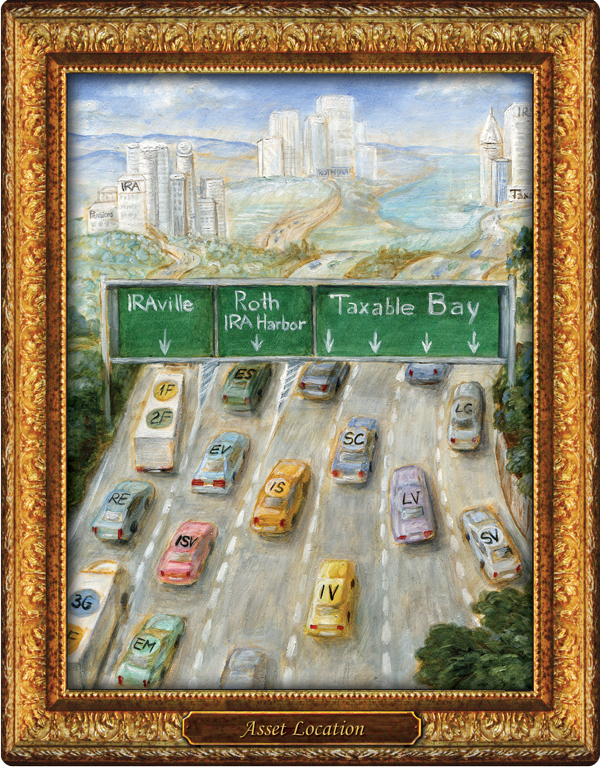

Implementation of asset location in our client portfolios comes with a review of how different funds — invested in different types (or classes) of assets — can be expected to generate differing rates of return. As depicted in the illustration below, IFA's strategy also considers how different types of brokerage and retirement accounts are designed to handle capital gains.

For example, contributions to a traditional individual retirement account (IRA) are usually made on a pre-tax basis. Typically when you withdraw any money (i.e., contributions and earnings) from a traditional IRA, you'll owe income taxes.

On the flip side, a Roth IRA is an after-tax retirement savings account. While contributions are made on an after-tax basis, though, withdrawals of that money (including earnings on all contributions) are tax-free. (For more information about which type of account might be better depending on individual financial circumstances, you can read more about personal IRA options by clicking here. You can also check our article comparing workplace retirement plan options here.)

Again, our overarching purpose of developing a well-defined asset location strategy is to maximize after-tax returns. Specifically, for a client who has a mixture of taxable accounts — along with traditional IRAs and Roth IRAs — IFA finds it to be more efficient (and effective) to take a top-down view of portfolio construction. In practice, we implement our portfolios with a goal of producing the most tax-efficient results.

Taking a Deeper Look

Our investment committee considers several different factors in deciding which asset classes to place in different account types. This results in the following takeaways:

1. For Roth IRAs — where all of the investment growth is tax-free — the preference in our process is to utilize asset classes with the highest expected returns. Still, we know from top-drawer academic research that higher expected returns come part and parcel with exposure to greater levels of risk. So our implementation of this aspect of IFA's asset location strategy is made with the realization that we're including funds with higher expected risks. Examples include emerging markets and international small-cap value stock funds.

2. For traditional IRAs — where current dividends are tax-deferred until withdrawal and future withdrawals are taxed as ordinary income (e.g., the highest personal tax rate) — the most effective strategy is typically to include the asset classes that generate higher interest income and lower expected returns. A prime example is a fixed-income fund with lower expected returns and a steady stream of interest payouts.

3. For taxable accounts, our strategy utilizes exchange-traded funds (ETFs) that provide greater tax-efficiencies. Remember that when you sell positions that've been held for more than a year in a taxable account, the tax treatment is going to be better — since long-term capital gains are generally taxed at a lower rate than ordinary income.

It is important for clients to understand that in an asset-located or tax-hybrid portfolio, each of the accounts will have very different performance characteristics. If the client is not comfortable with this performance difference (i.e., a married couple where the wife's Roth IRA has a higher expected return than the husband's traditional IRA), then the tax-hybrid portfolio structure might not be appropriate.

Furthermore, a good passive wealth manager will evaluate the purpose of each account to determine if it should be reviewed on a stand-alone basis or as part of a hybrid portfolio structure. A special needs trust for a disabled child or a donor advised fund are examples of accounts that might be managed as different portfolios.

Not a Cookie-Cutter Strategy

Establishing an asset-located or tax-hybrid investment plan isn't a matter of one hat proving to be a good fit for everyone. In some cases, an individual's tax situation might wind up creating better after-tax results by utilizing a portfolio implementation that includes municipal bond funds.

At IFA, our advisors work with each client to consider potential investment ramifications relating to issues that could increase personal tax liabilities and make funds less desirable in a taxable account. Advisors working on behalf of investors they serve can also tap into our in-house expertise offered through IFA's dedicated tax planning group, IFA Taxes.

No matter what type of unique situation investors find themselves in relating to taxes, going through an objective and fact-based assessment of the best locations for different funds arguably is one of those exercises that should be checked-off before investing in a globally diversified and passively managed portfolio.

IFA's wealth management process takes into consideration how to trade all of a client's accounts in unison with an eye toward tax-efficiency, minimization of transaction costs and maintenance of each investor's designated asset allocation in-line with results from each person's Risk Capacity Survey results.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. IFA Index Portfolios are recommended based on time horizon and risk tolerance. Take the IFA Risk Capacity Survey (www.ifa.com/survey) to determine which portfolio captures the right mix of stock and bond funds best suited to you. Allocations and holdings are subject to change. Please see ifa.com for more details on the construction and historical data of IFA Index Portfolios. See ifabt.com for backtested info and disclosures. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com. This article is intended to be informational in nature and should not be construed as tax advice. IFA Taxes does not provide auditing or attestation services and therefore is not a licensed CPA firm.