College Savings Analyzer

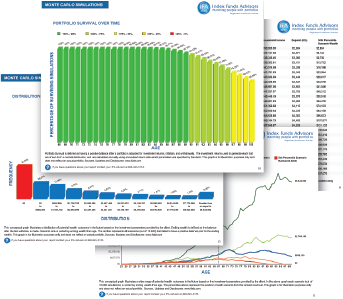

What are the chances that your portfolio will survive through college savings?

IFA's College Savings Analyzer is a useful tool for helping investors get on track and stay there—helping put children through college.

The chart below shows the asset allocations through time for a student who begins college at age 18. The glide path is based on annual decrease of 5 IFA Index Portfolio risk levels. This glide path is much steeper than the glide path used for retirement savings because the duration of the liability is much shorter.