About IFA Institutional

IFA Institutional provides fee-only investment advice to endowments, foundations, corporate pension and retirement plans, public pensions and Taft-Hartley plans. IFA Institutional's professional investment management services fully implement the tenets of fiduciary prudence and Modern Portfolio Theory.

IFA Institutional begins by educating investment committees and plan trustees regarding the intrinsic relationship between risk, return, time and diversification. This meaningful education enables committee members and plan sponsors to make informed investment decisions for plan assets that are in keeping with fiduciary prudence, mitigating liability concerns.

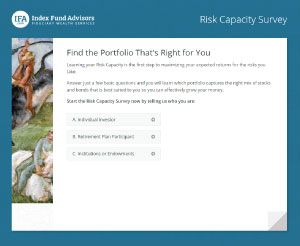

IFA Institutional matches institutions with portfolios by carefully measuring risk capacity and risk exposure, providing the ability to earn optimal risk-adjusted returns. IFA Institutional assists clients in the creation, purchase, and rebalancing of portfolios comprised of risk-calibrated and globally diversified blends of passively managed index funds.

Extensive research shows that active management and fund speculation lead to increased expenses that have shown to negatively impact returns over time, while adding excessive and unrewarded risk. Hundreds of peer-reviewed academic studies and more than 98 years of risk and return data support IFA Institutional's passive strategy that controls costs and replaces speculation with risk-optimization and global diversification.

Clients of IFA Institutional Benefit from:

- Risk-Appropriate Investing Strategy implemented by an ERISA Section 3(38) fiduciary in accordance with the Prudent Investor Rule, protecting stewards from fiduciary liability

- Clearly Defined Risk Capacity Quantification, measuring key elements critical to risk-appropriate investing

- Globally Diversified Index Portfolios that are transparent and designed to manage costs and risk

- A Prudent Process for Managing Plan Assets that eliminates conflicts of interest

- Expected Risk and Returns Data based on more than 98 years of history with 600 months of monthly rolling period data that spans the most recent 50 years

- Extensive and Ongoing Education on the Science of Investing, fostering investor temperance that has shown to yield higher risk-adjusted returns over time

- Ongoing Portfolio Management that maintains a consistent and appropriate risk exposure through rebalancing and Risk Capacity review

- Clear and Timely Reporting, enabling fiduciary stewards to assess performance and portfolio activity since and for various time periods in between

Brochure:

IFA Institutional is a division of Index Fund Advisors, Inc. (IFA), a fee-only independent financial adviser, registered with the U.S. Securities and Exchange Commission (SEC), see ifa.com for more details. IFA is headquartered in Irvine, California, with offices in Irvine, California and Austin, Texas. To contact IFA Institutional, please call 888-643-3133, or visit ifa.com for more information.